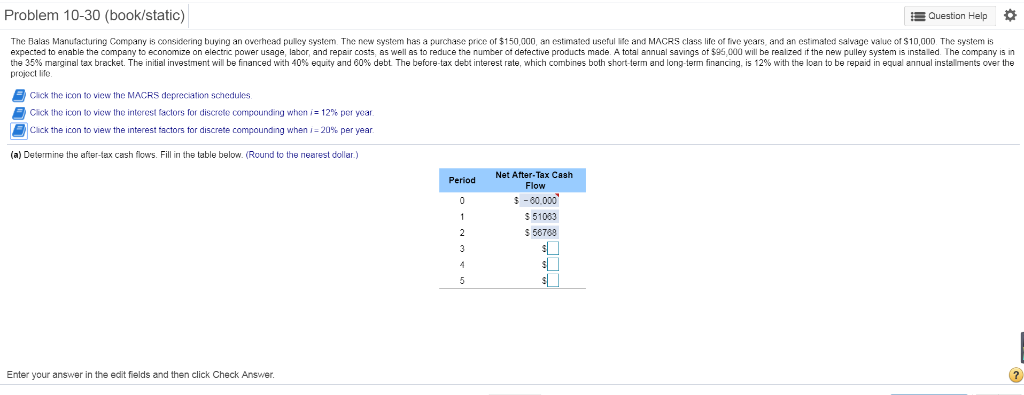

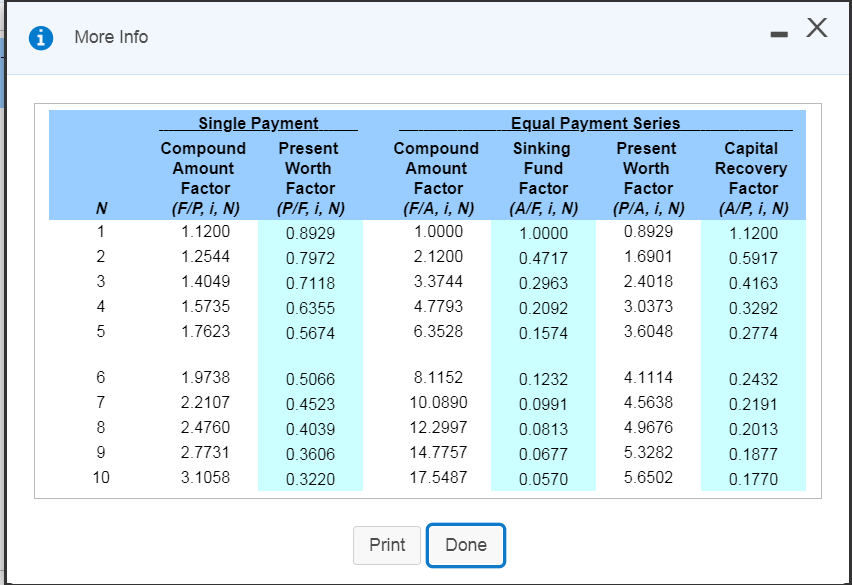

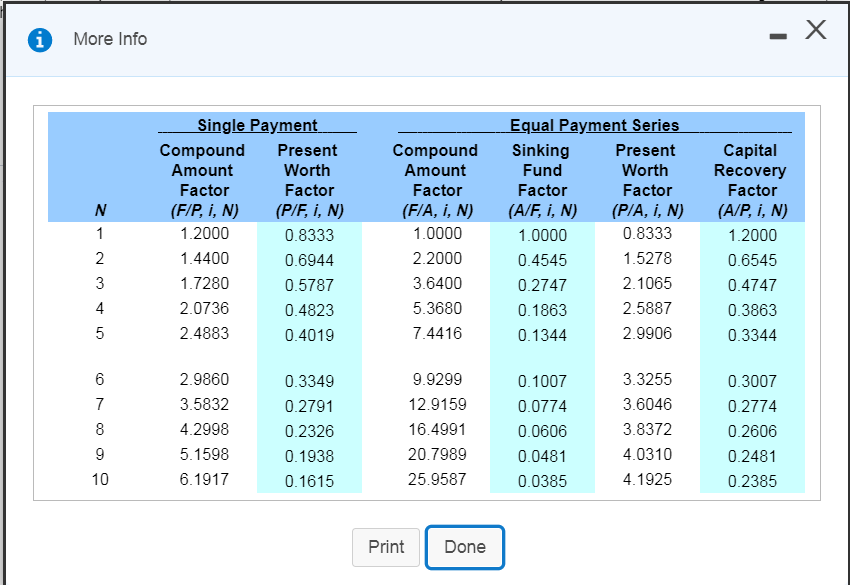

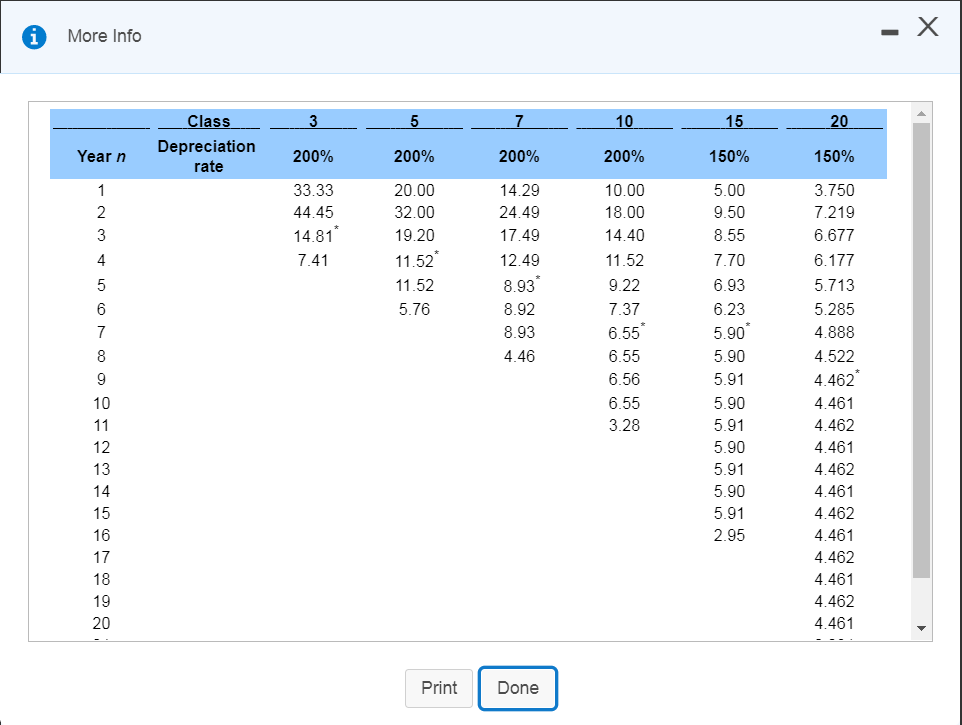

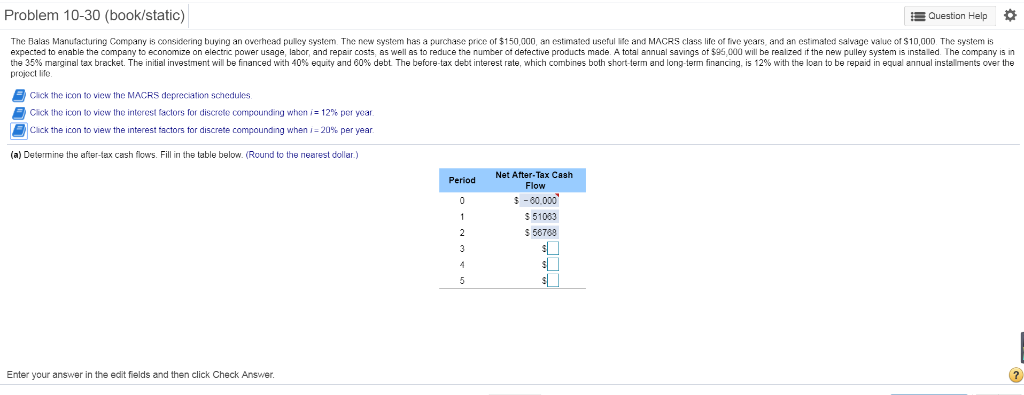

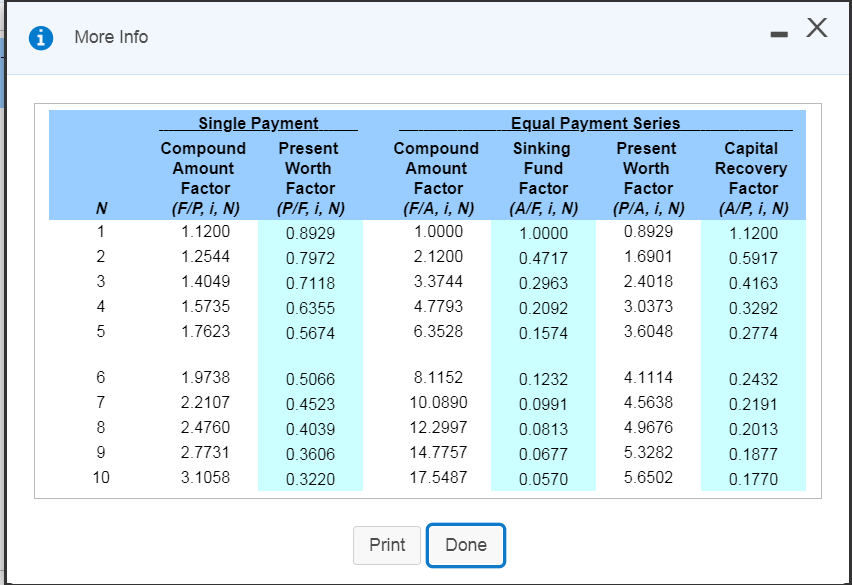

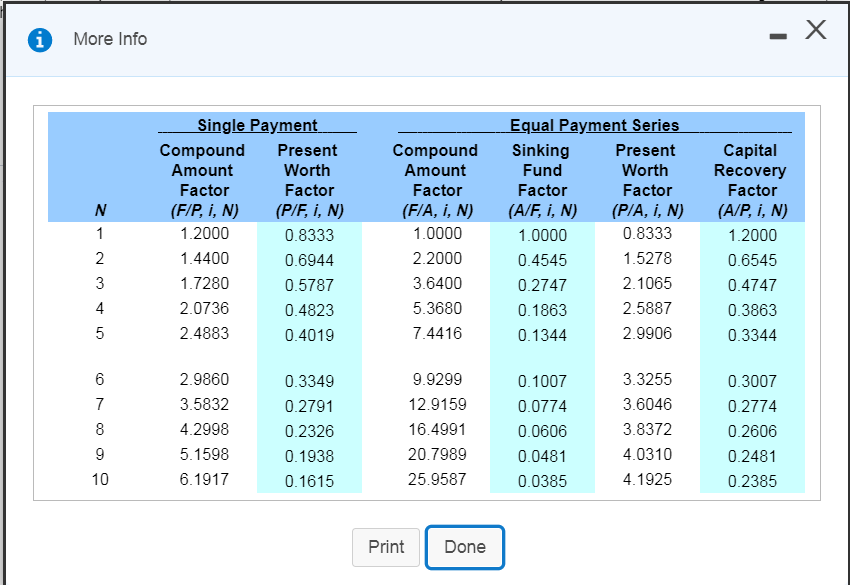

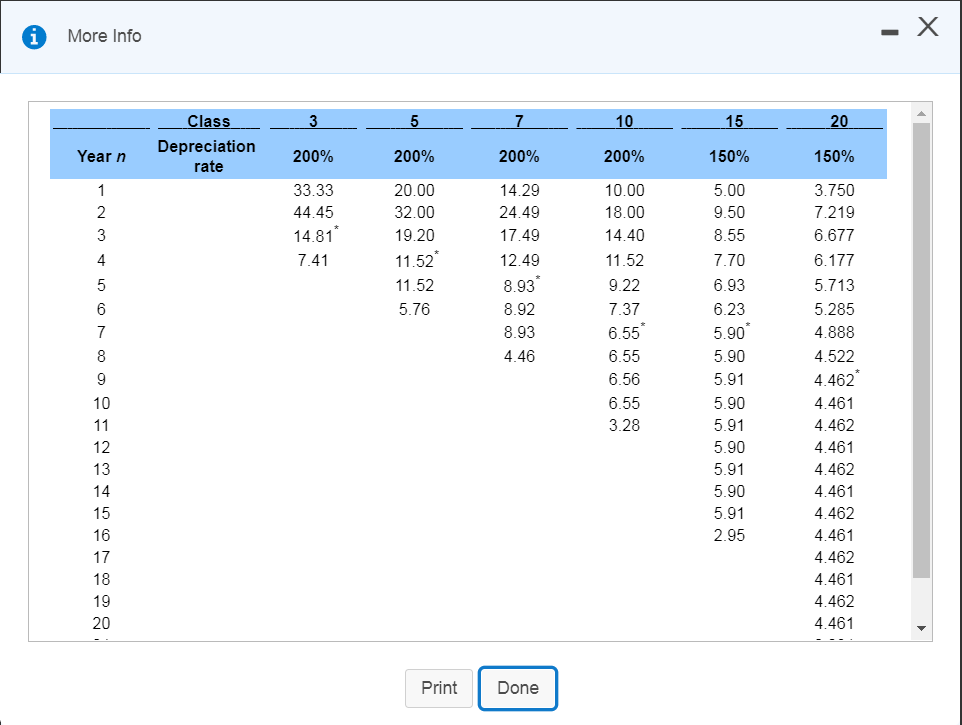

Problem 10-30 (book/static) Question Help 0 The Balas Manufacturing Company is considering buying an overhead puley system. The new system has a purchase price of $150,d00, an estimated useful life and MACRS class life of five years, and an estimated salvage value of $10,000 The system is expected to enable the company to economize on electric power usage, labor, and repair costs, as well as to reduce the number of detective products made. A total