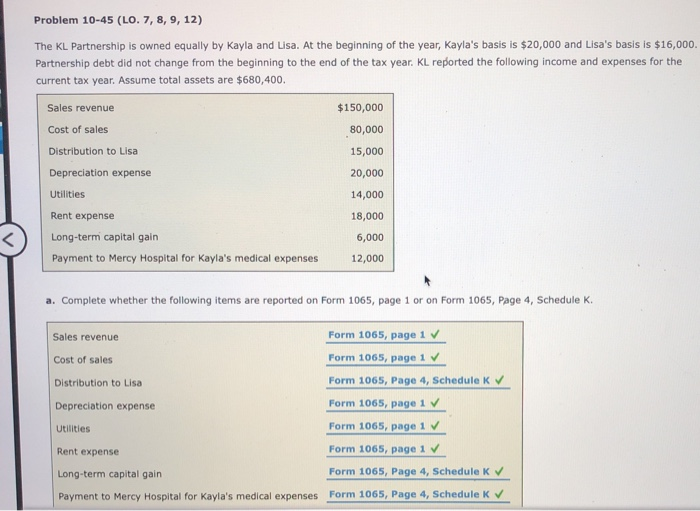

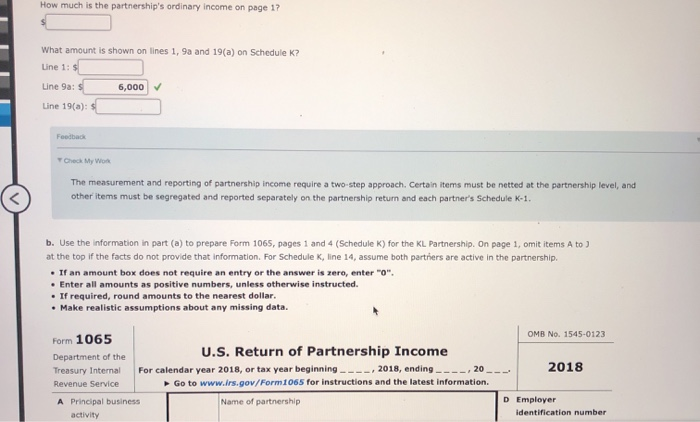

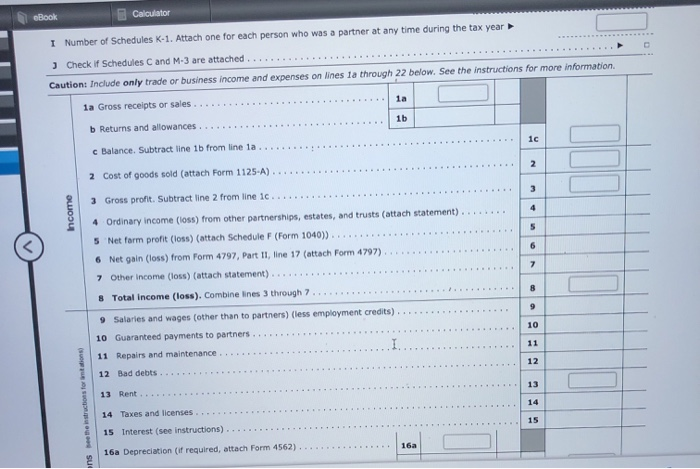

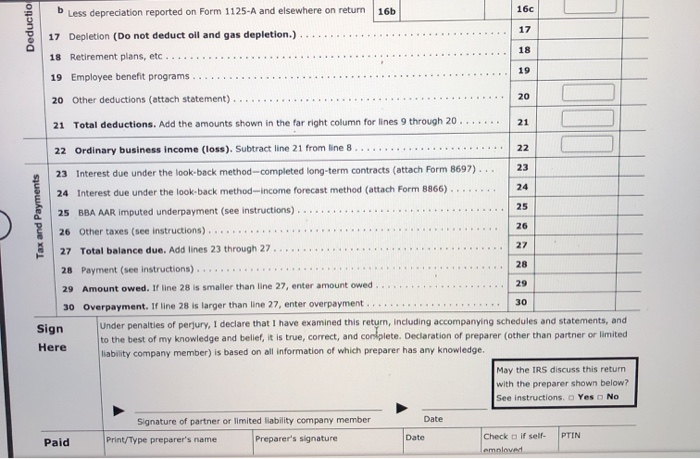

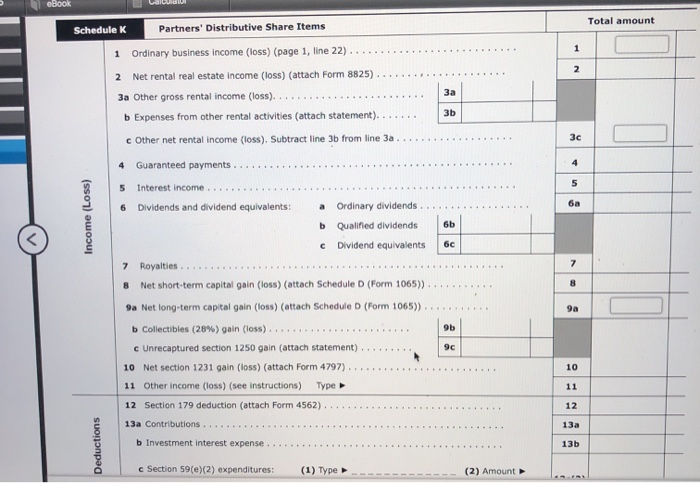

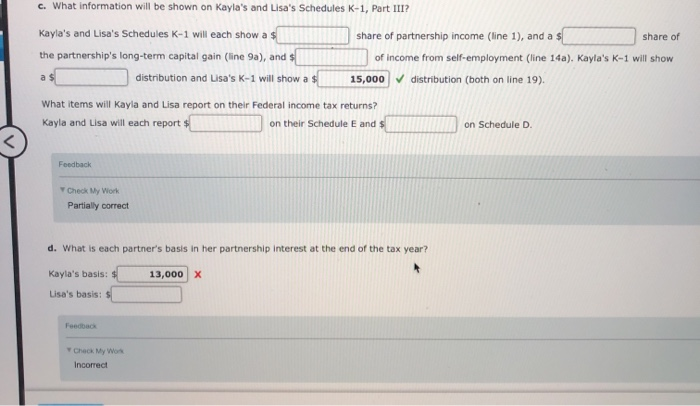

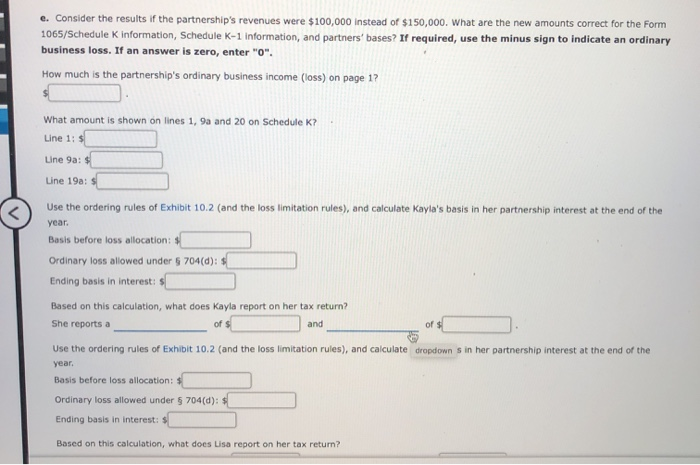

Problem 10-45 (LO. 7, 8, 9, 12) The KL Partnership is owned equally by Kayla and Lisa. At the beginning of the year, Kayla's basis is $20,000 and Lisa's basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year. Assume total assets are $680,400. Sales revenue Cost of sales Distribution to Lisa $150,000 80,000 15,000 20,000 14,000 Depreciation expense Utilities Rent expense 18,000 Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses 6,000 12,000 a. Complete whether the following items are reported on Form 1065, page 1 or on Form 1065, Page 4, Schedule K. Sales revenue Form 1065, page 1 Cost of sales Form 1065, page 1 Distribution to Lisa Form 1065, Page 4, Schedule K Depreciation expense Form 1065, page 1 Utilities Form 1065, page 1 Rent expense Form 1065, page 1 Long-term capital gain Form 1065, Page 4, Schedule K Payment to Mercy Hospital for Kayla's medical expenses Form 1065, Page 4, Schedule K How much is the partnership's ordinary income on page 17 What amount is shown on lines 1, 9a and 19(a) on Schedule K? Line 1: $ Line 9a: S 6,000 Line 19(a): $ Feedback Check My Won The measurement and reporting of partnership income require a two-step approach. Certain items must be netted at the partnership level, and other items must be segregated and reported separately on the partnership return and each partner's Schedule K-1. b. Use the information in part (a) to prepare Form 1065, pages 1 and 4 (Schedule K) for the KL Partnership. On page 1, omit items A to at the top if the facts do not provide that information. For Schedule K, line 14, assume both partners are active in the partnership . If an amount box does not require an entry or the answer is zero, enter "0". Enter all amounts as positive numbers, unless otherwise instructed. . If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data. OMB No. 1545-0123 Form 1065 Department of the Treasury Internal Revenue Service U.S. Return of Partnership Income For calendar year 2018, or tax year beginning ---- 2018, ending. 20 Go to www.irs.gov/Form 1065 for instructions and the latest Information, 2018 A Name of partnership Principal business activity D Employer identification number eBook Calculator I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached Caution: Include only trade or business income and expenses on lines la through 22 below. See the instructions for more information la Gross receipts or sales ......... b Returns and allowances.............. c Balance. Subtract line 1b from line la.......... 2 Cost of goods sold (attach Form 1125-A).............. 3 Gross profit. Subtract line 2 from line ic........... 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) 5 Net form profit (loss) (attach Schedule F (Form 1040))... 