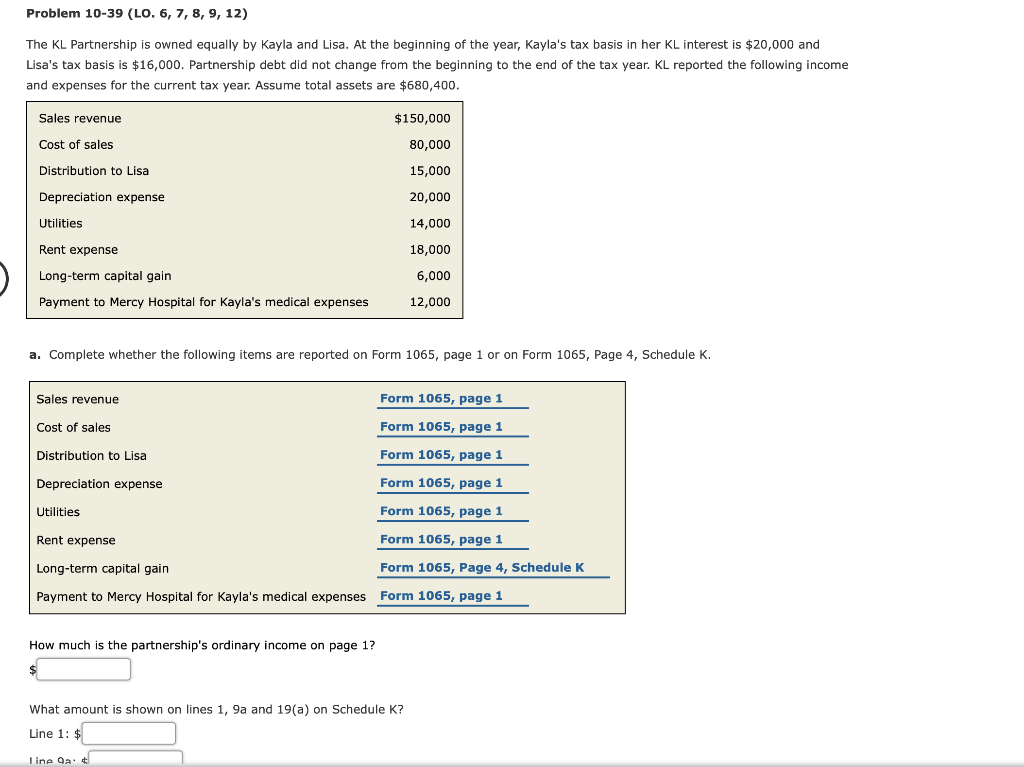

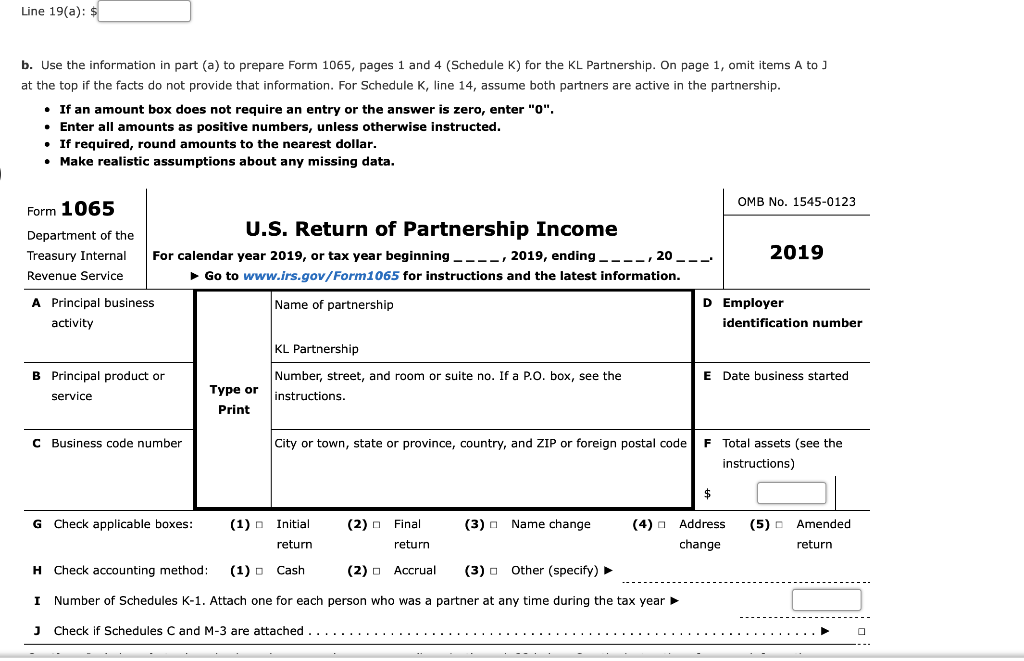

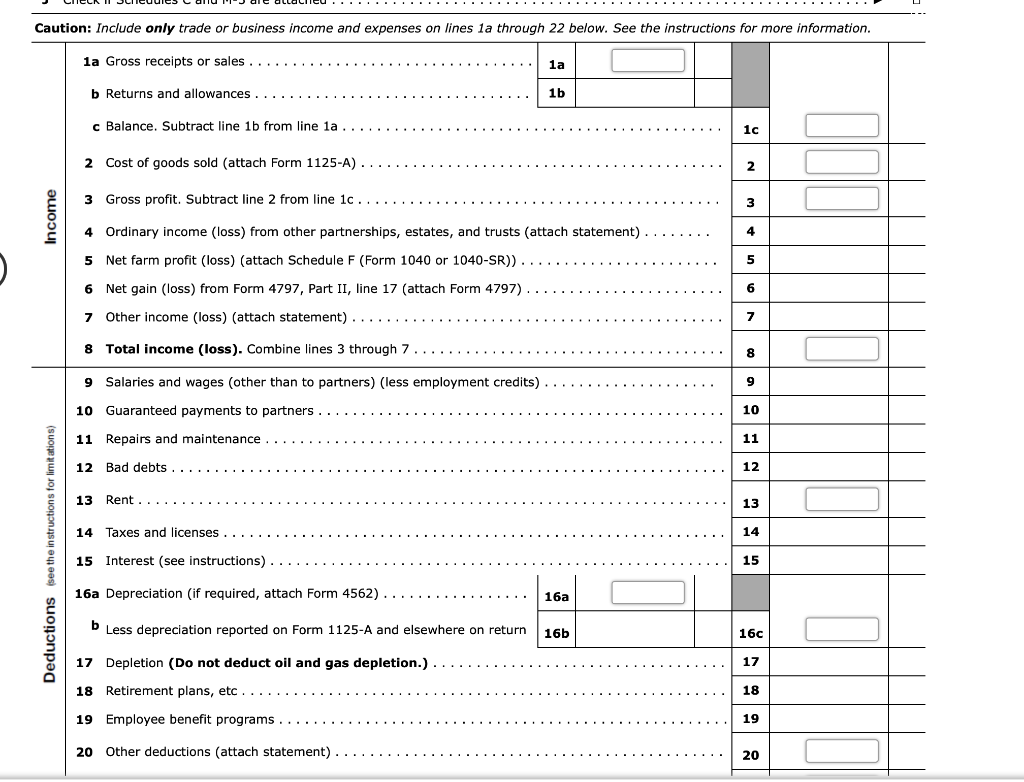

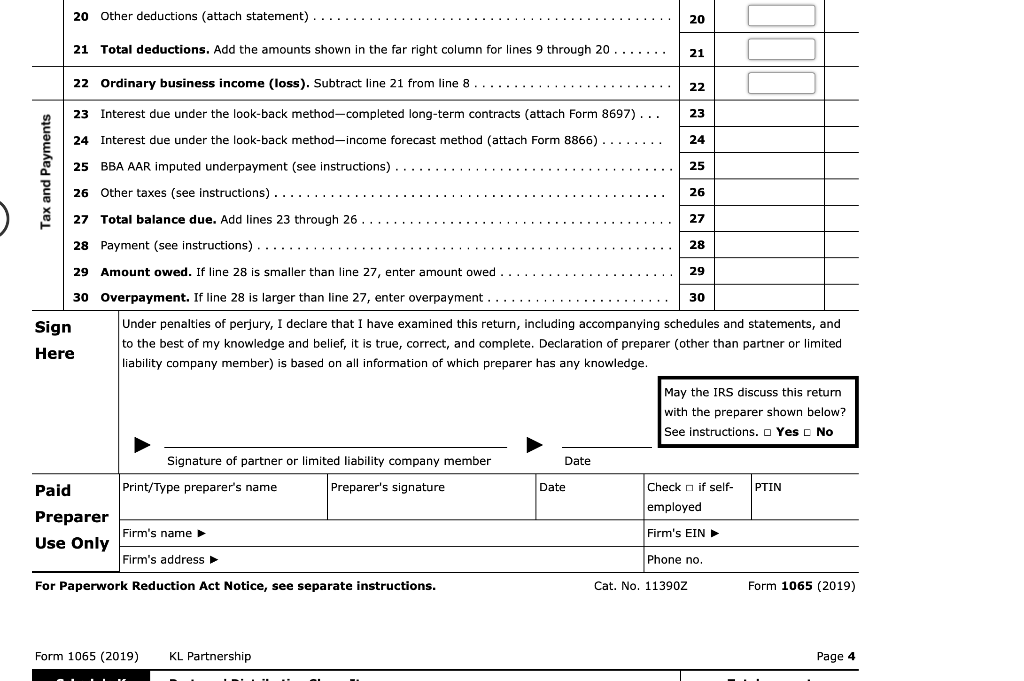

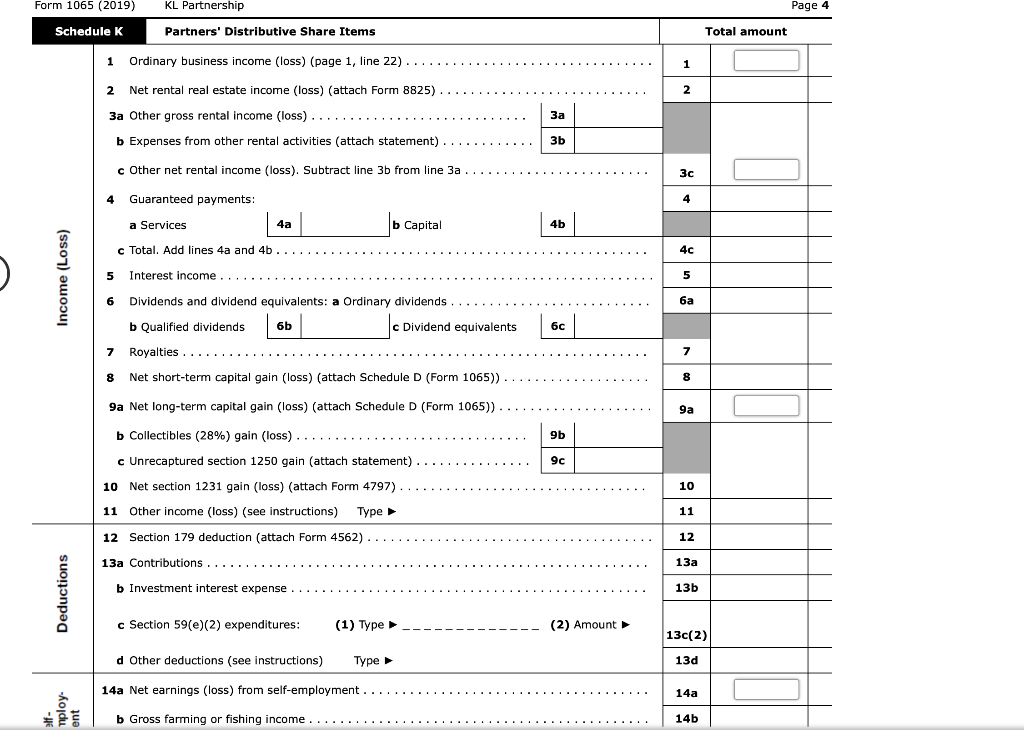

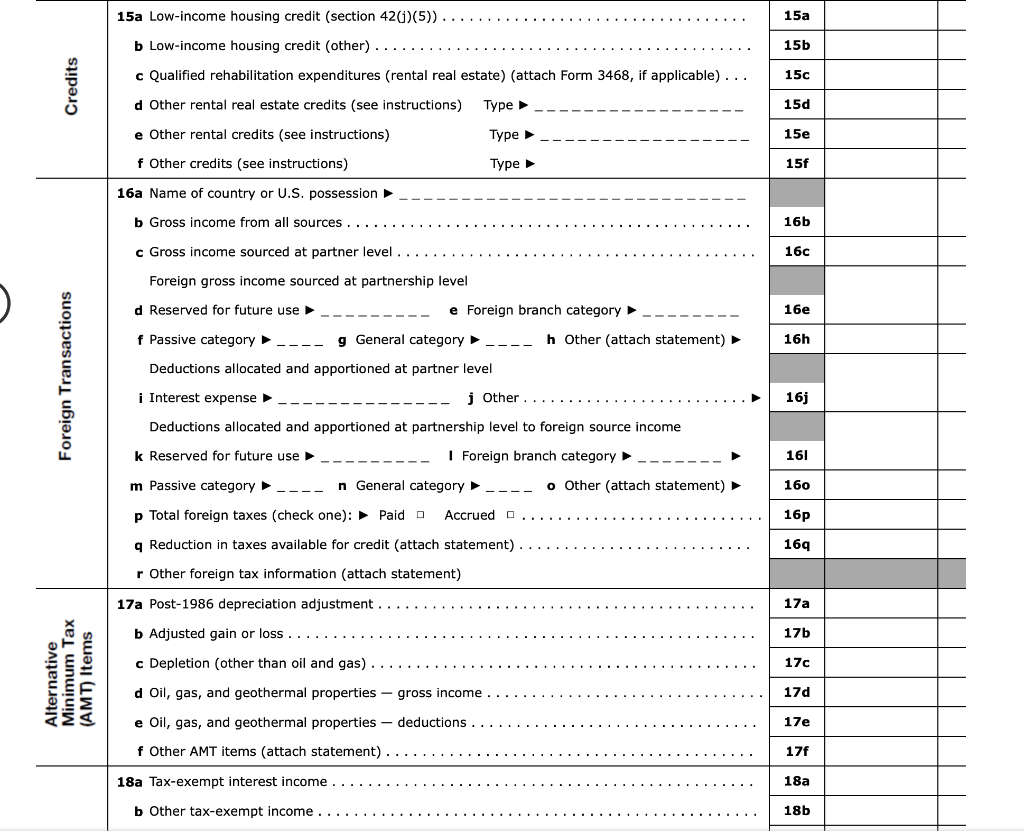

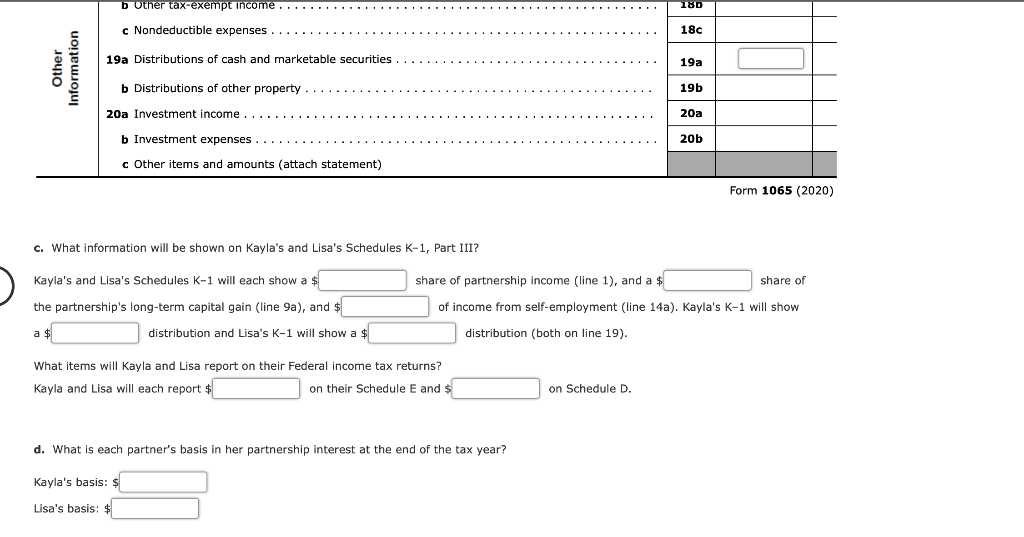

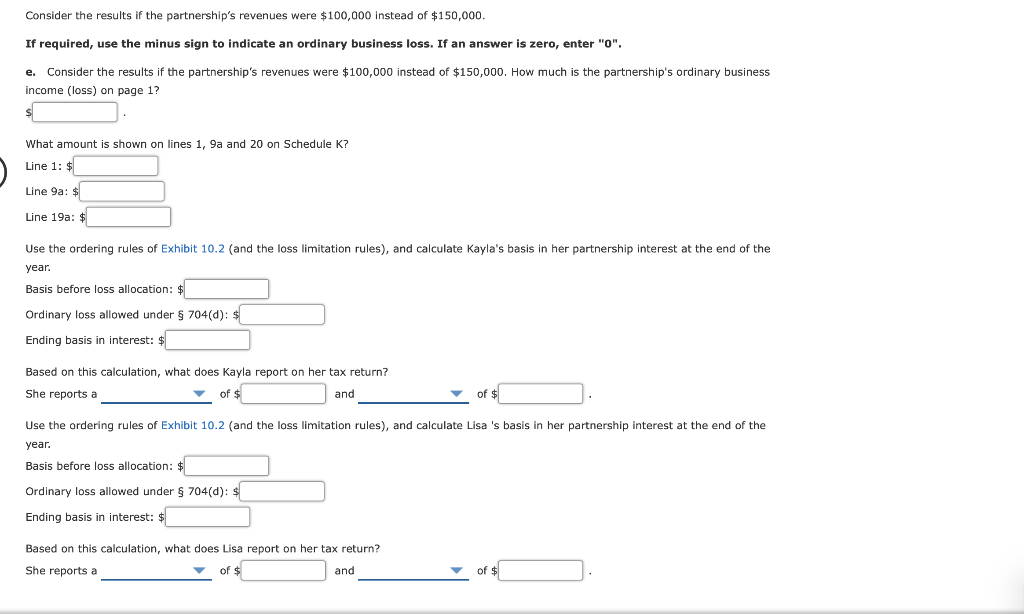

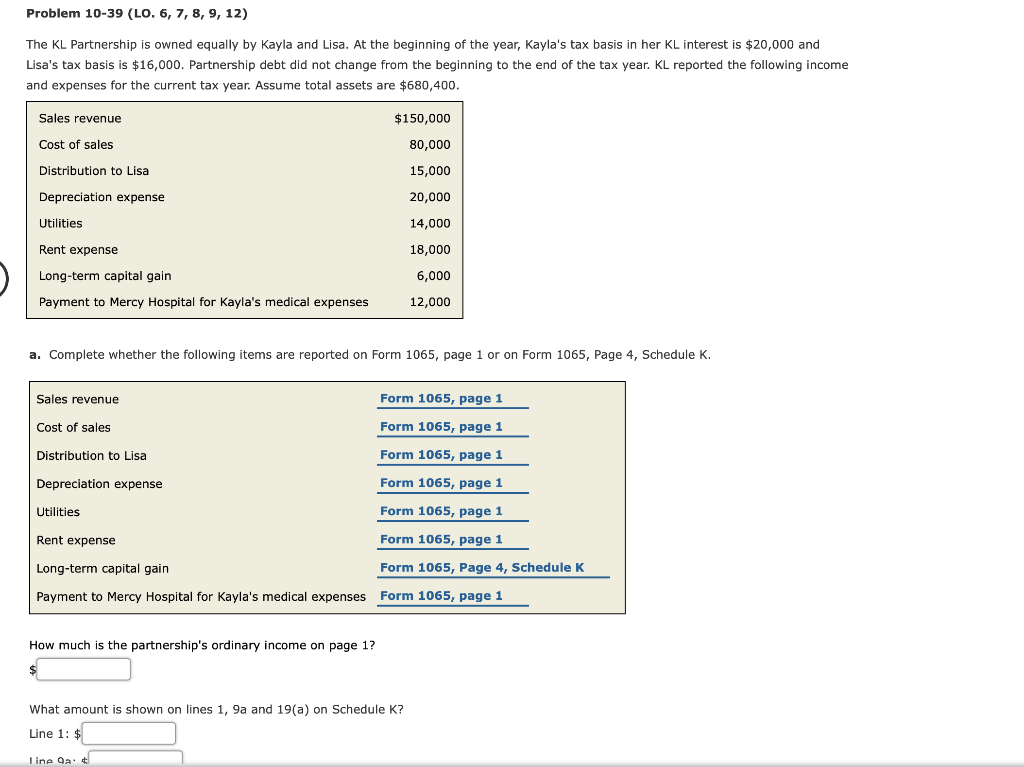

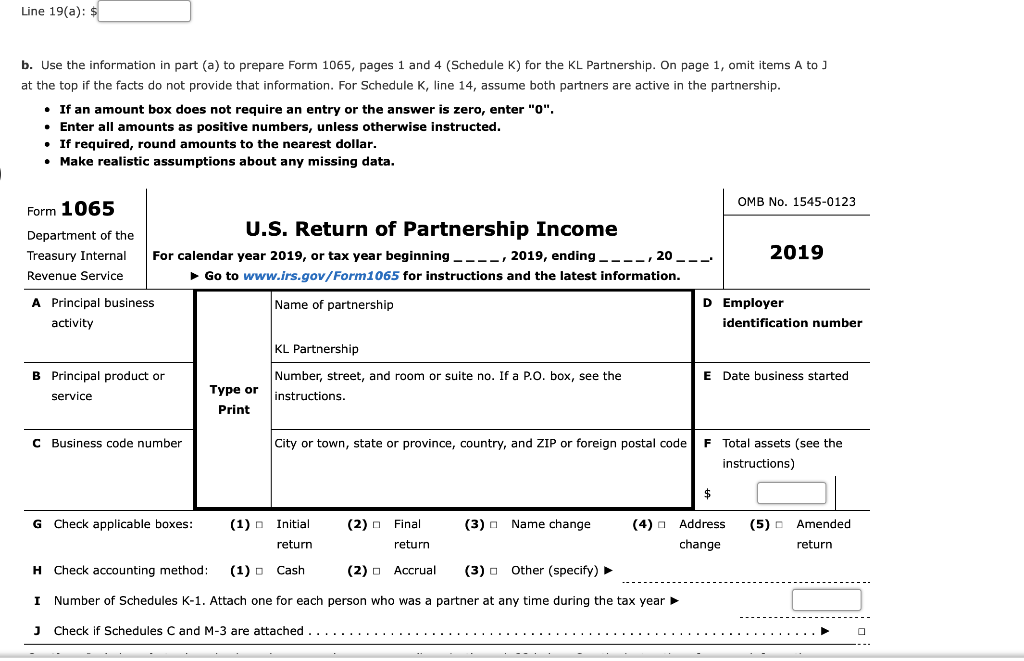

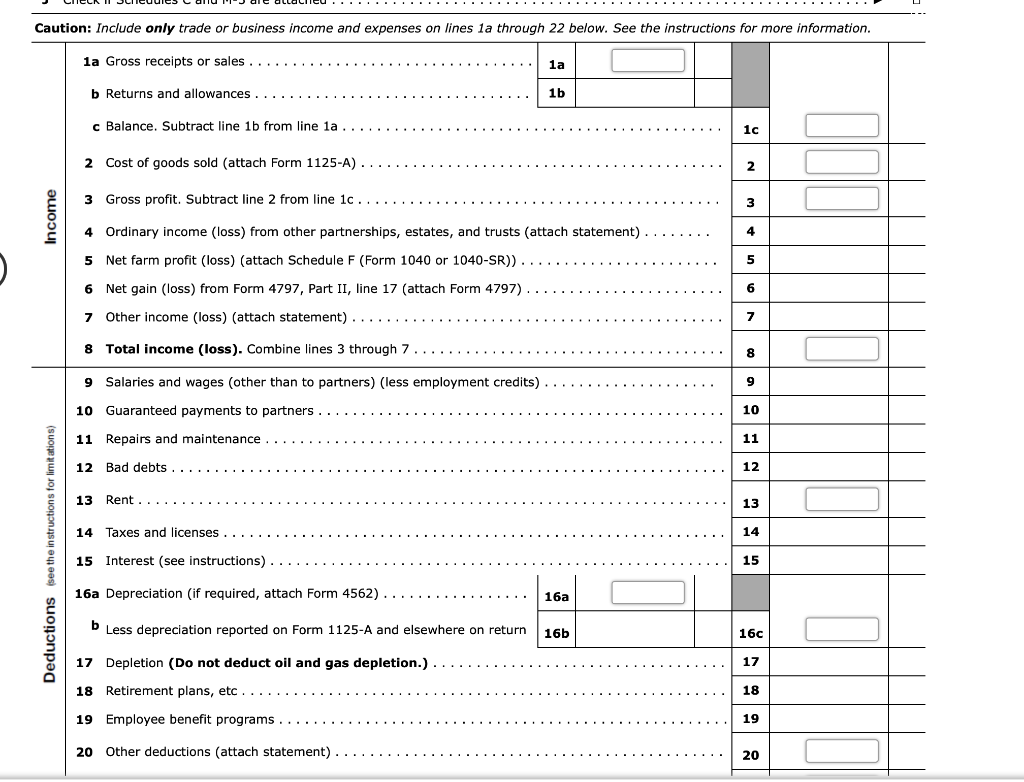

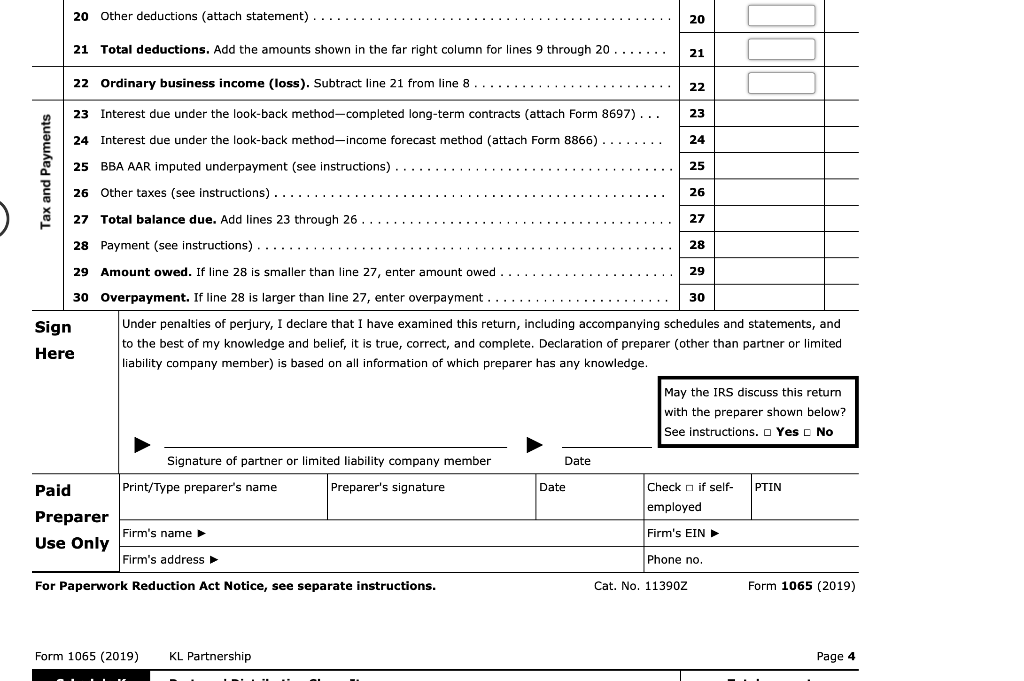

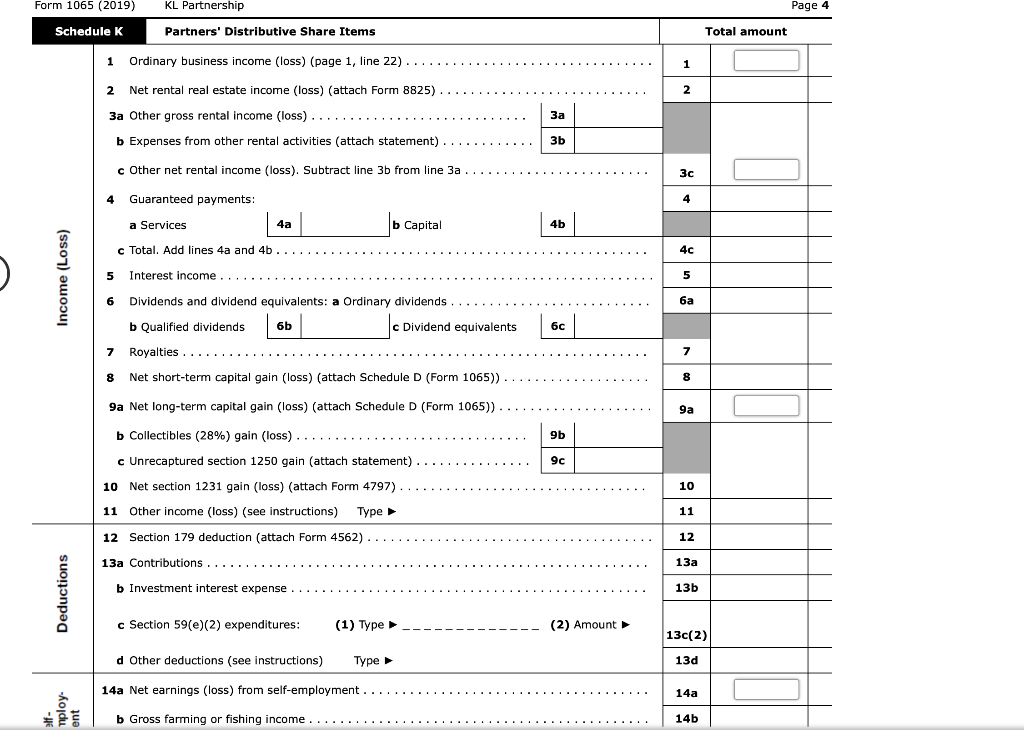

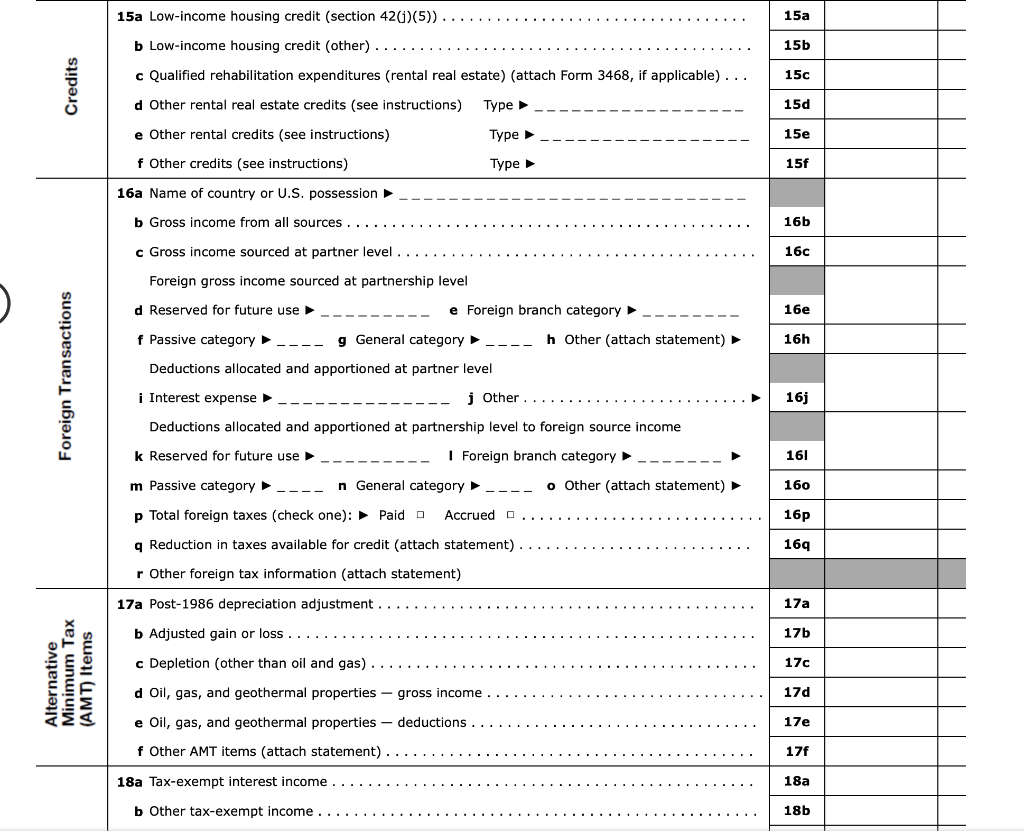

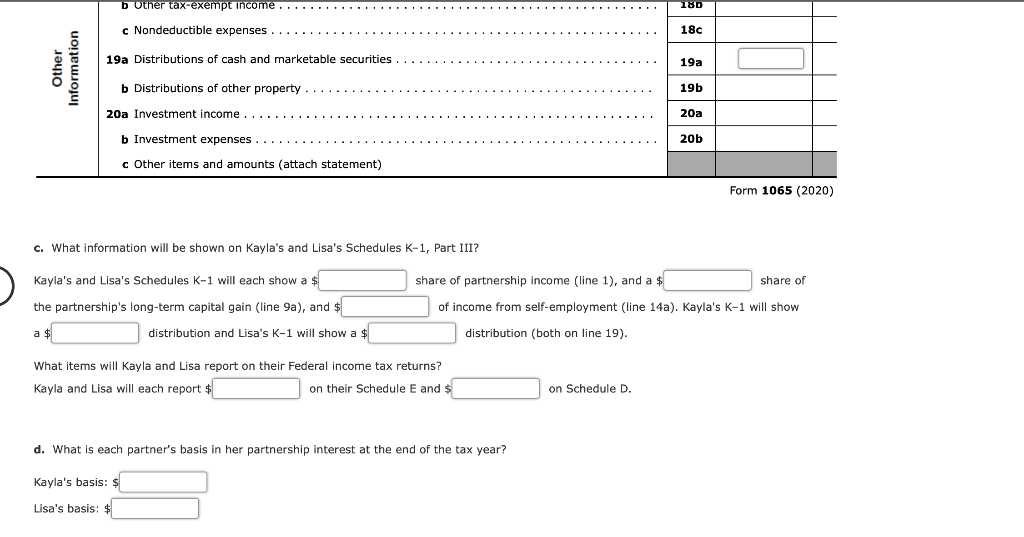

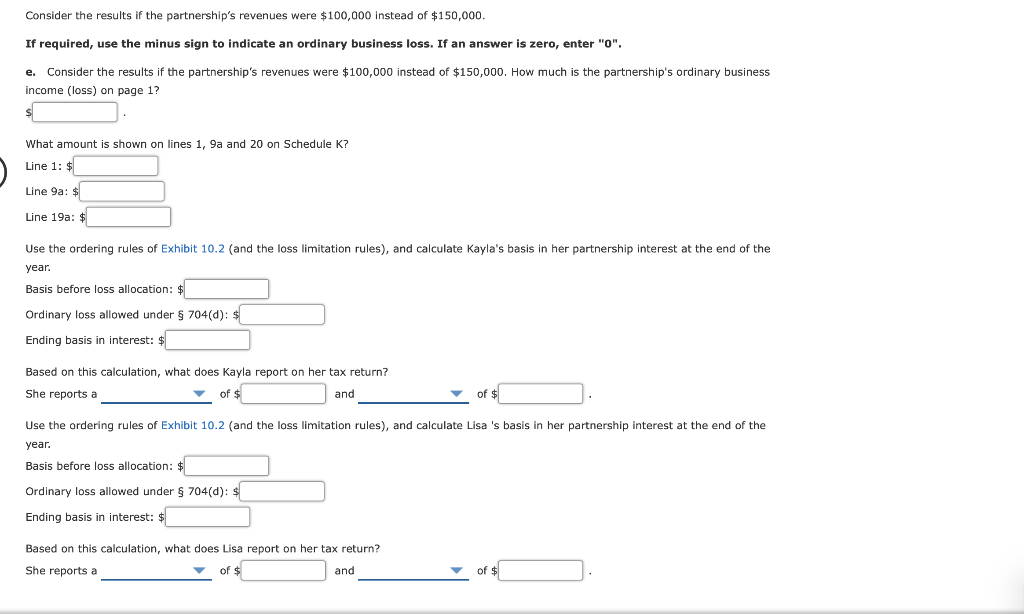

Problem 10-39 (LO. 6, 7, 8, 9, 12) The KL Partnership is owned equally by kayla and Lisa. At the beginning of the year, Kayla's tax basis in her KL interest is $20,000 and Lisa's tax basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year. Assume total assets are $680,400. Sales revenue $150,000 80,000 Cost of sales Distribution to Lisa 15,000 Depreciation expense 20,000 Utilities 14,000 Rent expense 18,000 6,000 Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses 12,000 a. Complete whether the following items are reported on Form 1065, page 1 or on Form 1065, Page 4, Schedule K. Sales revenue Form 1065, page 1 Cost of sales Form 1065, page 1 Distribution to Lisa Form 1065, page 1 Depreciation expense Form 1065, page 1 Utilities Form 1065, page 1 Rent expense Form 1065, page 1 Long-term capital gain Form 1065, Page 4, Schedule K Payment to Mercy Hospital for Kayla's medical expenses Form 1065, page 1 How much is the partnership's ordinary income on page 1? $ What amount is shown on lines 1, 9a and 19(a) on Schedule K? Line 1: $ line Qa. Line 19(a): $ b. Use the information in part (a) to prepare Form 1065, pages 1 and 4 (Schedule K) for the KL Partnership. On page 1, omit items A to ] at the top if the facts do not provide that information. For Schedule K, line 14, assume both partners are active in the partnership. If an amount box does not require