Question

Problem 1.2. A stock is trading at $50. An investor wants you to design her a portfolio whose value after six months will depend on

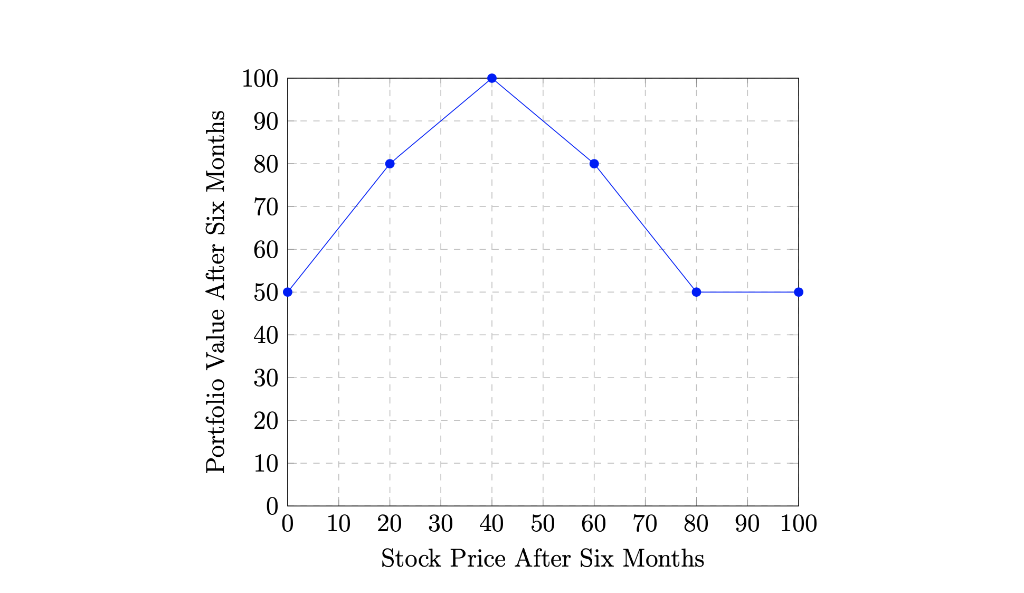

Problem 1.2. A stock is trading at $50. An investor wants you to design her a portfolio whose value after six months will depend on the price of the stock at that time as shown in the figure below. The portfolio value varies linearly between circular markers. How can you structure such a portfolio for her? How much will it cost her? Assume option prices are given by Black-Scholes formulas. Assume that the stock does not pay dividend and its volatility is 40%. The risk-free rate is 5% per annum with continuous compounding. Ignore transaction costs and any other fees. To ensure that your answer is correct, check the value of the portfolio at maturity for a few values of stock price after six months. You dont need to report these checks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started