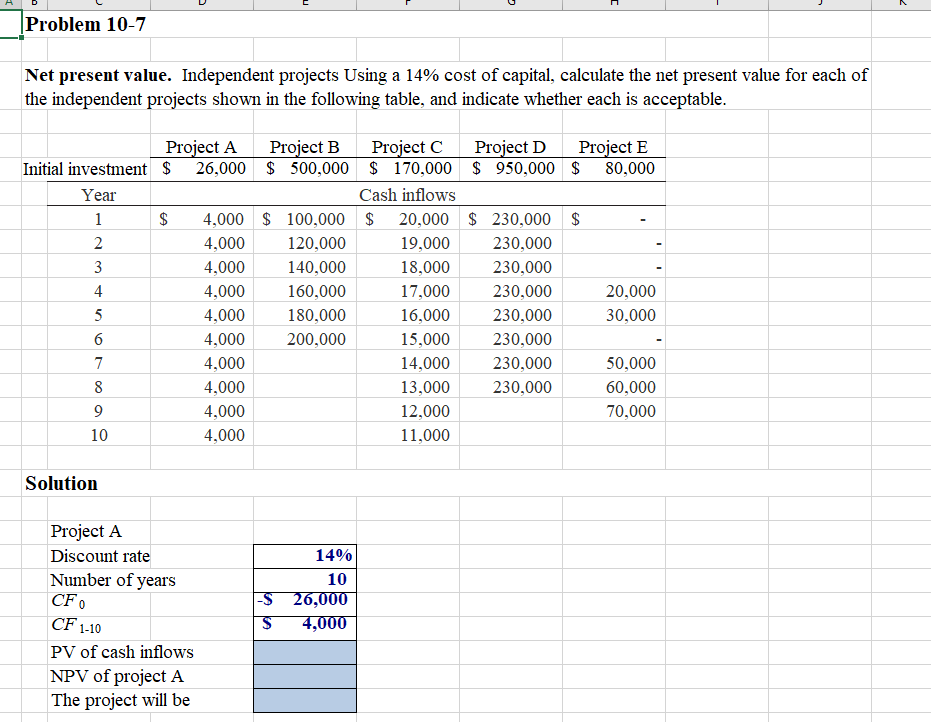

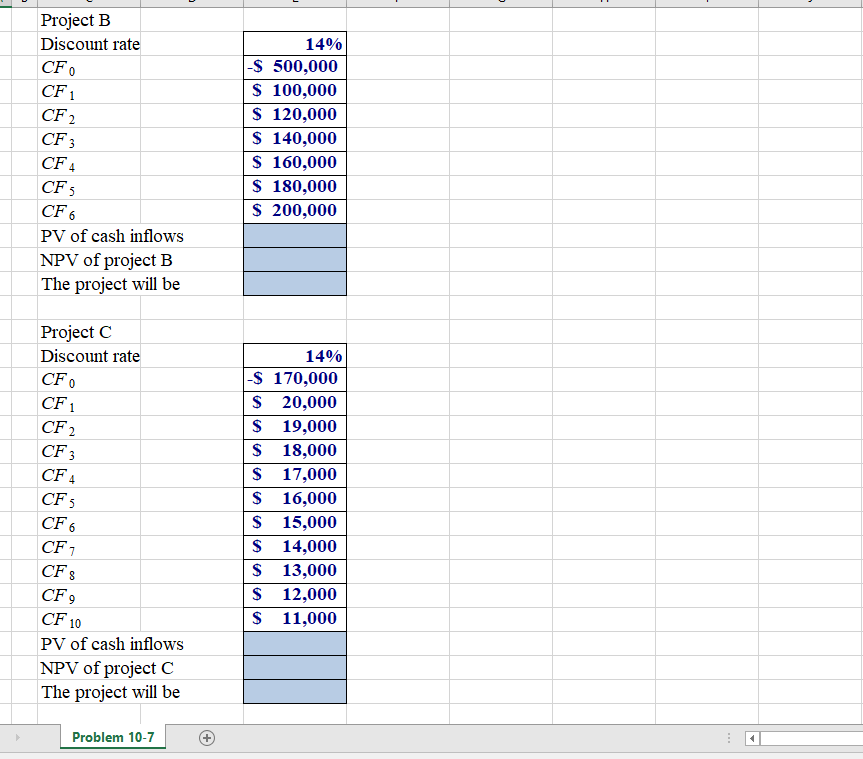

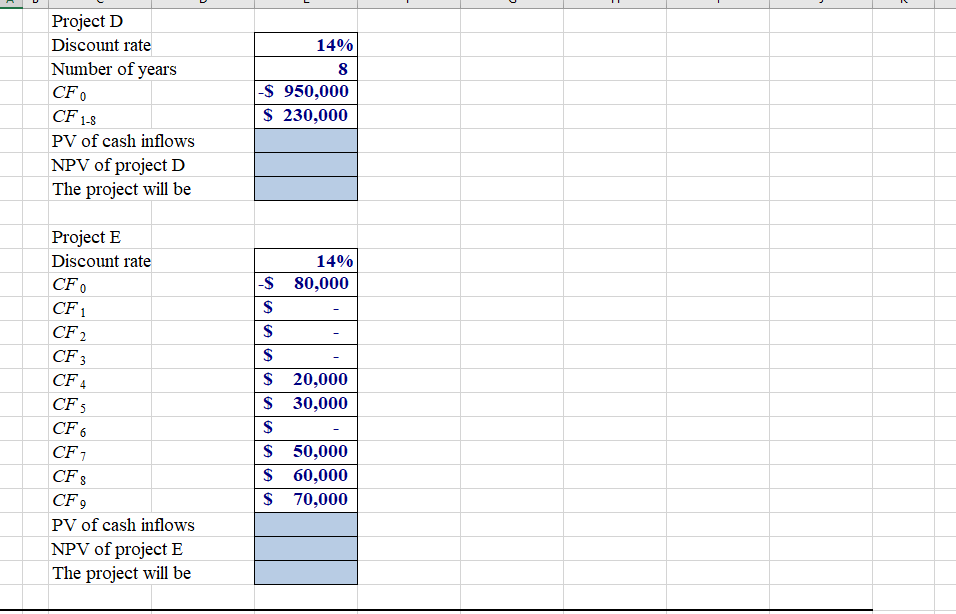

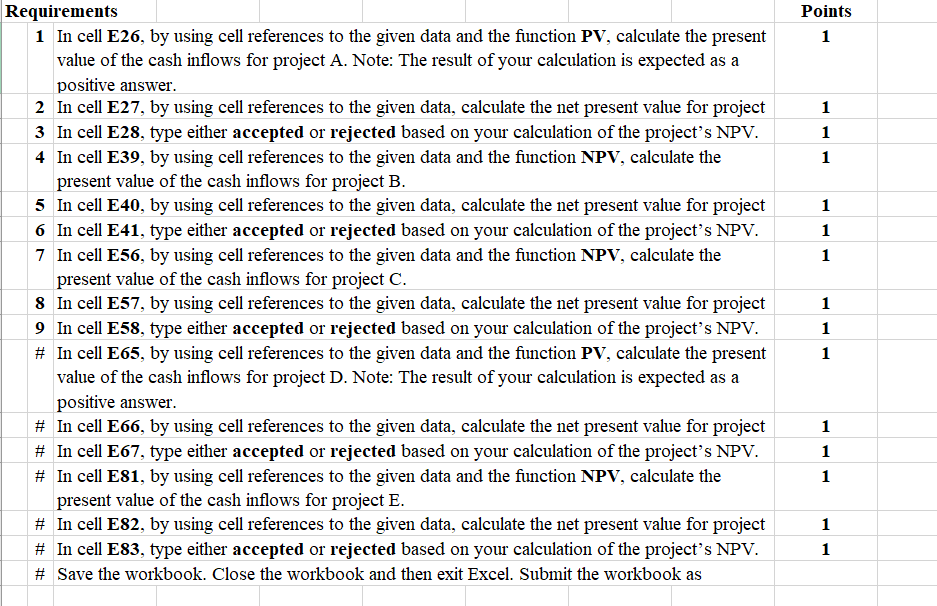

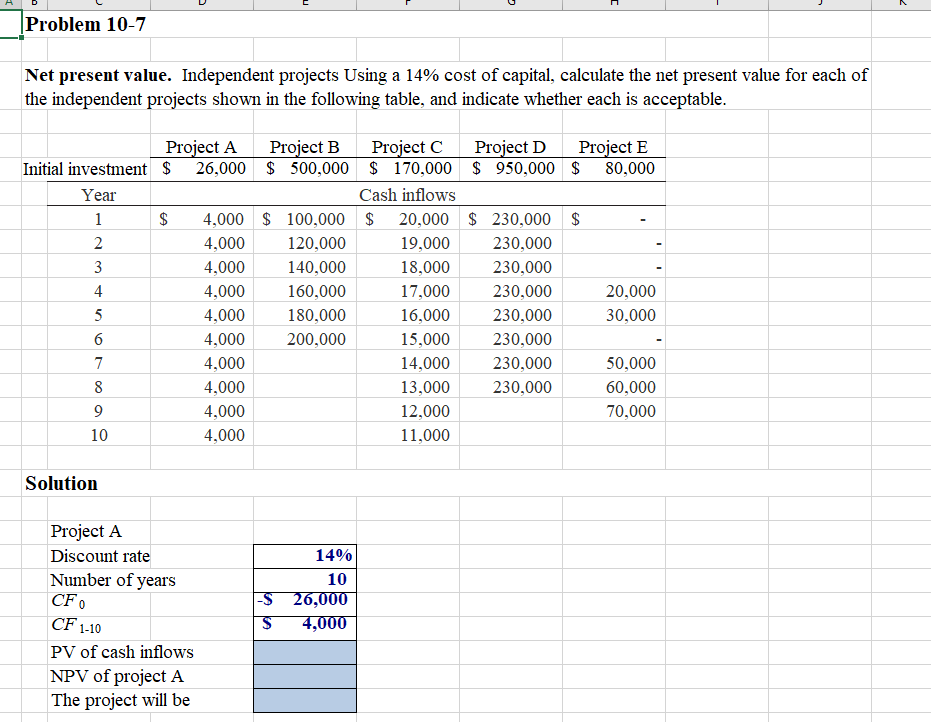

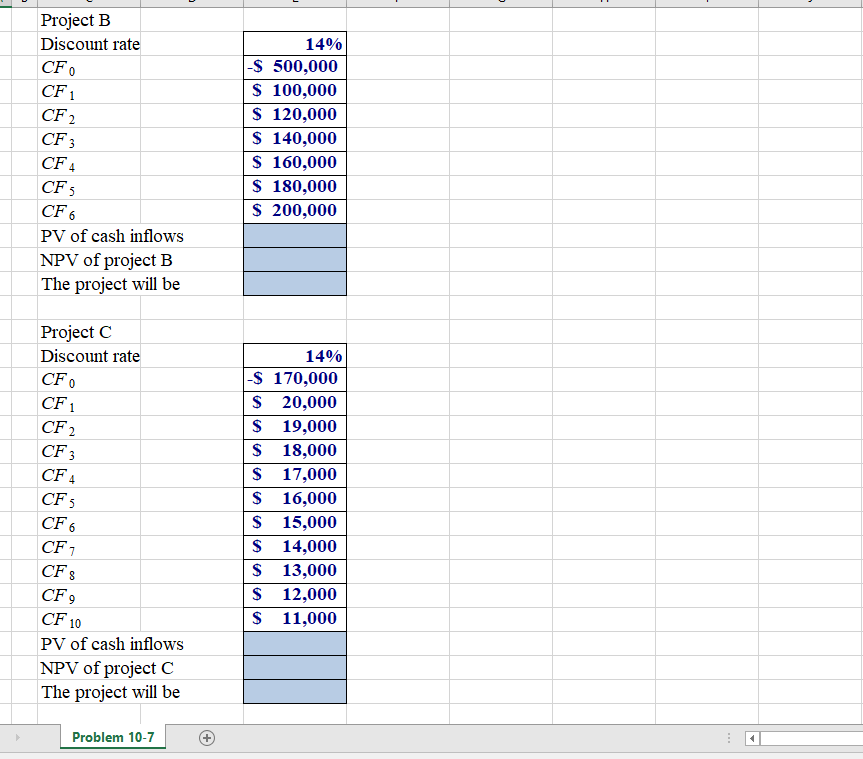

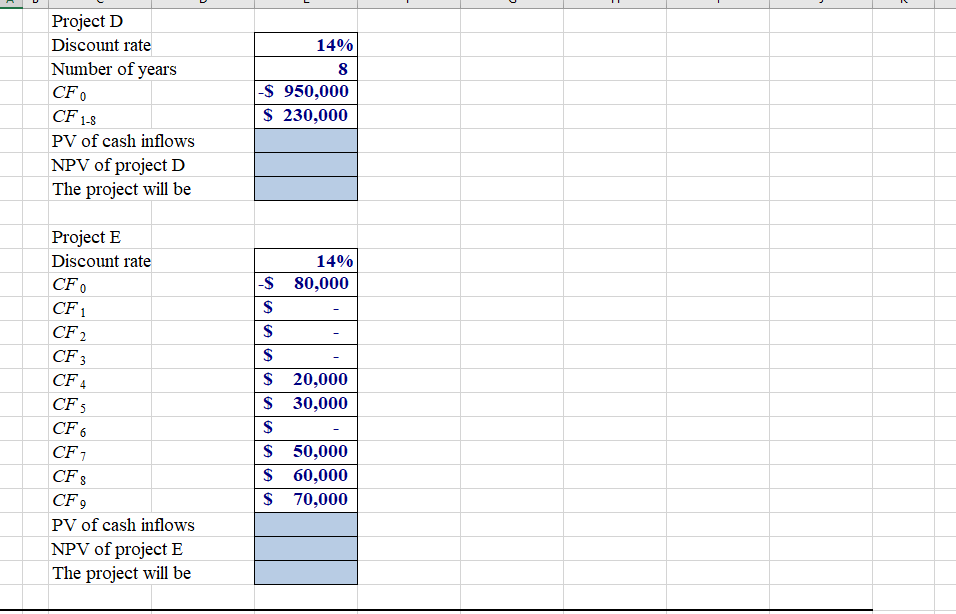

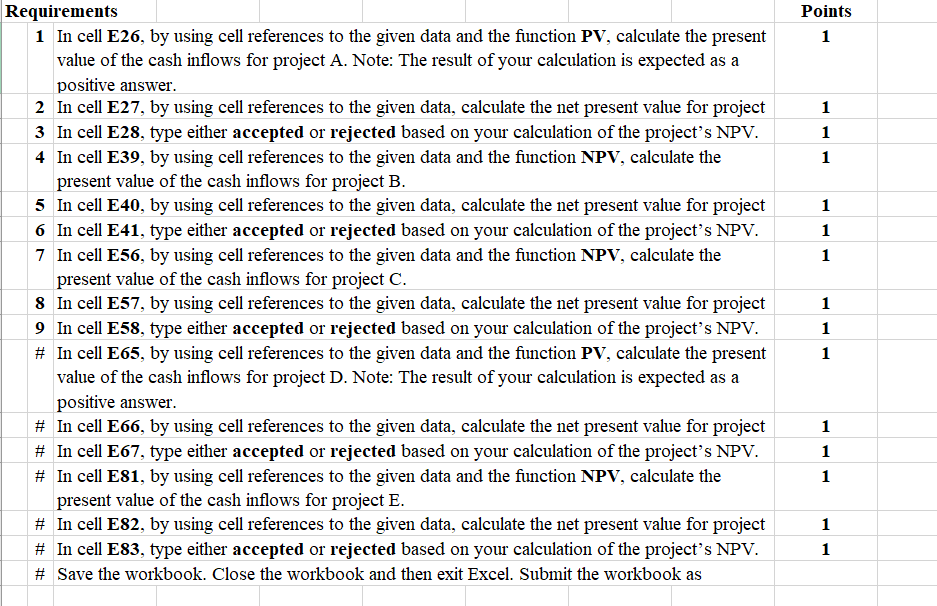

Problem 10-7 Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project A Project B Project C Project D Project E Initial investment $ 26,000 $ 500,000 $ 170,000 $ 950,000 $ 80,000 Year Cash inflows 1 $ 4,000 $ 100,000 $ 20,000 $ 230,000 $ 2 4,000 120,000 19,000 230,000 3 4,000 140,000 18,000 230,000 4 4,000 160,000 17,000 230,000 20,000 5 4,000 180,000 16,000 230,000 30,000 6 4,000 200,000 15,000 230,000 7 4,000 14,000 230,000 50,000 8 4,000 13,000 230,000 60,000 9 4,000 12,000 70,000 10 4,000 11,000 Solution Project A Discount rate Number of years CFO CF 1-10 14% 10 -$ 26,000 S 4,000 PV of cash inflows NPV of project A The project will be Project B Discount rate CF CF1 CF2 CF3 CF4 CFS CF6 PV of cash inflows NPV of project B The project will be 14% -$ 500,000 $ 100,000 $ 120,000 $ 140,000 $ 160,000 $ 180,000 $ 200,000 Project C Discount rate CF0 CF 1 CF 2 CF; CF4 