Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 You are a crude oil producer, and you use swaps to hedge against prices falling. In May 2023, you entered a calendar swap

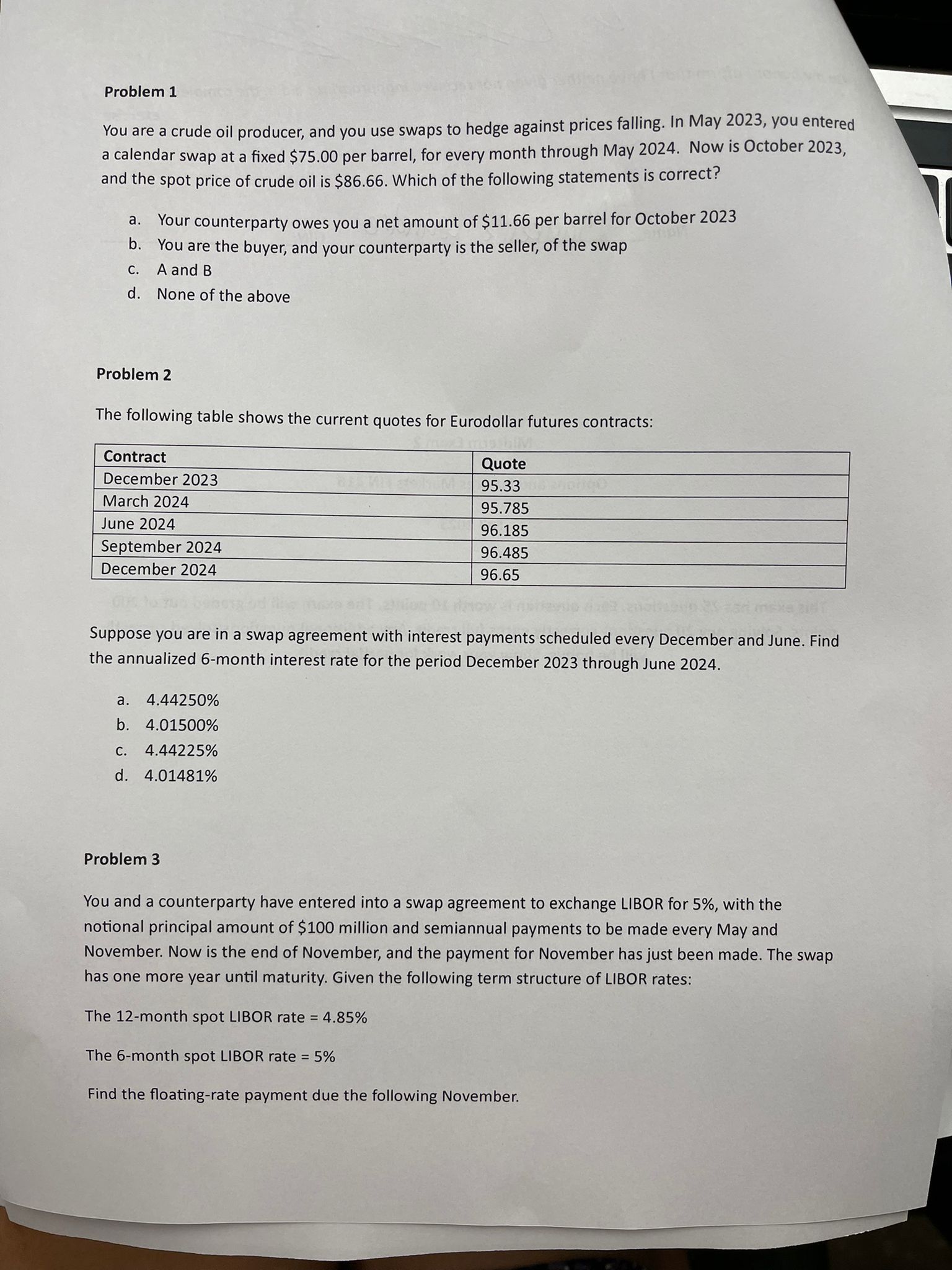

Problem 1 You are a crude oil producer, and you use swaps to hedge against prices falling. In May 2023, you entered a calendar swap at a fixed $75.00 per barrel, for every month through May 2024. Now is October 2023, and the spot price of crude oil is $86.66. Which of the following statements is correct? a. Your counterparty owes you a net amount of $11.66 per barrel for October 2023 b. You are the buyer, and your counterparty is the seller, of the swap c. A and B d. None of the above Problem 2 The following table shows the current quotes for Eurodollar futures contracts: Suppose you are in a swap agreement with interest payments scheduled every December and June. Find the annualized 6-month interest rate for the period December 2023 through June 2024. a. 4.44250% b. 4.01500% c. 4.44225% d. 4.01481% Problem 3 You and a counterparty have entered into a swap agreement to exchange LIBOR for 5%, with the notional principal amount of $100 million and semiannual payments to be made every May and November. Now is the end of November, and the payment for November has just been made. The swap has one more year until maturity. Given the following term structure of LIBOR rates: The 12-month spot LIBOR rate =4.85% The 6-month spot LIBOR rate =5% Find the floating-rate payment due the following November

Problem 1 You are a crude oil producer, and you use swaps to hedge against prices falling. In May 2023, you entered a calendar swap at a fixed $75.00 per barrel, for every month through May 2024. Now is October 2023, and the spot price of crude oil is $86.66. Which of the following statements is correct? a. Your counterparty owes you a net amount of $11.66 per barrel for October 2023 b. You are the buyer, and your counterparty is the seller, of the swap c. A and B d. None of the above Problem 2 The following table shows the current quotes for Eurodollar futures contracts: Suppose you are in a swap agreement with interest payments scheduled every December and June. Find the annualized 6-month interest rate for the period December 2023 through June 2024. a. 4.44250% b. 4.01500% c. 4.44225% d. 4.01481% Problem 3 You and a counterparty have entered into a swap agreement to exchange LIBOR for 5%, with the notional principal amount of $100 million and semiannual payments to be made every May and November. Now is the end of November, and the payment for November has just been made. The swap has one more year until maturity. Given the following term structure of LIBOR rates: The 12-month spot LIBOR rate =4.85% The 6-month spot LIBOR rate =5% Find the floating-rate payment due the following November Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started