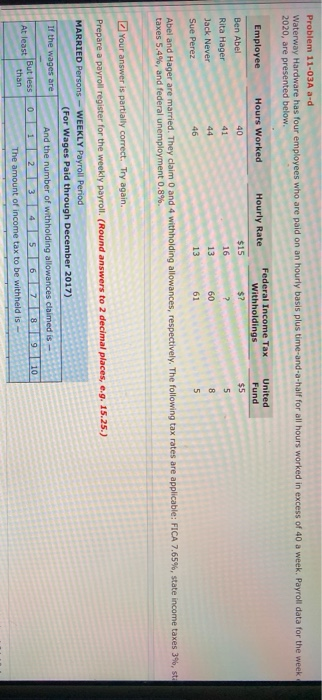

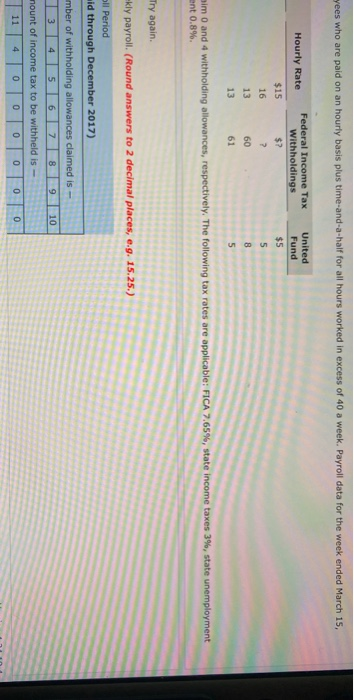

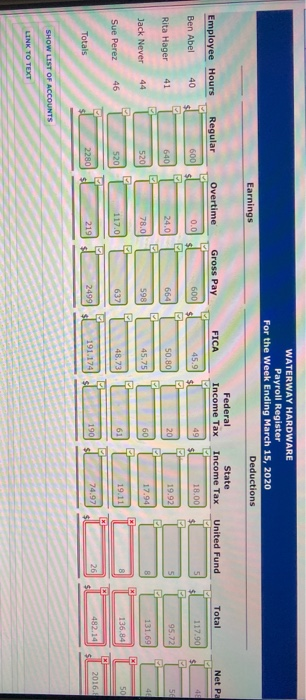

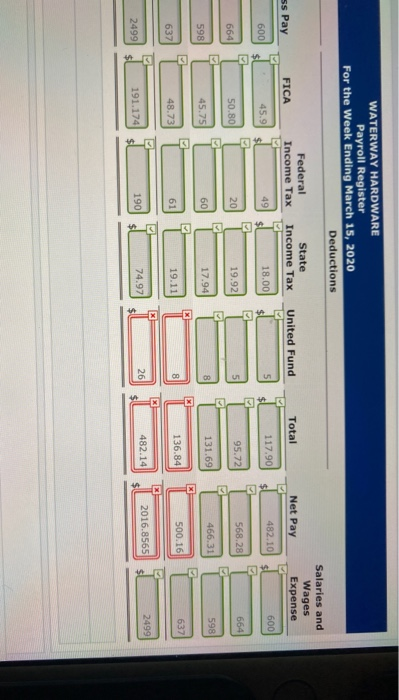

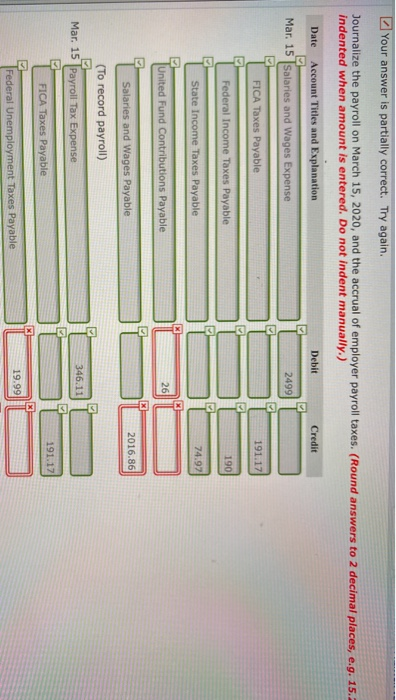

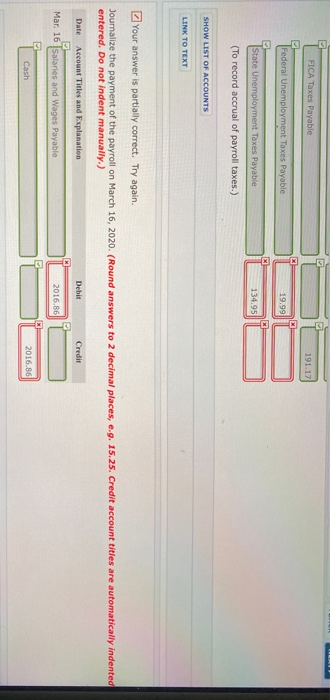

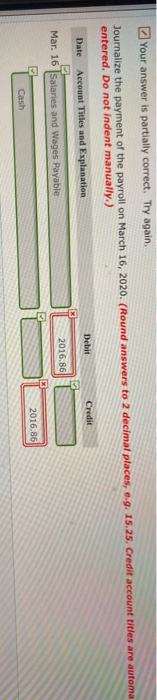

Problem 11-03A a-d Waterway Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week 2020, are presented below: Federal Income Tax United Employee Hours Worked Hourly Rate Withholdings Fund Ben Abel 40 $15 $7 $5 Rita Hager 41 16 75 Jack Never 1360 Sue Perez 1361 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, st taxes 5.4%, and federal unemployment 0.8%. Your answer is partially correct. Try again. Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017) If the wages are And the number of withholding allowances claimed is But less0 1 2 3 4 5 6 7 8 At least 9 than The amount of income tax to be withheld is - 10 yees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, Hourly Rate Federal Income Tax Withholdings United Fund $15 16 13 60 13 sim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment ant 0.8%. Try again. kly payroll (Round answers to 2 decimal places, e.g. 15.25.) ll Period aid through December 2017) umber of withholding allowances claimed is - 3 4 5 6 7 8 9 mount of income tax to be withheld is - 11 4 0 0 0 0 0 10 0 WATERWAY HARDWARE Payroll Register For the Week Ending March 15, 2020 Deductions Earnings Federal Income Tax State