6 Net gain (loss) from Form 4797, Part 11, line 17 (attach Form 4797) .......... 7 Other income (loss) (attach statement) 8 Total income (loss). Combine lines 3 through 7.... ..... 9 Salaries and wages (other than to partners) (less employment credits).. 10 Guaranteed payments to partners ......... 11 Repairs and maintenance .............. 12 Bad debts... . 13 Rent ... . ... the instructions for 14 Taxes and licenses........... 15 Interest (see instructions)...... inse 16a Depreciation (if required, attach Form 4562) .... Less depreciation reported on Form 1125-A and elsewhere on return 16b Deductio 17 Depletion (Do not deduct oil and gas depletion.) .. 18 Retirement plans, etc... 19 Employee benefit programs .......... 20 Other deductions (attach statement)... 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20... 22 Ordinary business income (loss). Subtract line 21 from line 8..... Tax and Payments 23 Interest due under the look back method-completed long-term contracts (attach Form 8697) 24 Interest due under the look back method-income forecast method (attach Form 8866) 25 BBA AAR imputed underpayment (see instructions)... 26 Other taxes (see instructions)..... ... 27 Total balance due. Add lines 23 through 27......... 28 Payment (see Instructions) ...... ........ . .. 29 Amount owed. If line 28 is smaller than line 27, enter amount owed ... 30 Overpayment. If line 28 is larger than line 27, enter overpayment.... Sign Here Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and conplete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. May the IRS discuss this return with the preparer shown below? See instructions. Yes No Signature of partner or limited liability company member Print/Type preparer's name Preparer's signature Paid PTIN Check if self. lameloved Schedule K Partners' Distributive Share Items Total amount 1 Ordinary business income (loss) (page 1, line 22). 2 Net rental real estate income (loss) (attach Form 8825).. 3a Other gross rental income (loss)............ b Expenses from other rental activities (attach statement)....... c Other net rental income (loss). Subtract line 3b from line 3a.... 4 Guaranteed payments ..... 5 Interest income... Income (Loss) 60 6 Dividends and dividend equivalents: a Ordinary dividends. b Qualified dividends C Dividend equivalents 7 Royalties.. . 8 Net short-term capital gain (los) (attach Schedule D (Form 1065)) 9a Net long-term capital gain (loss) (attach Schedule (Form 1065)).. b Collectibles (28%) gain (loss).... . c Unrecaptured section 1250 gain (attach statement) ........ 10 Net section 1231 gain (loss) (attach Form 4797)... 11 Other income (loss) (see instructions) Type 12 Section 179 deduction (attach Form 4562) ...... 13a Contributions ..... Deductions b Investment interest expense...... 