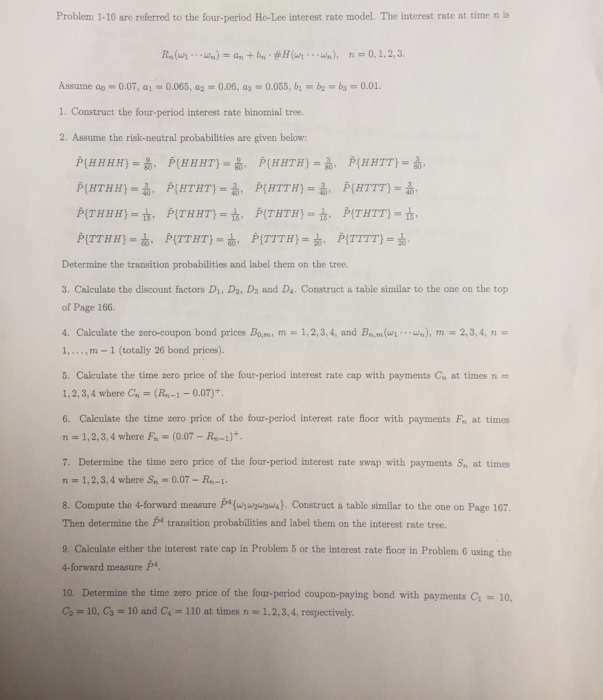

Problem 1-10 are referred to the four-period Ho-Lee interest rate model. The interest rate at time n is Assume ao-0.07, at-0.065, a2 = 0.06, aa = 0.055, b1-b2-ba = 0.01. 1. Construct the four-period interest rate binomial tree. 2. Assume the risk-neutral probabilities are given below: Determine the transition probabilities and label them on the tree. 3. Calculate the discount factors Di, D2, Ds and Ds. Construct a table similar to the one on the top of Page 166. 4. Calculate the zero-coupon bond prices Bom, m = 1, 2, 3, 4, and Bn,m(n m), m = 2,3,4, n = 1,...,m-1 (totally 26 bond prices). 5. Calculate the time zero price of the four-period interest rate cap with payments at times n = 1, 2, 3, 4 where C" = (Rn-1-0.07)" 6. Calculate the time zero price of the four-period interest rate floor with payments Fo at times n = 1, 2, 3, 4 where F,-0.07-Rn-1)+. 7. Determine the time zero price of the four-period interest rate swap with payments Sn at times n=l,2, 3, 4 where S, = 0.07-Rn-1. 8. Compute the 4-forward measure). Construct a table similar to the one on Page 167. Then determine the Pi transition probabilities and label them on the interest rate tree. 9. Calculate either the interest rate cap in Problem 5 or the interest rate floor in Problem 6 using the 4-forward measure P4, 10. Determine the time zero price of the four-period coupon-paying bond with payments C-10 d, = 10, c, = 10 and C = 110 at times n = 1,2,3,4, respectively. Problem 1-10 are referred to the four-period Ho-Lee interest rate model. The interest rate at time n is Assume ao-0.07, at-0.065, a2 = 0.06, aa = 0.055, b1-b2-ba = 0.01. 1. Construct the four-period interest rate binomial tree. 2. Assume the risk-neutral probabilities are given below: Determine the transition probabilities and label them on the tree. 3. Calculate the discount factors Di, D2, Ds and Ds. Construct a table similar to the one on the top of Page 166. 4. Calculate the zero-coupon bond prices Bom, m = 1, 2, 3, 4, and Bn,m(n m), m = 2,3,4, n = 1,...,m-1 (totally 26 bond prices). 5. Calculate the time zero price of the four-period interest rate cap with payments at times n = 1, 2, 3, 4 where C" = (Rn-1-0.07)" 6. Calculate the time zero price of the four-period interest rate floor with payments Fo at times n = 1, 2, 3, 4 where F,-0.07-Rn-1)+. 7. Determine the time zero price of the four-period interest rate swap with payments Sn at times n=l,2, 3, 4 where S, = 0.07-Rn-1. 8. Compute the 4-forward measure). Construct a table similar to the one on Page 167. Then determine the Pi transition probabilities and label them on the interest rate tree. 9. Calculate either the interest rate cap in Problem 5 or the interest rate floor in Problem 6 using the 4-forward measure P4, 10. Determine the time zero price of the four-period coupon-paying bond with payments C-10 d, = 10, c, = 10 and C = 110 at times n = 1,2,3,4, respectively