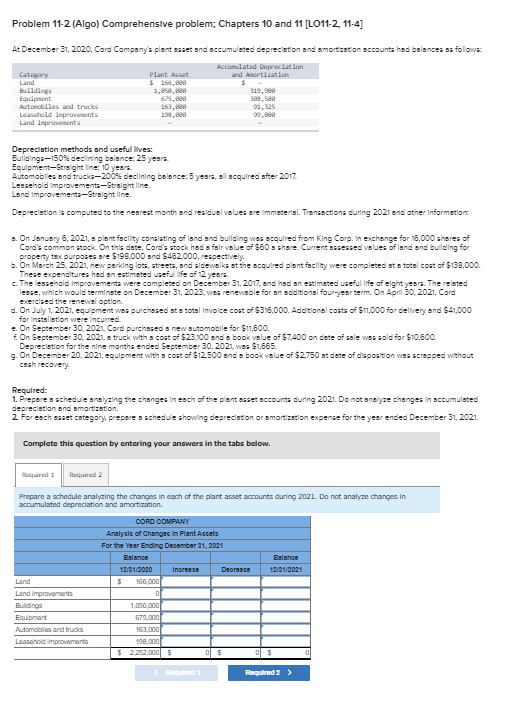

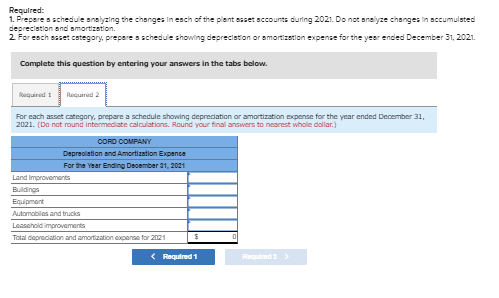

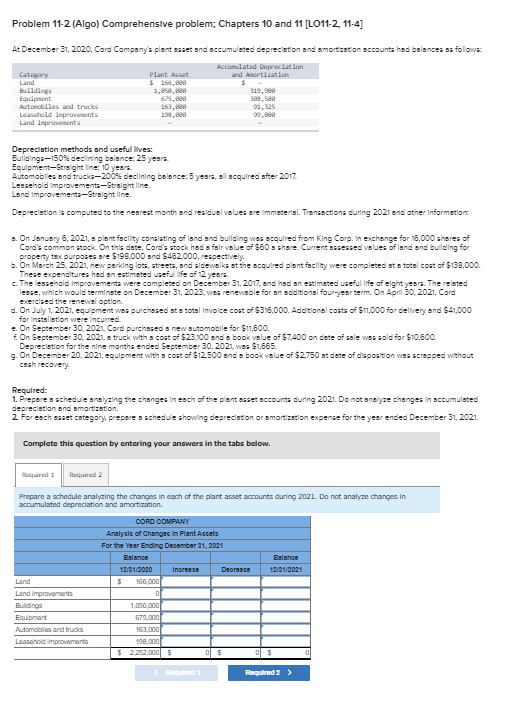

Problem 11-2 (Algo) Comprehensive problem: Chapters 10 and 11 [L011-2.11-4) A: December 31, 2020. Cord Companys pot send scumbed depreciation and account had beences so A lated Depreciation Cat Plant AS 308, Sac 96.325 Depreciation methods and useful lives Buildings-150% de ning balance: 25 years Equipmentreghtline: 10 years Automobiles and trucio-2005 declining balance: 5 yess, Lesseholdmprovement Straight line Landmprovements-straight line cured sitter 2017 Depreciation is computed to the nearest month and residual values are material. Transactions during 2021 ng other informes .. On January 6, 2021, o planticity consisting of land and building was acquired from King Corp. in exchange for 16,000 shares of Core's common stock. On this date. Core's stock he i r value of $60.shareCurrentoessed values of land and building for property tax purposes are $198.000 and $462.000, respectively b. On March 25, 2021, new parking lots, streets, and sidewalks at the acquired plant facility were completed at a total cost of $139,000 These expenditures has an estimated useful fe of 2 years c. The lessehold improvements were completed on December 31, 2017, and had an estimated selle of eight years. The related leese, which would terminate on December 31, 2023. was renewable for an additional four year term. On April 30, 2021, Cord exercised the renewal option d. On July 1, 2021, equipment was purchased at a total invoice cost of $316,000. Additional costs of $11,000 for delivery and $41,000 for installation were incurred On September 30, 2021 Cord purchased a new automobile for $11,600. On September 30, 2021 a truck with a cost of $23.100 and a book value of $7.400 on date of sole was sold for $10,600 Depreciation for the nine months ended September 30, 2021. Wes $1.665. 9. On December 20, 2021, equipment with a cost of $12.500 and a book value of $2,750 state of disposition was scrapped without cash recovery Required: 1. Prepare a schedule analyzing the changes in each of the plant asset accounts during 2021. Do not analyse changes in accumulated depreciation and amortization 2. For each esset category, prepare a schedule showing depreciation or amortization expense for the year ended December 31, 2021. Complete this question by entering your answers in the tabs below. counts during 2021. Do not analyze changes in Prepare a schedule analyzing the changes in each of the plant as cumulated depreciation and amortization CORD COMPANY Analysis of Changes in Plant Accats For the Year Ending December 31, 2021 Balance 13.01.2000 Inora Deore $ 16.000 Balance 19.012021 Land Bonart Atoms and Loots 200 Required 2 > Reguired: 1. Prepare schedule analyzing the changes in each of the plant asset accounts during 2021. Do not analyze changes in accumulated depreciation and amortization 2 For each esset category, prepare a schedule showing depreciation or amortization expense for the year ended December 31, 2021. Complete this question by entering your answers in the tabs below. bequired: Required 2 For each asset category, prepare a schedule showing depredation or amortization expense for the year ended December 31, 2021. (Do not round intermediate calculations, Round your final answers to nearest Whole dollar) CORD COMPANY Depreciation and Amortization Expance For the Year Ending December 31, 2021 Land improvements Idings Equipment Automobiles and trucks Leasehold improvements Total depreciation and amortization expense for 2021 Reguired: 1. Prepare schedule analyzing the changes in each of the plant asset accounts during 2021. Do not analyze changes in accumulated depreciation and amortization 2 For each esset category, prepare a schedule showing depreciation or amortization expense for the year ended December 31, 2021. Complete this question by entering your answers in the tabs below. bequired: Required 2 For each asset category, prepare a schedule showing depredation or amortization expense for the year ended December 31, 2021. (Do not round intermediate calculations, Round your final answers to nearest Whole dollar) CORD COMPANY Depreciation and Amortization Expance For the Year Ending December 31, 2021 Land improvements Idings Equipment Automobiles and trucks Leasehold improvements Total depreciation and amortization expense for 2021