135 c Section 59(e)(2) expenditures: (1) Type (2) Amount c. What information will be shown on Kayla's and Lisa's Schedules K-1, Part III? Kayla's and Lisa's Schedules K-1 will each show as the partnership's long-term capital gain (line 9a), and as distribution and Lisa's K-1 will show as share of partnership income (line 1), and a s share of of income from self-employment (line 14a). Kayla's K-1 will show 15,000 distribution (both on line 19). What items will Kayla and Lisa report on their Federal income tax returns? Kayla and Lisa will each reports on their Schedule E and $ on Schedule D. Feedback Check My Work Partially correct d. What is each partner's basis in her partnership interest at the end of the tax year? 13,000 Kayla's basis: $ Lisa's basis: 5 Incorrect e. Consider the results if the partnership's revenues were $100,000 instead of $150,000. What are the new amounts correct for the Form 1065/Schedule K information, Schedule K-1 Information, and partners' bases? If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "0". How much is the partnership's ordinary business income (loss) on page 1? What amount is shown on lines 1, 9a and 20 on Schedule K? Line 1: $1 Line 9a: Line 19a: $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year: Basis before loss allocation: Ordinary loss allowed under 5 704(d): 5 Ending basis in interest: s Based on this calculation, what does Kayla report on her tax return? She reports a of and Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate dropdown s in her partnership interest at the end of the year Basis before loss allocation: Ordinary loss allowed under 5704(d): S Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return? Problem 10-45 (LO. 7, 8, 9, 12) The KL Partnership is owned equally by Kayla and Lisa. At the beginning of the year, Kayla's basis is $20,000 and Lisa's basis is $16,000. Partnership debt did not change from the beginning to the end of the tax year. KL reported the following income and expenses for the current tax year. Assume total assets are $680,400. Sales revenue Cost of sales Distribution to Lisa $150,000 80,000 15,000 20,000 14,000 Depreciation expense Utilities Rent expense 18,000 Long-term capital gain Payment to Mercy Hospital for Kayla's medical expenses 6,000 12,000 a. Complete whether the following items are reported on Form 1065, page 1 or on Form 1065, Page 4, Schedule K. Sales revenue Form 1065, page 1 Cost of sales Form 1065, page 1 Distribution to Lisa Form 1065, Page 4, Schedule K Depreciation expense Form 1065, page 1 Utilities Form 1065, page 1 Rent expense Form 1065, page 1 Long-term capital gain Form 1065, Page 4, Schedule K Payment to Mercy Hospital for Kayla's medical expenses Form 1065, Page 4, Schedule K How much is the partnership's ordinary income on page 17 What amount is shown on lines 1, 9a and 19(a) on Schedule K? Line 1: $ Line 9a: S 6,000 Line 19(a): $ Feedback Check My Won The measurement and reporting of partnership income require a two-step approach. Certain items must be netted at the partnership level, and other items must be segregated and reported separately on the partnership return and each partner's Schedule K-1. b. Use the information in part (a) to prepare Form 1065, pages 1 and 4 (Schedule K) for