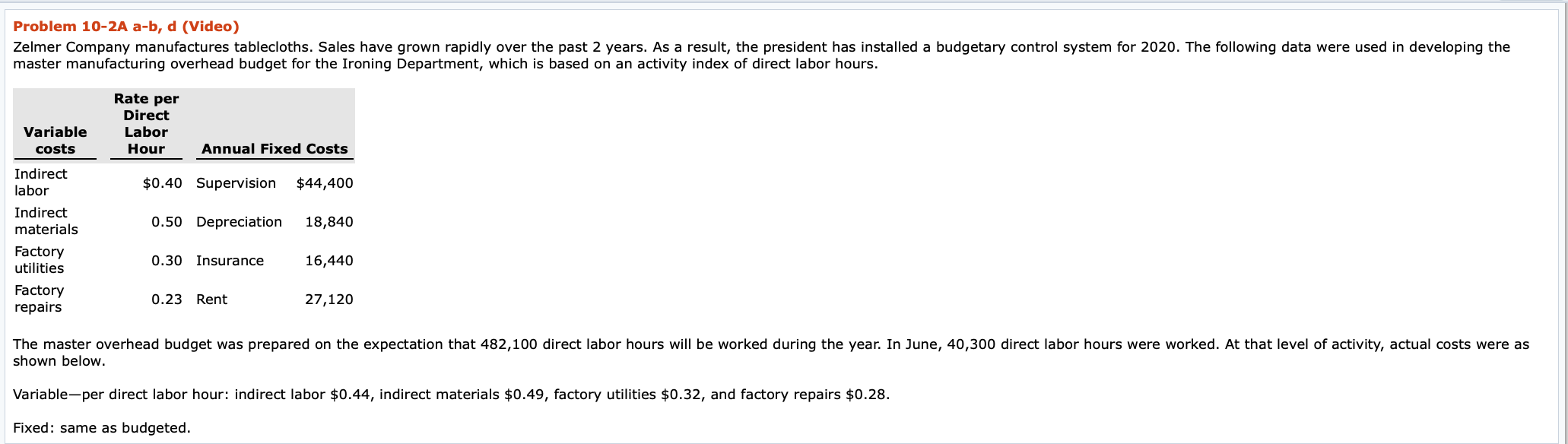

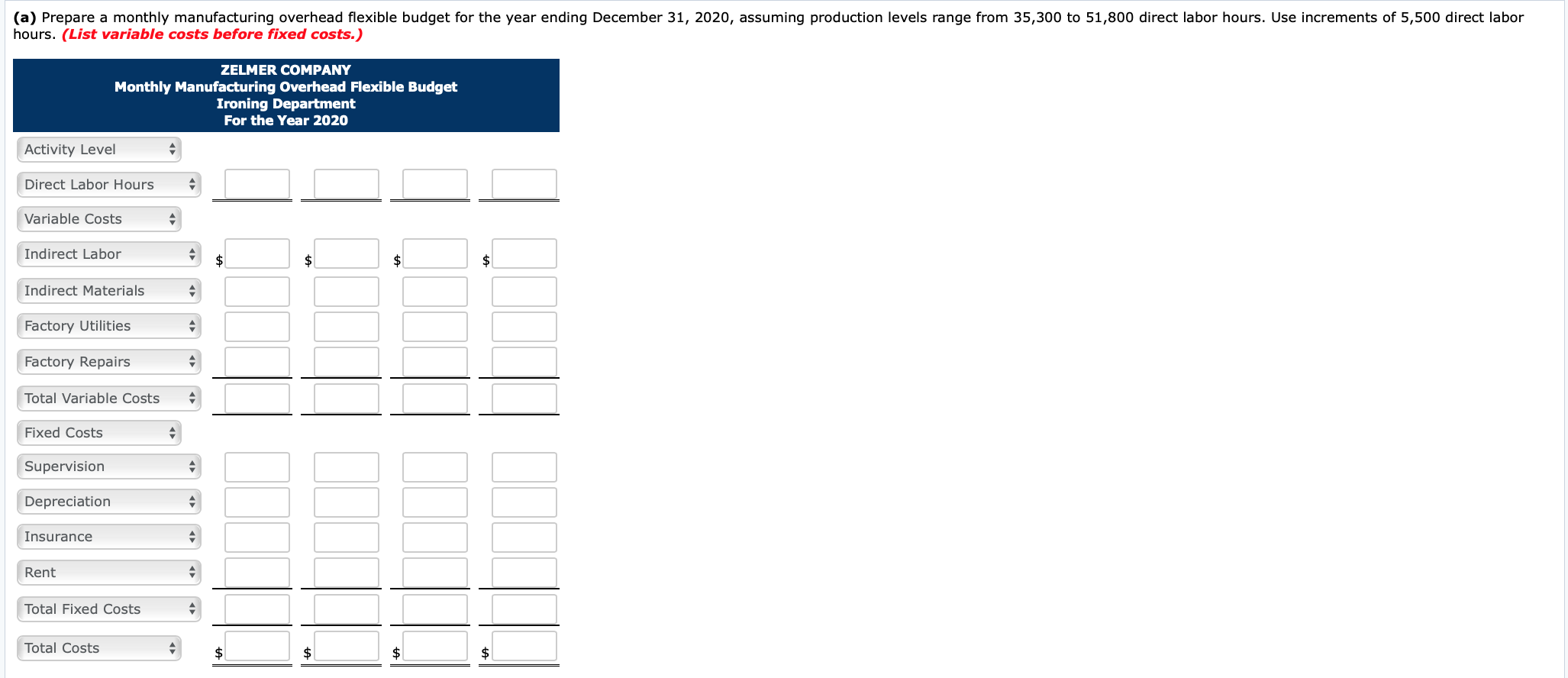

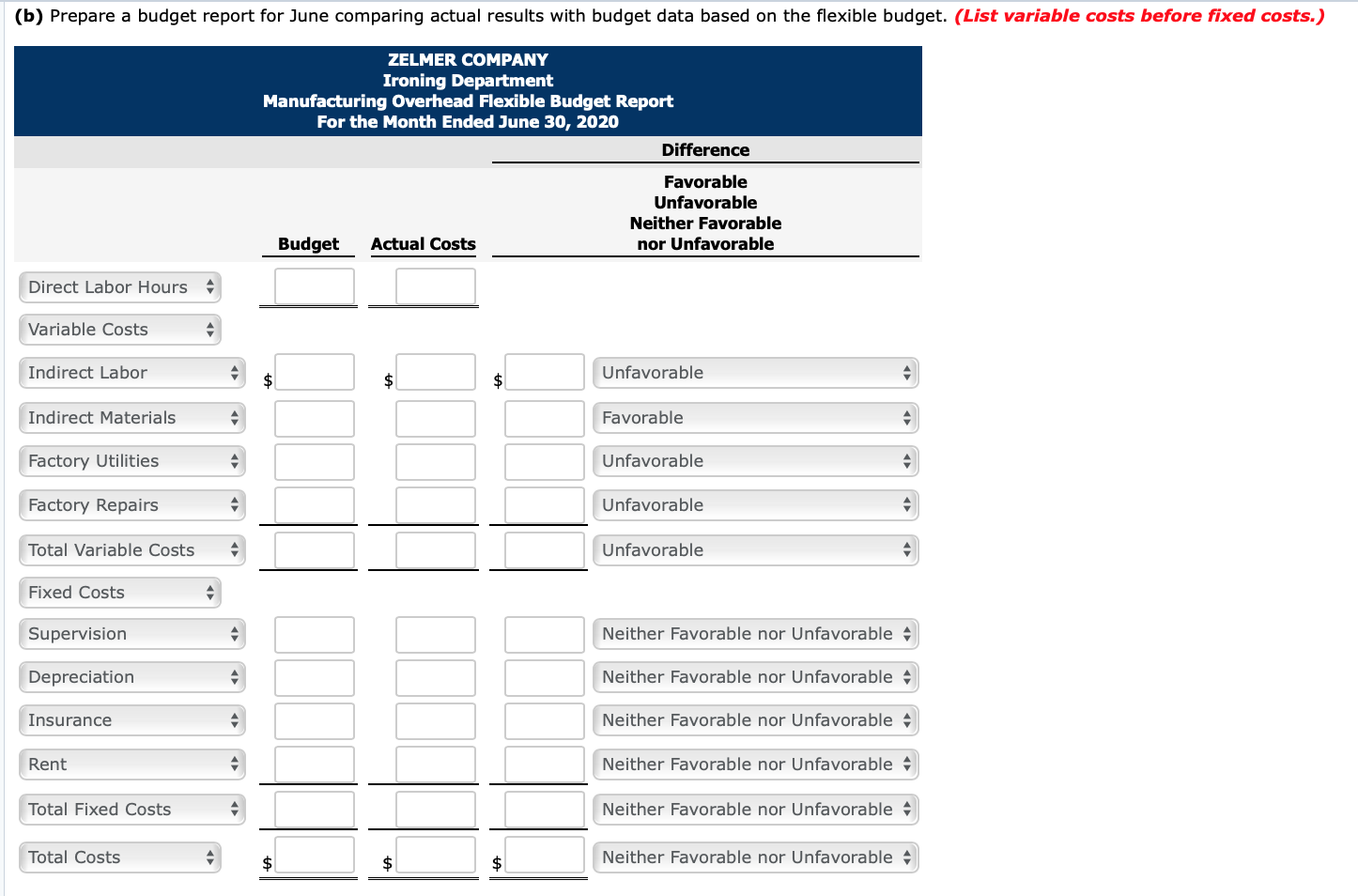

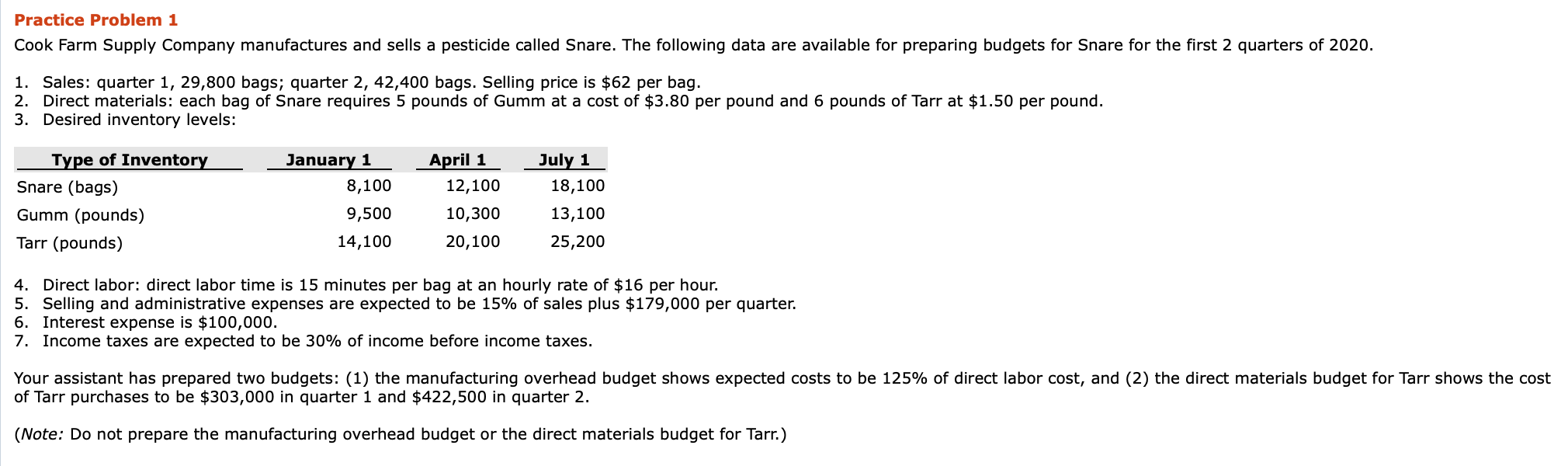

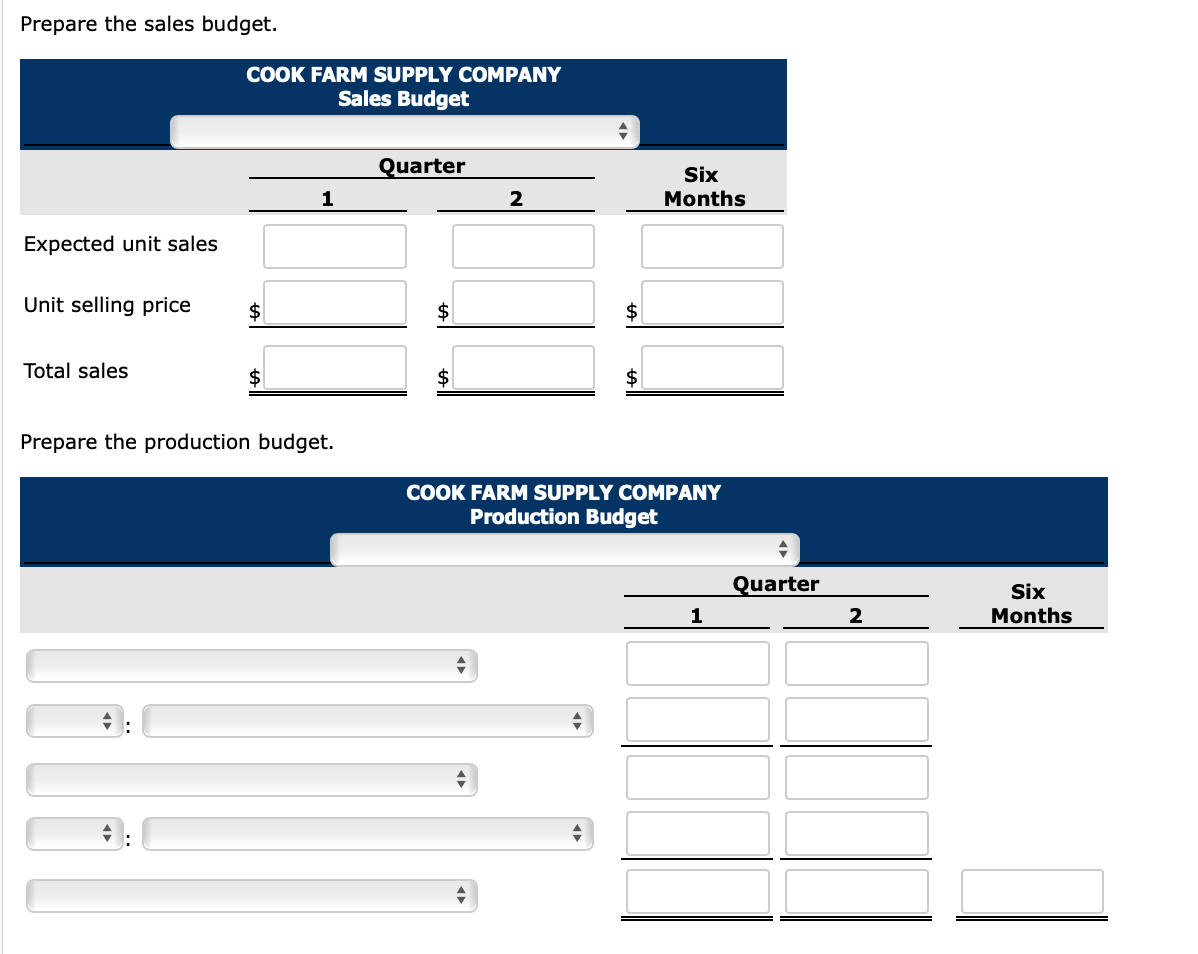

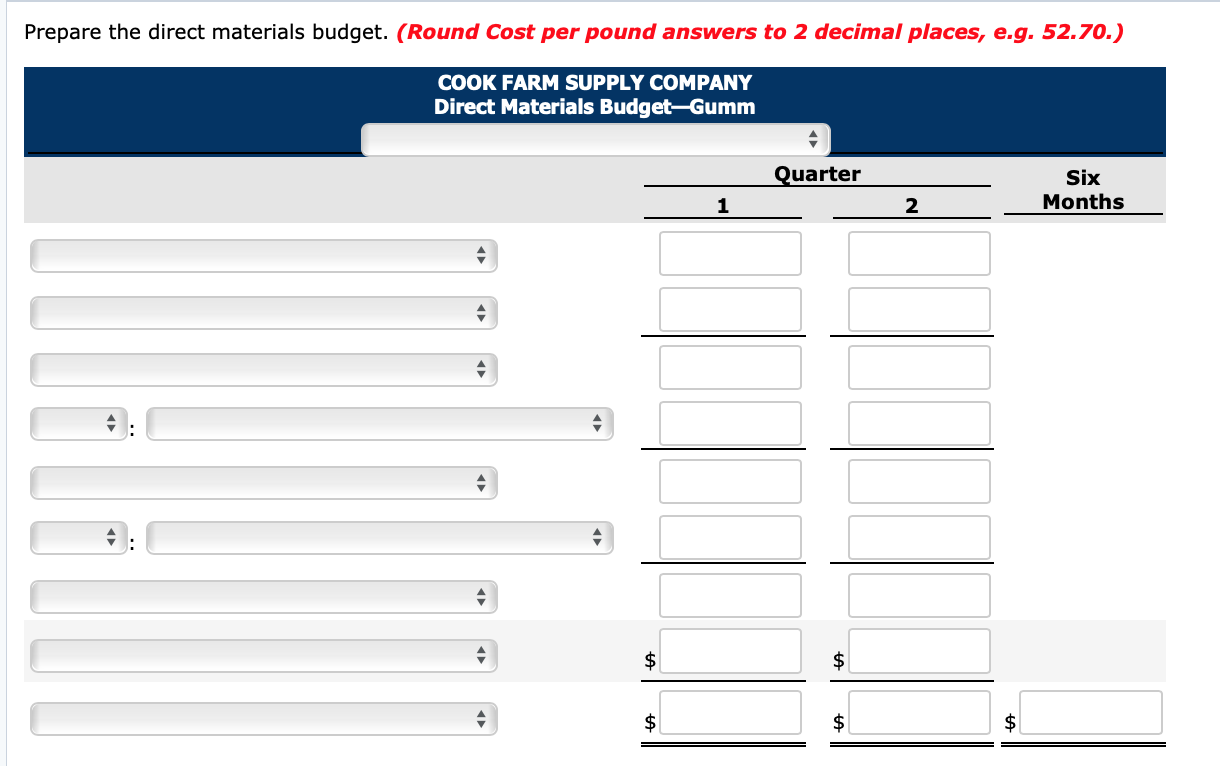

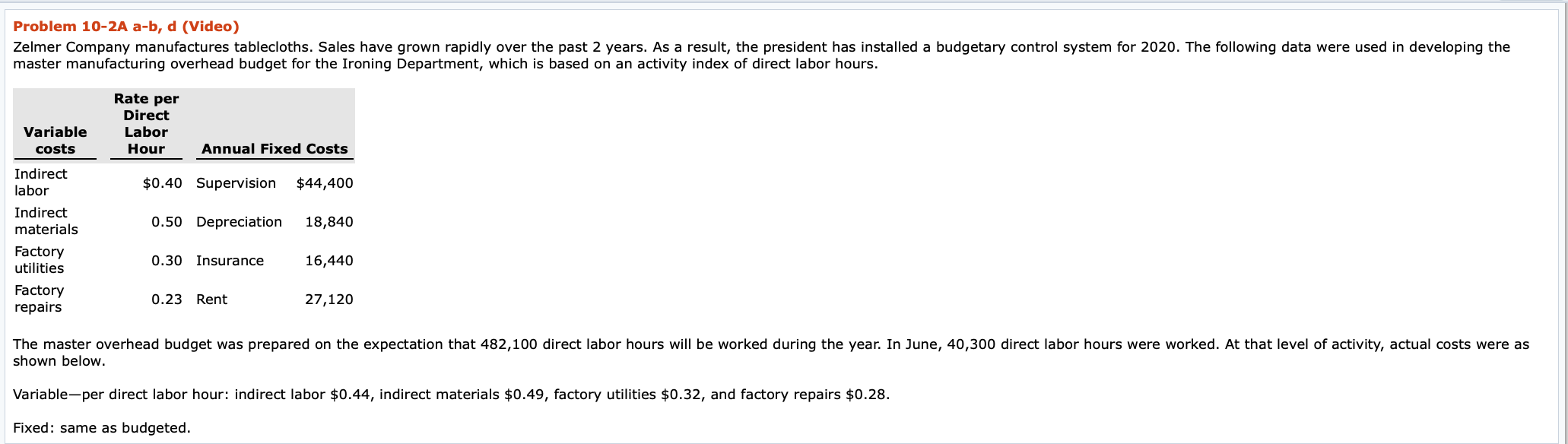

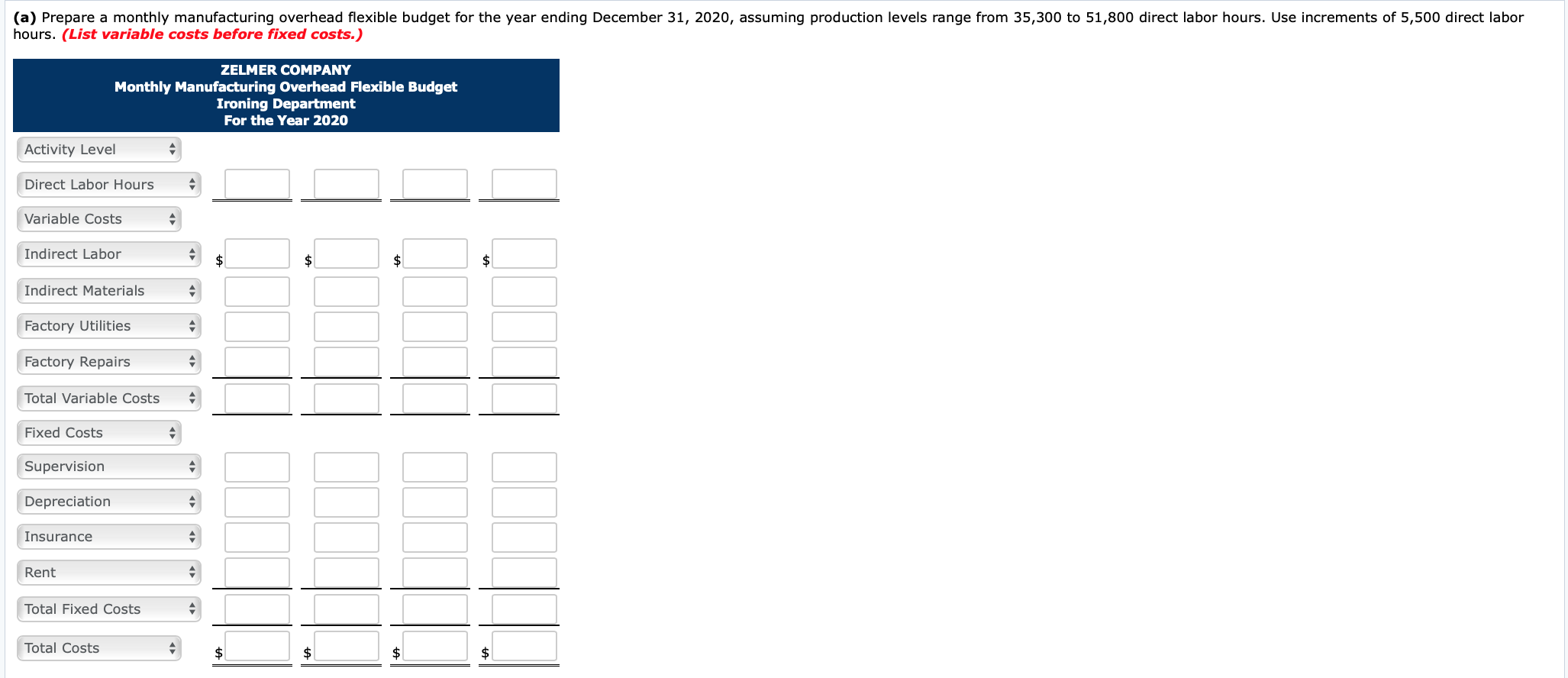

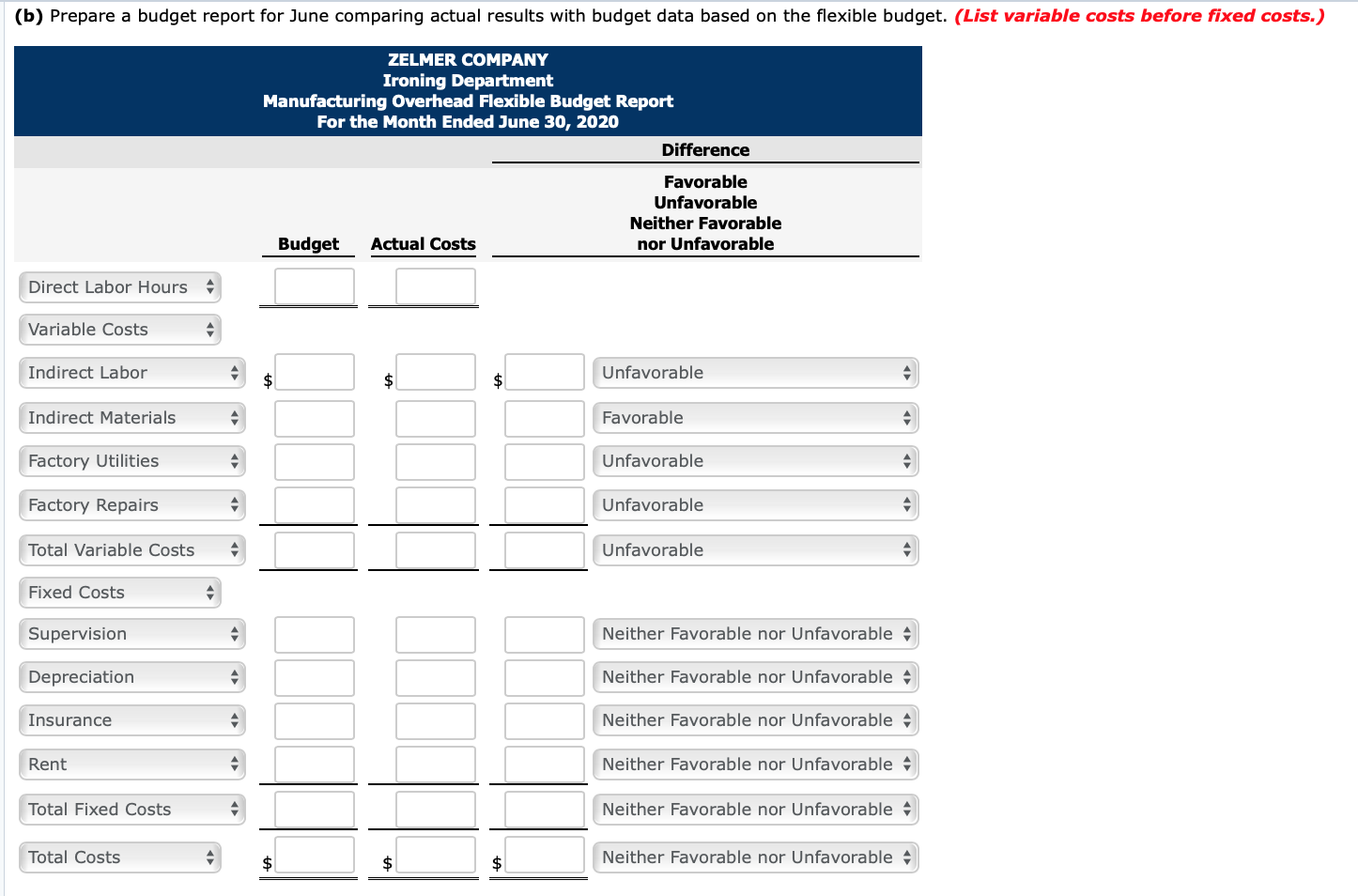

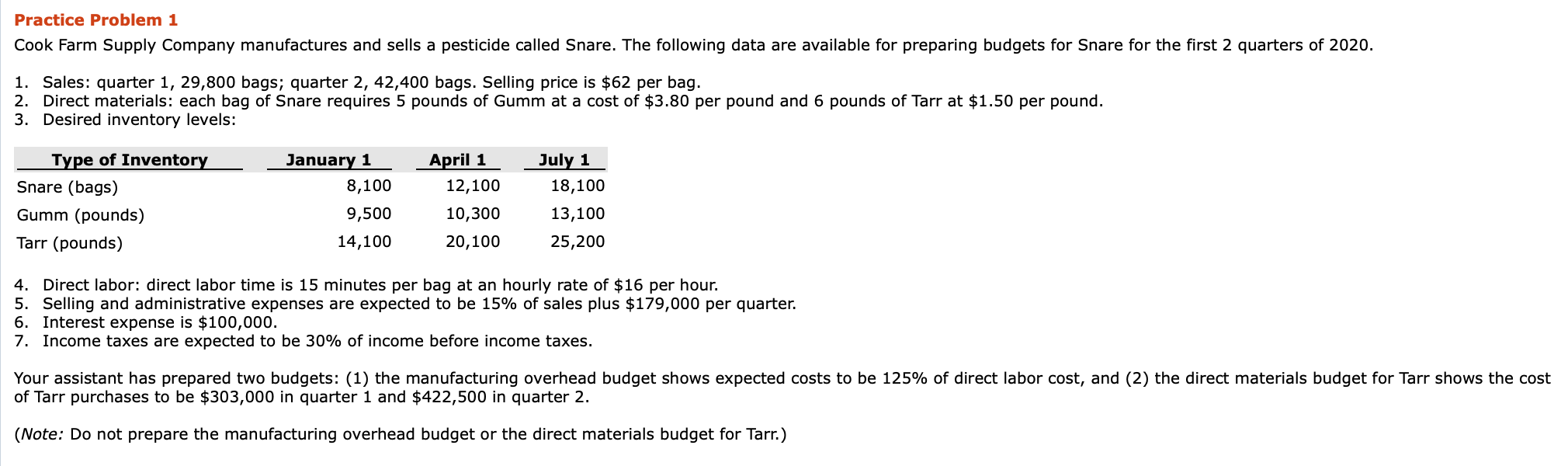

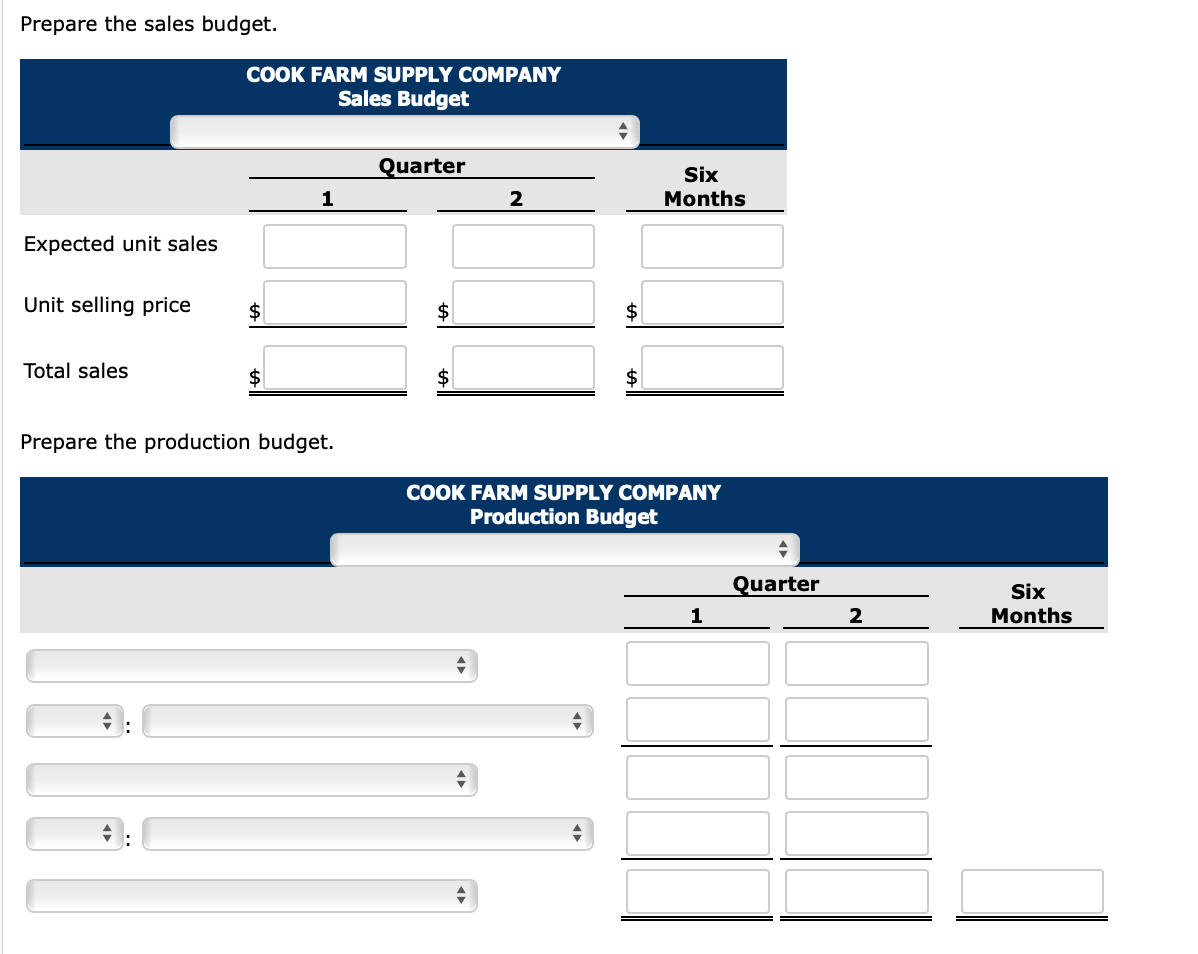

