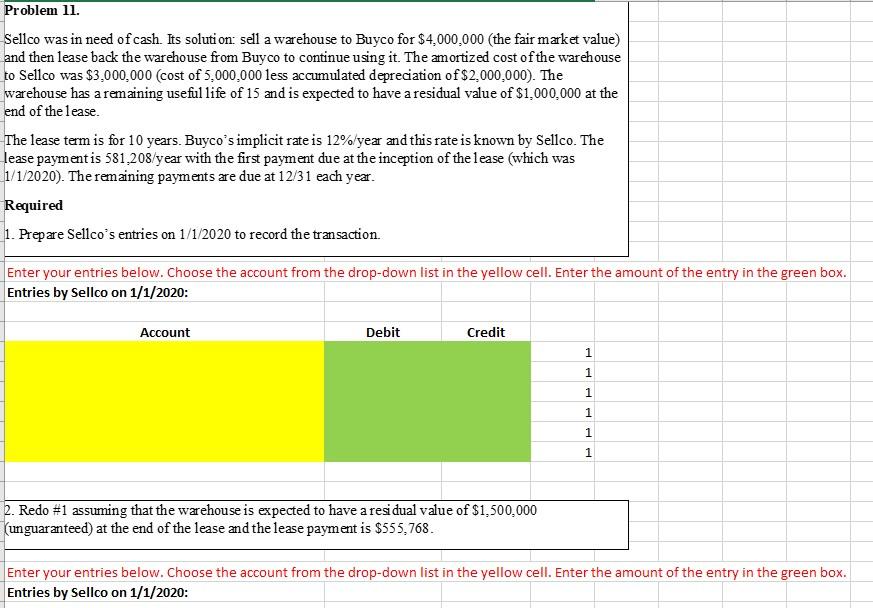

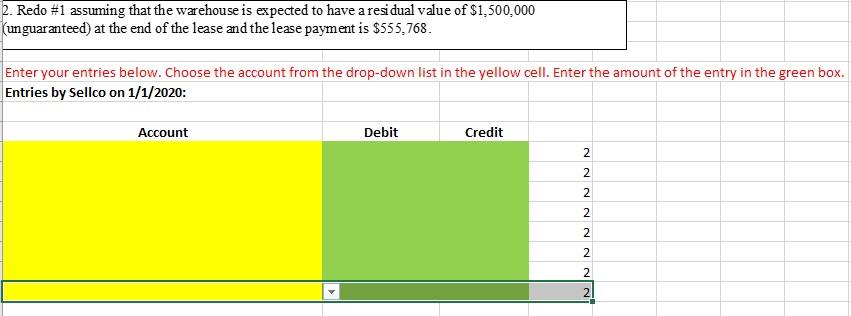

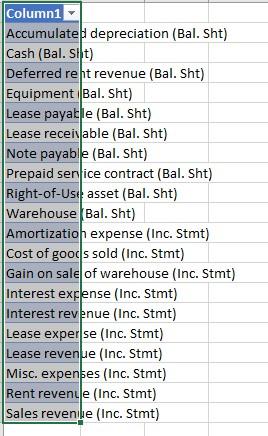

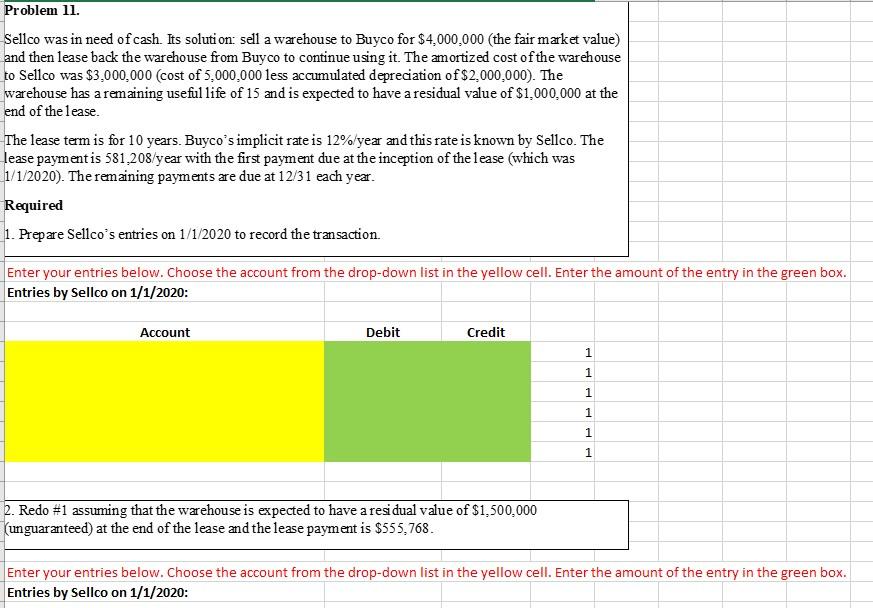

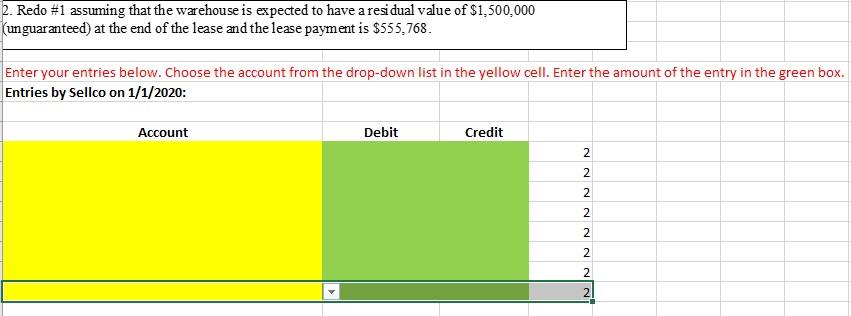

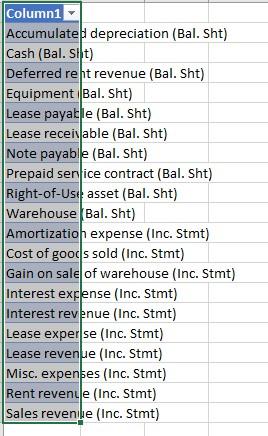

Problem 11. Sellco was in need of cash. Its solution: sell a warehouse to Buyco for $4,000,000 (the fair market value) and then lease back the warehouse from Buyco to continue using it. The amortized cost of the warehouse to Sellco was $3,000,000 (cost of 5.000.000 less accumulated depreciation of $2,000,000). The warehouse has a remaining useful life of 15 and is expected to have a residual value of $1,000,000 at the end of the lease. The lease term is for 10 years. Buyco's implicit rate is 12%/year and this rate is known by Sellco. The lease payment is 581,208/year with the first payment due at the inception of the lease (which was 1/1/2020). The remaining payments are due at 12/31 each year. Required 1. Prepare Sellco's entries on 1/1/2020 to record the transaction. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Sellco on 1/1/2020: Account Debit Credit 1 1 1 1 1 1 1 2. Redo #1 assuming that the warehouse is expected to have a residual value of $1.500.000 (unguaranteed) at the end of the lease and the lease payment is $555.768. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Selico on 1/1/2020: 2. Redo #1 assuming that the warehouse is expected to have a residual value of $1,500,000 (unguaranteed) at the end of the lease and the lease payment is $555.768. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Sellco on 1/1/2020: Account Debit Credit 2 2 NNNN NN Column1 Accumulate depreciation (Bal. Sht) Cash (Bal. Sit) Deferred reht revenue (Bal. Sht) Equipment Bal. Sht) Lease payable (Bal. Sht) Lease receivable (Bal. Sht) Note payabile (Bal. Sht) Prepaid sen ice contract (Bal. Sht) Right-of-Use asset (Bal. Sht) Warehouse Bal. Sht) Amortization expense Inc. Stmt) Cost of goods sold (Inc. Stmt) Gain on sale of warehouse (Inc. Stmt) Interest expense (Inc. Stmt) Interest revenue (Inc. Stmt) Lease experse (Inc. Stmt) Lease revenue (Inc. Stmt) Misc. expenses (Inc. Stmt) Rent revenue (Inc. Stmt) Sales revenile (Inc. Stmt) Problem 11. Sellco was in need of cash. Its solution: sell a warehouse to Buyco for $4,000,000 (the fair market value) and then lease back the warehouse from Buyco to continue using it. The amortized cost of the warehouse to Sellco was $3,000,000 (cost of 5.000.000 less accumulated depreciation of $2,000,000). The warehouse has a remaining useful life of 15 and is expected to have a residual value of $1,000,000 at the end of the lease. The lease term is for 10 years. Buyco's implicit rate is 12%/year and this rate is known by Sellco. The lease payment is 581,208/year with the first payment due at the inception of the lease (which was 1/1/2020). The remaining payments are due at 12/31 each year. Required 1. Prepare Sellco's entries on 1/1/2020 to record the transaction. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Sellco on 1/1/2020: Account Debit Credit 1 1 1 1 1 1 1 2. Redo #1 assuming that the warehouse is expected to have a residual value of $1.500.000 (unguaranteed) at the end of the lease and the lease payment is $555.768. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Selico on 1/1/2020: 2. Redo #1 assuming that the warehouse is expected to have a residual value of $1,500,000 (unguaranteed) at the end of the lease and the lease payment is $555.768. Enter your entries below. Choose the account from the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Entries by Sellco on 1/1/2020: Account Debit Credit 2 2 NNNN NN Column1 Accumulate depreciation (Bal. Sht) Cash (Bal. Sit) Deferred reht revenue (Bal. Sht) Equipment Bal. Sht) Lease payable (Bal. Sht) Lease receivable (Bal. Sht) Note payabile (Bal. Sht) Prepaid sen ice contract (Bal. Sht) Right-of-Use asset (Bal. Sht) Warehouse Bal. Sht) Amortization expense Inc. Stmt) Cost of goods sold (Inc. Stmt) Gain on sale of warehouse (Inc. Stmt) Interest expense (Inc. Stmt) Interest revenue (Inc. Stmt) Lease experse (Inc. Stmt) Lease revenue (Inc. Stmt) Misc. expenses (Inc. Stmt) Rent revenue (Inc. Stmt) Sales revenile (Inc. Stmt)