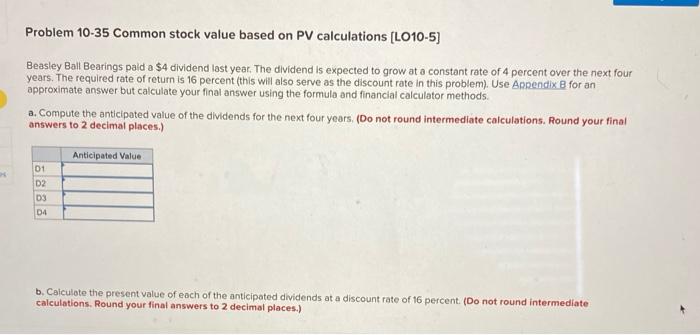

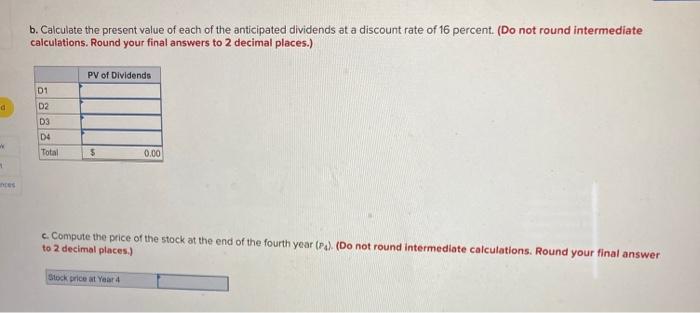

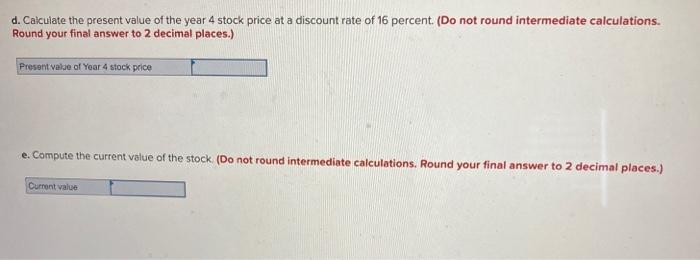

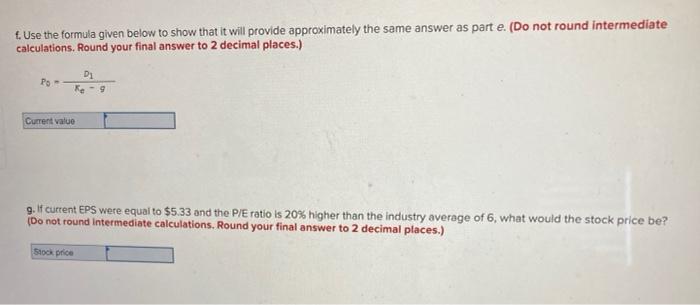

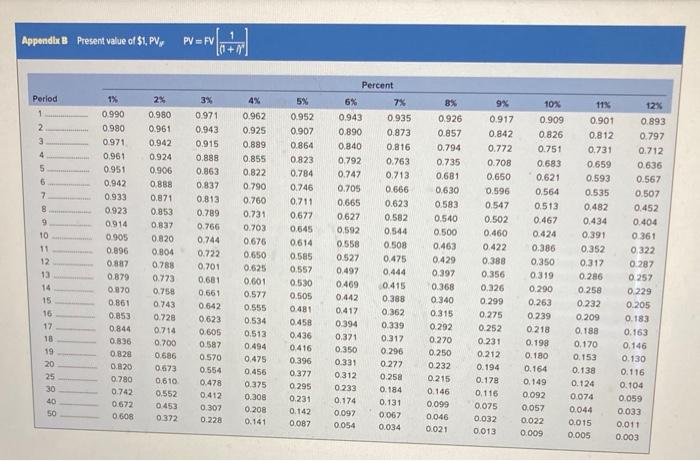

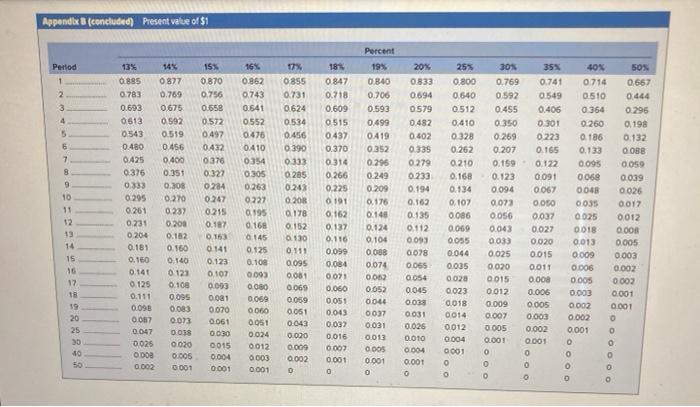

Problem 10-35 Common stock value based on PV calculations (LO10-5) Beasley Ball Bearings pald a $4 dividend last year. The dividend is expected to grow at a constant rate of 4 percent over the next four years. The required rate of return is 16 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Anticipated Value 01 D2 D3 04 b. Calculate the present value of each of the anticipated dividends at a discount rate of 16 percent. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) b. Calculate the present value of each of the anticipated dividends at a discount rate of 16 percent. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) PV of Dividends D1 D2 D3 D4 Total $ 0.00 c. Compute the price of the stock at the end of the fourth year (ra). (Do not round intermediate calculations. Round your final answer to 2 decimal places) Stock price at Year d. Caiculate the present value of the year 4 stock price at a discount rate of 16 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value of Year 4 stock price e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Current value f. Use the formula given below to show that it will provide approximately the same answer as part e. (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) Po - DI ke 9 Current value g. I current EPS were equal to $5.33 and the P/E ratio is 20% higher than the industry average of 6, what would the stock price be? (Do not found intermediate calculations. Round your final answer to 2 decimal places.) Stock price h. By what dollar amount is the stock price in part g different from the stock price in part ? (Do not round intermediate calculations Round your final answer to 2 decimal places.) Spood Amount Book With regard to the stock price in part indicate which direction it would move if: (1) D1 increases (2) Ko increases (3) increases Appendix B Present value of $1, PV, PV = FV Period 2% 4% 1 2 3 4 5 6 7 8 9 10 11 12 13 1% 0.990 0.980 0971 0.961 0951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.820 0.820 0.780 0.742 0672 0.608 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0,681 0.661 0.642 0.623 