CF3 CF 6 CF 1 CFS 14% $ 170,000 $ 20,000 $ 19,000 $ 18,000 $ 17,000 $ 16,000 $ 15,000 $ 14,000 $ 13,000 $ 12,000 $ 11,000 CF9 CF 10 PV of cash inflows NPV of project C The project will be Problem 10-7 Project D Discount rate Number of years CFO CF 1-8 14% 8 -$ 950,000 $ 230,000 PV of cash inflows NPV of project D The project will be Project E Discount rate 14% 80,000 CFO CF1 -S $ $ CF 2 CF3 CFA CF5 CF6 CF1 CFS CF9 S 20,000 $ 30,000 $ 50,000 S 60,000 S 70,000 al PV of cash inflows NPV of project E The project will be Points 1 1 1 1 1 1 1 Requirements 1 In cell E26, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project A. Note: The result of your calculation is expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for project 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for project 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for project 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. # In cell E65, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project D. Note: The result of your calculation is expected as a positive answer. # In cell E66, by using cell references to the given data, calculate the net present value for project # In cell E67, type either accepted or rejected based on your calculation of the project's NPV. # In cell E81, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project E. # In cell E82, by using cell references to the given data, calculate the net present value for project # In cell E83, type either accepted or rejected based on your calculation of the project's NPV. # Save the workbook. Close the workbook and then exit Excel. Submit the workbook as 1 1 1 1 1 1 1 1 Problem 10-7 Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project A Project B Project C Project D Project E Initial investment $ 26,000 $ 500,000 $ 170,000 $ 950,000 $ 80,000 Year Cash inflows 1 $ 4,000 $ 100,000 $ 20,000 $ 230,000 $ 2 4,000 120,000 19,000 230,000 3 4,000 140,000 18,000 230,000 4 4,000 160,000 17,000 230,000 20,000 5 4,000 180,000 16,000 230,000 30,000 6 4,000 200,000 15,000 230,000 7 4,000 14,000 230,000 50,000 8 4,000 13,000 230,000 60,000 9 4,000 12,000 70,000 10 4,000 11,000 Solution Project A Discount rate Number of years CFO CF 1-10 14% 10 -$ 26,000 S 4,000 PV of cash inflows NPV of project A The project will be Project B Discount rate CF CF1 CF2 CF3 CF4 CFS CF6 PV of cash inflows NPV of project B The project will be 14% -$ 