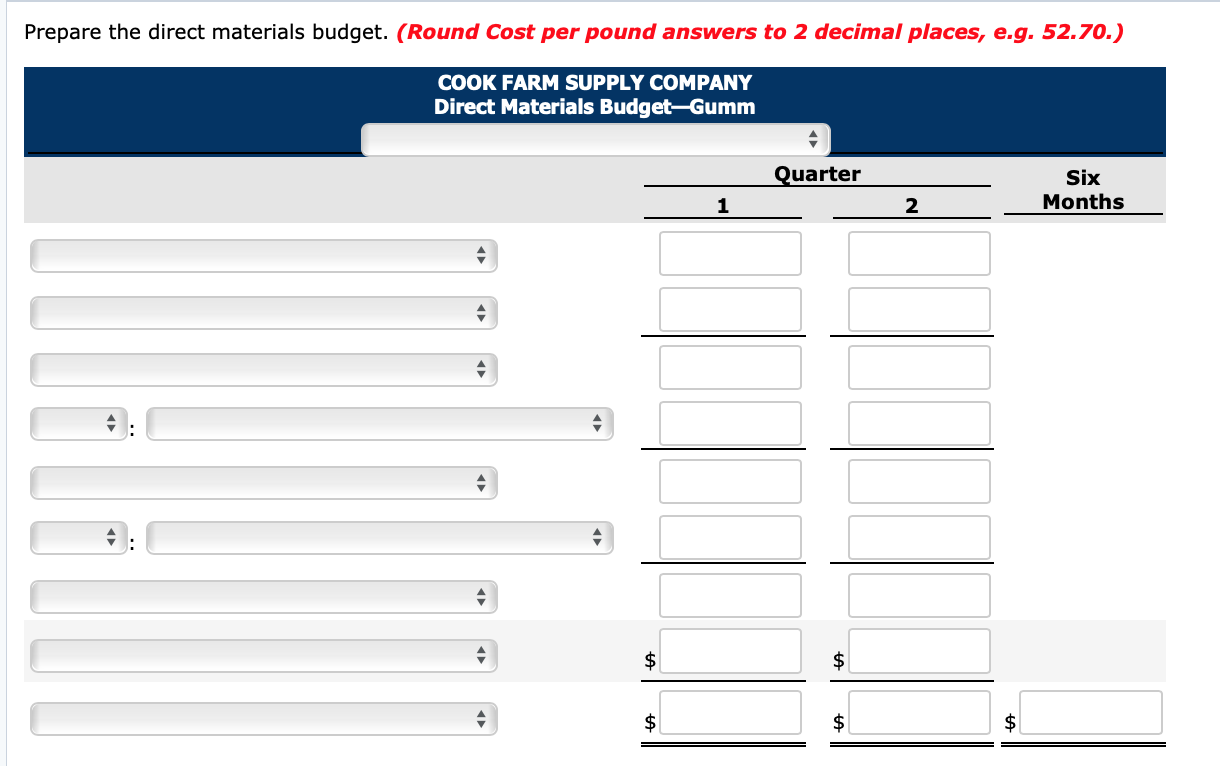

Problem 10-2A a-b, d (Video) Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for the Ironing Department, which is based on an activity index of direct labor hours. Rate per Direct Labor Hour Variable costs Annual Fixed Costs $0.40 Supervision $44,400 0.50 Depreciation 18,840 Indirect labor Indirect materials Factory utilities Factory repairs 0.30 Insurance 16,440 0.23 Rent 27,120 The master overhead budget was prepared on