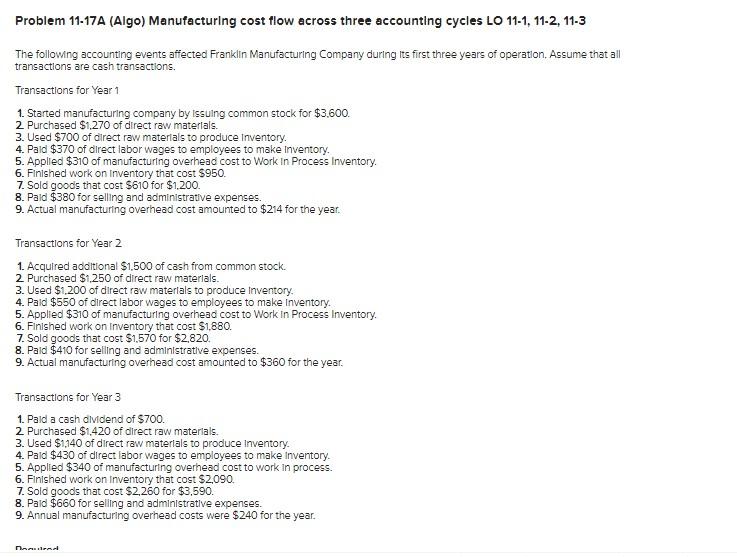

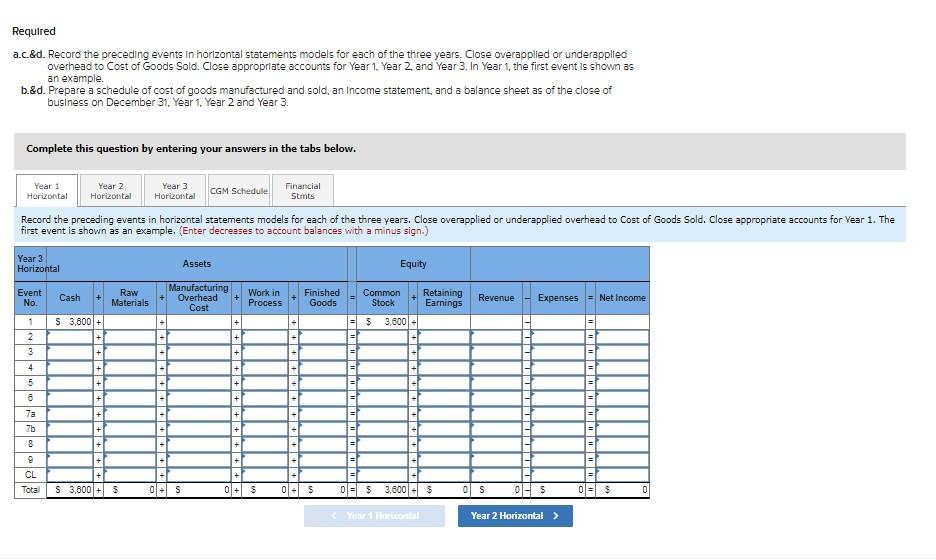

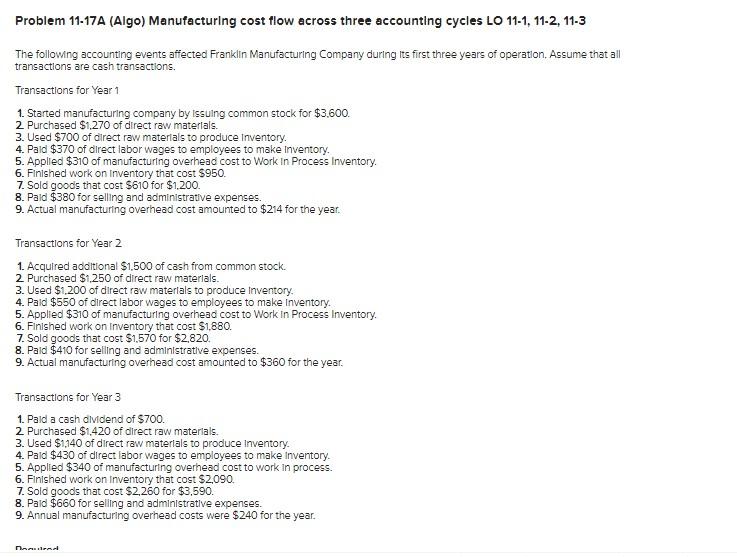

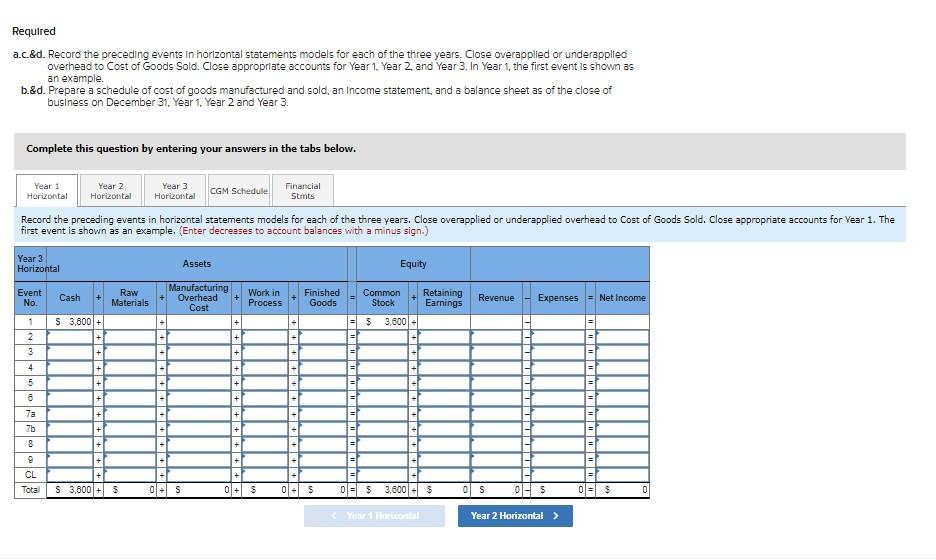

Problem 11-17A (Algo) Manufacturing cost flow across three accounting cycles LO 11-1, 11-2, 11-3 The followng accounting events affected Franklin Manufacturing Company during its first three years of operation, Assume that all transactlons are cash transactions. Transactions for Year 1 1. Started manufacturing company by issulng common stock for $3,600. 2. Purchased $1,270 of direct raw materlals. 3. Used $700 of direct raw materlals to produce Inventory. 4. Pald $370 of direct labor wages to employees to make inventory. 5. Applied $310 of manufacturing overhead cost to Work In Process Inventory. 6 . Finished work on inventory that cost $950. 7. Sold goods that cost $610 for $1,200. 8. Paid $380 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $214 for the year. Transactions for Year 2 1. Acquired additional $1,500 of cash from common stock. 2. Purchased $1,250 of direct raw materlals. 3. Used $1,200 of direct raw materlals to produce Inventory. 4. Paid $550 of direct labor wages to employees to make Inventory. 5. Applied $310 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on Inventory that cost $1,880. 7. Sold goods that cost $1,570 for $2,820. 8. Paid $410 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $360 for the year. Transactions for Year 3 1. Pald a cash dividend of $700. 2. Purchased $1,420 of direct raw materlals. 3 . Used $1,140 of direct raw materlals to produce inventory. 4. Paid $430 of direct labor wages to employees to make Inventory. 5. Applied $340 of manufacturing overhead cost to work in process. 6. Finished work on Inventory that cost $2,090. 7. Sold goods that cost $2,260 for $3,590. 8. Paid $660 for selling and administrative expenses. 9. Annual manufacturing overhead costs were $240 for the year. Required a.c.\&d. Record the preceding events in horizontal statements models for each of the three years. Close overappiled or underapplied overhead to Cost of Goods Sold. Close appropriate accounts for Year 1 . Year 2 , and Year 3 . In Year 1 , the first event is shown as an example. b.