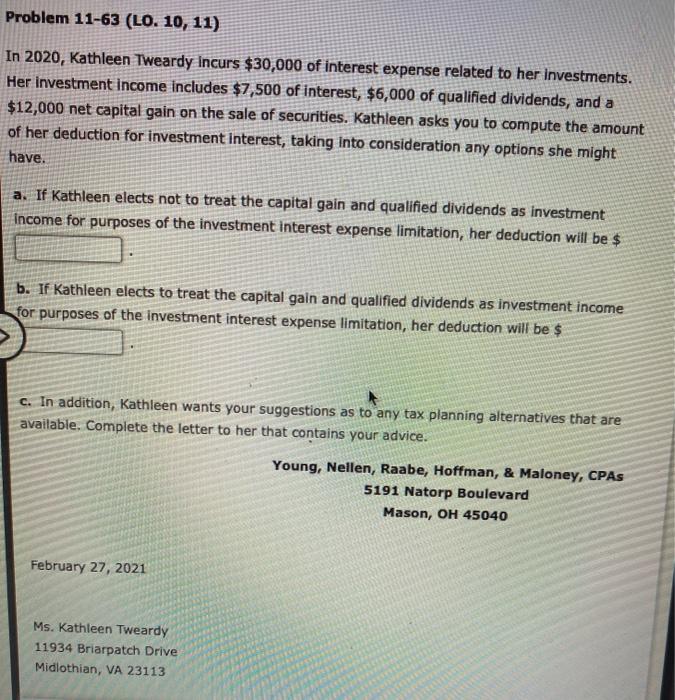

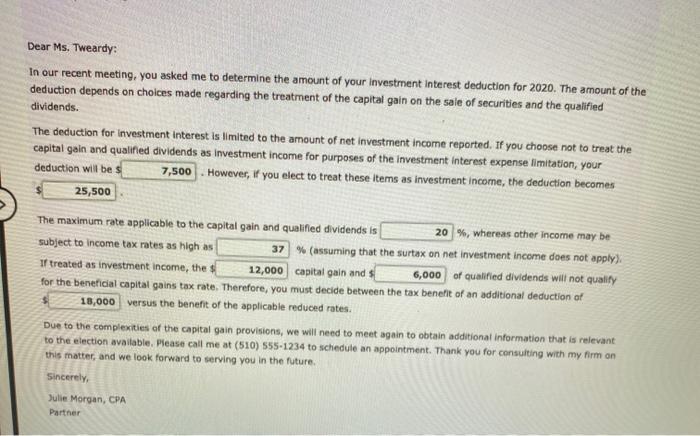

Problem 11-63 (LO. 10, 11) In 2020, Kathleen Tweardy Incurs $30,000 of interest expense related to her investments. Her investment income includes $7,500 of interest, $6,000 of qualified dividends, and a $12,000 net capital gain on the sale of securities. Kathleen asks you to compute the amount of her deduction for investment interest, taking into consideration any options she might have. a. If Kathleen elects not to treat the capital gain and qualified dividends as investment income for purposes of the investment interest expense limitation, her deduction will be $ b. If Kathleen elects to treat the capital gain and qualified dividends as investment income for purposes of the investment interest expense limitation, her deduction will be $ c. In addition, Kathleen wants your suggestions as to any tax planning alternatives that are available. Complete the letter to her that contains your advice. Young, Nellen, Raabe, Hoffman, & Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 February 27, 2021 Ms. Kathleen Tweardy 11934 Briarpatch Drive Midlothian, VA 23113 Dear Ms. Tweardy: In our recent meeting, you asked me to determine the amount of your investment interest deduction for 2020. The amount of the deduction depends on choices made regarding the treatment of the capital gain on the sale of securities and the qualified dividends. The deduction for investment interest is limited to the amount of net investment income reported. If you choose not to treat the capital gain and qualified dividends as investment income for purposes of the investment interest expense limitation, your deduction will be s 7,500. However, if you elect to treat these items as investment Income, the deduction becomes 25,500 The maximum rate applicable to the capital gain and qualified dividends is 20 %, whereas other Income may be subject to Income tax rates as high as 37 % (assuming that the surtax on net investment income does not apply). if treated as investment income, the $ 12,000 capital gain and 6,000 of qualified dividends will not quality for the beneficial capital gains tax rate. Therefore, you must decide between the tax benefit of an additional deduction af 18,000 versus the benefit of the applicable reduced rates. Due to the complexities of the capital gain provisions, we will need to meet again to obtain additional information that is relevant to the election available. Please call me at (510) 555-1234 to schedule an appointment. Thank you for consulting with my firmon this matter, and we look forward to serving you in the future. Sincerely, Julie Morgan, CPA Partner