Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 12-28 (Static) Working capital requirements in capital budgeting [LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan.

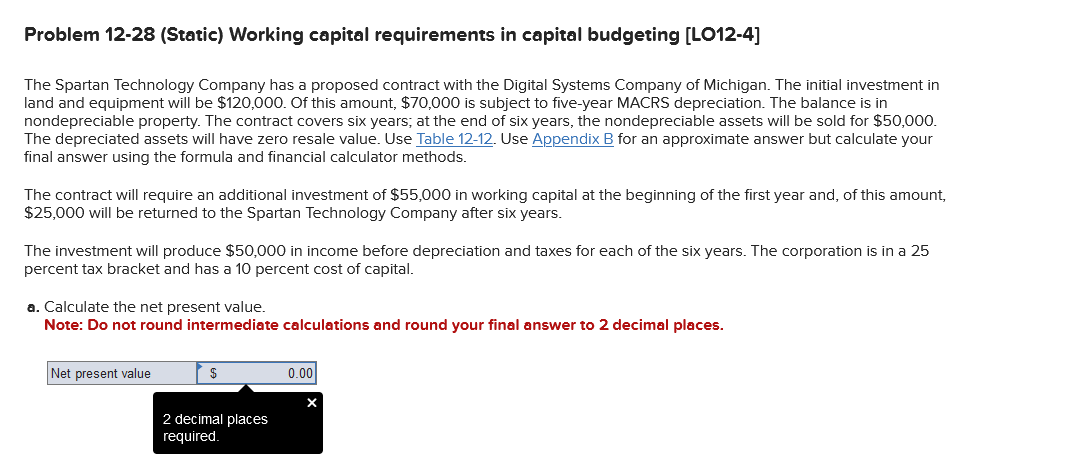

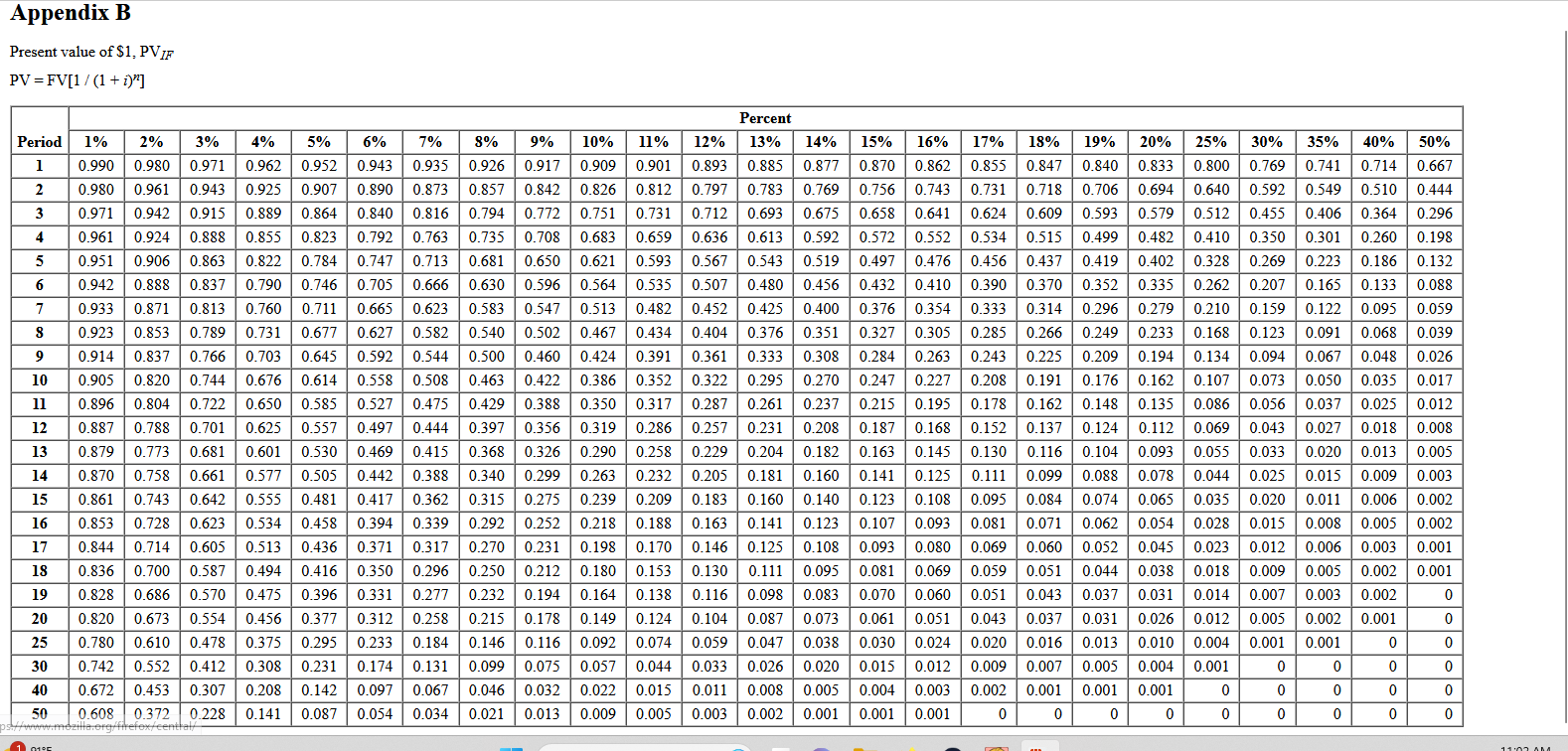

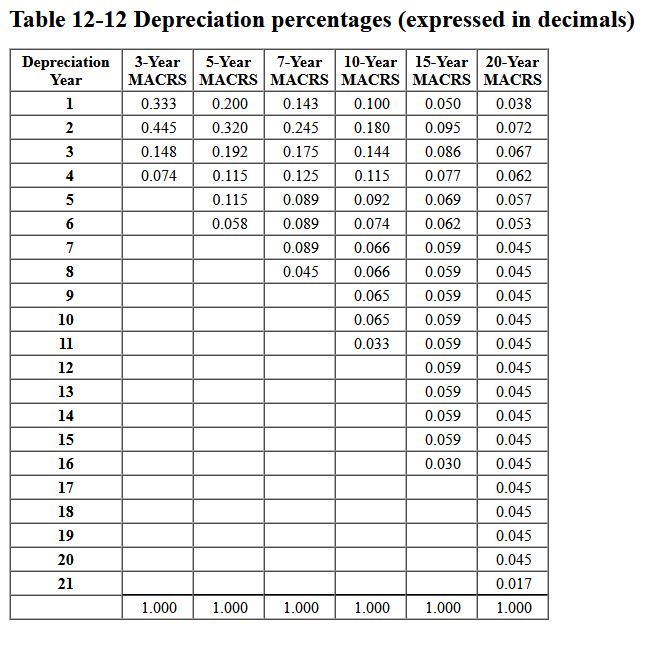

Problem 12-28 (Static) Working capital requirements in capital budgeting [LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $120,000. Of this amount, $70,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $50,000. The depreciated assets will have zero resale value. Use Table 12-12. Use for an approximate answer but calculate your final answer using the formula and financial calculator methods. The contract will require an additional investment of $55,000 in working capital at the beginning of the first year and, of this amount, $25,000 will be returned to the Spartan Technology Company after six years. The investment will produce $50,000 in income before depreciation and taxes for each of the six years. The corporation is in a 25 percent tax bracket and has a 10 percent cost of capital. a. Calculate the net present value. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Present value of $1,PVIF PV=FV[1/(1+i)n] Table 12-12 Depreciation percentages (expressed in decimals) \begin{tabular}{|c|c|c|c|c|c|c|} \hline DepreciationYear & 3-YearMACRS & 5-YearMACRS & 7-YearMACRS & 10-YearMACRS & 15-YearMACRS & 20-YearMACRS \\ \hline 1 & 0.333 & 0.200 & 0.143 & 0.100 & 0.050 & 0.038 \\ \hline 2 & 0.445 & 0.320 & 0.245 & 0.180 & 0.095 & 0.072 \\ \hline 3 & 0.148 & 0.192 & 0.175 & 0.144 & 0.086 & 0.067 \\ \hline 4 & 0.074 & 0.115 & 0.125 & 0.115 & 0.077 & 0.062 \\ \hline 5 & & 0.115 & 0.089 & 0.092 & 0.069 & 0.057 \\ \hline 6 & & 0.058 & 0.089 & 0.074 & 0.062 & 0.053 \\ \hline 7 & & & 0.089 & 0.066 & 0.059 & 0.045 \\ \hline 8 & & & 0.045 & 0.066 & 0.059 & 0.045 \\ \hline 9 & & & & 0.065 & 0.059 & 0.045 \\ \hline 10 & & & & 0.065 & 0.059 & 0.045 \\ \hline 11 & & & & 0.033 & 0.059 & 0.045 \\ \hline 12 & & & & & 0.059 & 0.045 \\ \hline 13 & & & & & 0.059 & 0.045 \\ \hline 14 & & & & & 0.059 & 0.045 \\ \hline 15 & & & & & 0.059 & 0.045 \\ \hline 16 & & & & & 0.030 & 0.045 \\ \hline 17 & & & & & & 0.045 \\ \hline 18 & & & & & & 0.045 \\ \hline 19 & & & & & & 0.045 \\ \hline 20 & & & & & & 0.045 \\ \hline 21 & & & & & & 0.017 \\ \hline & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 \\ \hline \end{tabular}

Problem 12-28 (Static) Working capital requirements in capital budgeting [LO12-4] The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan. The initial investment in land and equipment will be $120,000. Of this amount, $70,000 is subject to five-year MACRS depreciation. The balance is in nondepreciable property. The contract covers six years; at the end of six years, the nondepreciable assets will be sold for $50,000. The depreciated assets will have zero resale value. Use Table 12-12. Use for an approximate answer but calculate your final answer using the formula and financial calculator methods. The contract will require an additional investment of $55,000 in working capital at the beginning of the first year and, of this