an entry or the answer is zero, enter "O". Enter all amounts as positive numbers, unless otherwise instructed. If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data. OMB No. 1545-0123 Form 1065 Department of the Treasury Internal Revenue Service U.S. Return of Partnership Income For calendar year 2019, or tax year beginning ----, 2019, ending ----,20--- Go to www.irs.gov/Form 1065 for instructions and the latest information. 2019 Name of partnership A Principal business activity D Employer identification number B Principal product or service KL Partnership Number, street, and room or suite no. If a P.O. box, see the instructions. E Date business started Type or Print C Business code number City or town, state or province, country, and ZIP or foreign postal code F Total assets (see the instructions) $ G Check applicable boxes: (2) (3) Name change (5) Amended (1) Initial return Final return (4) a Address change return H Check accounting method: (1) Cash (2) Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached Caution: Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information. la Gross receipts or sales .. 1a b Returns and allowances.. 1b c Balance. Subtract line 1b from line la 1c 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 1c.. 3 Income 4 5 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement). 5 Net farm profit (loss) (attach Schedule F (Form 1040 or 1040-SR)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 7 Other income (loss) (attach statement) 6 7 8 Total income (loss). Combine lines 3 through 7 8 9 9 Salaries and wages (other than to partners) (less employment credits) 10 Guaranteed payments to partners. 10 11 Repairs and maintenance. 11 12 Bad debts 12 13 Rent. 13 14 Taxes and licenses 14 Deductions (see the instructions for limitations) 15 Interest (see instructions) 15 16a Depreciation (if required, attach Form 4562) 16a b Less depreciation reported on Form 1125-A and elsewhere on return 16b 160 17 Depletion (Do not deduct oil and gas depletion.) 