Answered step by step

Verified Expert Solution

Question

1 Approved Answer

problem 12-4 12.05 e cost of a paleta T in 2018 and 2019 June 30 Pald expenses related to obtaining a patent Dec 11 U

problem 12-4

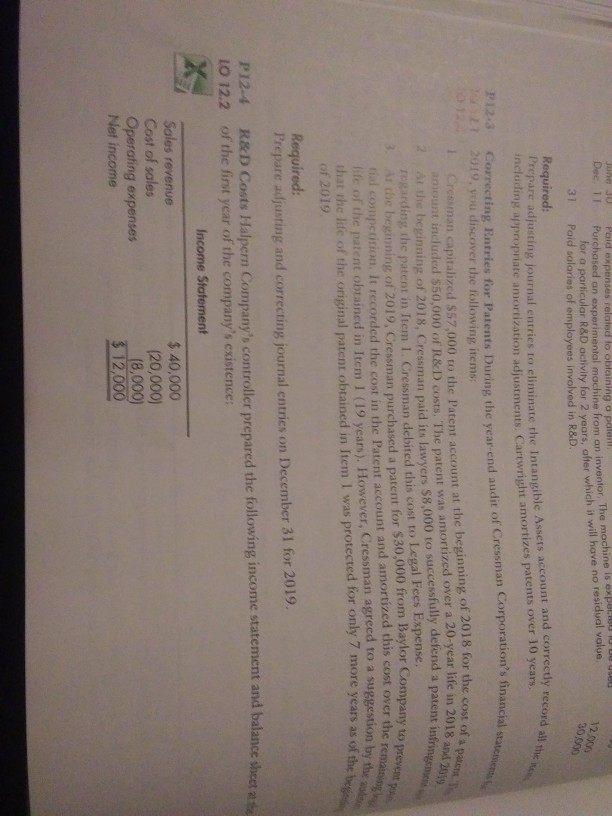

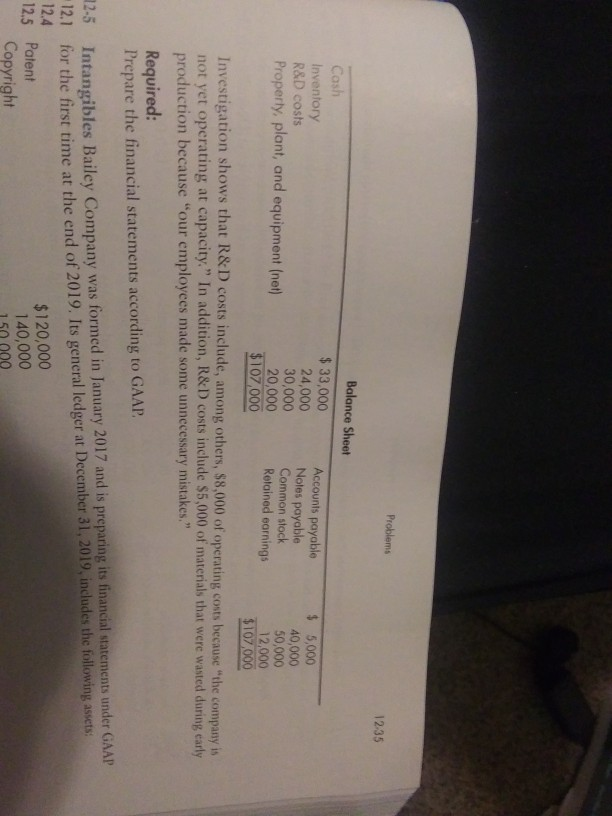

12.05 e cost of a paleta T in 2018 and 2019 June 30 Pald expenses related to obtaining a patent Dec 11 U U ULOG Purchased an experimental machine from an inventor ased on experimental machine from an inventor. The machine is expecte 31 particular R&D activity for 2 years, after which it will have no residual value Poid salaries of employees involved in R&D. Required: Prepare adjusting journal entries to eliminate the intan tries to eliminate the Intangible Assets account and correctly reco including appropriate amortization adjustments. Cartwright omization adjustments Cartwright amortizes parents over 10 years P123 Correcting Entries for Patents Duri Bntries for Patients Du che warend audit of Cressman Corpor unancial 2019. you discover the following items: Cressman capitalized 857,000 to the Patent account at the beginning the beginning of 2018 for the cost of a aunt included 550,000 of R&D costs. The patent was amortized over a year e in 2018 and the beginning of 2018, Cressman paid its lawyers $8,000 to successfully defend a patent infrin garding the patent in Item 1. Cressman debited this cost to Legal Fees per at the beginning of 2019, Cressman purchased a patent for $30,000 from Baylor Company to pres al competition. It recorded the cost in the Patent account and amortized this cost over the rem e of the patent obtained in Item 1 (19 years). However, Cressman agreed to a suggestion by the that the life of the original patent obtained in Item I was protected for only 7 more years as of the of 2019 Required: Prepare adjusting and correcting journal entries on December 31 for 2019. w to pre the remai by the sol the begget P12-4 R&D Costs Halpern Company's controller prepared the following income statement and balance sheet as LO 12.2 of the first year of the company's existence: Income Statement Sales revenue $ 40,000 Cost of sales (20,000) Operating expenses 18,000) Net income $ 12,000 Problems 1235 Balance Sheet Cash $ 33,000 Inventory Accounts payable 24,000 $5,000 R&D costs Noles payable 40,000 30,000 Common stock Property, plant, and equipment (net) 50,000 20,000 Retained earnings 12,000 $107.000 $107.000 Investigation shows that R&D costs include, among others, $8,000 of operating costs because the company is not yet operating at capacity." In addition, R&D costs include $5,000 of materials that were wasted during early production because "our employees made some unnecessary mistakes.", Required: Prepare the financial statements according to GAAP. 2-5 Intangibles Bailey Company was formed in January 2017 and is preparing its financial statements under GAAP 12.1 for the first time at the end of 2019. Its general ledger at December 31, 2019, includes the following assets 12.4 12.5 Patent $120,000 Copyright 140,000 150 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started