\&d. Prepare a schedule of cost of goods manufactured and sold, an Income statement, and a balance sheet as of the close of business on December 31 , Year 1 , Year 2 and Year 3. Complete this question by entering your answers in the tabs below. Problem 11-17A (Algo) Manufacturing cost flow across three accounting cycles LO 11-1, 11-2, 11-3 The followng accounting events affected Franklin Manufacturing Company during its first three years of operation, Assume that all transactlons are cash transactions. Transactions for Year 1 1. Started manufacturing company by issulng common stock for $3,600. 2. Purchased $1,270 of direct raw materlals. 3. Used $700 of direct raw materlals to produce Inventory. 4. Pald $370 of direct labor wages to employees to make inventory. 5. Applied $310 of manufacturing overhead cost to Work In Process Inventory. 6 . Finished work on inventory that cost $950. 7. Sold goods that cost $610 for $1,200. 8. Paid $380 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $214 for the year. Transactions for Year 2 1. Acquired additional $1,500 of cash from common stock. 2. Purchased $1,250 of direct raw materlals. 3. Used $1,200 of direct raw materlals to produce Inventory. 4. Paid $550 of direct labor wages to employees to make Inventory. 5. Applied $310 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on Inventory that cost $1,880. 7. Sold goods that cost $1,570 for $2,820. 8. Paid $410 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $360 for the year. Transactions for Year 3 1. Pald a cash dividend of $700. 2. Purchased $1,420 of direct raw materlals. 3 . Used $1,140 of direct raw materlals to produce inventory. 4. Paid $430 of direct labor wages to employees to make Inventory. 5. Applied $340 of manufacturing overhead cost to work in process. 6. Finished work on Inventory that cost $2,090. 7. Sold goods that cost $2,260 for $3,590. 8. Paid $660 for selling and administrative expenses. 9. Annual manufacturing overhead costs were $240 for the year. Required a.c.\&d. Record the preceding events in horizontal statements models for each of the three years. Close overappiled or underapplied overhead to Cost of Goods Sold. Close appropriate accounts for Year 1 . Year 2 , and Year 3 . In Year 1 , the first event is shown as an example. b.\&d. Prepare a schedule of cost of goods manufactured and sold, an Income statement, and a balance sheet as of the close of business on December 31 , Year 1 , Year 2 and Year 3. Complete this question by entering your answers in the tabs below