17 18 Retirement plans, etc 18 19 Employee benefit programs 19 20 Other deductions (attach statement) 20 20 Other deductions (attach statement) 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 22 Tax and Payments 23 Interest due under the look back method-completed long-term contracts (attach Form 8697)... 23 24 24 Interest due under the look back method-income forecast method (attach Form 8866) 25 BBA AAR imputed underpayment (see instructions) 25 26 Other taxes (see instructions). 26 27 27 Total balance due. Add lines 23 through 26. 28 Payment (see instructions) 28 29 29 Amount owed. If line 28 is smaller than line 27, enter amount owed 30 Overpayment. If line 28 is larger than line 27, enter overpayment 30 Sign Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and Here to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. May the IRS discuss this return with the preparer shown below? See instructions. o Yes No Signature of partner or limited liability company member Date Paid Print/Type preparer's name Preparer's signature Date PTIN Check if self- employed Preparer Use Only Firm's name Firm's EIN Firm's address Phone no. For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11390Z Form 1065 (2019) Form 1065 (2019) KL Partnership Page 4 Form 1065 (2019) KL Partnership Page 4 Schedule K Partners' Distributive Share Items Total amount 1 Ordinary business income (loss) (page 1, line 22).. 1 2 2 Net rental real estate income (loss) (attach Form 8825) 3a Other gross rental income (loss).... b Expenses from other rental activities (attach statement) 3b c Other net rental income (loss). Subtract line 3b from line 3a 3c 4 4b 4c Income (Loss) 5 4 Guaranteed payments: a Services 4a b Capital c Total. Add lines 4a and 4b 5 Interest income... Dividends and dividend equivalents: a Ordinary dividends b Qualified dividends 6b C Dividend equivalents 7 Royalties 8 Net short-term capital gain (loss) (attach Schedule D (Form 1065)) 6 6c 7 8 9a Net long-term capital gain (loss) (attach Schedule D (Form 1065)) 9a 9a b Collectibles (28%) gain (loss).. 