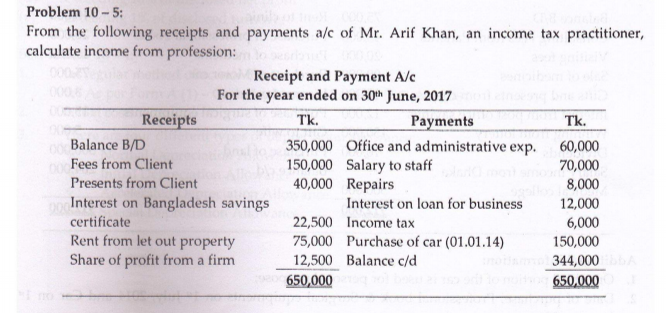

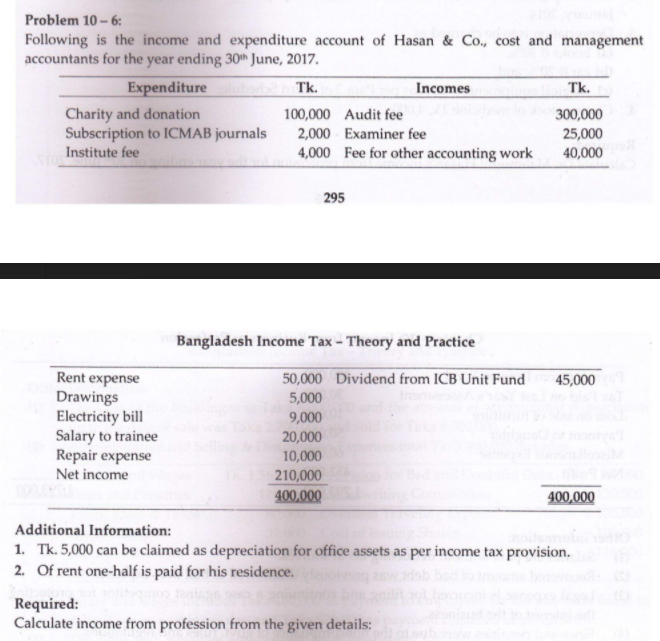

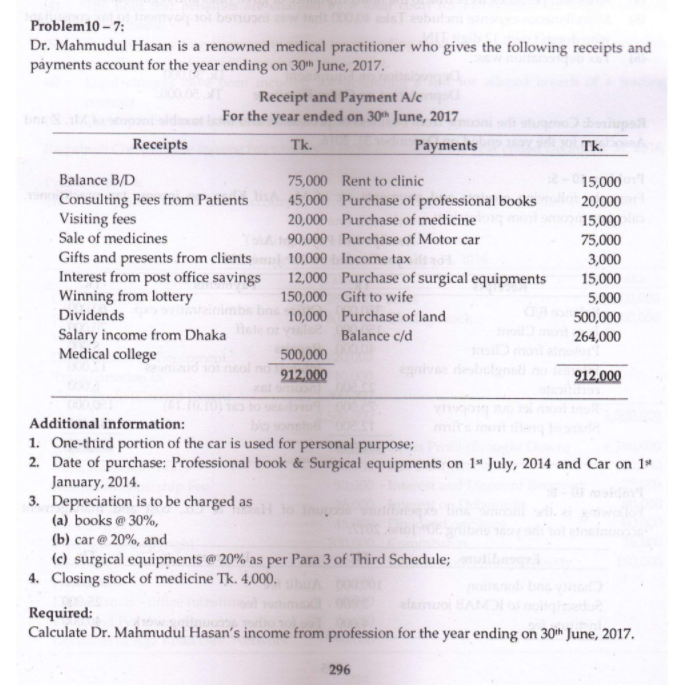

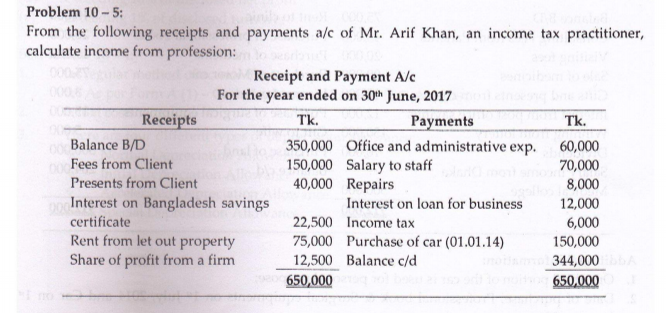

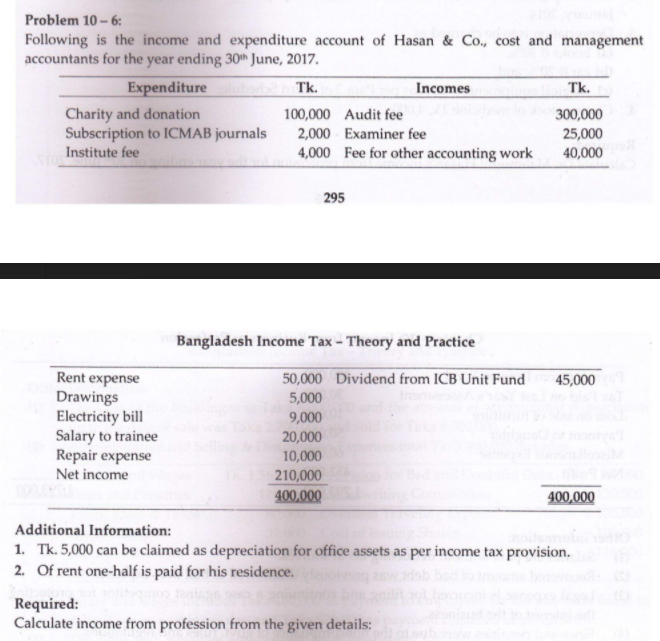

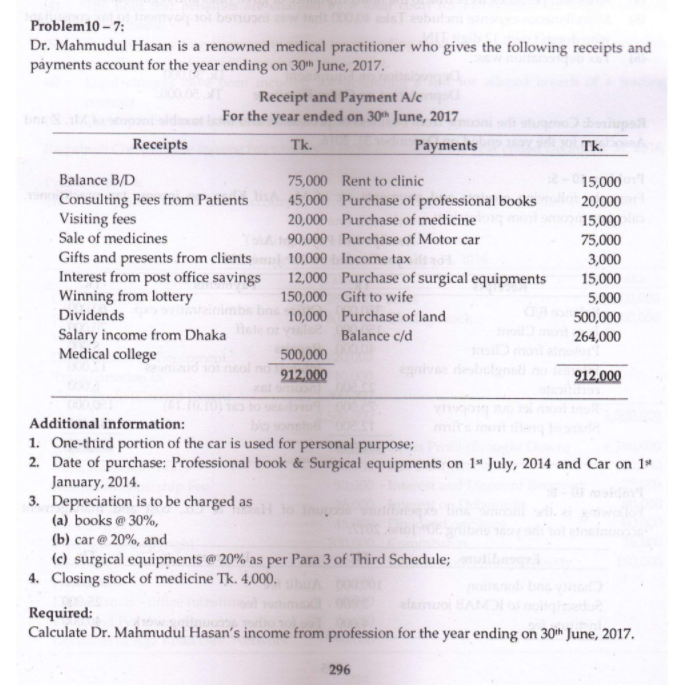

Problem 10 - 5: From the following receipts and payments a/c of Mr. Arif Khan, an income tax practitioner, calculate income from profession: Receipt and Payment A/c For the year ended on 30th June, 2017 Receipts Tk. Payments Tk. Balance B/D 350,000 Office and administrative exp. 60,000 Fees from Client 150,000 Salary to staff 70,000 Presents from Client 40,000 Repairs 8,000 Interest on Bangladesh savings Interest on loan for business 12,000 certificate 22,500 Income tax 6,000 Rent from let out property 75,000 Purchase of car (01.01.14) 150,000 Share of profit from a firm 12,500 Balance c/d 344,000 650,000 650,000 Problem 10 - 6: Following is the income and expenditure account of Hasan & Co., cost and management accountants for the year ending 30th June, 2017 Expenditure Incomes Tk. Charity and donation 100,000 Audit fee 300,000 Subscription to ICMAB journals 2,000 Examiner fee 25,000 Institute fee 4,000 Fee for other accounting work 40,000 Tk. 295 45,000 Rent expense Drawings Electricity bill Salary to trainee Repair expense Net income Bangladesh Income Tax - Theory and Practice 50,000 Dividend from ICB Unit Fund 5,000 9,000 20,000 10,000 210,000 400,000 400,000 Additional Information: 1. Tk. 5,000 can be claimed as depreciation for office assets as per income tax provision. 