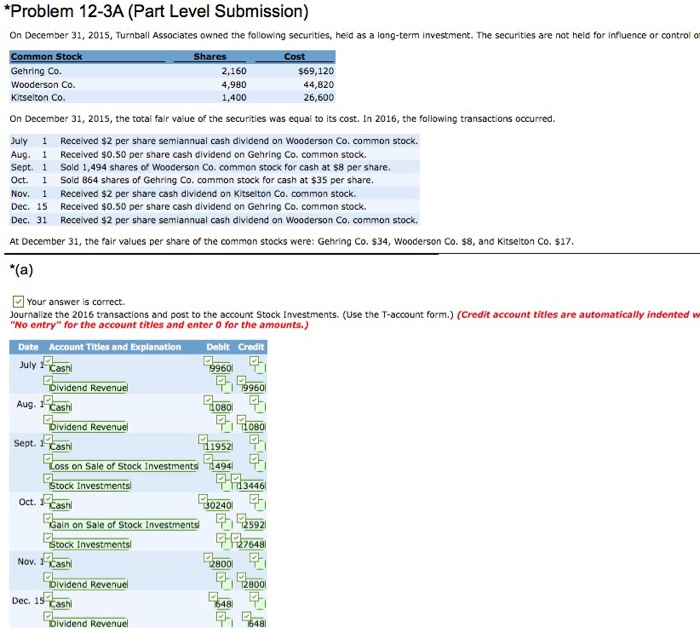

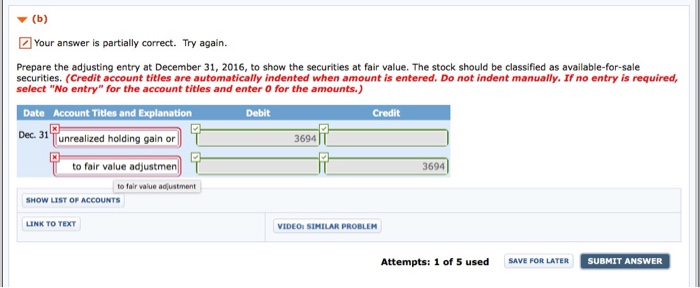

Problem 12-3A (Part Level Submission) On December 31, 2015, Turnball Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control o Gehring Co. Wooderson Co. Kitselton Co. 2,160 4,980 1,400 $69,120 44,820 26,600 On December 31, 2015, the total fair value of the securities was equal to its cost. In 2016, the following transactions occurred. July 1 Received $2 per share semiannual cash dividend on Wooderson Co. common stock. Aug. 1 Received $0.50 per share cash dividend on Gehring Co. common stock Sept. Sold 1,494 shares of Wooderson Co. common stock for cash at $8 per share. Oct. 1 Sold 864 shares of Gehring Co. common stock for cash at $35 per share. Nov. 1 Received $2 per share cash dividend on Kitselton Co. common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co. common stock Dec. 31 Received $2 per share semiannual cash dividend on Wooderson Co. common stock. At December 31, the fair values per share of the common stocks were: Gehring Co. $34, Wooderson Co. $8, and Kitselton Co. $17 Your answer is correct. Journalize the 2016 transactions and post to the account Stock Investments. (Use the T-account form.) (Credit account titles are automatically indented w "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit July SN 3960 ividend Revenuel 9960 Aug. Cash 080 ividend Revenuel T1080 Sept. cash 1952 s on S ale of Stock Investment s 1494 tock i 3446 Oct. Cash 0240 ' ale 127648 Nov. ashl 80 ' ividend Revenu Dec. 1 ividend Revenuel (b) Your answer is partially correct. Try again. Prepare the adjusting entry at December 31, 2016, to show the securities at fair value. The stock should be classified as available-for-sale securities. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Tunrealized holding gain or 3694 | | to fair value adjustmen 3694 to fair value ad ustment SHOW LIST OF ACCOUNTS LINK TO TEXT VIDEOs SIMILAR PROBLEM Attempts: 1 of 5 used SAVE FOR LATER SUBMIT ANSW