9b c Unrecaptured section 1250 gain (attach statement) 9c 10 10 Net section 1231 gain (loss) (attach Form 4797) 11 Other income (loss) (see instructions) Type - 11 12 12 Section 179 deduction (attach Form 4562) 13a Contributions .... b Investment interest expense 13a 13b Deductions c Section 59(e)(2) expenditures: (1) Type (2) Amount 13c(2) ( d Other deductions (see instructions) Type 13d 14a Net earnings (loss) from self-employment. 14a b Gross farming or fishing income 14b bother tax-exempt Thcome ..... 180 c Nondeductible expenses 18c 19a Distributions of cash and marketable securities 19a Other Information b Distributions of other property 19b 20a Investment income 20a b Investment expenses.. 20b c Other items and amounts (attach statement) Form 1065 (2020) c. What information will be shown on Kayla's and Lisa's Schedules K-1, Part III? Kayla's and Lisa's Schedules K-1 will each show a $ the partnership's long-term capital gain (line 9a), and $ share of partnership income (line 1), and a $ share of of income from self-employment (line 14a). Kayla's K-1 will show a $ distribution and Lisa's K-1 will show a $ distribution (both on line 19). What items will Kayla and Lisa report on their Federal income tax returns? Kayla and Lisa will each report $ on their Schedule E and $ on Schedule D. d. What is each partner's basis in her partnership interest at the end of the tax year? Kayla's basis: $ Lisa's basis: $ Consider the results if the partnership's revenues were $100,000 instead of $150,000. If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "O". e. Consider the results if the partnership's revenues were $100,000 instead of $150,000. How much is the partnership's ordinary business income (loss) on page 1? shown on lines 1, 9a and 20 on Schedule K? What amount Line 1: $ Line 9a: $ Line 19a: $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year. Basis before loss allocation: $ Ordinary loss allowed under & 704(d): $ Ending basis in interest: $ Based on this calculation, what does Kayla report on her tax return? She