Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 10-4A (Algo) Pricing using total cost, target cost, and variable cost LO P6 Techcom is designing a new smartphone. Each unit of this new

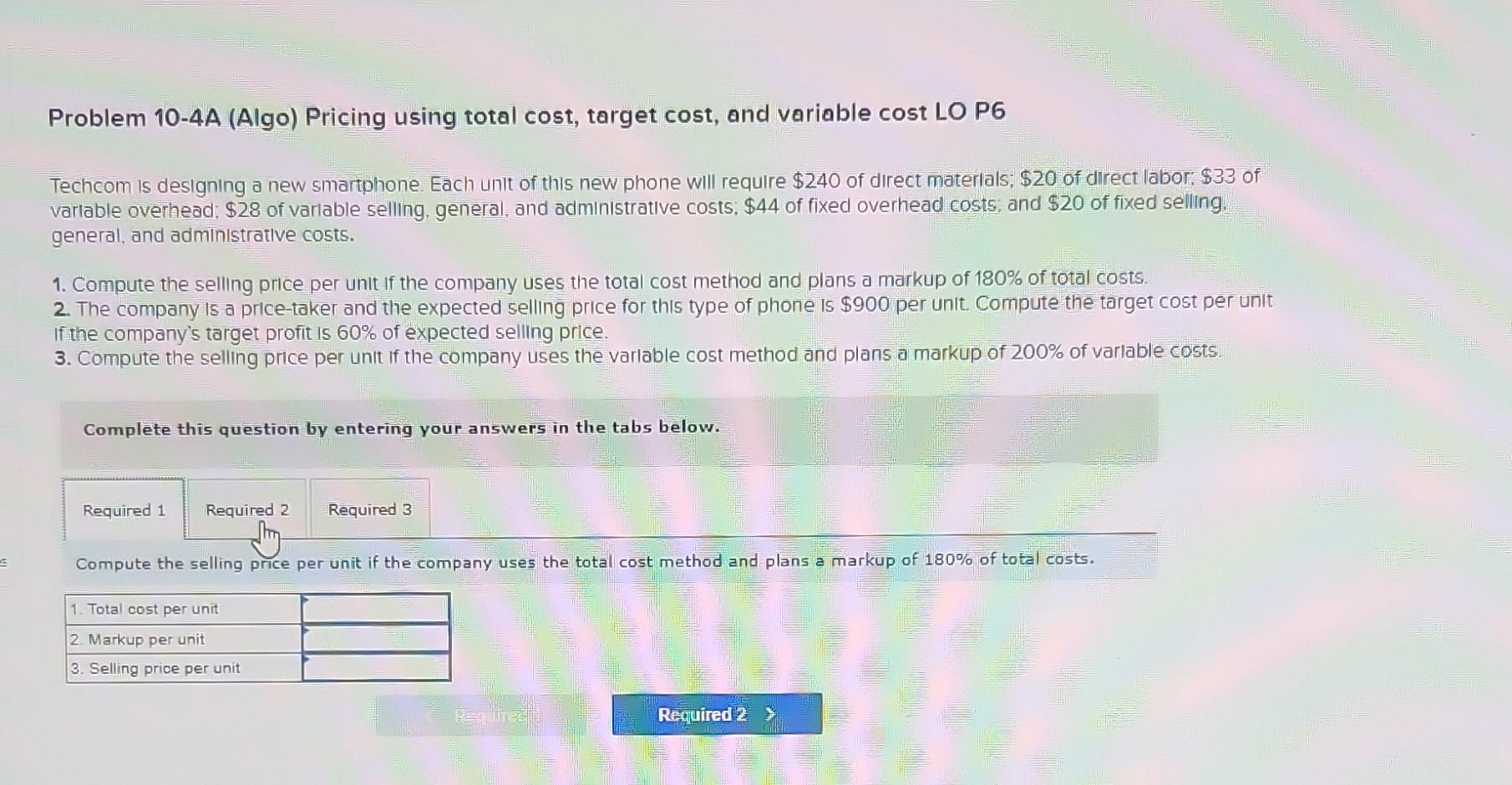

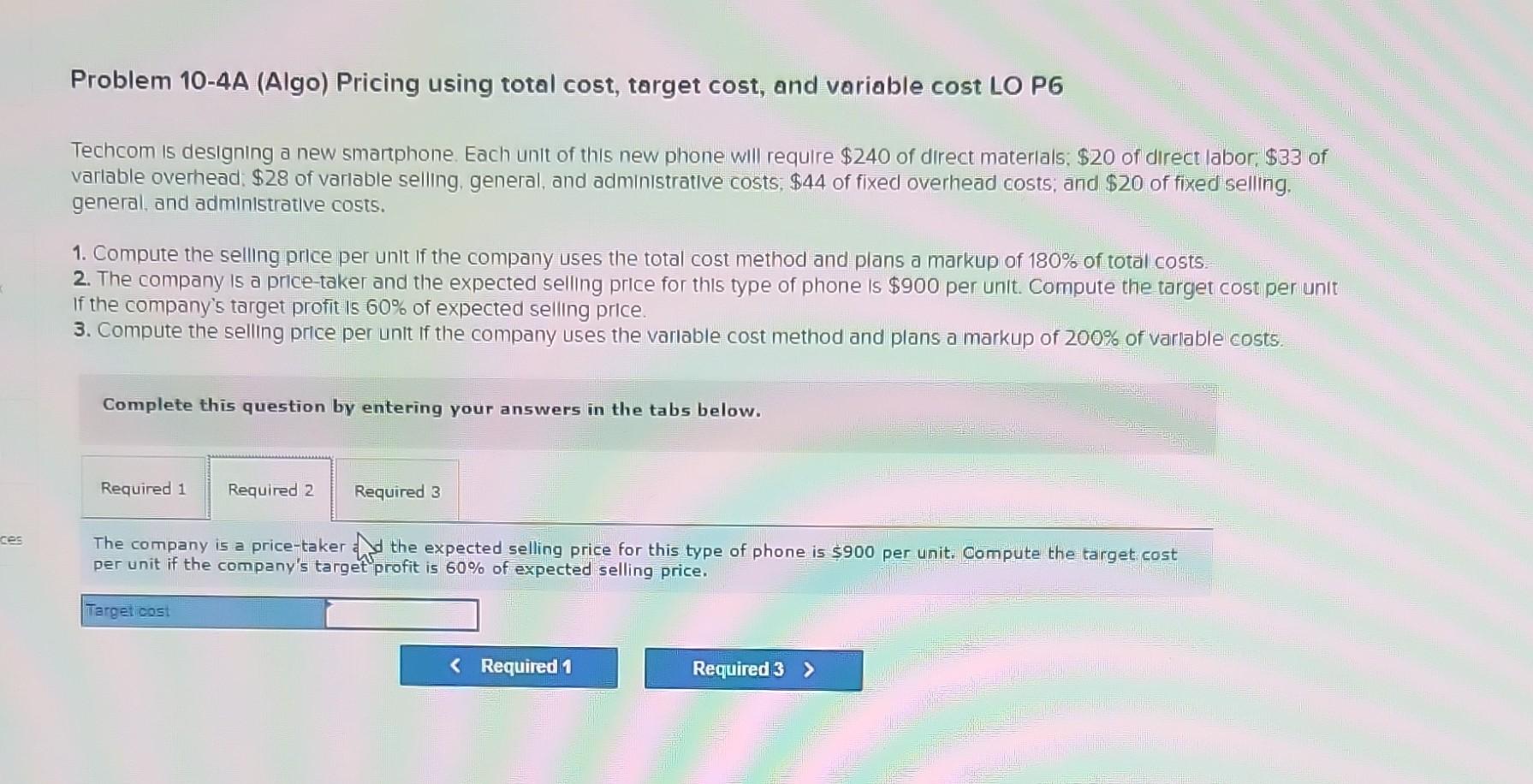

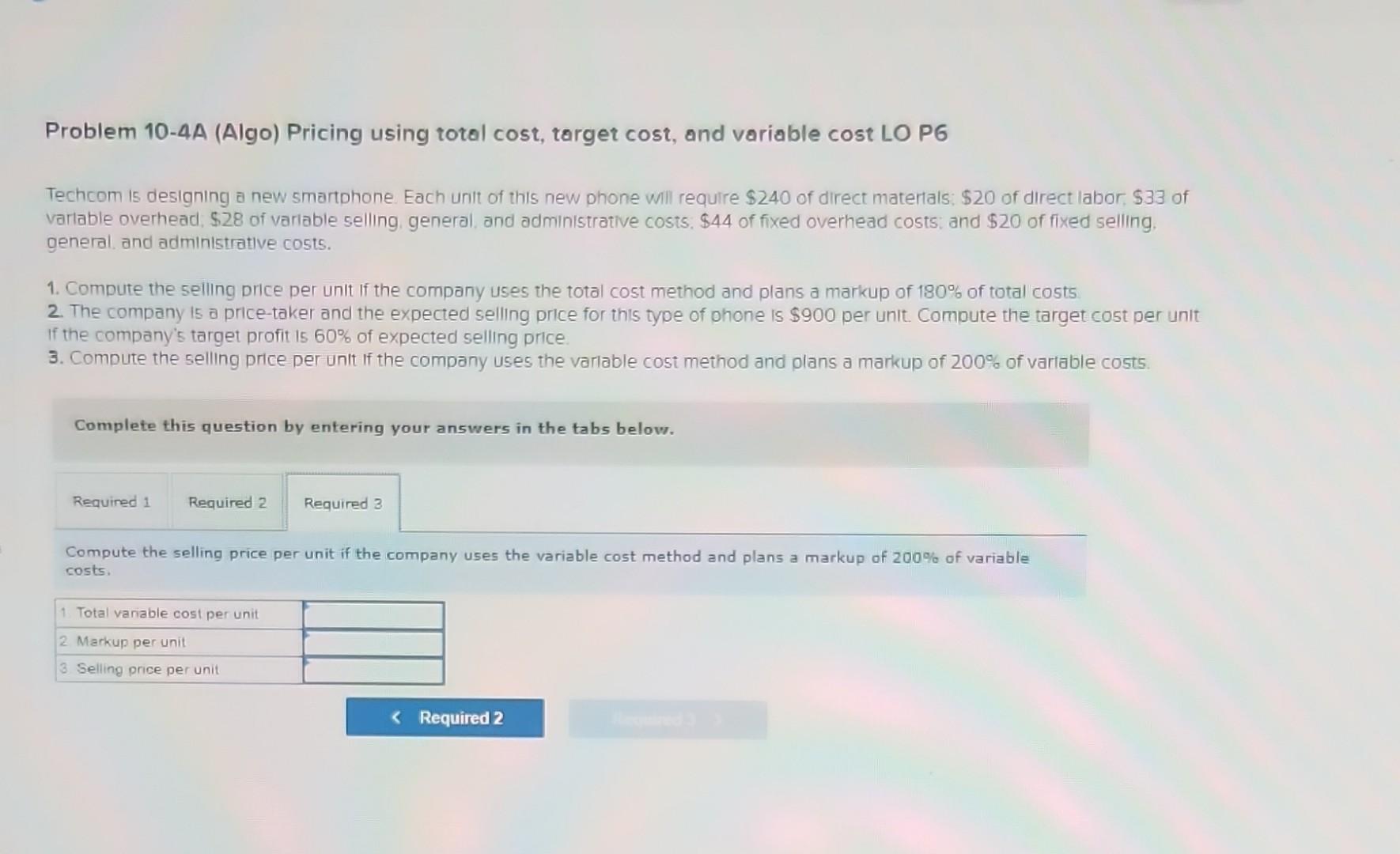

Problem 10-4A (Algo) Pricing using total cost, target cost, and variable cost LO P6 Techcom is designing a new smartphone. Each unit of this new phone will require $240 of direct materlals; $20 of direct labor: $33 of varlable overhead; $28 of varlable selling, general, and administratlve costs; $44 of fixed overhead costs; and $20 of fixed selling, general, and administratlve costs. 1. Compute the selling price per unit if the company uses the total cost method and plans a markup of 180% of total costs. 2. The company is a price-taker and the expected selling price for this type of phone is $900 per unit. Compute the target cost per unit If the company's target profit is 60% of expected selling price. 