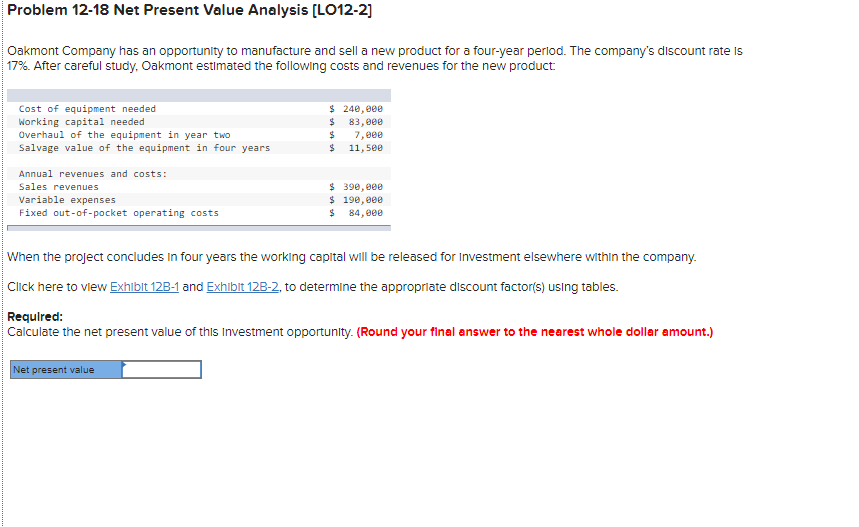

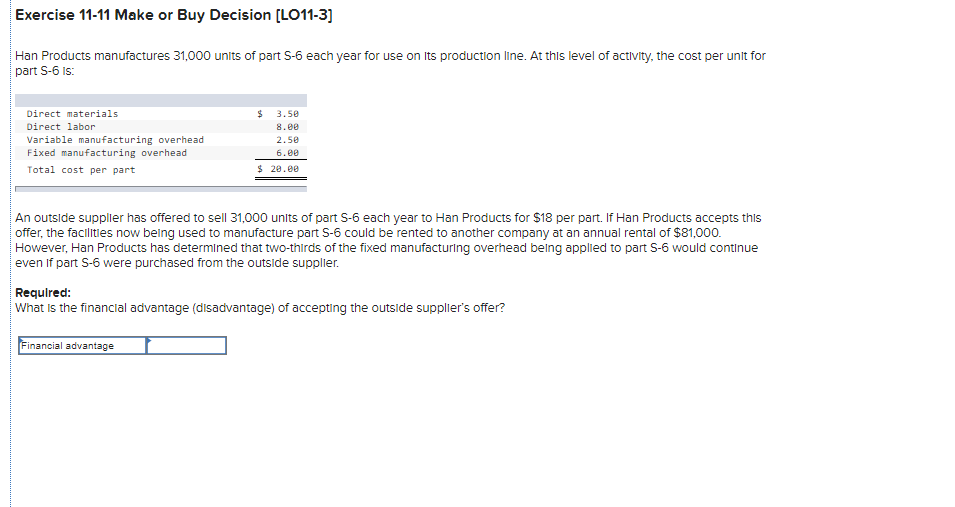

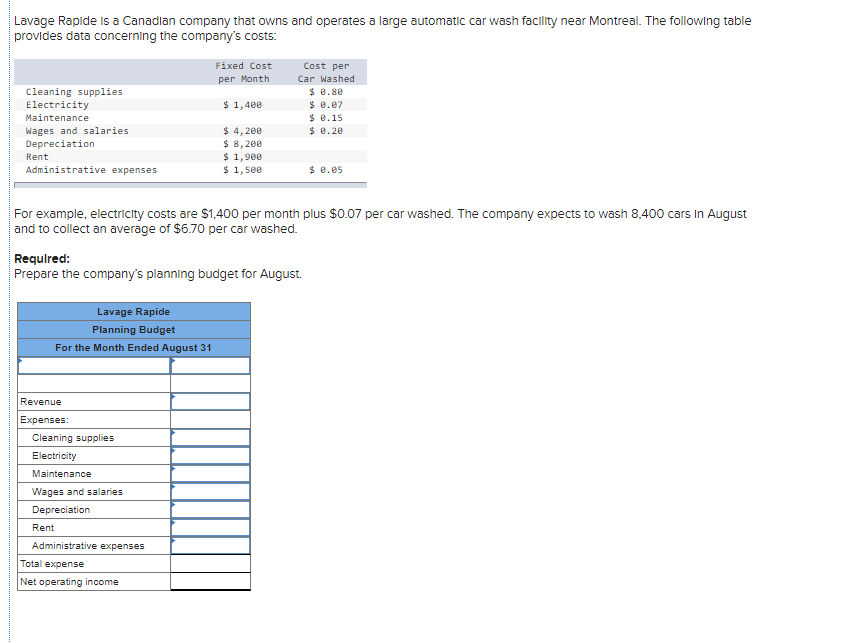

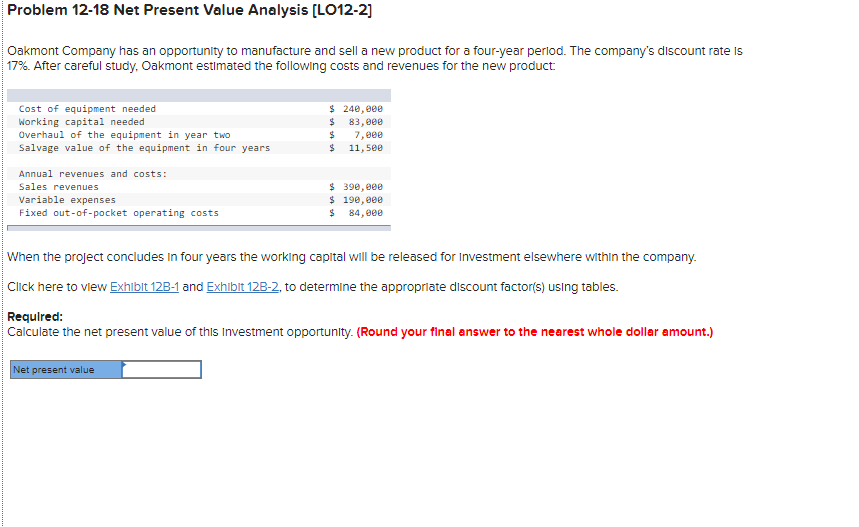

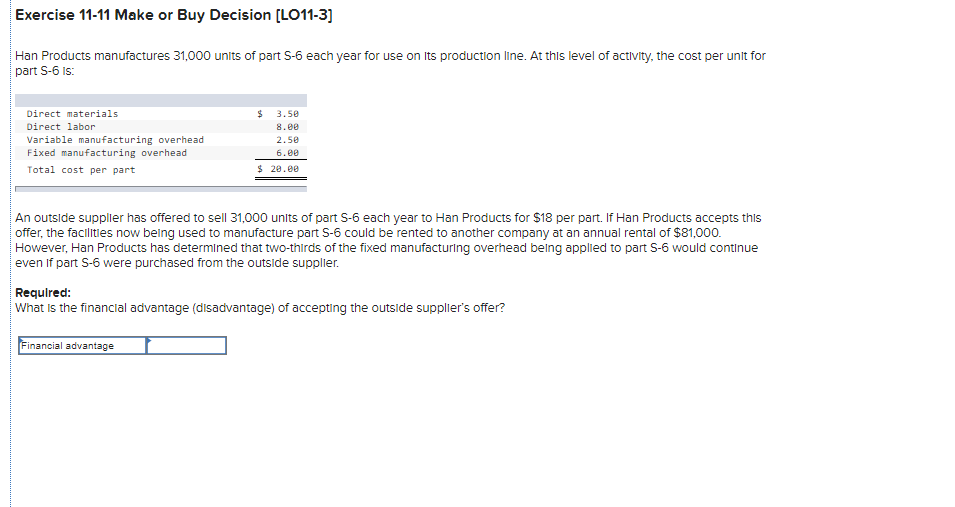

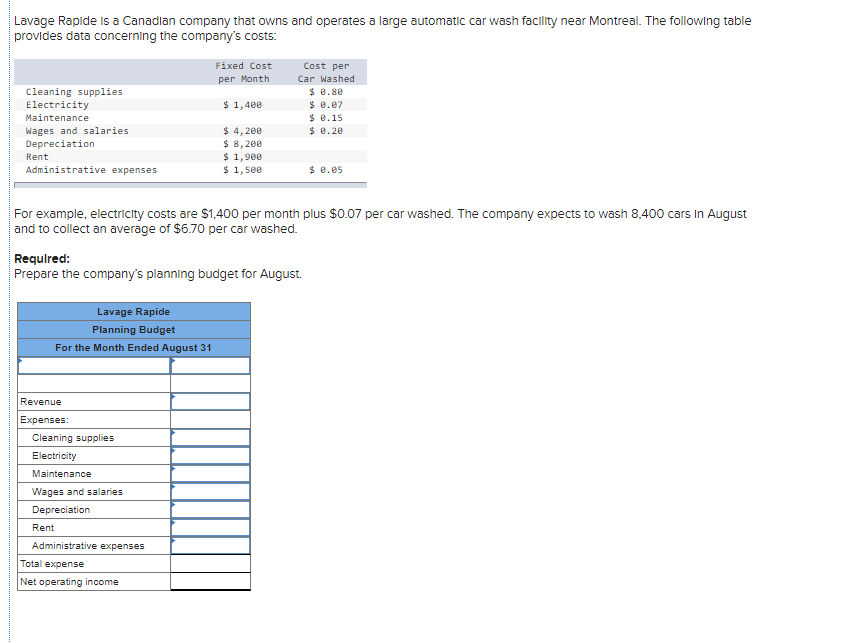

Problem 12-18 Net Present Value Analysis (LO12-2] Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The company's discount rate is 17%. After careful study, Oakmont estimated the following costs and revenues for the new product Cost of equipment needed Working capital needed Overhaul of the equipment in year two Salvage value of the equipment in four years $ 240, eee $ 83,00 $ 7, eee $ 11,500 Annual revenues and costs: Sales revenues Variable expenses Fixed out-of-pocket operating costs $ 390,000 $ 190,000 $ 84,00 When the project concludes in four years the working capital will be released for Investment elsewhere within the company. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Calculate the net present value of this Investment opportunity. (Round your final answer to the nearest whole dollar amount.) Net present value Exercise 11-11 Make or Buy Decision (LO11-3] Han Products manufactures 31,000 units of part 5-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 IS: $ Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per part 3.5e 8.ee 2.50 6.00 $ 20.ee An outside supplier has offered to sell 31,000 units of part S-6 each year to Han Products for $18 per part. If Han Products accepts this offer, the facilities now being used to manufacture part 5-6 could be rented to another company at an annual rental of $81,000. However, Han Products has determined that two-thirds of the fixed manufacturing overhead being applied to part S-6 would continue even if part 5-6 were purchased from the outside supplier. Required: What is the financial advantage (disadvantage) of accepting the outside supplier's offer? Financial advantage Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near Montreal. The following table provides data concerning the company's costs: Fixed Cost per Month Cost per Car Washed $ 0.80 $ 0.07 $ 0.15 $ 0.20 Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses $ 1,400 $ 4,200 $ 8, 2ee $1,900 $1,500 $ 0.05 For example, electricity costs are $1,400 per month plus $0.07 per car washed. The company expects to wash 8,400 cars in August and to collect an average of $6.70 per car washed. Required: Prepare the company's planning budget for August. Lavage Rapide Planning Budget For the Month Ended August 31 Revenue Expenses: Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses Total expense Net operating income