Answered step by step

Verified Expert Solution

Question

1 Approved Answer

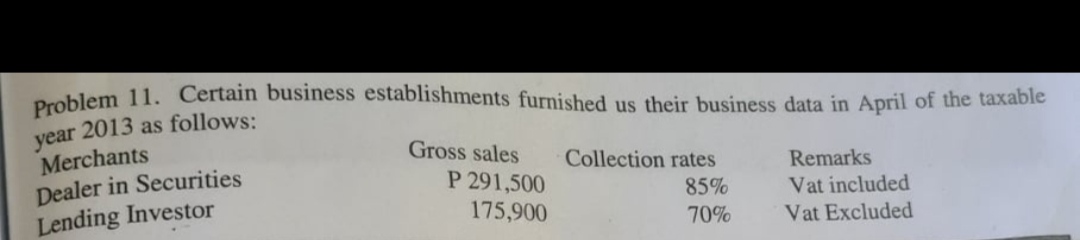

Problem 11. Certain business establishments furnished us their business data in April of the taxable year 2013 as follows: Merchants Dealer in Securities Lending

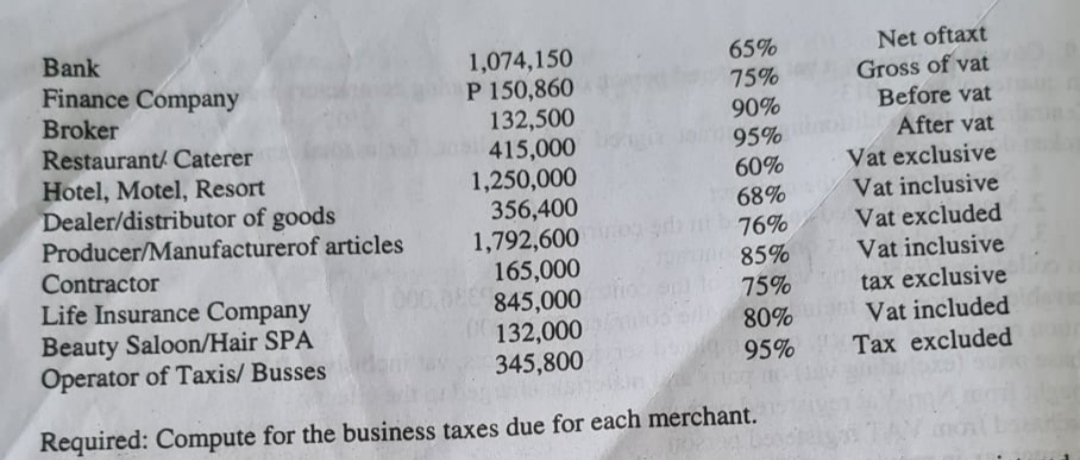

Problem 11. Certain business establishments furnished us their business data in April of the taxable year 2013 as follows: Merchants Dealer in Securities Lending Investor Gross sales P 291,500 175,900 Collection rates 85% 70% Remarks Vat included Vat Excluded Bank Finance Company Broker Restaurant/ Caterer Hotel, Motel, Resort Dealer/distributor of goods Producer/Manufacturerof articles 1,074,150 P 150,860 132,500 09415,000 1,250,000 356,400 1,792,600 65% 75% 90% 95% 60% 68% 76% 85% 75% 80% 95% Contractor 165,000 845,000 Life Insurance Company Beauty Saloon/Hair SPA Operator of Taxis/ Busses 132,000 345,800 Required: Compute for the business taxes due for each merchant. Net oftaxt Gross of vat Before vat After vat Vat exclusive Vat inclusive Vat excluded Vat inclusive tax exclusive Vat included Tax excluded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the computations for taxes due from each merchant based on the data provided Merchant Merchants Gross Sales Rs 291500 Collection Rate 85 Taxable Amount Gross Sales Collection Rate Rs 291500 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started