500,000 $ 100,000 $ 120,000 $ 140,000 $ 160,000 $ 180,000 $ 200,000 Project C Discount rate CF0 CF 1 CF 2 CF; CF4 CF3 CF 6 CF 1 CFS 14% $ 170,000 $ 20,000 $ 19,000 $ 18,000 $ 17,000 $ 16,000 $ 15,000 $ 14,000 $ 13,000 $ 12,000 $ 11,000 CF9 CF 10 PV of cash inflows NPV of project C The project will be Problem 10-7 Project D Discount rate Number of years CFO CF 1-8 14% 8 -$ 950,000 $ 230,000 PV of cash inflows NPV of project D The project will be Project E Discount rate 14% 80,000 CFO CF1 -S $ $ CF 2 CF3 CFA CF5 CF6 CF1 CFS CF9 S 20,000 $ 30,000 $ 50,000 S 60,000 S 70,000 al PV of cash inflows NPV of project E The project will be Points 1 1 1 1 1 1 1 Requirements 1 In cell E26, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project A. Note: The result of your calculation is expected as a positive answer. 2 In cell E27, by using cell references to the given data, calculate the net present value for project 3 In cell E28, type either accepted or rejected based on your calculation of the project's NPV. 4 In cell E39, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project B. 5 In cell E40, by using cell references to the given data, calculate the net present value for project 6 In cell E41, type either accepted or rejected based on your calculation of the project's NPV. 7 In cell E56, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project C. 8 In cell E57, by using cell references to the given data, calculate the net present value for project 9 In cell E58, type either accepted or rejected based on your calculation of the project's NPV. # In cell E65, by using cell references to the given data and the function PV, calculate the present value of the cash inflows for project D. Note: The result of your calculation is expected as a positive answer. # In cell E66, by using cell references to the given data, calculate the net present value for project # In cell E67, type either accepted or rejected based on your calculation of the project's NPV. # In cell E81, by using cell references to the given data and the function NPV, calculate the present value of the cash inflows for project E. # In cell E82, by using cell references to the given data, calculate the net present value for project # In cell E83, type either accepted or rejected based on your calculation of the project's NPV. # Save the workbook. Close the workbook and then exit Excel. Submit the workbook as 1 1 1 1 1 1 1 1