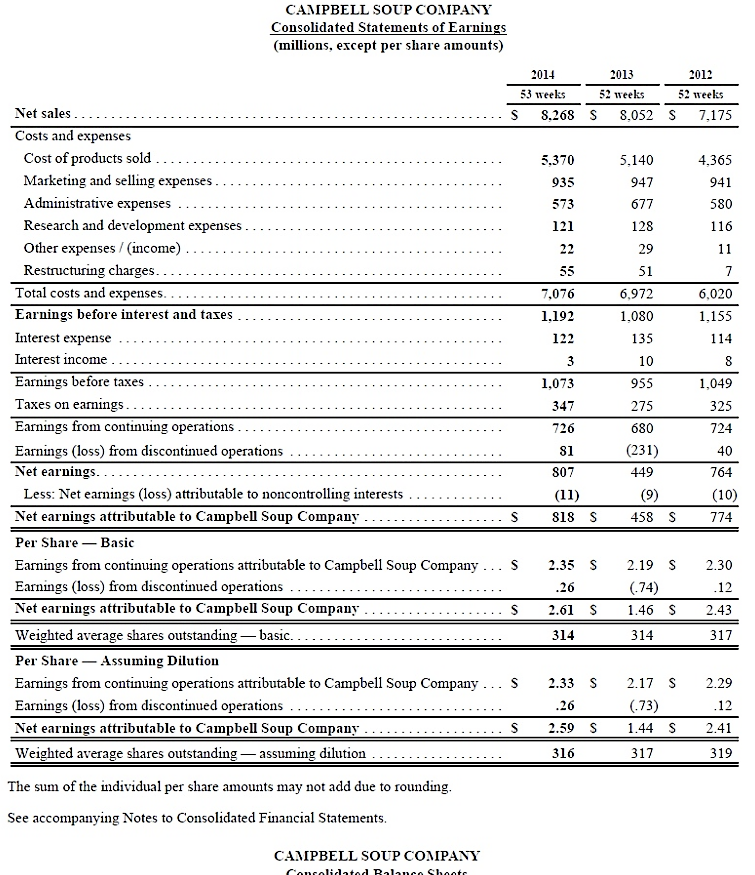

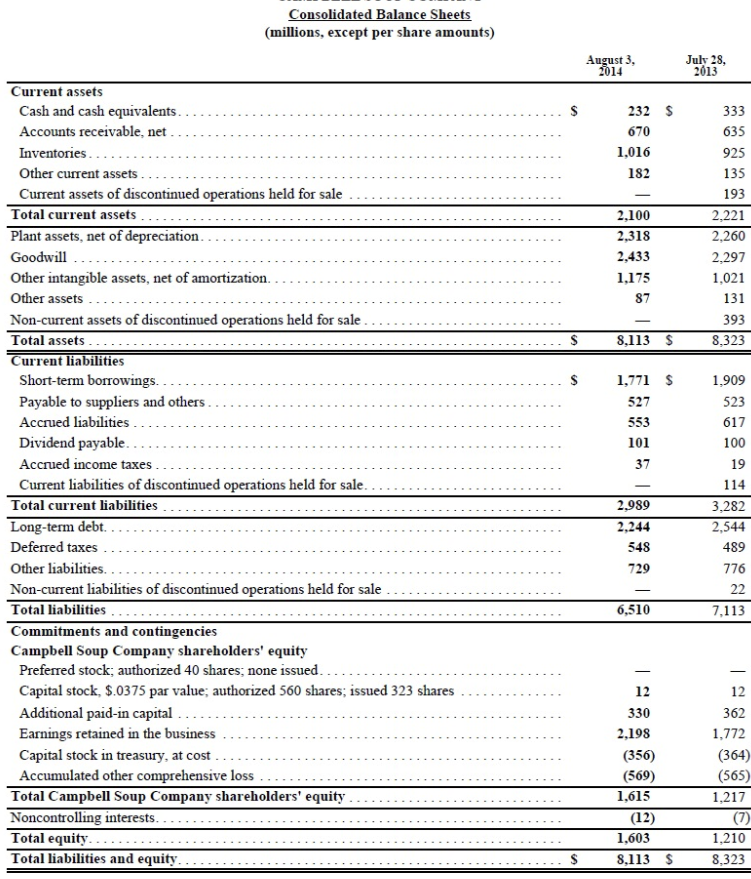

Problem 11-14 Ratio analysis-comprehensive problem, 2014 data

This problem is based on the 2014 annual report ofCampbell Soup Company.

3. Price/earnings ratio. Use $41.96 as the year-end market price.(Round your answer to 1 decimal place.)

5. Dividend payout ratio.(Round your answer to 1 decimal place.)

I have all the other I just need these two, thanks

?

CAMPBELL SOUP COMPANY Consolidated Statements of Earning ( millions , except per share amounts ) 53 weeks 52 weeks 52 weeks Net sales 5 8.268 8.052 5 7.175 Costs and expenses Cost of products sold 5370 5.140 1 365 Marketing and selling expense Administrative expenses Research and development expenses Other expenses ( income ) Restructuring charges Total costs and expen 7076 6 020 Earnings before interest and taxes 1.155 Interest expens Interest income Earnings before taxes 1073 1 049 Taxes on earnings Earnings from continuing operations Earnings ( loss ) from discontinued operations ( 231 ) Net earnings Less : Net earnings ( loss ) attributable to noncontrolling interests ( 10 ) Net earnings a lines attributable to Campbell Soup Compan $18 s 458 S Per Share - Basic Earnings from continuing operations attributable to Campbell Soup Company 235 5 2 19 5 Earnings ( loss ) from discontinued operations ( 74 ) Net earnings attributable to Campbell Soup Company 2 61 S 1.46 5 Weighted average shares outstanding - basic Per Share - Assuming Dilution Earnings from continuing operations attributable to Campbell Soup Company 2 33 8 217 5 Earnings ( loss ) from discontinued operations ( 73 ) Net earnings attributable to Campbell Soup Company 2.50 S 4 4 S Weighted average shares outstanding - assuming dilution The sum of the individual per share amounts may not add due to rounding See accompanying Notes to Consolidated Financial Statements CAMPBELL SOUP COMPANY Consolidated Ralanon ChanteConsolidated Balance Sheets ( millions . except per share amounts ) August 3 July 28 , Current assets Cash and cash equivalents 232 5 Accounts receivable net HAVETURNED Other current assets Current assets of discontinued operations held for sale Total current assets 2100 2 .2 2 Plant assets net of depreciation 2318 2. 260 Goodwill 1 433 2 297 Other intangible assets net of amortization 1 175 1021 Other assets Non-current assets of discontinued operations held for sale Total assets 8. 1 13 5 8 323 Current Liabilities Short -term borrowing 171 5 Payable to suppliers and others Accrued Liabilities Dividend parable Accrued income taxes Current Liabilities of discontinued operations held for sale Total current liabilities 7989 2 383 Long-term debt . 234 4 2.541 Deferred taxes Other liabilities Non - current liabilities of discontinued operations held for sale Total liabilities 6 510 7, 1 13 Commitments and contingencies Campbell Soup Company shareholders equity Preferred stock authorized 40 shares none issued Capital stock , 5 0375 par value authorized 560 shares issued 323 shares Additional paid in capital Earnings retained in the business 1.272 Capital stock in treasury . at cost (350 ( 364) Accumulated other comprehensive loss (509) ( 565 ) Total Campbell Soup Company shareholders equity 1015 1.217 Noncontrolling interests 12 ) Total equity 1603 1.210 ofal liabilities and equity 8. 1 13 5