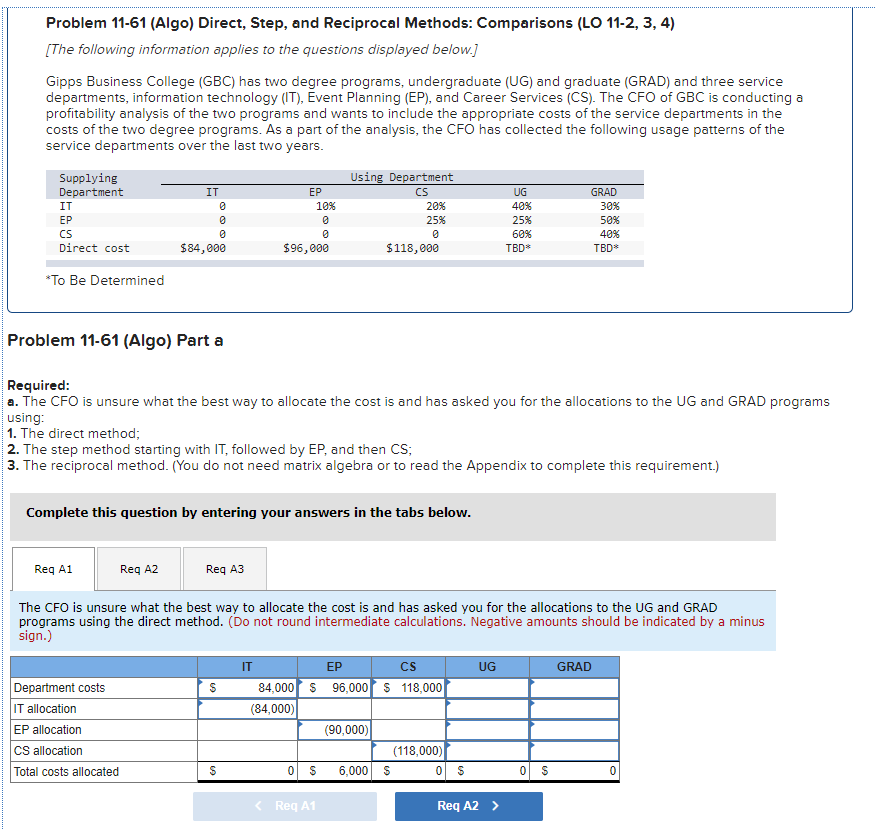

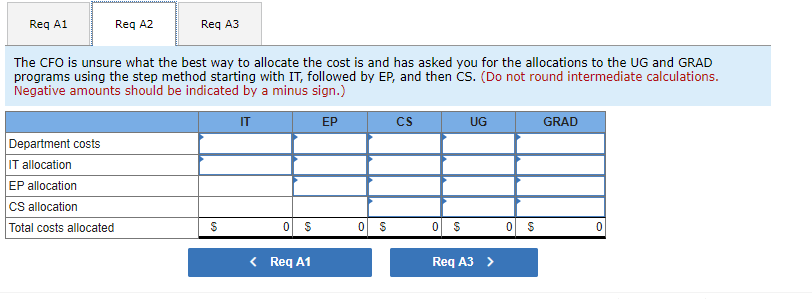

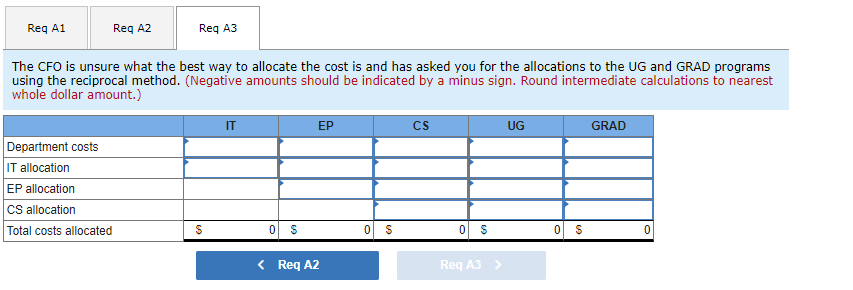

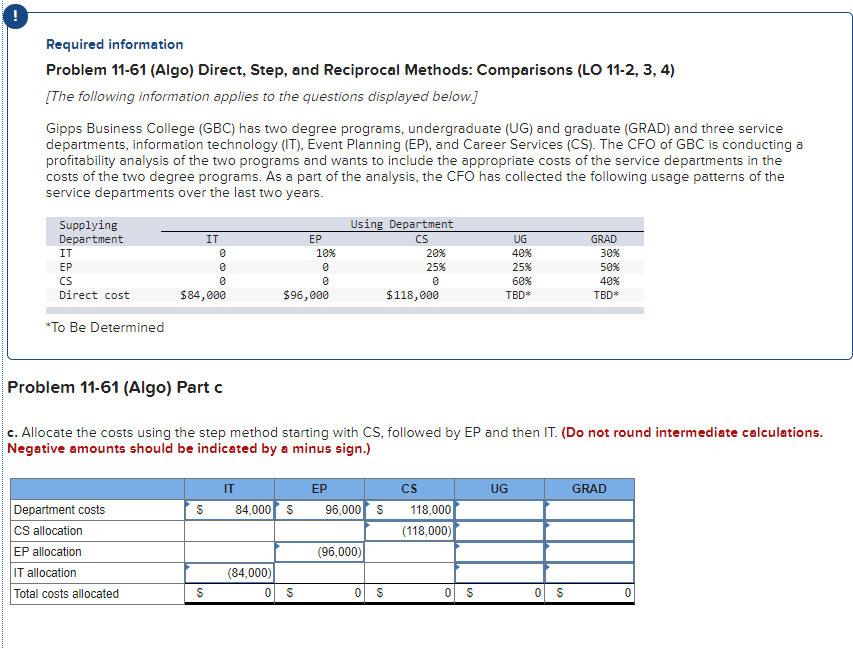

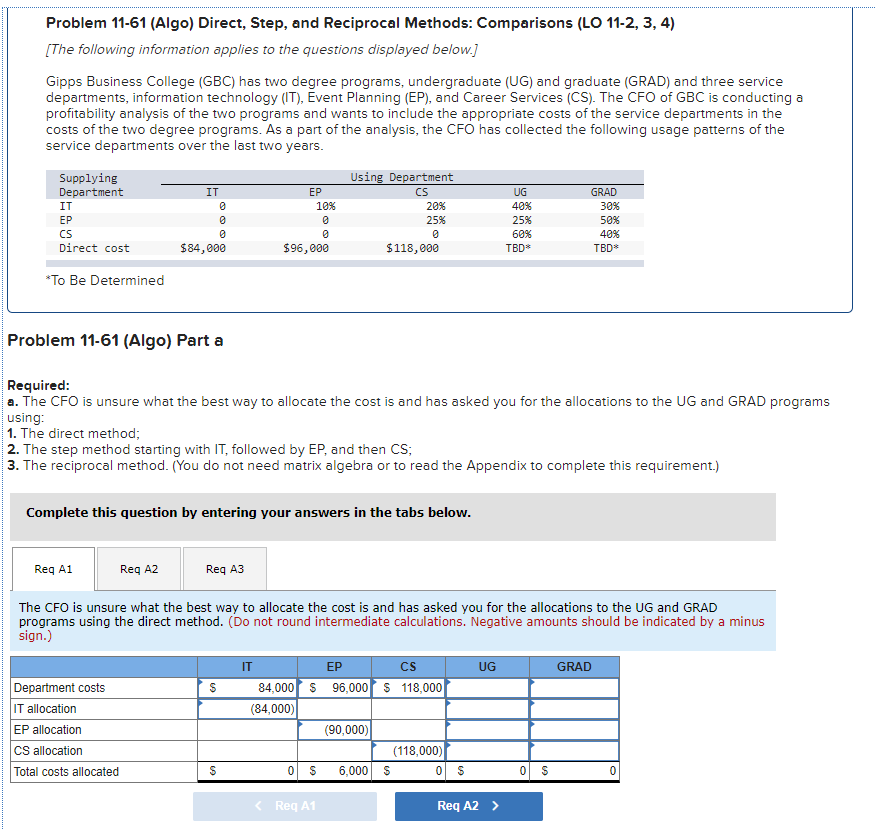

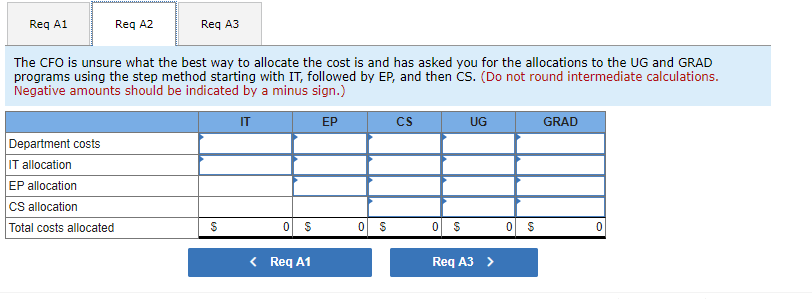

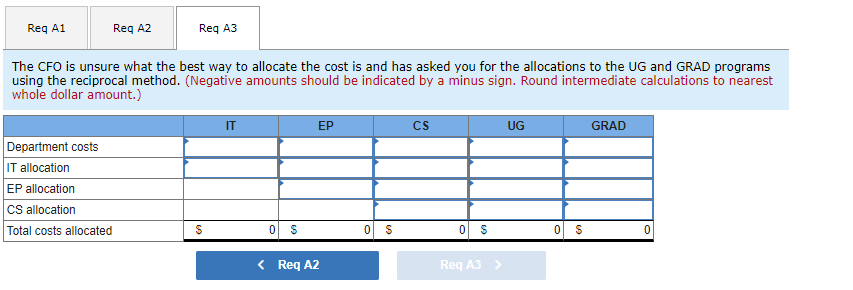

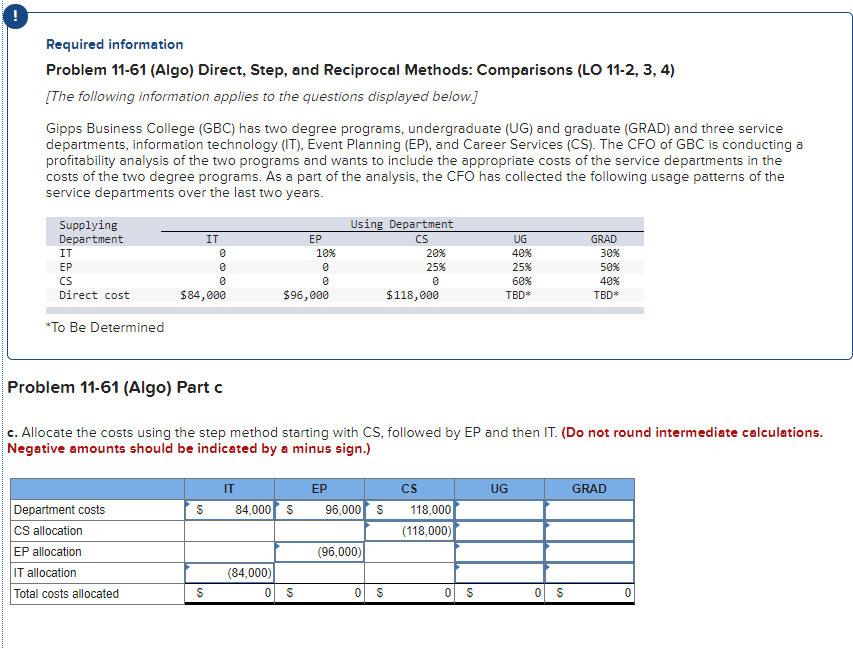

Problem 11-61 (Algo) Direct, Step, and Reciprocal Methods: Comparisons (LO 11-2, 3, 4) [The following information applies to the questions displayed below.] Gipps Business College (GBC) has two degree programs, undergraduate (UG) and graduate (GRAD) and three service departments, information technology (IT), Event Planning (EP), and Career Services (CS). The CFO of GBC is conducting a profitability analysis of the two programs and wants to include the appropriate costs of the service departments in the costs of the two degree programs. As a part of the analysis, the CFO has collected the following usage patterns of the service departments over the last two years. Supplying Using Department Department EP CS 10% 20% 25% @ @ @ $84,000 $96,000 $118,000 IT @ IT EP CS Direct cost UG 40% 25% 60% TBD GRAD 30% 50% 40% TBD *To Be Determined Problem 11-61 (Algo) Part a Required: a. The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using: 1. The direct method; 2. The step method starting with IT, followed by EP, and then CS; 3. The reciprocal method. (You do not need matrix algebra or to read the Appendix to complete this requirement.) Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using the direct method. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) EP UG GRAD S Department costs IT allocation EP allocation CS allocation IT CS 84,000 S 96,000 118,000 (84,000) (90,000) (118,000) 0 S 6,000 S 0 Total costs allocated S S 0 S Req A1 Req A2 > Reg A1 Req A2 Req A3 The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using the step method starting with IT, followed by EP, and then CS. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) IT EP CS UG GRAD Department costs IT allocation EP allocation CS allocation Total costs allocated S S 0 02 0 S 0 S 0 Required information Problem 11-61 (Algo) Direct, Step, and Reciprocal Methods: Comparisons (LO 11-2, 3, 4) [The following information applies to the questions displayed below.] Gipps Business College (GBC) has two degree programs, undergraduate (UG) and graduate (GRAD) and three service departments, information technology (IT), Event Planning (EP), and Career Services (CS). The CFO of GBC is conducting a profitability analysis of the two programs and wants to include the appropriate costs of the service departments in the costs of the two degree programs. As a part of the analysis, the CFO has collected the following usage patterns of the service departments over the last two years. IT @ EP 10% Supplying Department IT EP CS Direct cost Using Department CS 20% 25% $118,000 UG 40% 25% 60% TBD GRAD 30% 50% 40% TBD @ $84,000 @ $96,000 *To Be Determined Problem 11-61 (Algo) Part c. Allocate the costs using the step method starting with CS, followed by EP and then IT. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) IT CS UG GRAD EP 96,000 s $ 84,000 $ 118,000 (118,000) Department costs CS allocation EP allocation IT allocation (96,000) (84,000) 0 Total costs allocated S S S 0 $ 0 5 Problem 11-61 (Algo) Direct, Step, and Reciprocal Methods: Comparisons (LO 11-2, 3, 4) [The following information applies to the questions displayed below.] Gipps Business College (GBC) has two degree programs, undergraduate (UG) and graduate (GRAD) and three service departments, information technology (IT), Event Planning (EP), and Career Services (CS). The CFO of GBC is conducting a profitability analysis of the two programs and wants to include the appropriate costs of the service departments in the costs of the two degree programs. As a part of the analysis, the CFO has collected the following usage patterns of the service departments over the last two years. Supplying Using Department Department EP CS 10% 20% 25% @ @ @ $84,000 $96,000 $118,000 IT @ IT EP CS Direct cost UG 40% 25% 60% TBD GRAD 30% 50% 40% TBD *To Be Determined Problem 11-61 (Algo) Part a Required: a. The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using: 1. The direct method; 2. The step method starting with IT, followed by EP, and then CS; 3. The reciprocal method. (You do not need matrix algebra or to read the Appendix to complete this requirement.) Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using the direct method. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) EP UG GRAD S Department costs IT allocation EP allocation CS allocation IT CS 84,000 S 96,000 118,000 (84,000) (90,000) (118,000) 0 S 6,000 S 0 Total costs allocated S S 0 S Req A1 Req A2 > Reg A1 Req A2 Req A3 The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using the step method starting with IT, followed by EP, and then CS. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) IT EP CS UG GRAD Department costs IT allocation EP allocation CS allocation Total costs allocated S S 0 02 0 S 0 S 0 Required information Problem 11-61 (Algo) Direct, Step, and Reciprocal Methods: Comparisons (LO 11-2, 3, 4) [The following information applies to the questions displayed below.] Gipps Business College (GBC) has two degree programs, undergraduate (UG) and graduate (GRAD) and three service departments, information technology (IT), Event Planning (EP), and Career Services (CS). The CFO of GBC is conducting a profitability analysis of the two programs and wants to include the appropriate costs of the service departments in the costs of the two degree programs. As a part of the analysis, the CFO has collected the following usage patterns of the service departments over the last two years. IT @ EP 10% Supplying Department IT EP CS Direct cost Using Department CS 20% 25% $118,000 UG 40% 25% 60% TBD GRAD 30% 50% 40% TBD @ $84,000 @ $96,000 *To Be Determined Problem 11-61 (Algo) Part c. Allocate the costs using the step method starting with CS, followed by EP and then IT. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.) IT CS UG GRAD EP 96,000 s $ 84,000 $ 118,000 (118,000) Department costs CS allocation EP allocation IT allocation (96,000) (84,000) 0 Total costs allocated S S S 0 $ 0 5