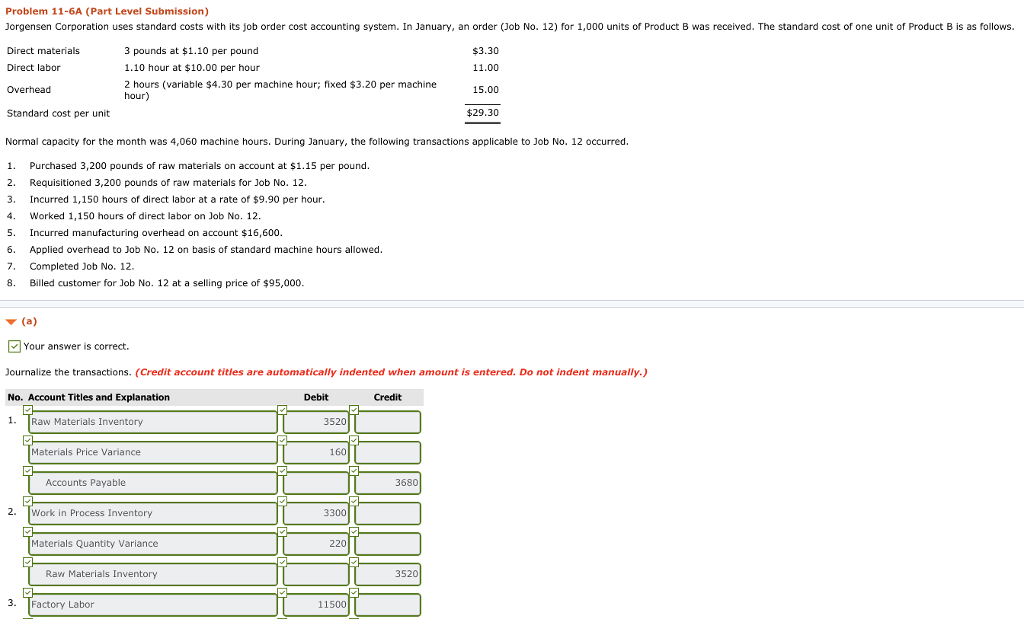

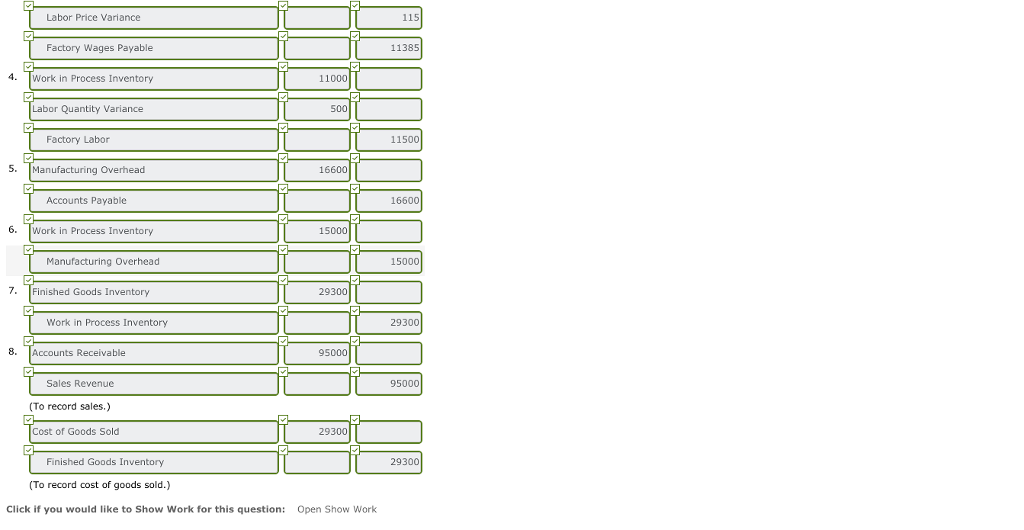

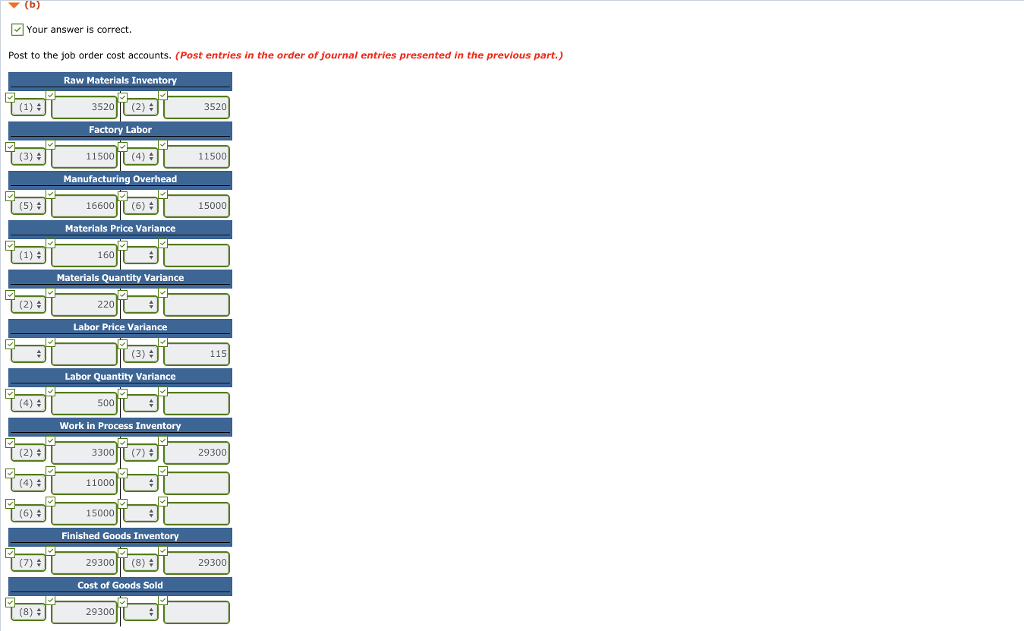

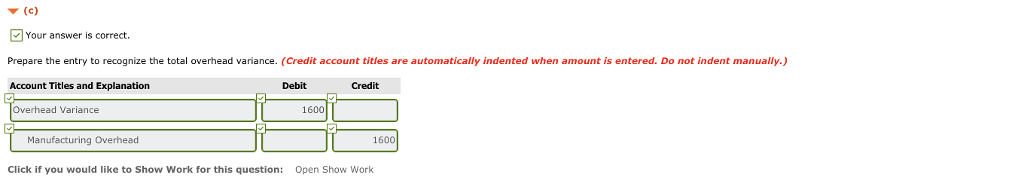

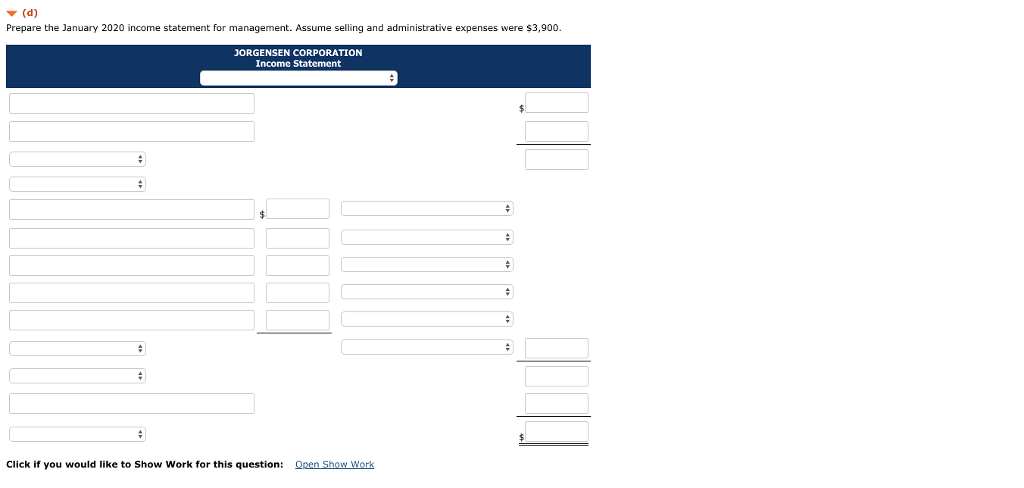

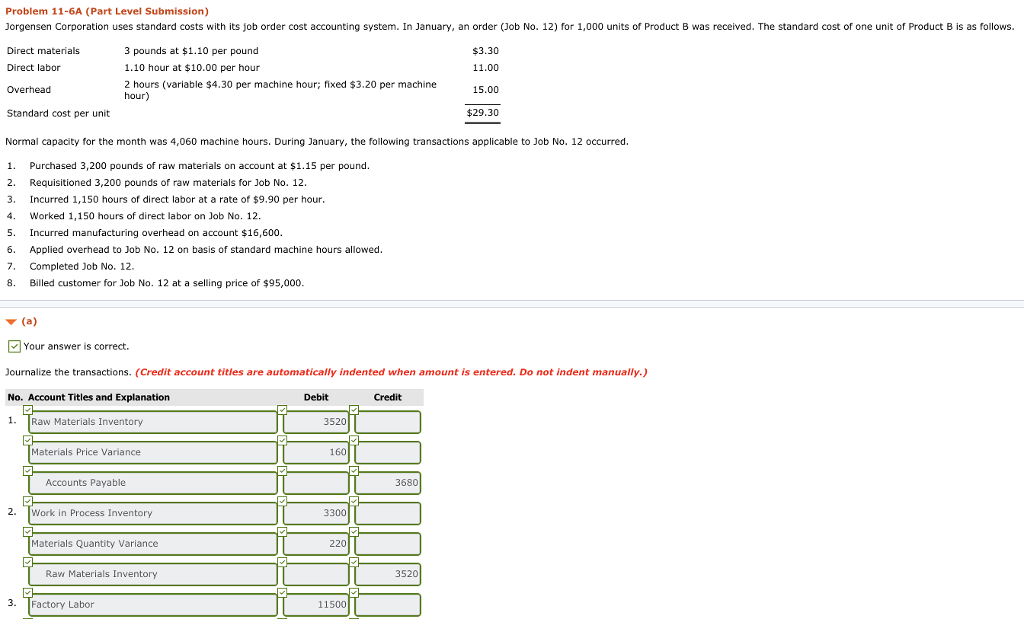

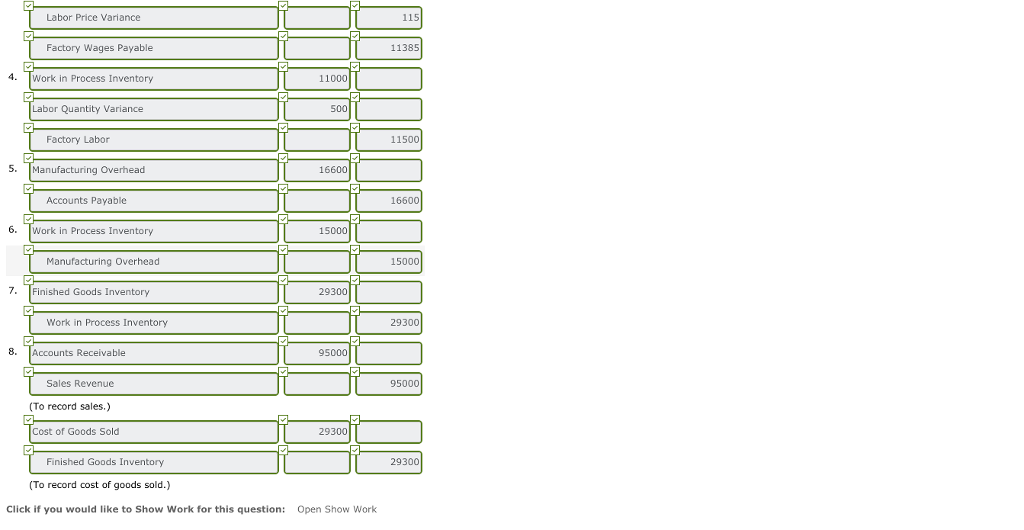

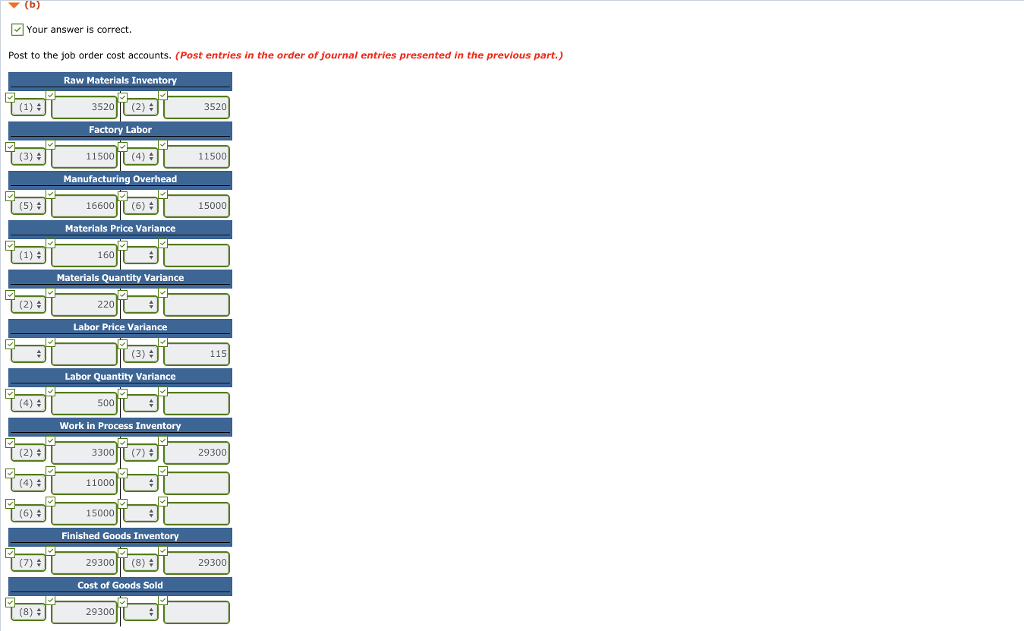

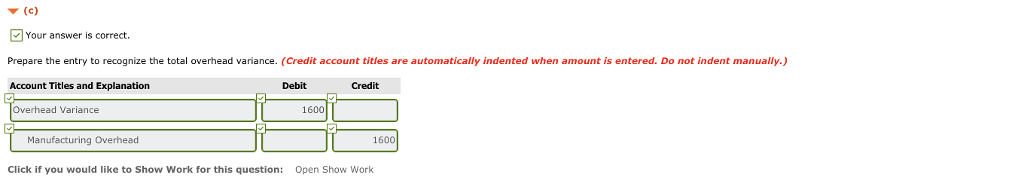

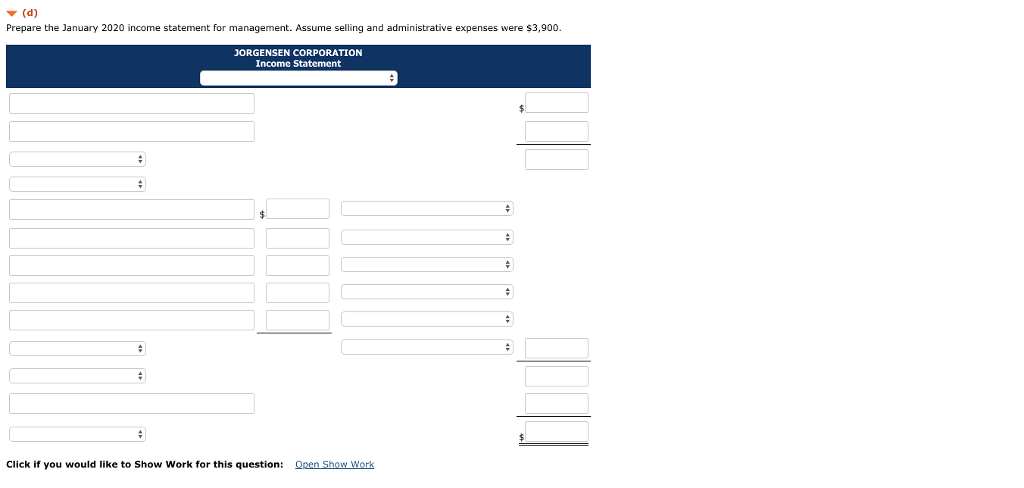

Problem 11-6A (Part Level Submission) Jorgensen Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,000 units of Product B was received. The standard cost of one unit of Product B is as follows. Direct materials Direct labor Overhead 