2. Of rent one-half is paid for his residence. Required: Calculate income from profession from the given details: Problem 10 - 7: Dr. Mahmudul Hasan is a renowned medical practitioner who gives the following receipts and payments account for the year ending on 30th June, 2017 Receipt and Payment A/c For the year ended on 30th June, 2017 Receipts Tk. Payments Tk. Balance B/D 75,000 Rent to clinic 15,000 Consulting Fees from Patients 45,000 Purchase of professional books 20,000 Visiting fees 20,000 Purchase of medicine 15,000 Sale of medicines 90,000 Purchase of Motor car 75,000 Gifts and presents from clients 10,000 Income tax 3,000 Interest from post office savings 12,000 Purchase of surgical equipments 15,000 Winning from lottery 150,000 Gift to wife 5,000 Dividends 10,000 Purchase of land 500,000 Salary income from Dhaka Balance c/d 264,000 Medical college 500,000 912,000 912,000 Additional information: 1. One-third portion of the car is used for personal purpose; 2. Date of purchase: Professional book & Surgical equipments on 19 July, 2014 and Car on 1 January, 2014 3. Depreciation is to be charged as (a) books @ 30%, (b) car @ 20%, and (c) surgical equipments @ 20% as per Para 3 of Third Schedule; 4. Closing stock of medicine Tk. 4,000. Required: Calculate Dr. Mahmudul Hasan's income from profession for the year ending on 30ih June, 2017 296