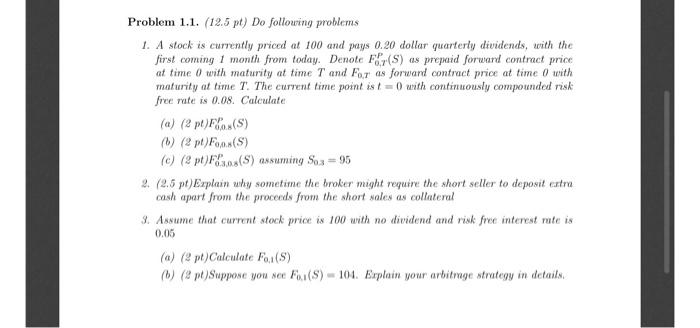

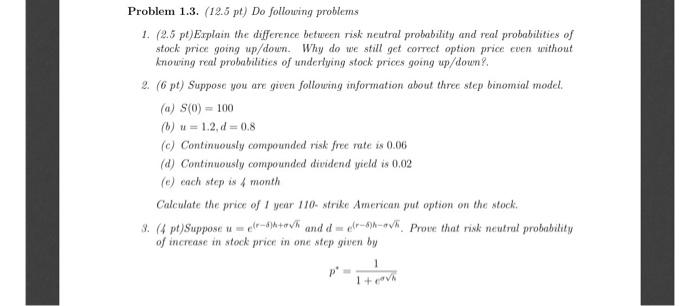

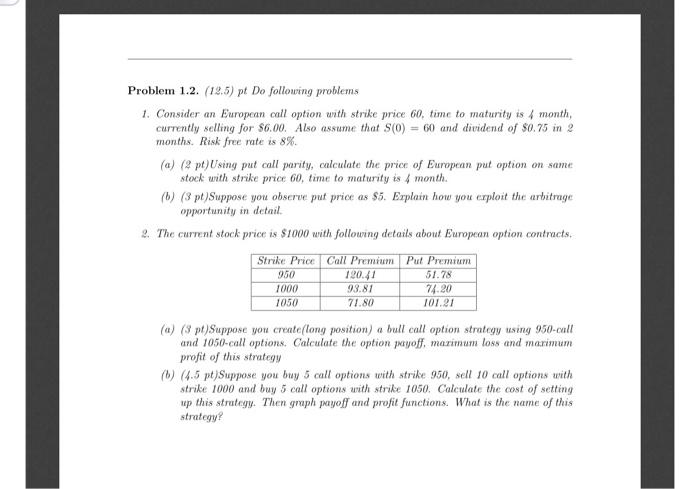

Problem 1.1. (12.5 pt) Do following problems 1. A stock is currently priced at 100 and pays 0.20 dollar quarterly dividends, with the first coming 1 month from today. Denote (S) as prepaid forward contract price at time 0 with maturity at time T and Far as forward contract price at time 0) with maturity at time I. The current time point is t=0 with continuously compounded risk free rate is 0.08. Calculate (a) (2) (S) (O) (pt) F(S) (e) (pt) 03(S) assuming Soz = 95 2. (2.5 pt)Explain why sometime the broker might require the short seller to deposit extra cash apart from the proceeds from the short sales as collateral 3. Assume that current stock price is 100 with no dividend and risk free interest rate is 0.05 (a) (pt)Calculate F(S) () (pt)Suppose you see (S)-101. Explain your arbitrage strategy in details Problem 1.3. (12.6 pt) Do following problems 1. (2.5 pt) Explain the difference between risk neutral prolubility and real probabilities of stock price going up/down. Why do we still get correct option price even without knouring real probabilities of underlying stock prices going up/down? 2. (6 pt) Suppose you are given following information about three step binomial model, (a) S(0) - 100 () 1.2.d = 0.8 (c) Continuously compounded risk free rate is 0.06 (d) Continuously compounded dividend yield is 0.02 (e) each step is 6 month Calculate the price of 1 year 110. strike American put option on the stock. 3. (4 pt)Suppose u = el--8}+ovh and a 5-ovh. Prowe that risk neutral probability of increase in stock price in one step given by 1 1+ Problem 1.2. (12.5) pt De following problems 1. Consider an European call option with strike price 60, time to maturity is month, currently selling for $6.00. Also assume that S(O) = 60 and dividend of $0.75 in 2 months. Risk free rate is 8% (a) (pt)Using put call parity, calculate the price of European put option on same stock with strike priec 60, time to maturity is 4 month. (W) (3 pt)Suppose you observe put price as $5. Explain how you exploit the arbitrage opportunity in detail 2. The current stock price is $1000 with following details about European option contracts. Strike Price Call Premium Pul Premium 950 120.41 51.78 1000 93.81 74.20 1050 71.80 101.91 (a) (3 pt)Suppose you create(long position) a bull call option strategy using 950-call and 1050-call options. Calculate the option paryoff, maximum loss and maximum profit of this strategy (O) (4.5 pt)Suppose you buy 5 call options with strike 950, sell 10 call options urith strike 1000 and buy I call options with strike 1050. Calculate the cost of setting up this strategy. Then graph