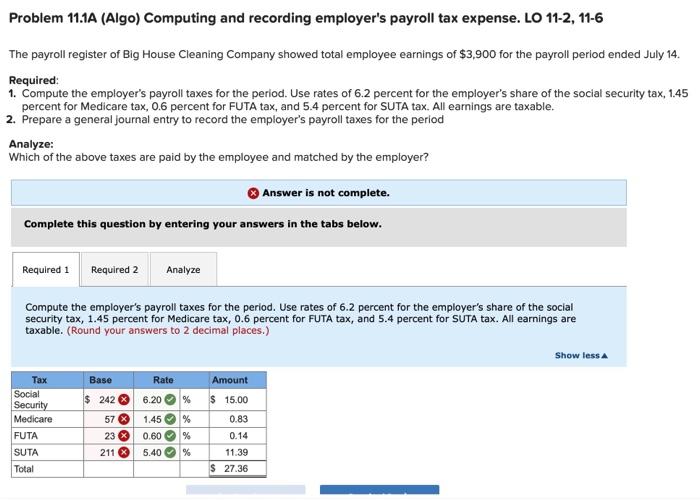

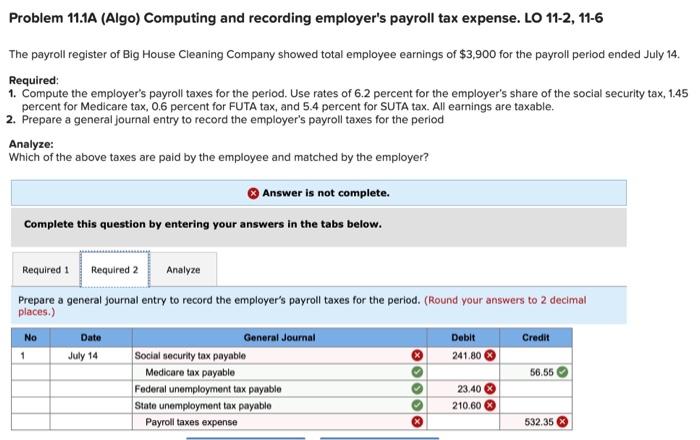

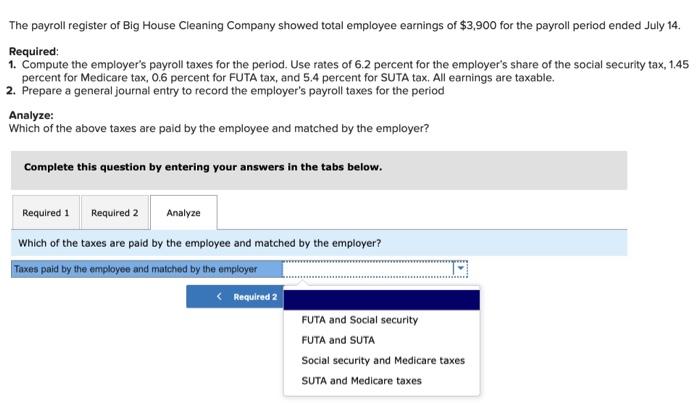

Problem 11.1A (Algo) Computing and recording employer's payroll tax expense. LO 11-2, 11-6 The payroll register of Big House Cleaning Company showed total employee earnings of $3,900 for the payroll period ended July 14. Required: 1. Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. 2. Prepare a general journal entry to record the employer's payroll taxes for the period Analyze: Which of the above taxes are paid by the employee and matched by the employer? Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. (Round your answers to 2 decimal places.) Show less Base Tax Social Security Medicare $ 242 57 23 X 211 Rate Amount 6.20% $ 15.00 1.45% 0.83 0.60% 0.14 5.40 % 11.39 $ 27.36 FUTA SUTA Total Problem 11.1A (Algo) Computing and recording employer's payroll tax expense. LO 11-2, 11-6 The payroll register of Big House Cleaning Company showed total employee earnings of $3,900 for the payroll period ended July 14. Required: 1. Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. 2. Prepare a general journal entry to record the employer's payroll taxes for the period Analyze: Which of the above taxes are paid by the employee and matched by the employer? Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze 1 Prepare a general journal entry to record the employer's payroll taxes for the period. (Round your answers to 2 decimal places.) No Date General Journal Debit Credit July 14 Social security tax payable 241.80 Medicare tax payable 56.55 Federal unemployment tax payable 23.40 State unemployment tax payable 210.60 Payroll taxes expense 532.35 The payroll register of Big House Cleaning Company showed total employee earnings of $3,900 for the payroll period ended July 14. Required: 1. Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax, All earnings are taxable. 2. Prepare a general journal entry to record the employer's payroll taxes for the period Analyze: Which of the above taxes are paid by the employee and matched by the employer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Analyze Which of the taxes are paid by the employee and matched by the employer? Taxes paid by the employee and matched by the employer