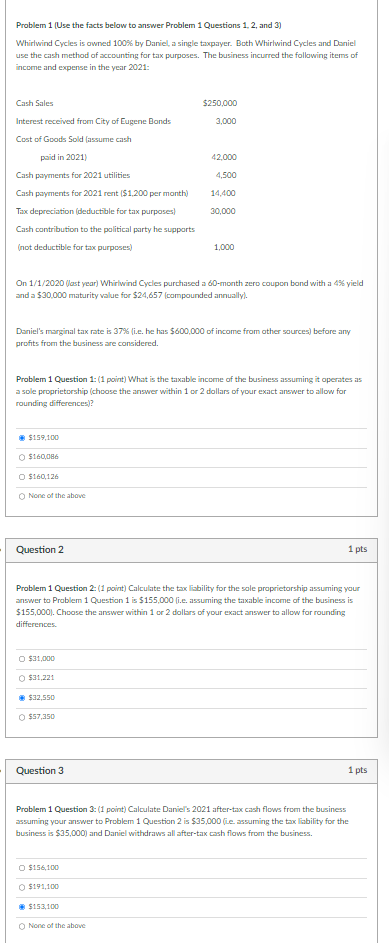

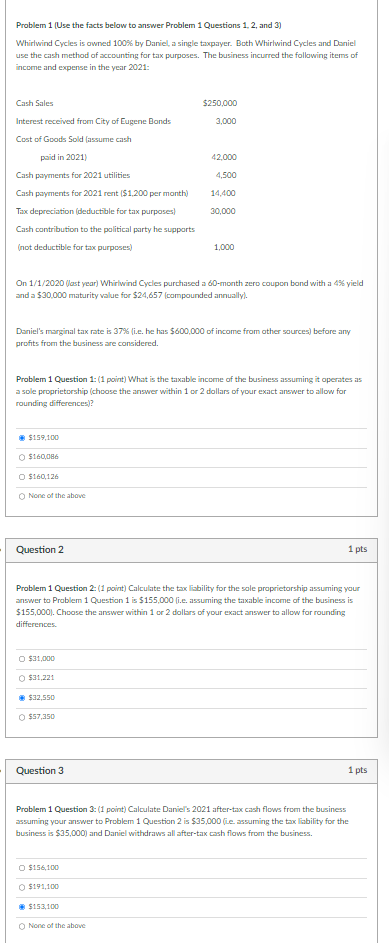

Problem 1 (Use the facts below to answer Problem 1 Questions 1, 2, and 3) Whirlwind Cycles is awned 1008 by Dariel, a single taxpayer. Brth Whirlwind Cycles and Daniel use the cash method of sccounting far tax purposes. The business incurred the follawing items of income and expense in the year 2021 : On 1/1/2020 (last year) Whirivind Cycles purchased a 60-month zero coupon bond with a 48 yield and a $30,000 maturity value for $24,657 [compounded annuallyl. Daniel's manginal tax rate is 37% (i.e. he has $600,000 of income from other saurces) before any profits from the business are considered. Problem 1 Question 1: (1 point) What is the taxable income of the busines assuming it operates as a sole proprietorship (chcose the answer within 1 or 2 dollars of your exact answer to allow for rounding differences)? Question 2 Problem 1 Question 2: (1 point) Calculate the tax liability for the sale praprietarship assuming your answer to Prablem 1 Question 1 is $155,000 li.e. assuming the taxable income of the busines is $155,000. Choose the answer within 1 or 2 dolbrs of your exact answer to allow for rounding differences. Question 3 Problem 1 Question 3: (1 point) Calculate Daniel's 2021 after-tax cash flows from the business assuming your answer to Problem 1 Questian 2 is $35,000 (iee assuming the tax liability for the business is $35,000) and Daniel withdraws all after-tax cosh flows from the business. \begin{tabular}{l} $156,100 \\ $191,100 \\ $153,100 \\ \hline Nope of the ahove \end{tabular} Problem 1 (Use the facts below to answer Problem 1 Questions 1, 2, and 3) Whirlwind Cycles is awned 1008 by Dariel, a single taxpayer. Brth Whirlwind Cycles and Daniel use the cash method of sccounting far tax purposes. The business incurred the follawing items of income and expense in the year 2021 : On 1/1/2020 (last year) Whirivind Cycles purchased a 60-month zero coupon bond with a 48 yield and a $30,000 maturity value for $24,657 [compounded annuallyl. Daniel's manginal tax rate is 37% (i.e. he has $600,000 of income from other saurces) before any profits from the business are considered. Problem 1 Question 1: (1 point) What is the taxable income of the busines assuming it operates as a sole proprietorship (chcose the answer within 1 or 2 dollars of your exact answer to allow for rounding differences)? Question 2 Problem 1 Question 2: (1 point) Calculate the tax liability for the sale praprietarship assuming your answer to Prablem 1 Question 1 is $155,000 li.e. assuming the taxable income of the busines is $155,000. Choose the answer within 1 or 2 dolbrs of your exact answer to allow for rounding differences. Question 3 Problem 1 Question 3: (1 point) Calculate Daniel's 2021 after-tax cash flows from the business assuming your answer to Problem 1 Questian 2 is $35,000 (iee assuming the tax liability for the business is $35,000) and Daniel withdraws all after-tax cosh flows from the business. \begin{tabular}{l} $156,100 \\ $191,100 \\ $153,100 \\ \hline Nope of the ahove \end{tabular}