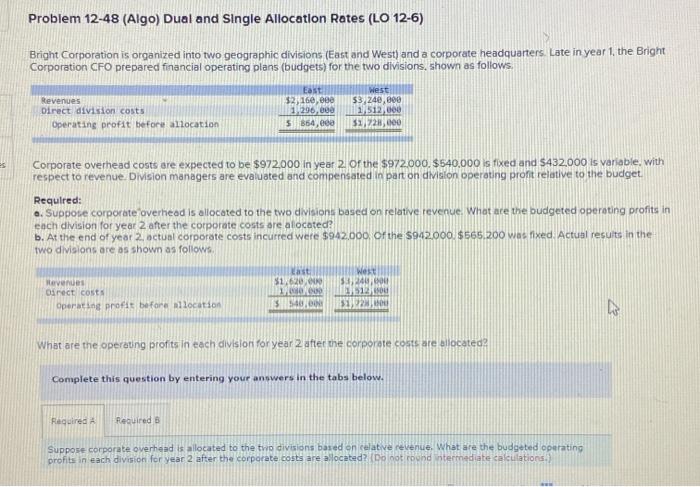

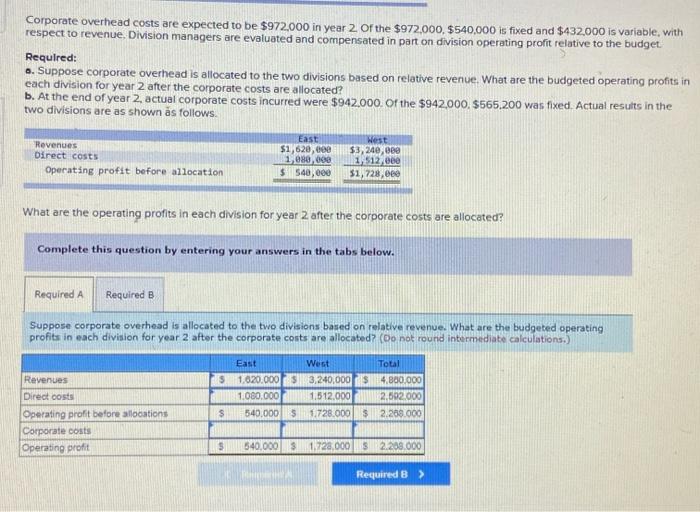

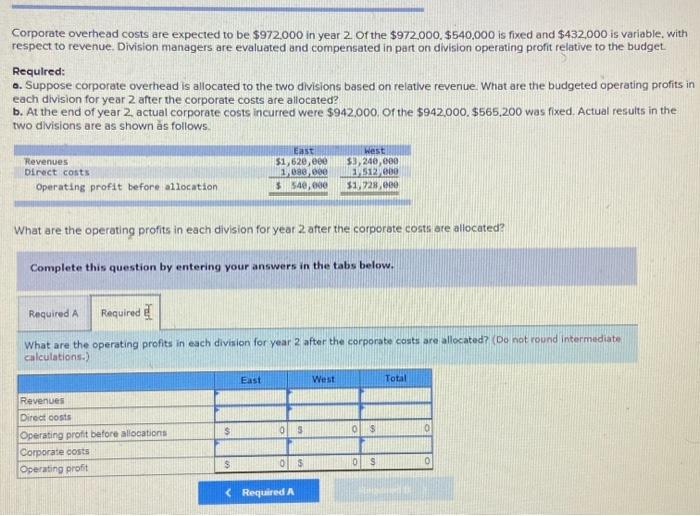

Problem 12-48 (Algo) Dual and Single Allocation Rates (LO 12-6) Bright Corporation is organized into two geographic divisions (East and West) and a corporate headquarters Late in year 1, the Bright Corporation CFO prepared financial operating plans (budgets) for the two divisions, shown as follows East West Revenues $2160,000 53,240,000 Direct division costs 1.296,000 1512,000 Operating profit before allocation 5 354,00 31,72,000 Corporate overhead costs are expected to be $972,000 in year 2. or the $972.000. $540,000 is fixed and $432,000 is variable, with respect to revenue. Division managers are evaluated and compensated in part on dislon operating profit relative to the budget Required: a. Suppose corporate overhead is allocated to the two divisions based on relative revenue. What are the budgeted operating profits in each division for year 2 after the corporate costs are allocated? b. At the end of year 2, actual corporate costs incurred were $942,000. Of the $942.000 $565.200 was fixed. Actual results in the two divisions are as shown as follows West Havenues $1,620,00 5.249.00 Direct conta DO 1312 Operating profit before allocation $ 340,00 5192 What are the operating profits in each division for year 2 after the corporate costs are allocated? Complete this question by entering your answers in the tabs below. Required Required B Suppose corporate overhead is allocated to the two divisions based on relative revenue. What are the budgeted operating profits in each division for year 2 after the corporate costs are allocated? Do not round ntermediate calculations.) Corporate overhead costs are expected to be $972,000 in year 2 of the $972,000, $540,000 is fixed and $432,000 is variable, with respect to revenue. Division managers are evaluated and compensated in part on division operating profit relative to the budget Required: o. Suppose corporate overhead is allocated to the two divisions based on relative revenue. What are the budgeted operating profits in each division for year 2 after the corporate costs are allocated? B. At the end of year 2, actual corporate costs incurred were $942.000. Of the $942.000.5565.200 was fixed. Actual results in the two divisions are as shown as follows. Revenues Direct costs Operating profit before allocation East West $1,620,000 $3,240,000 1,080,000 2,512,000 $ 540,000 $1,728,000 What are the operating profits in each division for year 2 after the corporate costs are allocated? Complete this question by entering your answers in the tabs below. Required A Required B Suppose corporate overhead is allocated to the two divisions based on relative revenue. What are the budgeted operating profits in each division for year 2 after the corporate costs are allocated? (Do not round Intermediate calculations.) Revenues Direct costs Operating profit before allocations Corporate costs Operating profit East West Total S 1.620.000 3.240,000 $ 4.800.000 1.080.000 1,512,000 2,692.000 $ 540.000 1.728.000 $ 2.268.000 5 540,000 $ 1.728,000S 2.208.000 Required B > Corporate overhead costs are expected to be $972,000 in year 2 of the $972,000 $540,000 is fixed and $432,000 is variable, with respect to revenue. Division managers are evaluated and compensated in part on division operating profit relative to the budget Required: 6. Suppose corporate overhead is allocated to the two divisions based on relative revenue What are the budgeted operating profits in each division for year 2 after the corporate costs are allocated? b. At the end of year 2 actual corporate costs incurred were $942,000, of the $942,000.$565,200 was fixed. Actual results in the two divisions are as shown as follows "Revenues Direct costs Operating profit before allocation East $1,620,000 1,000,000 $540,000 West $3,240,000 151200 $1,728.00 What are the operating profits in each division for year 2 after the corporate costs are allocated? Complete this question by entering your answers in the tabs below. Required A Required What are the operating profits in each division for year 2 after the corporate costs are allocated? (Do not round Intermediate calculations.) East West Total S OS 0$ a Revenues Direct costs Operating profit before allocations Corporate costs Operating profit $ 05 os 0