Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem # 1 You have decided to save at least $ 5 0 every month and put it towards your retirement in 3 0 years.

Problem #

You have decided to save at least $ every month and put it towards your retirement in years. You are considering investing in the stock market, but you are not sure of the risk, so you decide to compare it to not investing. The spreadsheet has the no investment formula, and you will need to use the FV function for the investment formula. Create a oneway data table and twoway data table on the same worksheet to compare the following scenarios. a Create a oneway data table on the same worksheet to show how changes in monthly investment from $ to

$ in increments of $ affect your retirement for both not investing and investing in the stock market.

Rename the title of the columns to No Investment" and "With Investment" accordingly. From your oneway

table, at what monthly deposit does the Noinvestment "retirement amount become just greater than

$

b Create a twoway data table to show how various rates of return to in increments of and monthly

investments from $ to $ in increments of $ affect your retirement when invested in the stock market.

What is your investment retirement account value if your monthly deposit $ and Rate of Return

c Assuming your rate of return is what is the lowest monthly payment that would ensure you retire with over

$ Change the values for rate of return, and then use Goal Seek on "the Value at Retirement if money

Invested" to answer the question.

d If your number of years until retirement increases to and the rate of return drops down to what monthly

deposit would you need to have enough for your $ vacation home? Change the values for years and rate of

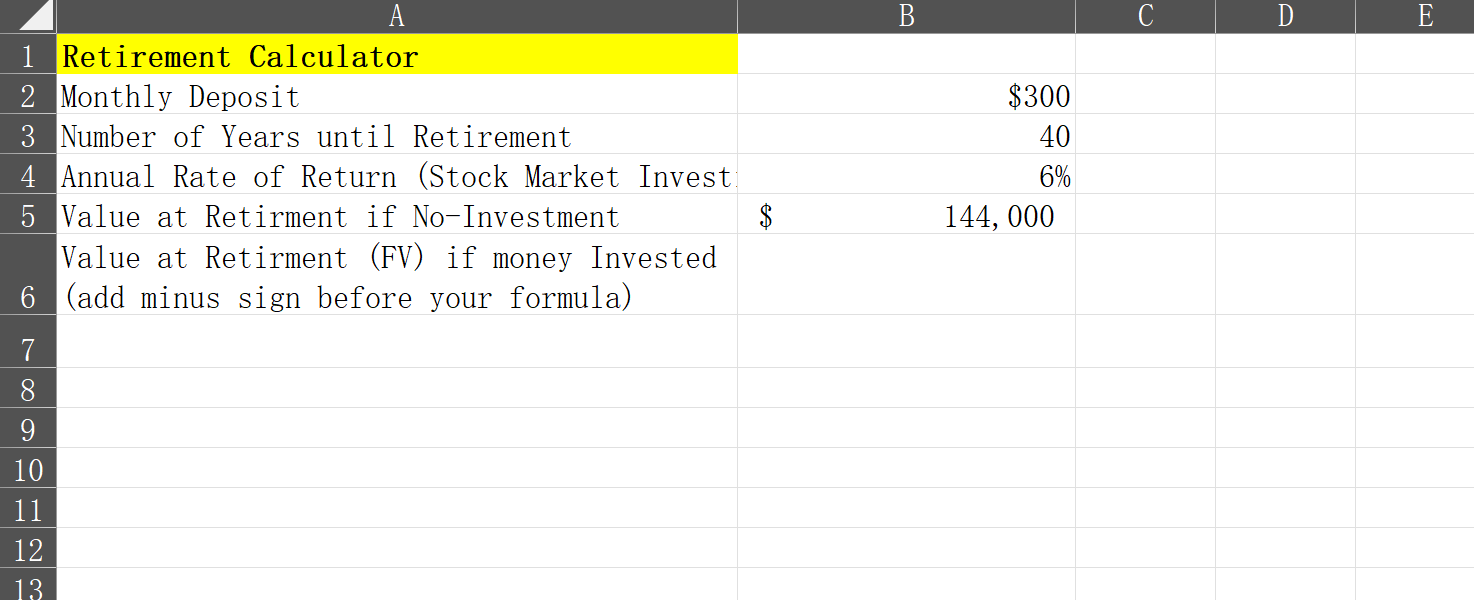

return, and then use Goal Seek on "the Value at Retirement if money Invested" to answer the question.Retirement Calculator

Monthly Deposit

Number of Years until Retirement

Annual Rate of Return Stock Market Invest

Value at Retirment if NoInvestment

Value at Retirment FV if money Invested

add minus sign before your formula

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started