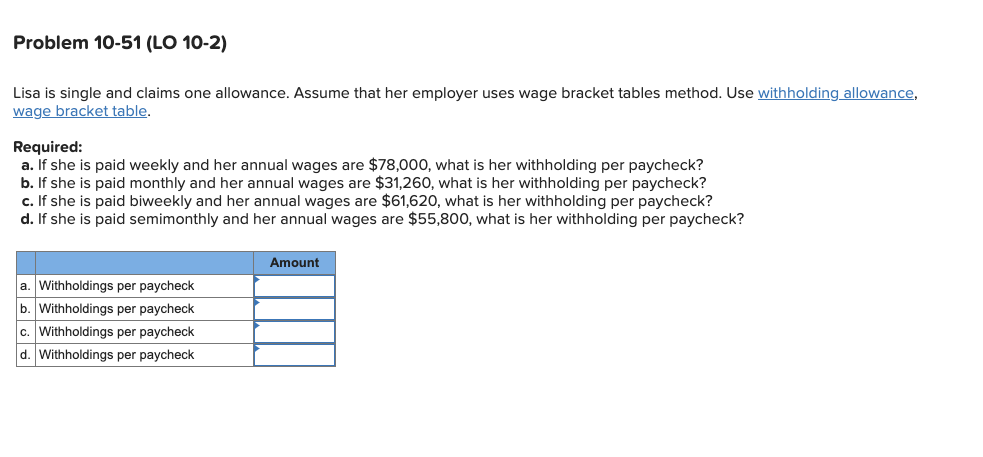

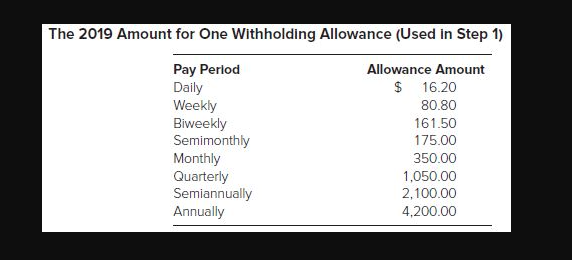

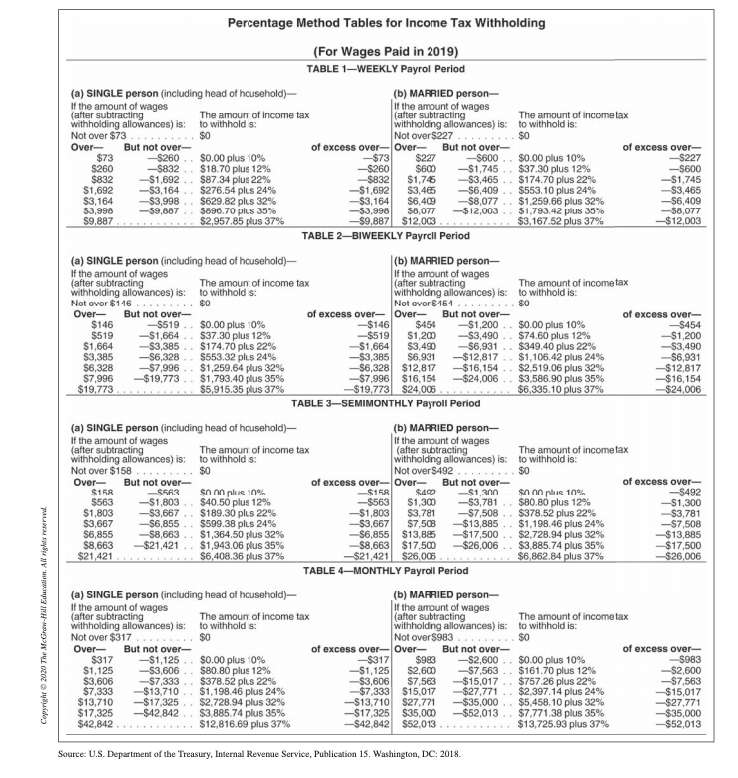

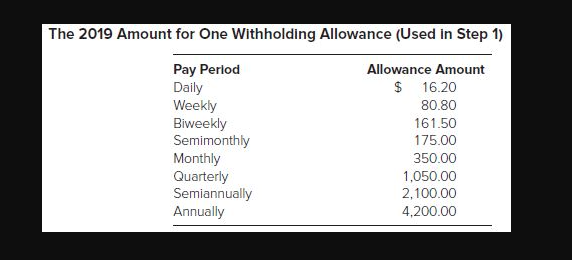

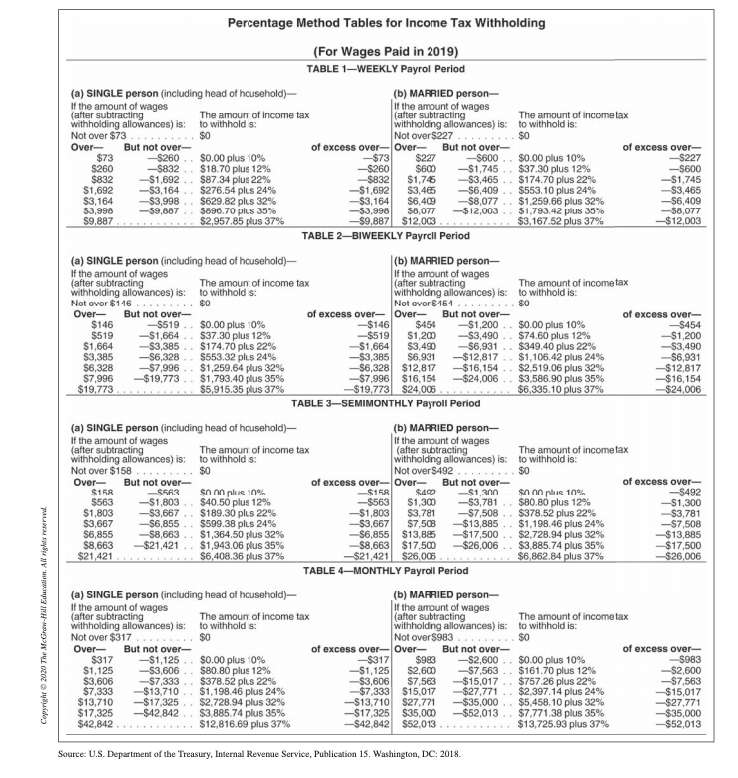

Problem 10-51 (LO 10-2) Lisa is single and claims one allowance. Assume that her employer uses wage bracket tables method. Use withholding allowance, wage bracket table. Required: a. If she is paid weekly and her annual wages are $78,000, what is her withholding per paycheck? b. If she is paid monthly and her annual wages are $31,260, what is her withholding per paycheck? c. If she is paid biweekly and her annual wages are $61,620, what is her withholding per paycheck? d. If she is paid semimonthly and her annual wages are $55,800, what is her withholding per paycheck? Amount a. Withholdings per paycheck b. Withholdings per paycheck c. Withholdings per paycheck d. Withholdings per paycheck The 2019 Amount for One Withholding Allowance (Used in Step 1) Pay Period Daily Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Allowance Amount $ 16.20 80.80 161.50 175.00 350.00 1,050.00 2,100.00 4,200.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1WEEKLY Payrol Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withholds: withholding allowances) is: to withhold is: Not over $73 $0 Not over $227 $0 Over- But not over- of excess over-Over- But not over- of excess over- $73 -$260.. $0.00 plus 10% -$73 $227 -S600 $0.00 plus 10% -S227 $260 -5832. $18.70 plus 12% -$260 $60 -$1,745 $37.30 plus 12% -S600 $832 - $1,692 $87.34 plus 22% -$832 $1,76 -$3,465 $174.70 plus 22% -$1,745 $1,692 -$3,164 $276.54 plus 24% -$1,692 $3,485 -S6,409 $553.10 plus 24% $3,465 $3,164 -$3,998 .. $629.82 plus 32% -$3,164 $6,409 -$8,077 $1,259.66 plus 32% -$6,409 53,990 -59,607 $690.70 plus 35% -53,990 30,077 -$12,003 $1.793.42 plus 35% -$8,077 $9,887 $2.957.85 plus 37% -$9,887 $12.003 $3,167.52 plus 37% -$12,003 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of hcusehold)- (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholding allowances) is: to withhold is: Not over $116..... $0 Not over 8154...... $0 Over- But not over- of excess over- Over- But not over- of excess over- $146 -$519 $0.00 plus 10% -$146 $454 -$1,200 $0.00 plus 10% - $454 $519 -$1,664 .. $37.30 plus 12% -$519 $1,20 -$3,490 $74.60 plus 12% -$1,200 $1,664 $3,385 . . $174.70 plus 22% - $1,664 $3,490 - $6,931 $349.40 plus 22% -$3,490 $3,385 -$6,328 $553.32 plus 24% -$3,385 $6,931 -$12,817 $1,106.42 plus 24% -$6,931 $6,328 -$7,996. . $1,259.64 plus 32% -$6,328 $12,817 -$16,154 .. $2,519.06 plus 32% -$12,817 $7,996 -$19,773 $1,793.40 plus 35% -$7.996 $16,154 - $24,006. $3,586.90 plus 35% -$16,154 $19,773 $5,915.35 plus 37% -$19,773 $24,005 $6,335.10 plus 37% - $24,006 TABLE 3-SEMIMONTHLY Payroll Period $8,663 .. Copyrighr2020 The Mcww.Hal Education. All rights reserved. (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amoun of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholdng allowances) is: to withhold is: Not over $158 $0 Not over $492 $0 Over- But not over of excess over-Over- But not over of excess over- $15 -S563 snonphe 10% -S1ER $400 -$1,300 $non plue 10% -S492 $563 -$1,803 $40.50 plus 12% -$563 $1,300 -$3,781 $80.80 plus 12% -$1,300 $1,803 -S3,667 .. $189.30 plus 22% -$1,803 $3,781 -$7,508.. $378.52 plus 22% -$3,781 $3,667 -$6,855 .. $599.38 plus 24% -$3,667 $7.508 -$13,885 .. $1,198.46 plus 24% -S7,508 $6,855 $1,364.50 plus 32% - $6,855 $13,885 -$17,500.. $2,728.94 plus 32% $13,885 $8,663 - $21,421 .. $1,943.06 plus 35% -$8,663 $17.500 - $26,006 .. $3,885.74 plus 35% -$17.500 $21,421 $6,408,36 plus 37% --$21,421 $26,006 $6,862.84 plus 37% - $26,006 TABLE 4MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholding allowances) is: to withhold is: Not over $317. $0 Not over $983 $0 Over- But not over- of excess over-Over- But not over- of excess over- $317 -S1,125 .. $0.00 plus 10% -$317 $983 -$2,600 $0.00 plus 10% -$983 $1,125 -$3,606 $80.80 plus 12% -$1,125 $2,600 -S7,563 $161.70 plus 12% -$2,600 $3,606 -$7,333 .. $378.52 plus 22% - $3,606 $7,563 -$15,017 .. $757.26 plus 22% -$7,563 $7,333 $13,710 $1,198.46 plus 24% -$7,333 $15,017 -$27,771 .. $2,397.14 plus 24% -$15,017 $13,710 -$17,325 $2,728.94 plus 32% -$13,710 $27.771 -$35,000 . . $5,458.10 plus 32% - $27.771 $17,325 -$42,842 $3,885.74 plus 35% -$17,325 $35,00 -$52,013 $7.771.38 plus 35% -$35,000 $42,842 $12,816.69 plus 37% -$42,842 $52,013 $13,725.93 plus 37% - $52,013 