3. Compute the selling price per unit if the company uses the varlable cost method and plans a markup of 200% of varlable costs. Complete this question by entering your answers in the tabs below. Compute the selling price per unit if the company uses the total cost method and plans a markup of 180% of total costs. Problem 10-4A (Algo) Pricing using total cost, target cost, and variable cost LO PG Techcom is designing a new smartphone. Each unit of this new phone will require $240 of direct materlals; $20 of direct labor; $33 of varlable overhead: $28 of varlable selling, general, and administrative costs; $44 of fixed overhead costs; and $20 of fixed selling. general, and administratlve costs. 1. Compute the selling price per unit if the company uses the total cost method and plans a markup of 180% of total costs. 2. The company is a price-taker and the expected selling price for this type of phone is $900 per unit. Compute the target cost per unit If the company's target profit is 60% of expected selling price. 3. Compute the selling price per unit if the company uses the varlable cost method and plans a markup of 200% of varlable costs. Complete this question by entering your answers in the tabs below. The company is a price-taker d the expected selling price for this type of phone is $900 per unit. Compute the target cost per unit if the company's target profit is 60% of expected selling price. Problem 10-4A (Algo) Pricing using total cost, target cost, and variable cost LO PG Techcom is designing a new smartphone. Each unit of this new phone will require $240 of direct materlals; $20 of direct labor, $33 of varlable overhead, $28 of varlable selling, general, and administrative costs, $44 of fixed overhead costs; and $20 of fixed selling. general. and administrative costs. 1. Compute the selling price per unit if the company uses the total cost method and plans a markup of 180% of total costs 2. The company is a price-taker and the expected selling price for this type of phone is $900 per unit. Compute the target cost per unit If the company's target profit 1560% of expected selling price. 3. Compute the selling price per unit if the company uses the varlable cost method and plans a markup of 200% of varlable costs. Complete this question by entering your answers in the tabs below. Compute the selling price per unit if the company uses the variable cost method and plans a markup of 200% of variable costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started