amount, $25,000 will be returned to the Spartan Technology Company after six years. The investment will produce $50,000 in income before depreciation and taxes for each of the six years. The corporation is in a 25 percent tax bracket and has a 10 percent cost of capital. a. Calculate the net present value. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Present value of $1,PVIF PV=FV[1/(1+i)n] Table 12-12 Depreciation percentages (expressed in decimals) \begin{tabular}{|c|c|c|c|c|c|c|} \hline DepreciationYear & 3-YearMACRS & 5-YearMACRS & 7-YearMACRS & 10-YearMACRS & 15-YearMACRS & 20-YearMACRS \\ \hline 1 & 0.333 & 0.200 & 0.143 & 0.100 & 0.050 & 0.038 \\ \hline 2 & 0.445 & 0.320 & 0.245 & 0.180 & 0.095 & 0.072 \\ \hline 3 & 0.148 & 0.192 & 0.175 & 0.144 & 0.086 & 0.067 \\ \hline 4 & 0.074 & 0.115 & 0.125 & 0.115 & 0.077 & 0.062 \\ \hline 5 & & 0.115 & 0.089 & 0.092 & 0.069 & 0.057 \\ \hline 6 & & 0.058 & 0.089 & 0.074 & 0.062 & 0.053 \\ \hline 7 & & & 0.089 & 0.066 & 0.059 & 0.045 \\ \hline 8 & & & 0.045 & 0.066 & 0.059 & 0.045 \\ \hline 9 & & & & 0.065 & 0.059 & 0.045 \\ \hline 10 & & & & 0.065 & 0.059 & 0.045 \\ \hline 11 & & & & 0.033 & 0.059 & 0.045 \\ \hline 12 & & & & & 0.059 & 0.045 \\ \hline 13 & & & & & 0.059 & 0.045 \\ \hline 14 & & & & & 0.059 & 0.045 \\ \hline 15 & & & & & 0.059 & 0.045 \\ \hline 16 & & & & & 0.030 & 0.045 \\ \hline 17 & & & & & & 0.045 \\ \hline 18 & & & & & & 0.045 \\ \hline 19 & & & & & & 0.045 \\ \hline 20 & & & & & & 0.045 \\ \hline 21 & & & & & & 0.017 \\ \hline & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started