3 pounds at $1.10 per pound 1.10 hour at $10.00 per hour 2 hours (variable $4.30 per machine hour; fixed $3.20 per machine $3.30 11.00 15.00 $29.30 hour) Standard cost per unit Normal capacity for the month was 4,060 machine hours. During January,the following transactions applicable to Job No. 12 occurred. 1. Purchased 3,200 pounds of raw materials on account at $1.15 per pound. 2. Requisitioned 3,200 pounds of raw materials for Job No. 12. 3. Incurred 1,150 hours of direct labor at a rate of $9.90 per hour 4. Worked 1,150 hours of direct labor on Job No. 12 5. Incurred manufacturing overhead on account $16,600 6. Applied overhead to Job No. 12 on basis of standard machine hours allowed 7. Completed Job No. 12 8. Billed customer for Job No. 12 at a selling price of $95,000 (a) Your answer is correct. ournalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation 1. Raw Materials Inventory Debit Credit 3520 Materials Price Variance 160 Accounts Payable 3680 2. Work in Process Inventory 3300 Materials Quantity Variance 220 Raw Materials Inventory 3520 3. Factory Labor 11500 Labor Price Variance 115 Factory Wages Payable Work in Process Inventory Labor Quantity Variance 11385 4. 11000 500 Factory Labor 11500 S. Manufacturing Overhead 16600 Accounts Payable 16600 6. Work in Process Inventory 15000 Manufacturing Overhead 15000 7. Finished Goods Inventory 29300 Work in Process Inventory 29300 8. Accounts Receivable 95000 Sales Revenue (To record sales.) Cost of Goods Sold 95000 29300 Finished Goods Inventory 29300 To record cost of goods sold.) Click if you would like to Show Work for this question: Open Show Work Your answer is correct. Post to the job order cost accounts. (Post entries in the order of journal entries presented in the previous part.) Raw Materials Inventory 352 (2) $ Factory Labor 11500 (4) 3520 (3) 11500 Manufacturing Overhead 16600 (6) 15000 Materials Price Variance 160 Materials Quantity Variance 220 Labor Price Variance (3) # 115 Labor Quantity Variance 500 Work in Process Inventory 3300(7) 29300 11000 15000 Finished Goods Inventory (7) 29300 (8) 29300 Cost of Goods Sold 29300 Your answer is correct Prepare the entry to recognize the total overhead variance. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Overhead Variance 1600 Manufacturing Overhead 1600 Click if you would like to Show Work for this question: Open Show Work Prepare the January 2020 income statement for management. Assume selling and administrative expenses were $3,900 JORGENSEN CORPORATION Income Statement Click if you would like to Show Work for this question: Open Show Work