payoff and profit functions. What is the name of this strategy? Problem 1.1. (12.5 pt) Do following problems 1. A stock is currently priced at 100 and pays 0.20 dollar quarterly dividends, with the first coming 1 month from today. Denote (S) as prepaid forward contract price at time 0 with maturity at time T and Far as forward contract price at time 0) with maturity at time I. The current time point is t=0 with continuously compounded risk free rate is 0.08. Calculate (a) (2) (S) (O) (pt) F(S) (e) (pt) 03(S) assuming Soz = 95 2. (2.5 pt)Explain why sometime the broker might require the short seller to deposit extra cash apart from the proceeds from the short sales as collateral 3. Assume that current stock price is 100 with no dividend and risk free interest rate is 0.05 (a) (pt)Calculate F(S) () (pt)Suppose you see (S)-101. Explain your arbitrage strategy in details Problem 1.3. (12.6 pt) Do following problems 1. (2.5 pt) Explain the difference between risk neutral prolubility and real probabilities of stock price going up/down. Why do we still get correct option price even without knouring real probabilities of underlying stock prices going up/down? 2. (6 pt) Suppose you are given following information about three step binomial model, (a) S(0) - 100 () 1.2.d = 0.8 (c) Continuously compounded risk free rate is 0.06 (d) Continuously compounded dividend yield is 0.02 (e) each step is 6 month Calculate the price of 1 year 110. strike American put option on the stock. 3. (4 pt)Suppose u = el--8}+ovh and a 5-ovh. Prowe that risk neutral probability of increase in stock price in one step given by 1 1+ Problem 1.2. (12.5) pt De following problems 1. Consider an European call option with strike price 60, time to maturity is month, currently selling for $6.00. Also assume that S(O) = 60 and dividend of $0.75 in 2 months. Risk free rate is 8% (a) (pt)Using put call parity, calculate the price of European put option on same stock with strike priec 60, time to maturity is 4 month. (W) (3 pt)Suppose you observe put price as $5. Explain how you exploit the arbitrage opportunity in detail 2. The current stock price is $1000 with following details about European option contracts. Strike Price Call Premium Pul Premium 950 120.41 51.78 1000 93.81 74.20 1050 71.80 101.91 (a) (3 pt)Suppose you create(long position) a bull call option strategy using 950-call and 1050-call options. Calculate the option paryoff, maximum loss and maximum profit of this strategy (O) (4.5 pt)Suppose you buy 5 call options with strike 950, sell 10 call options urith strike 1000 and buy I call options with strike 1050. Calculate the cost of setting up this strategy. Then graph payoff and profit functions. What is the name of this strategy