the expectation that 482,100 direct labor hours will be worked during the year. In June, 40,300 direct labor hours were worked. At that level of activity, actual costs were as shown below. Variable-per direct labor hour: indirect labor $0.44, indirect materials $0.49, factory utilities $0.32, and factory repairs $0.28. Fixed: same as budgeted. (a) Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020, assuming production levels range from 35,300 to 51,800 direct labor hours. Use increments of 5,500 direct labor hours. (List variable costs before fixed costs.) ZELMER COMPANY Monthly Manufacturing Overhead Flexible Budget Ironing Department For the Year 2020 Activity Level Direct Labor Hours Variable Costs Indirect Labor $ $ $ $ Indirect Materials Factory Utilities Factory Repairs Total Variable Costs Fixed Costs Supervision Depreciation Insurance Rent Total Fixed Costs Total Costs $ $ $ $ (b) Prepare a budget report for June comparing actual results with budget data based on the flexible budget. (List variable costs before fixed costs.) ZELMER COMPANY Ironing Department Manufacturing Overhead Flexible Budget Report For the Month Ended June 30, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Budget Actual Costs Direct Labor Hours Variable Costs Indirect Labor Unfavorable $ $ $ Indirect Materials Favorable Factory Utilities Unfavorable Factory Repairs Unfavorable Total Variable