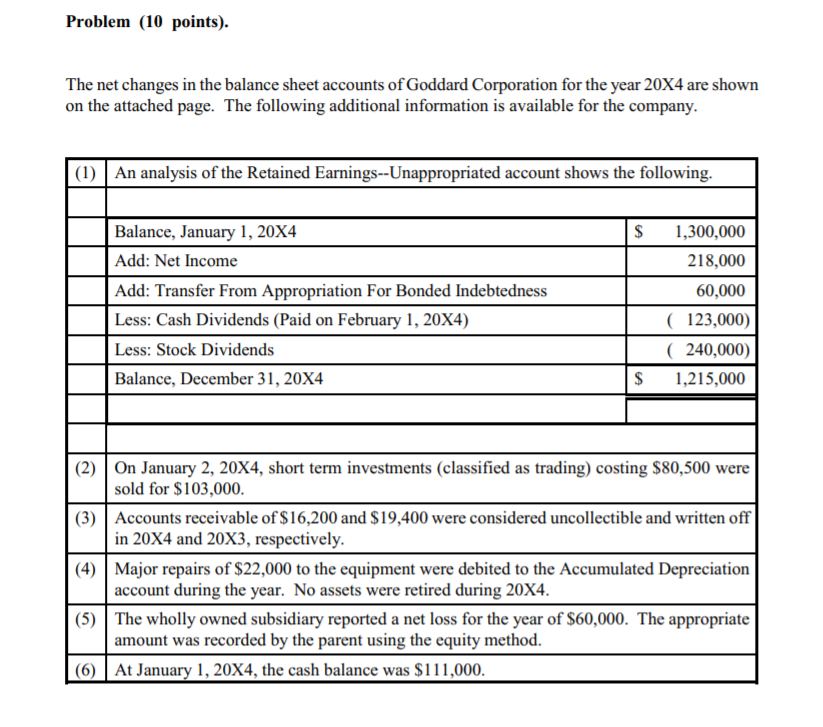

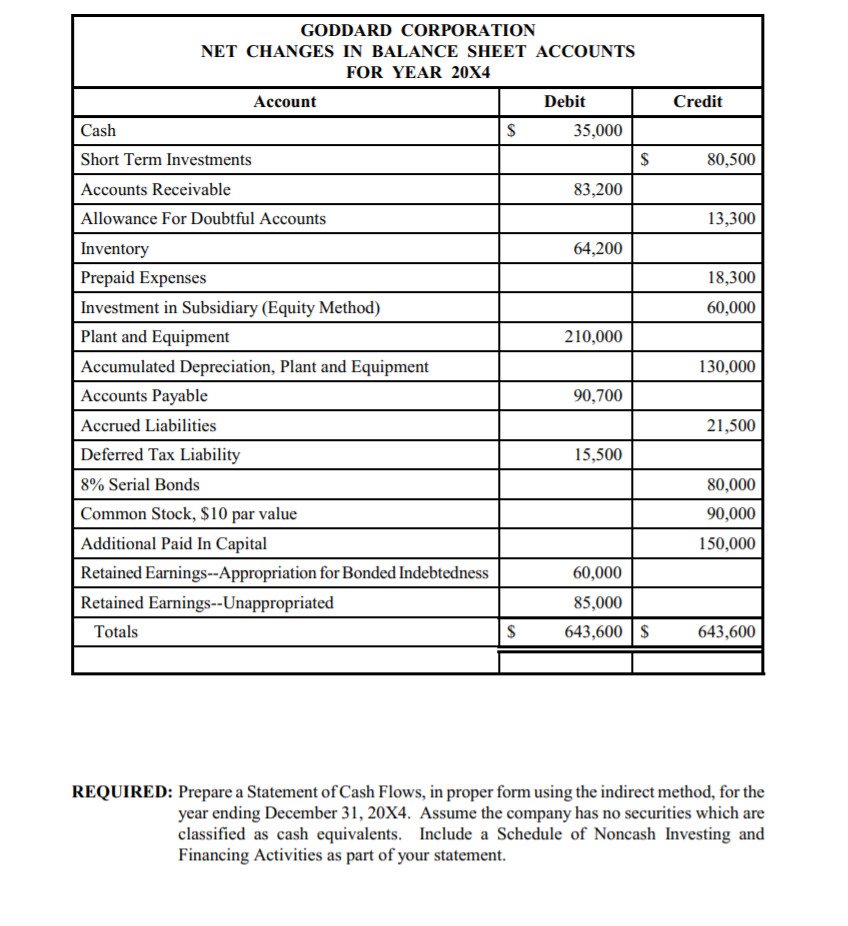

Problem (10 points). The net changes in the balance sheet accounts of Goddard Corporation for the year 20X4 are shown on the attached page. The following additional information is available for the company. (1) An analysis of the Retained Earnings--Unappropriated account shows the following. $ Balance, January 1, 20X4 Add: Net Income Add: Transfer From Appropriation For Bonded Indebtedness Less: Cash Dividends (Paid on February 1, 20X4) Less: Stock Dividends Balance, December 31, 20X4 1,300,000 218,000 60,000 ( 123,000) ( 240,000) 1,215,000 $ (3) (2) On January 2, 20X4, short term investments (classified as trading) costing $80,500 were sold for $103,000. Accounts receivable of $16,200 and $19,400 were considered uncollectible and written off in 20X4 and 20X3, respectively. Major repairs of $22,000 to the equipment were debited to the Accumulated Depreciation account during the year. No assets were retired during 20X4. The wholly owned subsidiary reported a net loss for the year of $60,000. The appropriate amount was recorded by the parent using the equity method. (6) At January 1, 20X4, the cash balance was $111,000. Credit 80,500 13,300 18,300 60,000 GODDARD CORPORATION NET CHANGES IN BALANCE SHEET ACCOUNTS FOR YEAR 20X4 Account Debit Cash $ 35,000 Short Term Investments Accounts Receivable 83,200 Allowance For Doubtful Accounts Inventory 64,200 Prepaid Expenses Investment in Subsidiary (Equity Method) Plant and Equipment 210,000 Accumulated Depreciation, Plant and Equipment Accounts Payable 90,700 Accrued Liabilities Deferred Tax Liability 15,500 8% Serial Bonds Common Stock, $10 par value Additional Paid In Capital Retained Earnings--Appropriation for Bonded Indebtedness 60,000 Retained Earnings--Unappropriated 85,000 Totals $ 643,600 $ 130,000 21,500 80,000 90,000 150,000 643,600 REQUIRED: Prepare a Statement of Cash Flows, in proper form using the indirect method, for the year ending December 31, 20X4. Assume the company has no securities which are classified as cash equivalents. Include a Schedule of Noncash Investing and Financing Activities as part of your statement