Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 11.5 Italiana S.A. (A) Italiana S.A. is the Italian subsidiary of a British automobile spare parts company. The following is its balance sheet

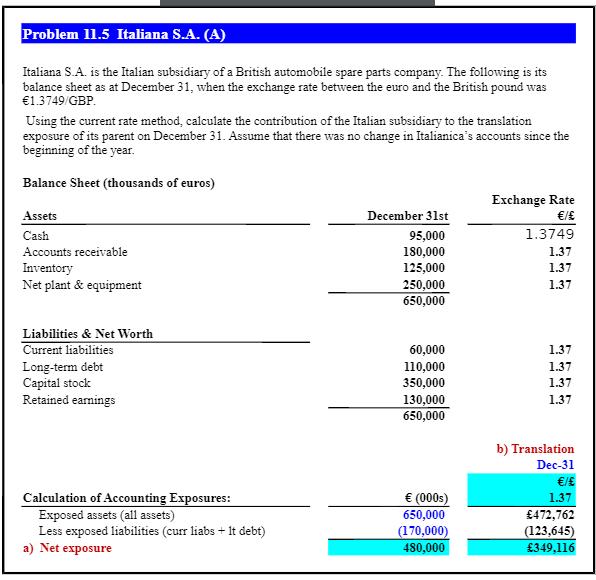

Problem 11.5 Italiana S.A. (A) Italiana S.A. is the Italian subsidiary of a British automobile spare parts company. The following is its balance sheet as at December 31, when the exchange rate between the euro and the British pound was 1.3749/GBP. Using the current rate method, calculate the contribution of the Italian subsidiary to the translation exposure of its parent on December 31. Assume that there was no change in Italianica's accounts since the beginning of the year. Balance Sheet (thousands of euros) Exchange Rate Assets December 31st / Cash. 1.3749 95,000 180,000 125,000 250,000 650,000 Accounts receivable 1.37 Inventory Net plant & equipment 1.37 1.37 Liabilities & Net Worth Current liabilities Long-term debt Capital stock Retained earnings 60,000 1.37 110,000 350,000 1.37 1.37 130,000 650,000 1.37 b) Translation Dec-31 / Calculation of Accounting Exposures: Exposed assets (all assets) Less exposed liabilities (curr liabs + it debt) a) Net exposure (000s) 650,000 (170,000) 480,000 1.37 472,762 (123,645) 349,116

Step by Step Solution

★★★★★

3.58 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The Italian subsidiary s translation exposure on D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started