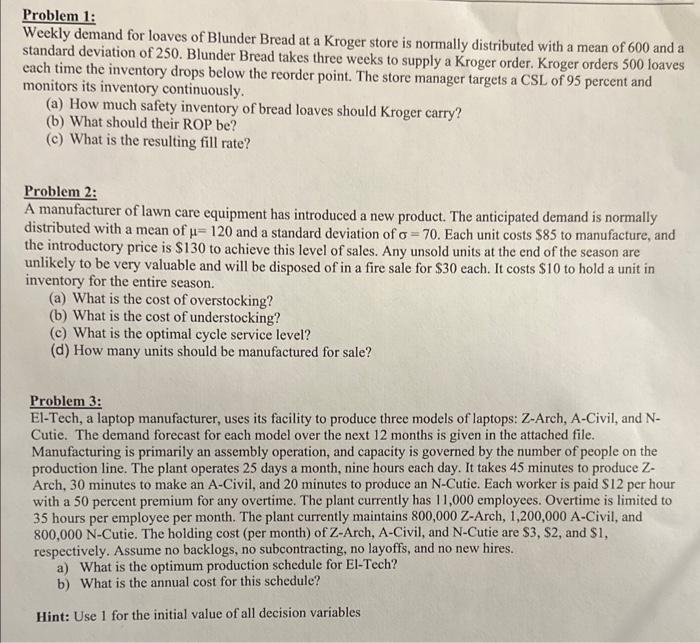

Problem 1: Weekly demand for loaves of Blunder Bread at a Kroger store is normally distributed with a mean of 600 and a standard deviation of 250 . Blunder Bread takes three weeks to supply a Kroger order. Kroger orders 500 loaves each time the inventory drops below the reorder point. The store manager targets a CSL of 95 percent and monitors its inventory continuously. (a) How much safety inventory of bread loaves should Kroger carry? (b) What should their ROP be? (c) What is the resulting fill rate? Problem 2: A manufacturer of lawn care equipment has introduced a new product. The anticipated demand is normally distributed with a mean of =120 and a standard deviation of =70. Each unit costs $85 to manufacture, and the introductory price is $130 to achieve this level of sales. Any unsold units at the end of the season are unlikely to be very valuable and will be disposed of in a fire sale for $30 each. It costs $10 to hold a unit in inventory for the entire season. (a) What is the cost of overstocking? (b) What is the cost of understocking? (c) What is the optimal cycle service level? (d) How many units should be manufactured for sale? Problem 3: El-Tech, a laptop manufacturer, uses its facility to produce three models of laptops: Z-Arch, A-Civil, and NCutie. The demand forecast for each model over the next 12 months is given in the attached file. Manufacturing is primarily an assembly operation, and capacity is governed by the number of people on the production line. The plant operates 25 days a month, nine hours each day. It takes 45 minutes to produce ZArch, 30 minutes to make an A-Civil, and 20 minutes to produce an N-Cutie. Each worker is paid $12 per hour with a 50 percent premium for any overtime. The plant currently has 11,000 employees. Overtime is limited to 35 hours per employee per month. The plant currently maintains 800,000ZArch,1,200,000A-Civil, and 800,000N Cutie. The holding cost (per month) of Z-Arch, A-Civil, and N-Cutie are \$3, \$2, and \$1, respectively. Assume no backlogs, no subcontracting, no layoffs, and no new hires. a) What is the optimum production schedule for El-Tech? b) What is the annual cost for this schedule? Hint: Use 1 for the initial value of all decision variables