annual savings of $96,000 will be realzed it the new pulley system is instaled. The company is in the 3 % marginal tax bracket. The intial investment wil b r anced with 40% e y an 00% debt. The before a d t interes ate, which combines bot short erm and ong er na cia, s 1 % w the loa to bere din qua annual sta ment erhe projoct life Click the icon to view the MACRS depreciation schedules Cick the icon to view the interest factors for discre e compoun ng when 2% per year Click the icon to view the interest tactors tor discrete compounding when 1-10% per year (a) Determine the after-tax cash flows. Fill in the table below. (Round to the nearest dollar.) Net After-Tax Cash Flow Period $-80,000 $51083 56789 Enter your answer in the edit fields and then click Check Answer More Info Single Payment Equal Payment SerieS Present Worth Factor Compound Sinking Present Worth Factor (P/A, N) 0.8929 1.6901 2.4018 3.0373 3.6048 Capital Recovery Factor (AP, i, N) 1.1200 0.5917 0.4163 0.3292 0.2774 Compound Amount Factor 1.1200 1.2544 1.4049 1.5735 1.7623 0.8929 0.7972 0.7118 0.6355 0.5674 Amount Factor (FA, i, N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, N) 1.0000 0.4717 0.2963 0.2092 0.1574 1.9738 2.2107 2.4760 2.7731 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 4.1114 4.5638 4.9676 5.3282 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 3.1058 PrintDone More Info Single Payment Equal Payment SerieS Compound Sinking Compound Present Worth Factor (F/P i, N) (P/F i, N) 0.8333 0.6944 0.5787 0.4823 0.4019 Present Worth Factor (P/A, i,N) 0.8333 1.5278 2.1065 2.5887 2.9906 Capital Recovery Factor (AP, i, N) 1.2000 0.6545 0.4747 0.3863 0.3344 Amount Factor 1.2000 1.4400 1.7280 2.0736 2.4883 Amount Factor (FA, N) 1.0000 2.2000 3.6400 5.3680 7.4416 Fund Factor (AF, i, N) 1.0000 0.4545 0.2747 0.1863 0.1344 2.9860 3.5832 4.2998 5.1598 6.1917 0.3349 0.2791 0.2326 0.1938 0.1615 9.9299 12.9159 16.4991 20.7989 25.9587 0.1007 0.0774 0.0606 0.0481 0.0385 3.3255 3.6046 3.8372 4.0310 4.1925 0.3007 0.2774 0.2606 0.2481 0.2385 PrintDone % 09 2051 3582212121212121 1882666666666666 72617285444444444444 1 37665544444444444444 5 % 005033*0 0 1 0 1 0 1 0 1 5 0 0557929999999999 5 5987665555555552 0045 0 0841 755 355 2 2 9766663 2444,3 2 3 6 9994 8884 9999* 0 4472 2 1211 % 000226 2 23111 35*1 3481 % 0 344 2341 sit re a 123456789 01234567890