the KL Partnership. On page 1, omit items A to at the top if the facts do not provide that information. For Schedule K, line 14, assume both partners are active in the partnership . If an amount box does not require an entry or the answer is zero, enter "0". Enter all amounts as positive numbers, unless otherwise instructed. . If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data. OMB No. 1545-0123 Form 1065 Department of the Treasury Internal Revenue Service U.S. Return of Partnership Income For calendar year 2018, or tax year beginning ---- 2018, ending. 20 Go to www.irs.gov/Form 1065 for instructions and the latest Information, 2018 A Name of partnership Principal business activity D Employer identification number eBook Calculator I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached Caution: Include only trade or business income and expenses on lines la through 22 below. See the instructions for more information la Gross receipts or sales ......... b Returns and allowances.............. c Balance. Subtract line 1b from line la.......... 2 Cost of goods sold (attach Form 1125-A).............. 3 Gross profit. Subtract line 2 from line ic........... 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) 5 Net form profit (loss) (attach Schedule F (Form 1040))... 6 Net gain (loss) from Form 4797, Part 11, line 17 (attach Form 4797) .......... 7 Other income (loss) (attach statement) 8 Total income (loss). Combine lines 3 through 7.... ..... 9 Salaries and wages (other than to partners) (less employment credits).. 10 Guaranteed payments to partners ......... 11 Repairs and maintenance .............. 12 Bad debts... . 13 Rent ... . ... the instructions for 14 Taxes and licenses........... 15 Interest (see instructions)...... inse 16a Depreciation (if required, attach Form 4562) .... Less depreciation reported on Form 1125-A and elsewhere on return 16b Deductio 17 Depletion (Do not deduct oil and gas depletion.) .. 18 Retirement plans, etc... 19 Employee benefit programs .......... 20 Other deductions (attach statement)... 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20... 22 Ordinary business income (loss). Subtract line 21 from line 8..... Tax and Payments 23 Interest due under the look back method-completed long-term contracts (attach Form 8697) 24 Interest due under the look back method-income forecast method (attach Form 8866) 25 BBA AAR imputed underpayment (see instructions)... 26 Other taxes (see instructions)..... ... 27 Total balance due. Add lines 23 through 27......... 28 Payment (see Instructions) ...... ........ . .. 29 Amount owed. If line 28 is smaller than line 27, enter amount owed ... 30 Overpayment. If line 28 is larger than line 27, enter overpayment.... Sign Here Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and conplete. Declaration of preparer (other than partner or limited liability company member) is based on all information of which preparer has any knowledge. May the IRS discuss this return with the preparer shown below? See instructions. Yes No Signature of partner or limited liability company member Print/Type preparer's name Preparer's signature Paid PTIN Check if self. lameloved Schedule K Partners' Distributive Share Items Total amount 1 Ordinary business income (loss) (page 1, line 22). 