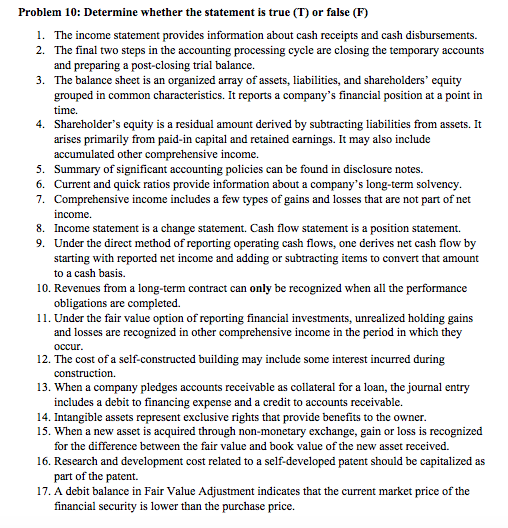

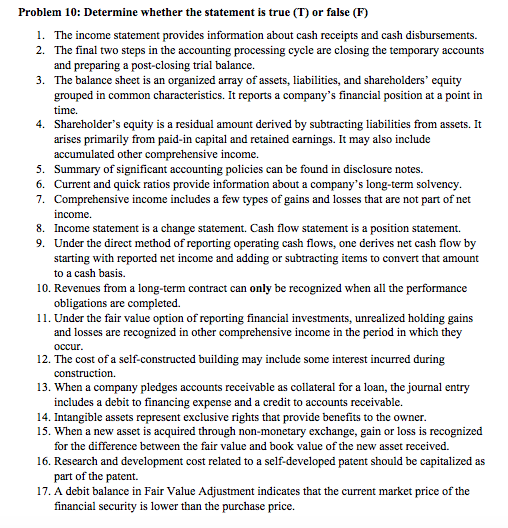

Problem 10: Determine whether the statement is true (T) or false (F) 1. 2. The income statement provides information about cash receipts and cash disbursements. The final two steps in the accounting processing cycle are closing the temporary accounts and preparing a post-closing trial balance. The balance sheet is an organized array of assets, liabilities, and shareholders' equity grouped in common characteristics. It reports a company's financial position at a point in 3. 4. Shareholder's equity is a residual amount derived by subtracting liabilities from assets. It arises primarily from paid-in capital and retained earnings. It may also include accumulated other comprehensive income. Summary of significant accounting policies can be found in disclosure notes. Current and quick ratios provide information about a company's long-term solvency Comprehensive income includes a few types of gains and losses that are not part of net 5. 6. 7. 8. 9. Income statement is a change statement. Cash flow statement is a position statement. Under the direct method of reporting operating cash flows, one derives net cash flow by starting with reported net income and adding or subtracting items to convert that amount to a cash basis 10. Revenues from a long-term contract can only be recognized when all the performance obligations are completed. 11. Under the fair value option of reporting financial investments, unrealized holding gains and losses are recognized in other comprehensive income in the period in which they 12. The cost of a self-constructed building may include some interest incurred during 13. When a company pledges accounts receivable as collateral for a loan, the journal entry 14. Intangible assets represent exclusive rights that provide benefits to the owner includes a debit to financing expense and a credit to accounts receivable. 15. When a new asset is acquired through non-monetary exchange, gain or loss is recognized 16. Research and development cost related to a self-developed patent should be capitalized as 17. A debit balance in Fair Value Adjustment indicates that the current market price of the for the difference between the fair value and book value of the new asset received. part of the patent. financial security is lower than the purchase price