Source: U.S. Department of the Treasury, Internal Revenue Service, Publication 15. Washington, DC: 2018 Problem 10-51 (LO 10-2) Lisa is single and claims one allowance. Assume that her employer uses wage bracket tables method. Use withholding allowance, wage bracket table. Required: a. If she is paid weekly and her annual wages are $78,000, what is her withholding per paycheck? b. If she is paid monthly and her annual wages are $31,260, what is her withholding per paycheck? c. If she is paid biweekly and her annual wages are $61,620, what is her withholding per paycheck? d. If she is paid semimonthly and her annual wages are $55,800, what is her withholding per paycheck? Amount a. Withholdings per paycheck b. Withholdings per paycheck c. Withholdings per paycheck d. Withholdings per paycheck The 2019 Amount for One Withholding Allowance (Used in Step 1) Pay Period Daily Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Allowance Amount $ 16.20 80.80 161.50 175.00 350.00 1,050.00 2,100.00 4,200.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1WEEKLY Payrol Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withholds: withholding allowances) is: to withhold is: Not over $73 $0 Not over $227 $0 Over- But not over- of excess over-Over- But not over- of excess over- $73 -$260.. $0.00 plus 10% -$73 $227 -S600 $0.00 plus 10% -S227 $260 -5832. $18.70 plus 12% -$260 $60 -$1,745 $37.30 plus 12% -S600 $832 - $1,692 $87.34 plus 22% -$832 $1,76 -$3,465 $174.70 plus 22% -$1,745 $1,692 -$3,164 $276.54 plus 24% -$1,692 $3,485 -S6,409 $553.10 plus 24% $3,465 $3,164 -$3,998 .. $629.82 plus 32% -$3,164 $6,409 -$8,077 $1,259.66 plus 32% -$6,409 53,990 -59,607 $690.70 plus 35% -53,990 30,077 -$12,003 $1.793.42 plus 35% -$8,077 $9,887 $2.957.85 plus 37% -$9,887 $12.003 $3,167.52 plus 37% -$12,003 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of hcusehold)- (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholding allowances) is: to withhold is: Not over $116..... $0 Not over 8154...... $0 Over- But not over- of excess over- Over- But not over- of excess over- $146 -$519 $0.00 plus 10% -$146 $454 -$1,200 $0.00 plus 10% - $454 $519 -$1,664 .. $37.30 plus 12% -$519 $1,20 -$3,490 $74.60 plus 12% -$1,200 $1,664 $3,385 . . $174.70 plus 22% - $1,664 $3,490 - $6,931 $349.40 plus 22% -$3,490 $3,385 -$6,328 $553.32 plus 24% -$3,385 $6,931 -$12,817 $1,106.42 plus 24% -$6,931 $6,328 -$7,996. . $1,259.64 plus 32% -$6,328 $12,817 -$16,154 .. $2,519.06 plus 32% -$12,817 $7,996 -$19,773 $1,793.40 plus 35% -$7.996 $16,154 - $24,006. $3,586.90 plus 35% -$16,154 $19,773 $5,915.35 plus 37% -$19,773 $24,005 $6,335.10 plus 37% - $24,006 TABLE 3-SEMIMONTHLY Payroll Period $8,663 .. Copyrighr2020 The Mcww.Hal Education. All rights reserved. (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amoun of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholdng allowances) is: to withhold is: Not over $158 $0 Not over $492 $0 Over- But not over of excess over-Over- But not over of excess over- $15 -S563 snonphe 10% -S1ER $400 -$1,300 $non plue 10% -S492 $563 -$1,803 $40.50 plus 12% -$563 $1,300 -$3,781 $80.80 plus 12% -$1,300 $1,803 -S3,667 .. $189.30 plus 22% -$1,803 $3,781 -$7,508.. $378.52 plus 22% -$3,781 $3,667 -$6,855 .. $599.38 plus 24% -$3,667 $7.508 -$13,885 .. $1,198.46 plus 24% -S7,508 $6,855 $1,364.50 plus 32% - $6,855 $13,885 -$17,500.. $2,728.94 plus 32% $13,885 $8,663 - $21,421 .. $1,943.06 plus 35% -$8,663 $17.500 - $26,006 .. $3,885.74 plus 35% -$17.500 $21,421 $6,408,36 plus 37% --$21,421 $26,006 $6,862.84 plus 37% - $26,006 TABLE 4MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold s: withholding allowances) is: to withhold is: Not over $317. $0 Not over $983 $0 Over- But not over- of excess over-Over- But not over- of excess over- $317 -S1,125 .. $0.00 plus 10% -$317 $983 -$2,600 $0.00 plus 10% -$983 $1,125 -$3,606 $80.80 plus 12% -$1,125 $2,600 -S7,563 $161.70 plus 12% -$2,600 $3,606 -$7,333 .. $378.52 plus 22% - $3,606 $7,563 -$15,017 .. $757.26 plus 22% -$7,563 $7,333 $13,710 $1,198.46 plus 24% -$7,333 $15,017 -$27,771 .. $2,397.14 plus 24% -$15,017 $13,710 -$17,325 $2,728.94 plus 32% -$13,710 $27.771 -$35,000 . . $5,458.10 plus 32% - $27.771 $17,325 -$42,842 $3,885.74 plus 35% -$17,325 $35,00 -$52,013 $7.771.38 plus 35% -$35,000 $42,842 $12,816.69 plus 37% -$42,842 $52,013 $13,725.93 plus 37% - $52,013 Source: U.S. Department of the Treasury, Internal Revenue Service, Publication 15. Washington, DC: 2018