Income Tax Gross Pay Overtime Regular Employee Hours Total United Fund Net Pa FICA 45.9 Ben Abel Rita Hager 41 - 50.80 Jack Never 44 - 1368 Sue Perez - L 8 117.0 219 2 637 24990 48.73 191.174 2016. Totals SHOW LIST OF ACCOUNTS LINK TO TEXT WATERWAY HARDWARE Payroll Register For the Week Ending March 15, 2020 Deductions Federal Income Tax State Income Tax Salaries and Wages Expense Net Pay ss Pay FICA Total United Fund 9 5 482 600 60- 0-3 466. - E- Hall -0 136.84 500.16 482.14 2016.8565 2499 191.174 Your answer is partially correct. Try again. Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, e.g. 15. indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 15 Salaries and Wages Expense FICA Taxes Payable 191.17 -3-3-3-3 *-3-3-3-3 Federal Income Taxes Payable State Income Taxes Payable United Fund Contributions Payable Salaries and Wages Payable 2016.86 (To record payroll) Mar. 15 Payroll Tax Expense 191.17 FICA Taxes Payable Federal Unemployment Taxes Payable FICA Taxes Payable 191.17 Federal Unemployment Taxes Payable State Unemployment Taxes Payable (To record accrual of payroll taxes.) SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 16 Salaries and Wages Payable 2016.86 Cash 2016.86 Your answer is partially correct. Try again. Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, e.. 15.25. Credit account tities are automa entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 2016.86 Mar. 16 Salaries and Wages Payable 2016.86 Cash