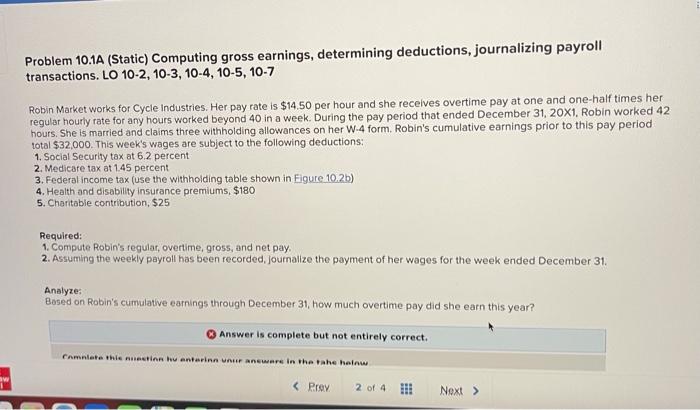

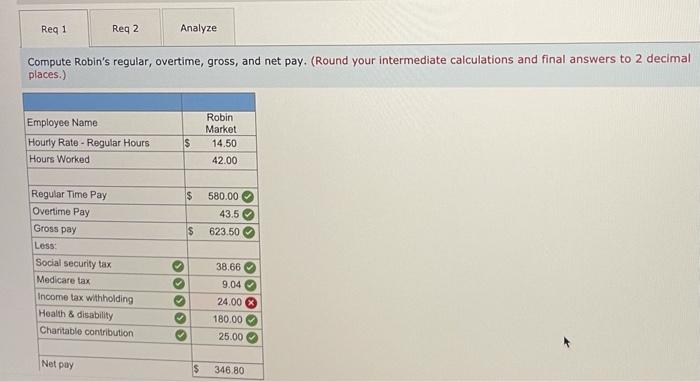

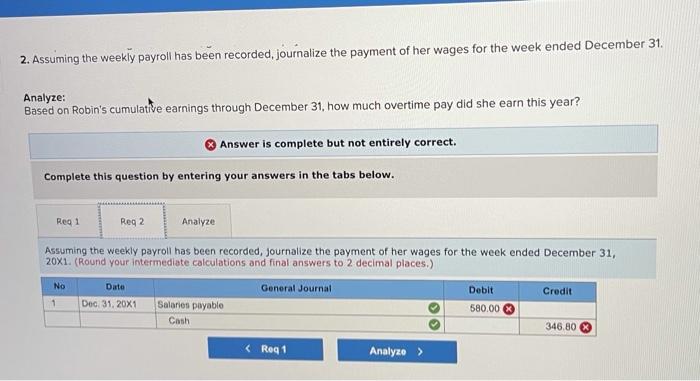

Problem 10.1A (Static) Computing gross earnings, determining deductions, journalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5, 10-7 Robin Market works for Cycle Industries. Her pay rate is $14.50 per hour and she receives overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31, 20X1. Robin worked 42 hours. She is married and claims three withholding allowances on her W-4 form, Robin's cumulative earnings prior to this pay period total $32,000. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3.Federal income tax (use the withholding table shown in Figure 10.25) 4. Health and disability insurance premiums, $180 5. Charitable contribution, $25 Required: 1. Compute Robin's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded journalize the payment of her wages for the week ended December 31, Analyze: Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year? Answer is complete but not entirely correct. Camnete this restinn hu antarinn UAE answers in the rahe hain w Reg 1 Reg 2 Analyze Compute Robin's regular, overtime, gross, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Name $ Hourly Rate - Regular Hours Hours Worked Robin Market 14.50 42.00 s 580.00 43.5 623.50 Regular Time Pay Overtime Pay Gross pay Less Social security tax Medicare tax Income tax withholding Health & disability Charitable contribution OOO 38,66 9.04 24.00 X 180.00 25.00 Net pay $ 346.80 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Rea 1 Reg 2 Analyze Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31, 20X1. (Round your intermediate calculations and final answers to 2 decimal places.) Date General Journal Dobit Credit Dec 31, 20X1 Salaries payable 580.00 $ Cash 346.80 No 1 Problem 10.1A (Static) Computing gross earnings, determining deductions, journalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5, 10-7 Robin Market works for Cycle Industries. Her pay rate is $14.50 per hour and she receives overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31, 20X1. Robin worked 42 hours. She is married and claims three withholding allowances on her W-4 form, Robin's cumulative earnings prior to this pay period total $32,000. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3.Federal income tax (use the withholding table shown in Figure 10.25) 4. Health and disability insurance premiums, $180 5. Charitable contribution, $25 Required: 1. Compute Robin's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded journalize the payment of her wages for the week ended December 31, Analyze: Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year? Answer is complete but not entirely correct. Camnete this restinn hu antarinn UAE answers in the rahe hain w Reg 1 Reg 2 Analyze Compute Robin's regular, overtime, gross, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Name $ Hourly Rate - Regular Hours Hours Worked Robin Market 14.50 42.00 s 580.00 43.5 623.50 Regular Time Pay Overtime Pay Gross pay Less Social security tax Medicare tax Income tax withholding Health & disability Charitable contribution OOO 38,66 9.04 24.00 X 180.00 25.00 Net pay $ 346.80 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Rea 1 Reg 2 Analyze Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31, 20X1. (Round your intermediate calculations and final answers to 2 decimal places.) Date General Journal Dobit Credit Dec 31, 20X1 Salaries payable 580.00 $ Cash 346.80 No 1