reports a of $ and of $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Lisa 's basis in her partnership interest at the end of the year. Basis before loss allocation: $ Ordinary loss allowed under $ 704(d): $ Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return? She reports a of $ and of $ Problem 10-39 (LO. 6, 7, 8, 9, 12) The KL Partnership is owned equally by kayla and Lisa. At the beginning of the year, Kayla's tax basis in her KL interest is $20,000 and Lisa's tax basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year. Assume total assets are $680,400. Sales revenue $150,000 80,000 Cost of sales Distribution to Lisa 15,000 Depreciation expense 20,000 Utilities 14,000 Rent expense 18,000 6,000 Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses 12,000 a. Complete whether the following items are reported on Form 1065, page 1 or on Form 1065, Page 4, Schedule K. Sales revenue Form 1065, page 1 Cost of sales Form 1065, page 1 Distribution to Lisa Form 1065, page 1 Depreciation expense Form 1065, page 1 Utilities Form 1065, page 1 Rent expense Form 1065, page 1 Long-term capital gain Form 1065, Page 4, Schedule K Payment to Mercy Hospital for Kayla's medical expenses Form 1065, page 1 How much is the partnership's ordinary income on page 1? $ What amount is shown on lines 1, 9a and 19(a) on Schedule K? Line 1: $ line Qa. Line 19(a): $ b. Use the information in part (a) to prepare Form 1065, pages 1 and 4 (Schedule K) for the KL Partnership. On page 1, omit items A to ] at the top if the facts do not provide that information. For Schedule K, line 14, assume both partners are active in the partnership. If an amount box does not require an entry or the answer is zero, enter "O". Enter all amounts as positive numbers, unless otherwise instructed. If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data. OMB No. 1545-0123 Form 1065 Department of the Treasury Internal Revenue Service U.S. Return of Partnership Income For calendar year 2019, or tax year beginning ----, 2019, ending ----,20--- Go to www.irs.gov/Form 1065 for instructions and the latest information. 