Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1.1 Help Can someone please help me with this? Part B needs to be the statements not just an explanation of how they would

Problem 1.1 Help Can someone please help me with this?

Part B needs to be the statements not just an explanation of how they would be reported. I'm really confused on this part.

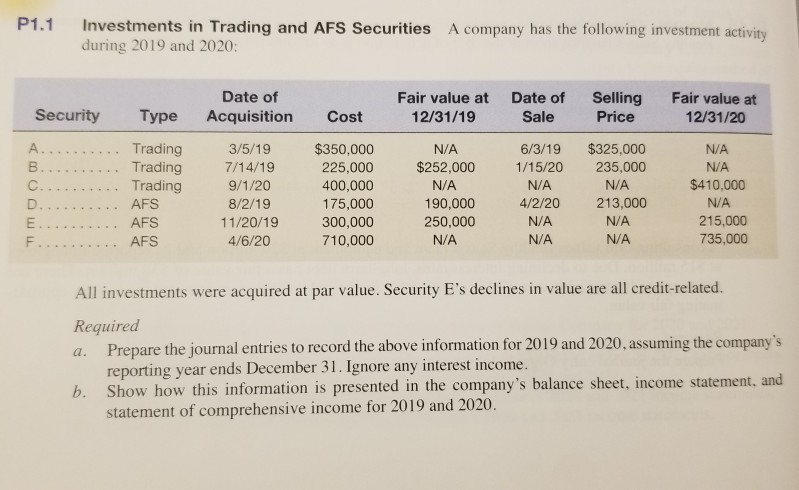

P1.1 Investments in Trading and AFS Securities A company has the following investment activity during 2019 and 2020: Date of Fair value at Date of Selling Fair value at SecurityType Acquisition Cost 12/31/19 Sale Price 12/31/20 Trading Trading A. . .. $350,000 6/3/19 $325,000 1/15/20 235,000 3/5/19 7/14/19 9/1/20 8/2/19 11/20/19 4/6/20 N/A 225,000 $%252,000 400,000 175,000 300,000 710,000 N/A 190,000 250,000 N/A N/A 213,000 N/A N/A N/A N/A $410,000 N/A 215,000 rading N/A . AFS AFS 4/2/20 N/A N/A 735,000 AFS All investments were acquired at par value. Security E's declines in value are all credit-related. Required a. Prepare the journal entries to record the above information for 2019 and 2020, assuming the company's b. Show how this information is presented in the company's balance sheet, income statement, and reporting year ends December 31. Ignore any interest income. statement of comprehensive income for 2019 and 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started