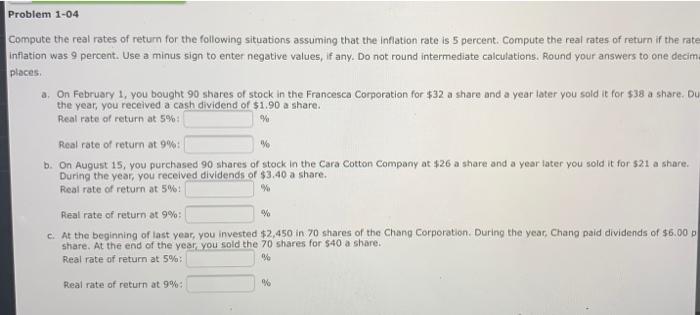

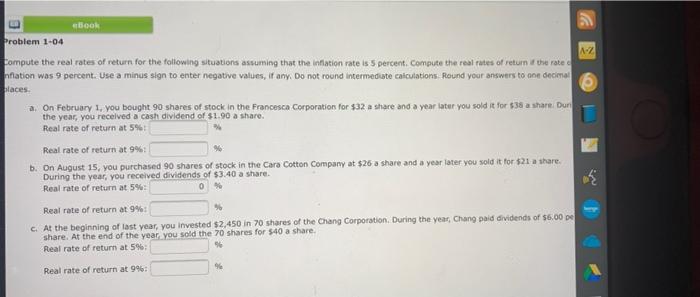

Problem 1-04 % Compute the real rates of return for the following situations assuming that the Inflation rate is 5 percent. Compute the real rates of return if the rate inflation was 9 percent. Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to one decim places 2. On February 1, you bought 90 shares of stock in the Francesca Corporation for $32 a share and a year later you sold it for $38 a share. Du the year, you received a cash dividend of $1.90 a share. Real rate of return at 5% Real rate of return at 9% b. On August 15, you purchased 90 shares of stock in the Cara Cotton Company at $26 a share and a year later you sold it for $21. a share. During the year, you received dividends of $3,40 a share. Real rate of return at 5% Real rate of return at 9% % c. At the beginning of last year, you invested $2.450 in 70 shares of the Chang Corporation. During the year. Chang paid dividends of $5.00 share. At the end of the year you sold the 70 shares for $40 a share Real rate of return at 5% % Real rate of return at 9%: %% book Problem 1-04 A-Z Compute the real rates of return for the following situations assuming that the inflation rate is 5 percent. Compute the real rates of return the ratec Intation was 9 percent. Use a minus sign to enter negative values, if any. Do not round intermediate calculations, Round your answers to con decimal places a. On February 1, you bought 90 shares of stock in the Francesca Corporation for $32 a share and a year later you sold it for 538 a share. Du the year, you received a cash dividend of $1.90 a share Real rate of return at 5% Real rate of return at 9% b. On August 15, you purchased 90 shares of stock in the Cara Cotton Company at $26 a share and a year later you sold it for $21 a share. During the year, you received dividends of $3.40 a share Real rate of return at 5% 0 Real rate of return at 9% c. At the beginning of last year, you invested $2,450 in 70 shares of the Chang Corporation. During the year, Chang paid dividends of $6.00 de share. At the end of the year you sold the 70 shares for $40 a share. Real rate of return at 5% 46 Real rate of return at 9%