2019 Name of partnership A Principal business activity D Employer identification number B Principal product or service KL Partnership Number, street, and room or suite no. If a P.O. box, see the instructions. E Date business started Type or Print C Business code number City or town, state or province, country, and ZIP or foreign postal code F Total assets (see the instructions) $ G Check applicable boxes: (2) (3) Name change (5) Amended (1) Initial return Final return (4) a Address change return H Check accounting method: (1) Cash (2) Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached Caution: Include only trade or business income and expenses on lines 1a through 22 below. See the instructions for more information. la Gross receipts or sales .. 1a b Returns and allowances.. 1b c Balance. Subtract line 1b from line la 1c 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 1c.. 3 Income 4 5 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement). 5 Net farm profit (loss) (attach Schedule F (Form 1040 or 1040-SR)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 7 Other income (loss) (attach statement) 6 7 8 Total income (loss). Combine lines 3 through 7 8 9 9 Salaries and wages (other than to partners) (less employment credits) 10 Guaranteed payments to partners. 10 11 Repairs and maintenance. 11 12 Bad debts 12 13 Rent. 13 14 Taxes and licenses 14 Deductions (see the instructions for limitations) 15 Interest (see instructions) 15 16a Depreciation (if required, attach Form 4562) 16a b Less depreciation reported on Form 1125-A and elsewhere on return 16b 160 17 Depletion (Do not deduct oil and gas depletion.) 17 18 Retirement plans, etc 18 19 Employee benefit programs 19 20 Other deductions (attach statement) 20 20 Other deductions (attach statement) 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 22 Tax and Payments 23 Interest due under the look back method-completed long-term contracts (attach Form 8697)... 