Question

Problem #11: The implementation of Proposal #1 would generally lead to shareholders: A. having to pay tax on the dividend received. B. experiencing a decrease

Problem #11: The implementation of Proposal #1 would generally lead to shareholders:

A. having to pay tax on the dividend received.

B. experiencing a decrease in the total cost basis of their shares

C. having the same proportionate ownership as before implementation

Answer choice: Calculation/Explanation:

Problem #12: If Yoshis management implemented Proposal #2 at the current share price shown in Exhibit 1, Yoshis book value per share after implementation would be closest to:

A. $25.20

B. $25.71

C. $26.12

Answer choice: Calculation/Explanation:

Problem #13: Based on Exhibit 1, if Yoshis management implemented Proposal #3 at the current share price, earnings per share would:

A. decrease

B. remain unchanged

C. increase

Answer choice: Calculation/Explanation:

Problem #14: Based on Exhibit 1 and Yoshis target capital structure, the total dividend that Yoshi would have paid last year under a residual dividend policy is closest to:

A. $77 million

B. $112 million

C. $175 million

Answer choice: Calculation/Explanation:

Problem #15: Based on Yoshis target capital structure, Proposal #4 will most likely:

A. increase the default risk of Yeta's debt

B. increase the agency conflict between Yeta's shareholders and managers

C. decrease the agency conflict between Yeta's shareholders and bondhonders

Answer choice: Calculation/Explanation:

Problem #16: The implementation of Proposal #4 would most likely signal to Lakin and other investors that future earnings growth can be expected to:

A. decrease

B. remain unchanged

C. increase

Answer choice: Calculation/Explanation:

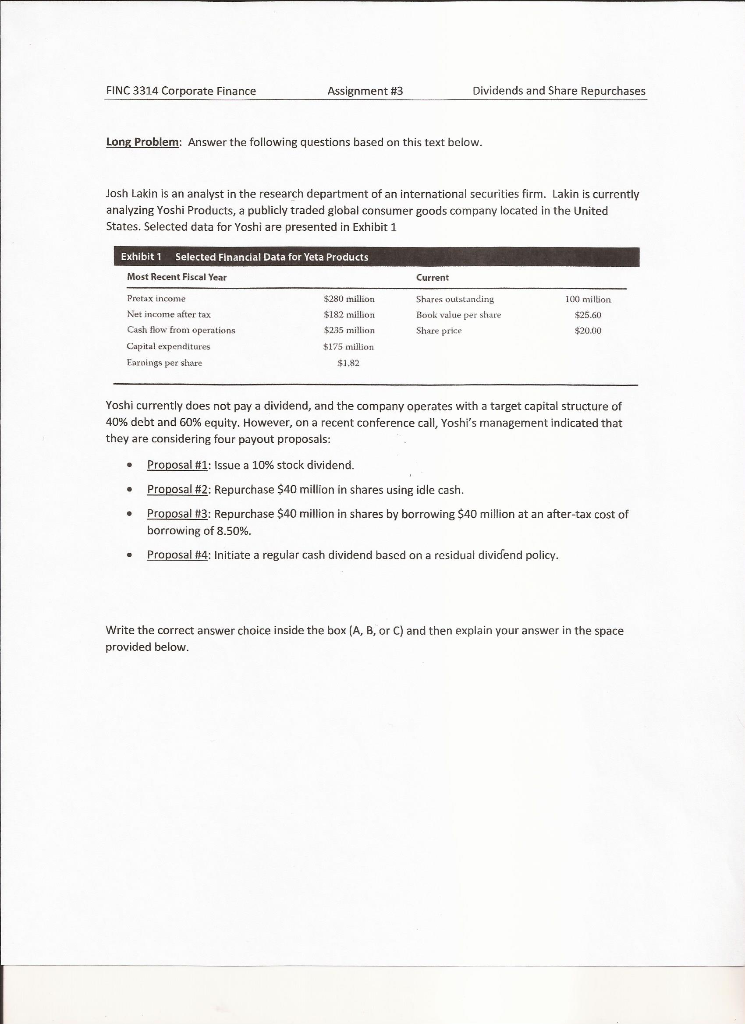

FINC 3314 Corporate Finance Assignment #3 Dividends and Share Repurchases Long Problem: Answer the following questions based on this text below. Josh Lakin is an analyst in the research department of an international securities firm. Lakin is currently analyzing Yoshi Products, a publicly traded global consumer goods company located in the United States. Selected data for Yoshi are presented in Exhibit 1 Exhibit 1 Selected Financial Data for Yeta Products Most Recent Fiscal Year Current Pretax income 100 million Net income after tax Cash flow from operations $25.60 $280 million $182 million $235 million $175 million $1.82 Shares outstanding Book value per share Share price $20.00 Capital expenditures Earnings per share Yoshi currently does not pay a dividend, and the company operates with a target capital structure of 40% debt and 60% equity. However, on a recent conference call, Yoshi's management indicated that they are considering four payout proposals: Proposal #1: Issue a 10% stock dividend. Proposal #2: Repurchase $40 million in shares using idle cash. Proposal #3: Repurchase $40 million in shares by borrowing $40 million at an after-tax cost of borrowing of 8.50%. Proposal #4: Initiate a regular cash dividend based on a residual dividend policy Write the correct answer choice inside the box (A, B, or C) and then explain your answer in the space provided below. FINC 3314 Corporate Finance Assignment #3 Dividends and Share Repurchases Long Problem: Answer the following questions based on this text below. Josh Lakin is an analyst in the research department of an international securities firm. Lakin is currently analyzing Yoshi Products, a publicly traded global consumer goods company located in the United States. Selected data for Yoshi are presented in Exhibit 1 Exhibit 1 Selected Financial Data for Yeta Products Most Recent Fiscal Year Current Pretax income 100 million Net income after tax Cash flow from operations $25.60 $280 million $182 million $235 million $175 million $1.82 Shares outstanding Book value per share Share price $20.00 Capital expenditures Earnings per share Yoshi currently does not pay a dividend, and the company operates with a target capital structure of 40% debt and 60% equity. However, on a recent conference call, Yoshi's management indicated that they are considering four payout proposals: Proposal #1: Issue a 10% stock dividend. Proposal #2: Repurchase $40 million in shares using idle cash. Proposal #3: Repurchase $40 million in shares by borrowing $40 million at an after-tax cost of borrowing of 8.50%. Proposal #4: Initiate a regular cash dividend based on a residual dividend policy Write the correct answer choice inside the box (A, B, or C) and then explain your answer in the space provided belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started