Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1: The present prices of a riskless asset, a stock, and an option, are provided in the first row of the table below.

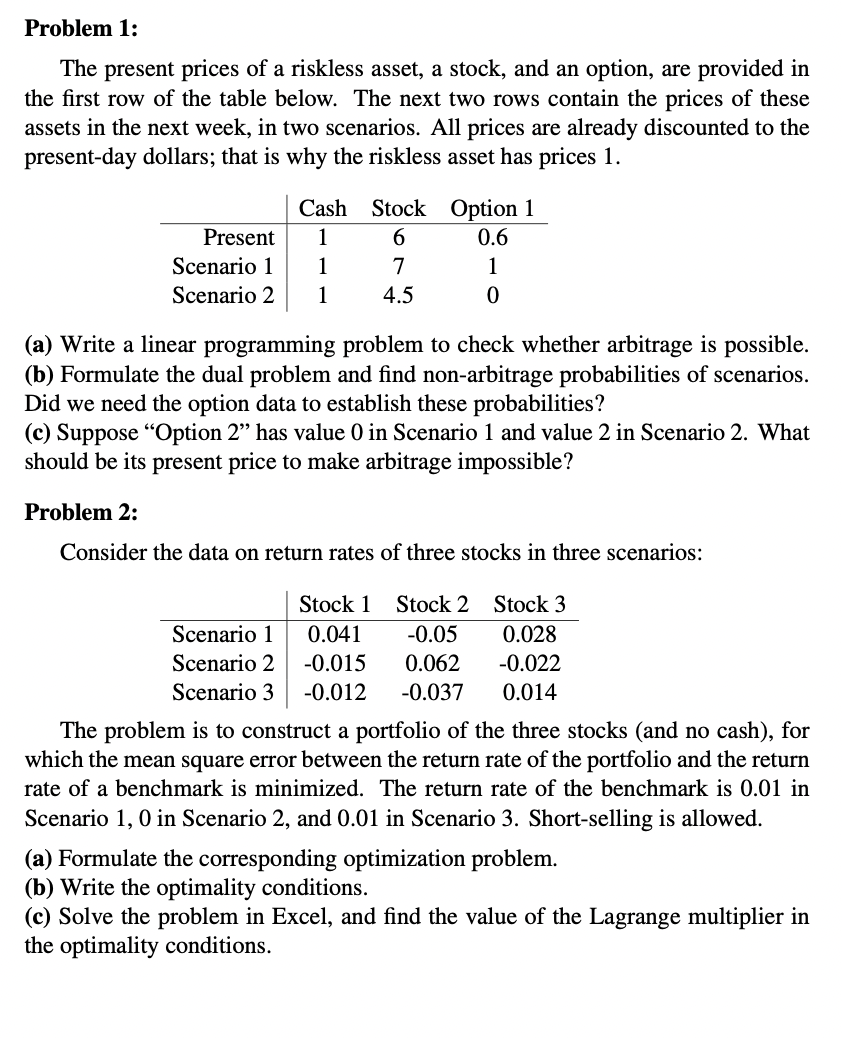

Problem 1: The present prices of a riskless asset, a stock, and an option, are provided in the first row of the table below. The next two rows contain the prices of these assets in the next week, in two scenarios. All prices are already discounted to the present-day dollars; that is why the riskless asset has prices 1. Present Scenario 1 Scenario 2 Cash Stock 1 6 1 7 1 4.5 Option 1 0.6 1 0 (a) Write a linear programming problem to check whether arbitrage is possible. (b) Formulate the dual problem and find non-arbitrage probabilities of scenarios. Did we need the option data to establish these probabilities? (c) Suppose "Option 2" has value 0 in Scenario 1 and value 2 in Scenario 2. What should be its present price to make arbitrage impossible? Problem 2: Consider the data on return rates of three stocks in three scenarios: Stock 1 Stock 2 Stock 3 Scenario 1 0.041 -0.05 0.028 Scenario 2 -0.015 0.062 -0.022 Scenario 3 -0.012 -0.037 0.014 The problem is to construct a portfolio of the three stocks (and no cash), for which the mean square error between the return rate of the portfolio and the return rate of a benchmark is minimized. The return rate of the benchmark is 0.01 in Scenario 1, 0 in Scenario 2, and 0.01 in Scenario 3. Short-selling is allowed. (a) Formulate the corresponding optimization problem. (b) Write the optimality conditions. (c) Solve the problem in Excel, and find the value of the Lagrange multiplier in the optimality conditions.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 a To check whether arbitrage is possible we can formulate a linear programming problem Lets define the decision variables as follows x Amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started