23 24 24 Interest due under the look back method-income forecast method (attach Form 8866) 25 BBA AAR imputed underpayment (see instructions) 25 26 Other taxes (see instructions). 26 27 27 Total balance due. Add lines 23 through 26. 28 Payment (see instructions) 28 29 29 Amount owed. If line 28 is smaller than line 27, enter amount owed 30 Overpayment. If line 28 is larger than line 27, enter overpayment 30 Sign Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and Here to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. May the IRS discuss this return with the preparer shown below? See instructions. o Yes No Signature of partner or limited liability company member Date Paid Print/Type preparer's name Preparer's signature Date PTIN Check if self- employed Preparer Use Only Firm's name Firm's EIN Firm's address Phone no. For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11390Z Form 1065 (2019) Form 1065 (2019) KL Partnership Page 4 Form 1065 (2019) KL Partnership Page 4 Schedule K Partners' Distributive Share Items Total amount 1 Ordinary business income (loss) (page 1, line 22).. 1 2 2 Net rental real estate income (loss) (attach Form 8825) 3a Other gross rental income (loss).... b Expenses from other rental activities (attach statement) 3b c Other net rental income (loss). Subtract line 3b from line 3a 3c 4 4b 4c Income (Loss) 5 4 Guaranteed payments: a Services 4a b Capital c Total. Add lines 4a and 4b 5 Interest income... Dividends and dividend equivalents: a Ordinary dividends b Qualified dividends 6b C Dividend equivalents 7 Royalties 8 Net short-term capital gain (loss) (attach Schedule D (Form 1065)) 6 6c 7 8 9a Net long-term capital gain (loss) (attach Schedule D (Form 1065)) 9a 9a b Collectibles (28%) gain (loss).. 9b c Unrecaptured section 1250 gain (attach statement) 9c 10 10 Net section 1231 gain (loss) (attach Form 4797) 11 Other income (loss) (see instructions) Type - 11 12 12 Section 179 deduction (attach Form 4562) 13a Contributions .... b Investment interest expense 13a 13b Deductions c Section 59(e)(2) expenditures: (1) Type (2) Amount 13c(2) ( d Other deductions (see instructions) Type 13d 14a Net earnings (loss) from self-employment. 