Question

Problem 1 White Cap Company makes luxury Kayaks. The production of the Kayak will go through three cost departments, Molding, Finishing, and General Assembly. The

Problem 1

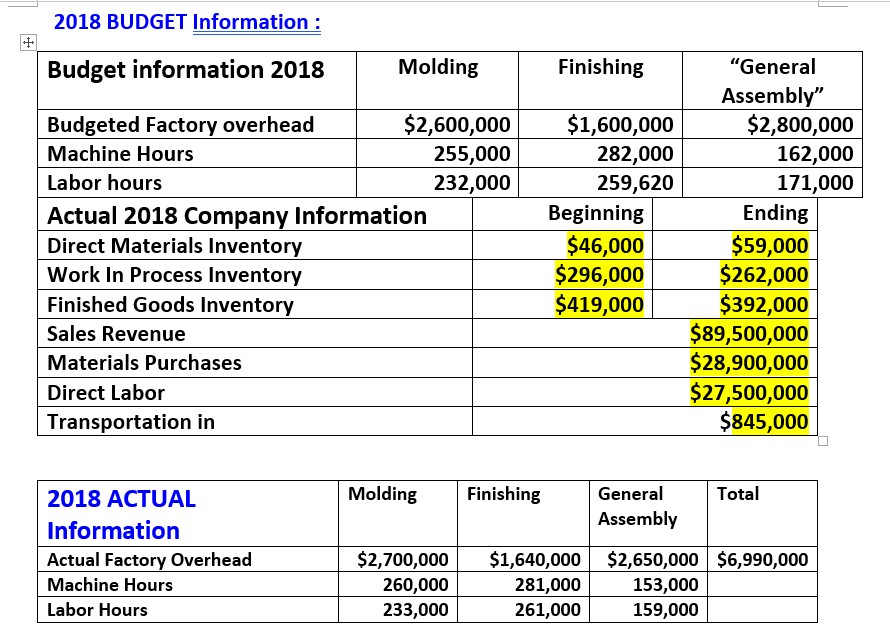

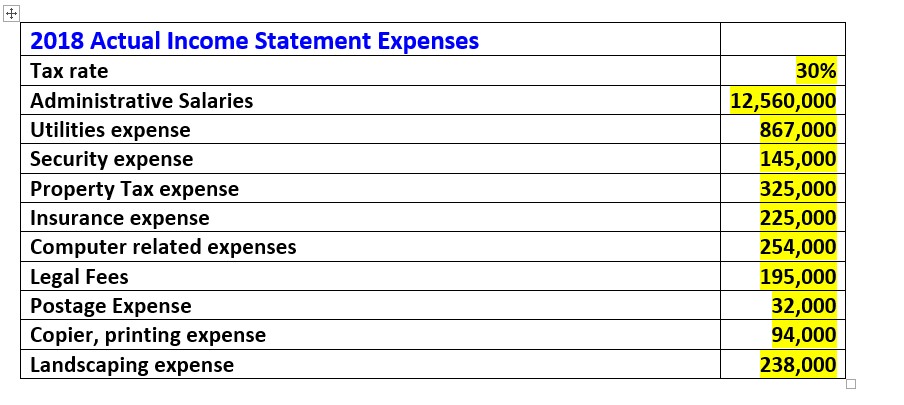

White Cap Company makes luxury Kayaks. The production of the Kayak will go through three cost departments, Molding, Finishing, and General Assembly. The Molding department applies factory overhead cost on the basis of Labor hours and the Finishing department applies factory overhead costs on the basis of Machine hours, all other factory overhead costs are lumped into the General Assembly and are allocated on the basis of machine hours. Total over or underapplied factory overhead for the three cost departments is considered material if the total over or underapplied is greater than 5% of the total applied FO for the three cost departments. Nonmaterial overhead is applied directly to Cost of Goods Sold as an adjustment. Material over or underapplied factory overhead is applied on a prorated basis to WIP, FG, and COGS. (For the COGS adjustment, rename the last line of the COGS schedule to Unadjusted COGS, insert a line below that for the over or underapplied factory overhead and conclude with a line called Adjusted COGS). Example: Unadjusted Cost of Goods Sold. 50,000 Underapplied Factory Overhead. 2,000 Adjusted Cost of Goods Sold $52,000

Required: 1. Prepare the COGS and Income Statement for the year ended 12/31/2018. Use perfect formatting. (Hint: On the COGS statement, the factory overhead allocated to WIP as an add is based on APPLIED Factory overhead rates , not actual factory overhead! You will have only 3 applied factory overhead accounts (Molding, Finishing, General Assembly). The amount for Actual Factory overhead will ONLY be used to compare to the applied FO for the computation of the over or underapplied Factory overhead for the 3 categories of FO) 2. Prepare a schedule to compute over or under applied factory overhead. (make sure a reader can follow your math and logic) 3. If the total over or underapplied factory is deemed material, create a chart that clearly Identifies the allocation of the over/underapplied overhead to WIP, Finished goods inventory, and COGS and identifies what the adjusted ending balance is for each account.

2018 BUDGET Information: Budget information 2018 Molding Finishing "General Assembly" $2,600,000 $1,600,000 282,000 259,620 $2,800,000 162,000 171,000 Budgeted Factory overhead Machine Hours Labor hours Actual 2018 Company Information Direct Materials Inventory Work In Process Inventory Finished Goods Inventory Sales Revenue Materials Purchases Direct Labor Transportation in 255,000 232,000 Ending $59,000 $262,000 $392,000 $89,500,000 $28,900,000 $27,500,000 $845,000 Beginning $46,000 $296,000 $419,000 Molding Finishing General Total 2018 ACTUAL Information Actual Factory Overhead Machine Hours Labor Hours Assembly $2,700,000 $1,640,000 $2,650,000 $6,990,000 260,000 233,000 281,000 261,000 153,000 159,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started