2 Net rental real estate income (loss) (attach Form 8825).. 3a Other gross rental income (loss)............ b Expenses from other rental activities (attach statement)....... c Other net rental income (loss). Subtract line 3b from line 3a.... 4 Guaranteed payments ..... 5 Interest income... Income (Loss) 60 6 Dividends and dividend equivalents: a Ordinary dividends. b Qualified dividends C Dividend equivalents 7 Royalties.. . 8 Net short-term capital gain (los) (attach Schedule D (Form 1065)) 9a Net long-term capital gain (loss) (attach Schedule (Form 1065)).. b Collectibles (28%) gain (loss).... . c Unrecaptured section 1250 gain (attach statement) ........ 10 Net section 1231 gain (loss) (attach Form 4797)... 11 Other income (loss) (see instructions) Type 12 Section 179 deduction (attach Form 4562) ...... 13a Contributions ..... Deductions b Investment interest expense...... 135 c Section 59(e)(2) expenditures: (1) Type (2) Amount c. What information will be shown on Kayla's and Lisa's Schedules K-1, Part III? Kayla's and Lisa's Schedules K-1 will each show as the partnership's long-term capital gain (line 9a), and as distribution and Lisa's K-1 will show as share of partnership income (line 1), and a s share of of income from self-employment (line 14a). Kayla's K-1 will show 15,000 distribution (both on line 19). What items will Kayla and Lisa report on their Federal income tax returns? Kayla and Lisa will each reports on their Schedule E and $ on Schedule D. Feedback Check My Work Partially correct d. What is each partner's basis in her partnership interest at the end of the tax year? 13,000 Kayla's basis: $ Lisa's basis: 5 Incorrect e. Consider the results if the partnership's revenues were $100,000 instead of $150,000. What are the new amounts correct for the Form 1065/Schedule K information, Schedule K-1 Information, and partners' bases? If required, use the minus sign to indicate an ordinary business loss. If an answer is zero, enter "0". How much is the partnership's ordinary business income (loss) on page 1? What amount is shown on lines 1, 9a and 20 on Schedule K? Line 1: $1 Line 9a: Line 19a: $ Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate Kayla's basis in her partnership interest at the end of the year: Basis before loss allocation: Ordinary loss allowed under 5 704(d): 5 Ending basis in interest: s Based on this calculation, what does Kayla report on her tax return? She reports a of and Use the ordering rules of Exhibit 10.2 (and the loss limitation rules), and calculate dropdown s in her partnership interest at the end of the year Basis before loss allocation: Ordinary loss allowed under 5704(d): S Ending basis in interest: $ Based on this calculation, what does Lisa report on her tax return