Costs Unfavorable Fixed Costs Supervision Neither Favorable nor Unfavorable Depreciation a Neither Favorable nor Unfavorable Insurance a Neither Favorable nor Unfavorable Rent Neither Favorable nor Unfavorable 4 Total Fixed Costs Neither Favorable nor Unfavorable 4 Total Costs $ $ Neither Favorable nor Unfavorable Practice Problem 1 Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 29,800 bags; quarter 2, 42,400 bags. Selling price is $62 per bag. 2. Direct materials: each bag of Snare requires 5 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory Snare (bags) Gumm (pounds) Tarr (pounds) January 1 8,100 9,500 14,100 April 1 12,100 10,300 20,100 July 1 18,100 13,100 25,200 4. Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. 5. Selling and administrative expenses are expected to be 15% of sales plus $179,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $303,000 in quarter 1 and $422,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.) Prepare the sales budget. COOK FARM SUPPLY COMPANY Sales Budget Quarter Six Months 1 2 Expected unit sales Unit selling price $ $ Total sales $ $ $ Prepare the production budget. COOK FARM SUPPLY COMPANY Production Budget Quarter Six Months 1 2 Prepare the direct materials budget. (Round Cost per pound answers to 2 decimal places, e.g. 52.70.) COOK FARM SUPPLY COMPANY Direct Materials Budget-Gumm Quarter Six Months 1 2 $ $ $ $ $