0.605 0.587 0570 0.554 0.478 0.412 0.302 0.228 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.545 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0.527 0.475 0.444 0469 0.415 0442 0388 0.417 0.362 0.394 0.339 0.371 0.317 0.350 0.296 0.331 0227 0.312 0.258 0233 0.184 0.174 0.131 0.097 0067 0054 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.497 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0,209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0,146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 14 15 16 17 18 19 20 25 30 40 50 0.377 6 8 8 8 8 0.295 0.231 0.142 0.087 0.032 0.013 Appendix (concluded) Present value of $1 18 25% 30% 16% 0862 0.743 0.641 0552 0476 35% 0.741 0.549 0.406 0 301 0.223 0410 0354 Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 30 40 13% 14% 0.885 0877 0.783 0.769 0.693 0.675 0513 0.592 0543 0.519 0.480 0456 0.425 0.400 0.376 0.351 0.333 0.308 0295 0.261 0.237 0.231 0208 0204 0.162 0.181 0.160 0.160 0.140 0.141 0.123 0.125 0.100 0.111 0.095 0.098 008) 0.087 0.073 0047 0.025 0020 0.005 2 0001 15% 0.870 0.756 0.558 0.572 0.497 0432 0.370 0.322 0284 0.247 0215 0.187 0.163 0 141 0.123 0107 0.093 0081 0070 0.061 OASS 0731 0.624 0534 0.456 0 390 0333 0209 0.243 0178 0.152 0.530 0.847 0.718 0.609 0515 0.437 0.370 0314 0.266 0.225 0.101 0.162 0.137 0.116 0.099 0.084 0021 0.060 0.051 00) 0.032 0.016 0.007 0.001 0305 0.263 0227 0.195 0.168 145 0.125 0.100 0.093 0000 0060 0051 0.024 0.012 0001 Percent 19% 0.840 0.706 0.593 0.499 0419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0000 0.074 002 0052 0044 0037 0.031 0.013 000 0.001 20% 0.833 0694 0579 0.482 0.402 0.335 0279 0.233 0.194 0.162 0.135 0.112 0093 0.078 ooks 0.054 0045 0.033 0.026 0.010 0.001 0.800 0.640 0.512 0.410 0328 0.262 0.210 0.168 0.134 0.107 0086 0.069 Ocss 0.044 0.005 0028 0 023 0014 0.012 0004 0001 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0,056 0.043 0033 0.025 0.020 0.015 0012 0.009 ? 0.005 0001 0 40 0.714 0510 0.364 0.260 186 0.133 0.095 0068 0048 0035 0.025 008 0.013 0.009 0005 0003 0.002 0.002 0.001 0.165 0.122 0.091 0007 0.037 0.027 0.020 0.015 0.011 0008 0.006 0005 0.003 0.002 000 0 0 0111 50% 0,667 0.444 0.296 0.198 0.132 0 000 0.059 0.039 0026 0017 0012 0 000 0.005 0.003 0.002 0002 0 001 1 0 0.095 0001 0.069 0059 0001 0.043 0.020 0.009 0.002 8 8 8 8 0030 0015 0.004 0.001 0 O