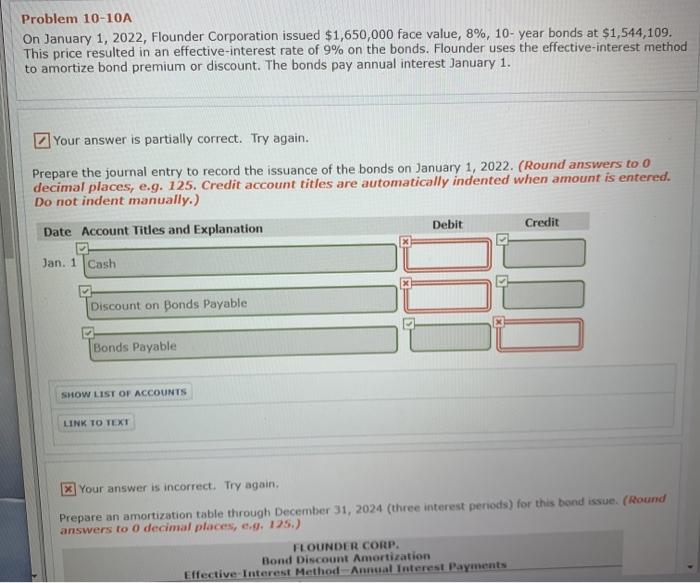

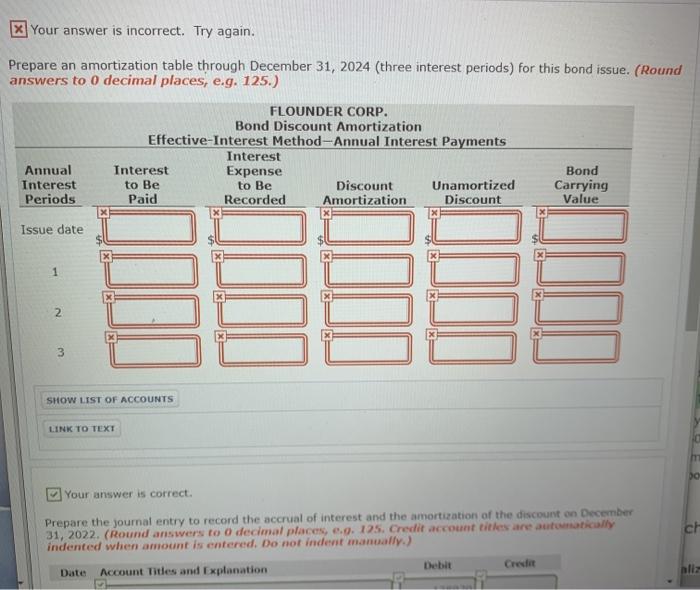

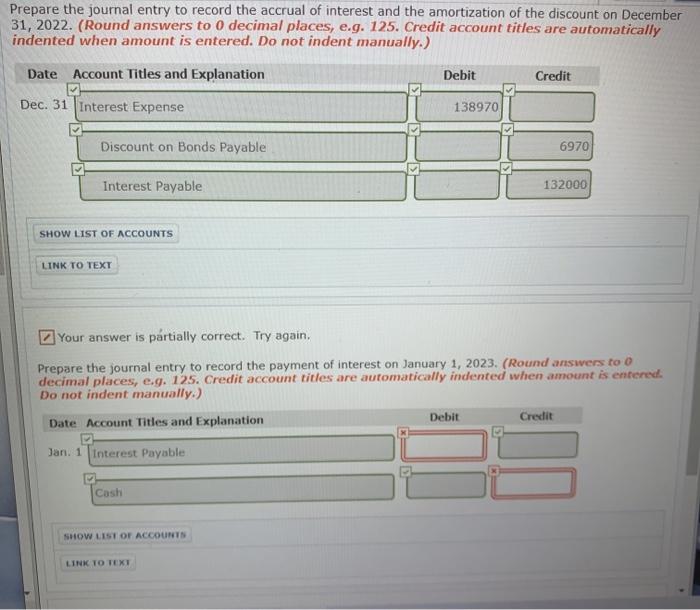

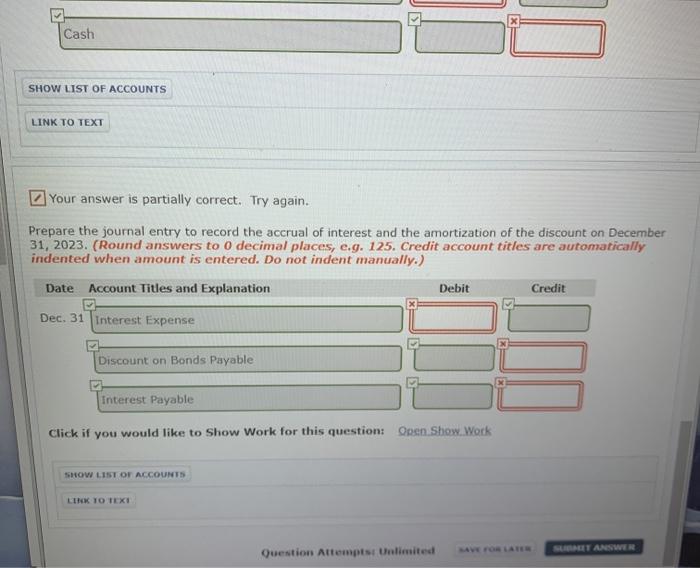

Problem 10-10A On January 1, 2022, Flounder Corporation issued $1,650,000 face value, 8%, 10-year bonds at $1,544,109. This price resulted in an effective-interest rate of 9% on the bonds. Flounder uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1. Your answer is partially correct. Try again. Prepare the journal entry to record the issuance of the bonds on January 1, 2022. (Round answers to O decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 Cash Discount on Bonds Payable Bonds Payable SHOW LIST OF ACCOUNTS LINK TO TEXT Ex Your answer is incorrect. Try again. Prepare an amortization table through December 31, 2024 (three interest periods) for this bond issue. (Round answers to o decimal places, e.g. 125.) FLOUNDER CORP. Bond Discount Amortization Effective Interest Method - Annual Interest Payments x Your answer is incorrect. Try again. Prepare an amortization table through December 31, 2024 (three interest periods) for this bond issue. (Round answers to 0 decimal places, e.g. 125.) FLOUNDER CORP. Bond Discount Amortization Effective Interest Method-Annual Interest Payments Interest Interest Expense to Be to Be Discount Unamortized Paid Recorded Amortization Discount Annual Interest Periods Bond Carrying Value Issue date 1 [TTT IIII 2 3 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is correct. ch Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2022. (Round answers to O decimal places, e.o. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Crest Date Account Titles and Explanation ali Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2022. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Interest Expense 138970 Discount on Bonds Payable 6970 Interest Payable 132000 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the journal entry to record the payment of interest on January 1, 2023. (Round answers to o decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 Interest Payable Cash SHOW LIST OF ACCOUNTS LINK TO TEXT Cash SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2023. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Interest Expense Discount on Bonds Payable Interest Payable Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Question Attempts Unlimited