Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 10-30 (Algorithmic) (LO. 4) Nichole, who is single and uses the cash method of accounting, lives in a state that imposes an income tax.

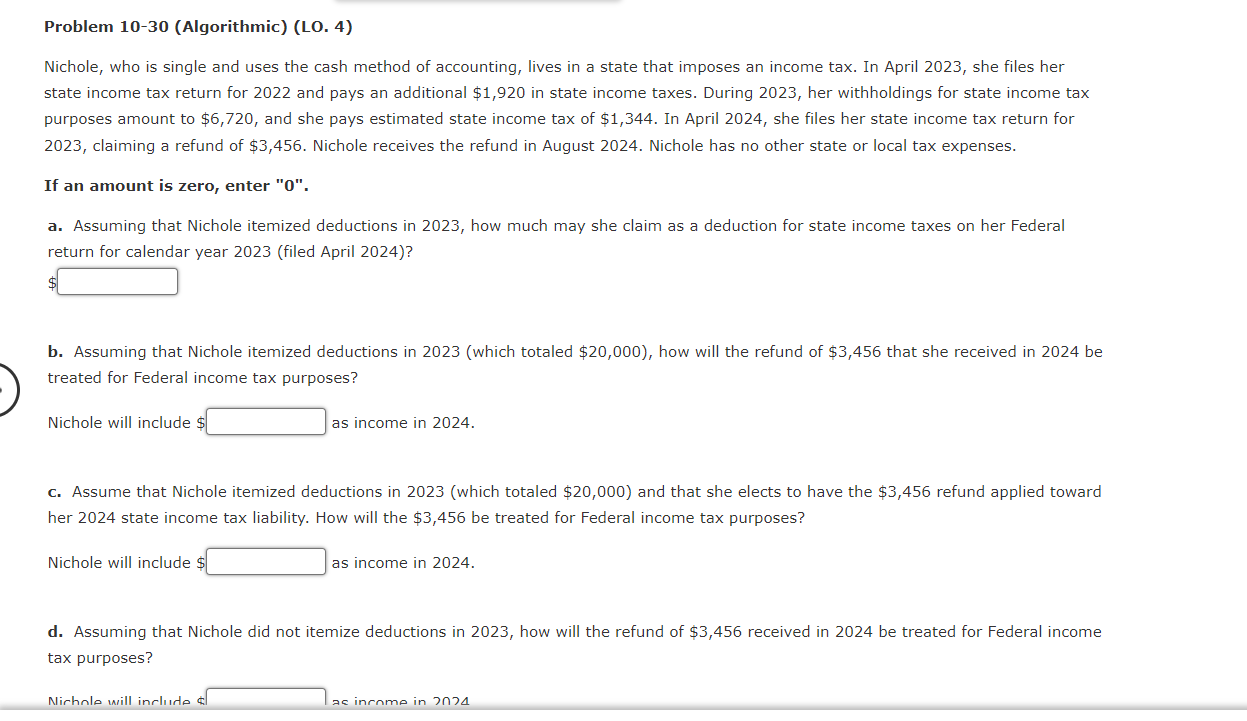

Problem 10-30 (Algorithmic) (LO. 4) Nichole, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2023 , she files her state income tax return for 2022 and pays an additional \$1,920 in state income taxes. During 2023, her withholdings for state income tax purposes amount to $6,720, and she pays estimated state income tax of $1,344. In April 2024 , she files her state income tax return for 2023 , claiming a refund of $3,456. Nichole receives the refund in August 2024. Nichole has no other state or local tax expenses. If an amount is zero, enter "0". a. Assuming that Nichole itemized deductions in 2023, how much may she claim as a deduction for state income taxes on her Federal return for calendar year 2023 (filed April 2024)? $ b. Assuming that Nichole itemized deductions in 2023 (which totaled $20,000 ), how will the refund of $3,456 that she received in 2024 be treated for Federal income tax purposes? Nichole will include $ as income in 2024 . c. Assume that Nichole itemized deductions in 2023 (which totaled $20,000 ) and that she elects to have the $3,456 refund applied toward her 2024 state income tax liability. How will the $3,456 be treated for Federal income tax purposes? Nichole will include as income in 2024 . d. Assuming that Nichole did not itemize deductions in 2023 , how will the refund of $3,456 received in 2024 be treated for Federal income tax purposes? Nirhnle will inclurte ac inrome in 2024

Problem 10-30 (Algorithmic) (LO. 4) Nichole, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2023 , she files her state income tax return for 2022 and pays an additional \$1,920 in state income taxes. During 2023, her withholdings for state income tax purposes amount to $6,720, and she pays estimated state income tax of $1,344. In April 2024 , she files her state income tax return for 2023 , claiming a refund of $3,456. Nichole receives the refund in August 2024. Nichole has no other state or local tax expenses. If an amount is zero, enter "0". a. Assuming that Nichole itemized deductions in 2023, how much may she claim as a deduction for state income taxes on her Federal return for calendar year 2023 (filed April 2024)? $ b. Assuming that Nichole itemized deductions in 2023 (which totaled $20,000 ), how will the refund of $3,456 that she received in 2024 be treated for Federal income tax purposes? Nichole will include $ as income in 2024 . c. Assume that Nichole itemized deductions in 2023 (which totaled $20,000 ) and that she elects to have the $3,456 refund applied toward her 2024 state income tax liability. How will the $3,456 be treated for Federal income tax purposes? Nichole will include as income in 2024 . d. Assuming that Nichole did not itemize deductions in 2023 , how will the refund of $3,456 received in 2024 be treated for Federal income tax purposes? Nirhnle will inclurte ac inrome in 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started