14a b Gross farming or fishing income 14b bother tax-exempt Thcome ..... 180 c Nondeductible expenses 18c 19a Distributions of cash and marketable securities 19a Other Information b Distributions of other property 19b 20a Investment income 20a b Investment expenses.. 20b c Other items and amounts (attach statement) Form 1065 (2020) c. What information will be shown on Kayla's and Lisa's Schedules K-1, Part III? Kayla's and Lisa's Schedules K-1 will each show a $ the partnership's long-term capital gain (line 9a), and $ share of partnership income (line 1), and a $ share of of income from self-employment (line 14a). Kayla's K-1 will show a $ distribution and Lisa's K-1 will show a $ distribution (both on line 19). What items will Kayla and Lisa report on their Federal income tax returns? Kayla and Lisa will each report $ on their Schedule E and $ on Schedule D. d. What is each partner's basis in her partnership interest at the end of the tax year? Kayla's basis: $ Lisa's basis: $ Consider the results if the partnership's revenues were $100,000 instead of $150,000. If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "O". e. Consider the results if the partnership's revenues were $100,000 instead of $150,000. How much is the partnership's ordinary business income (loss) on page 1? shown on lines 1, 9a and 20 on Schedule K? What amount Line 1: $ Line 9a: $ Line 19a: $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year. Basis before loss allocation: $ Ordinary loss allowed under & 704(d): $ Ending basis in interest: $ Based on this calculation, what does Kayla report on her tax return? She reports a of $ and of $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Lisa 's basis in her partnership interest at the end of the year. Basis before loss allocation: $ Ordinary loss allowed under $ 704(d): $ Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return? She reports a of $ and of $