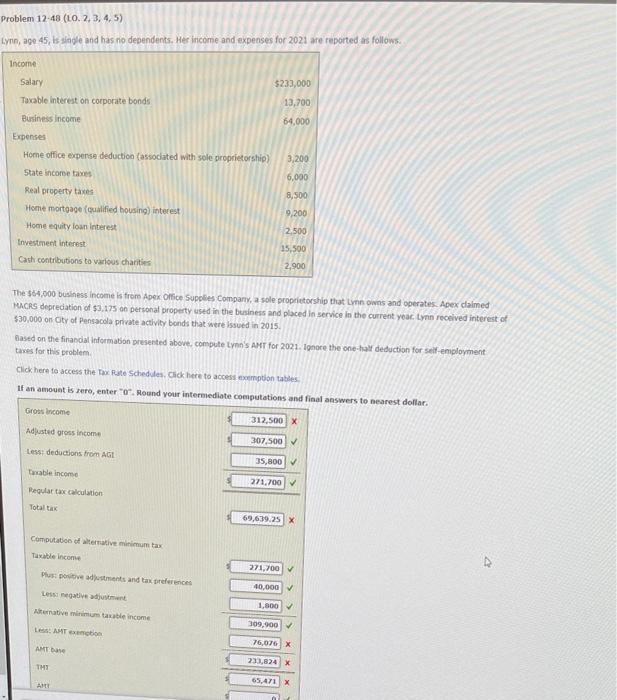

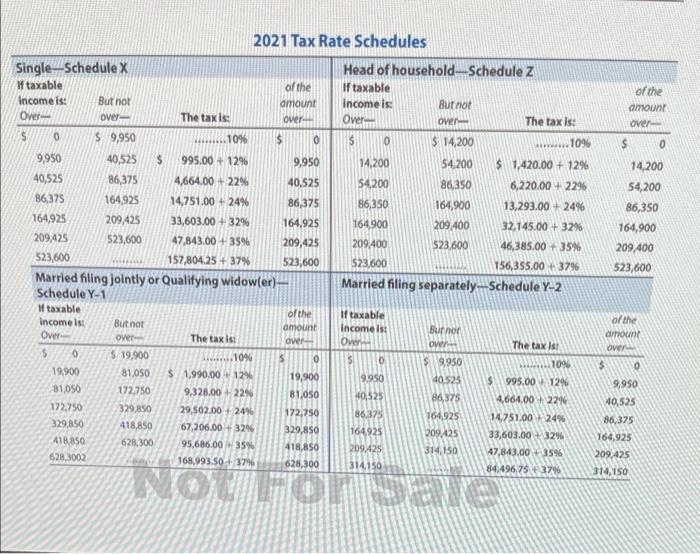

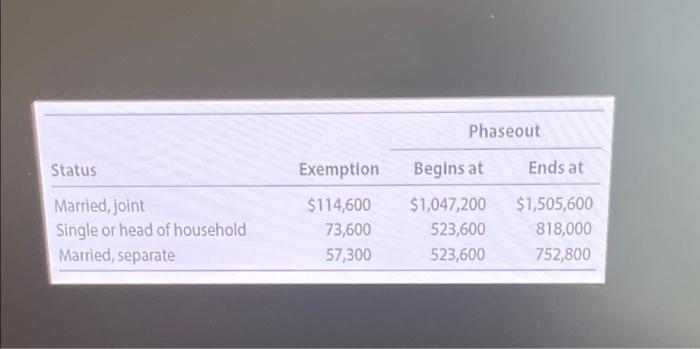

Problem 12-48 (LO.2.3,4,5) tynn, age 45, is single and has no dependents. Her income and expenses for 2021 are reported as follows Income $233,000 Salary Taxable interest on corporate bonds 13,700 Business income 64,000 3,200 6.000 8,500 Expenses Home office expense deduction (associated with sole proprietorship) State income taxes Real property taxes Home mortgage (qualified housing interest Home equity loan interest Investment interest Cash contributions to various charities 9,200 2.500 15,500 2,900 The $64,000 business income is from Apex Office Supplies Company, a sole proprietorship that you and operates. Apex daimed MACRS depredation of $3.175 on personal property used in the business and placed in service in the current year Lynn received interest of $30,000 on City of Pensacola private activity bonds that were issued in 2015. Based on the finandal information presented above, compute Lynn's ANT for 2021. ignore the one-halt deduction for self-employment taves for this problem Click here to access the Tax Rate Schedes. Click here to contemption tables tt an amount is zero, entero Round your intermediate computations and final answers to nearest dollar. Gross income 312,500X Adjusted gross income 307,500 Les deductions from AG 35,800 wable income Regular tax calculation 271,700 Totalta 69,639.25 Computation of alternative minimum tas Taxable income 271,700 plus pouvents and tax references 40.000 Les negative at Numative minute income 1,500 309,900 LAT 76,076 X AMT 231824 65.471 X 2021 Tax Rate Schedules Single-Schedule X Htaxable Income is: But not Over ove $ 0 $ 9,950 of the amount over of the amount over The taxis 1096 $ 0 $ 0 Head of household-Schedule Z If taxable Income is: But not Over over The tax is: S 0 $ 14,200 ... 1096 14,200 54,200 $ 1,420.00 + 12% 54,200 86,350 6,220.00 +2296 B6,350 164,900 13,293.00 24% 164.900 209 400 32.145.00 +32% 209.400 523,600 46,385.00 35% $23600 156,355.00 +37% Married filing separately- Schedule Y-2 14,200 54,200 86,350 164,900 209.400 523,600 9,950 40,525 $ 995.00 + 12% 9,950 40,525 86,375 4,664.00 +22% 40,525 86,375 164,925 14,751.00 +24% 86,375 164,925 209425 33,603.00 +32% 164,925 209,425 523,600 47,843.00 +35% 209,425 523,600 157,804.25 + 37% 523,600 Married filing jointly or Qualifying widow(er)- Schedule Y-1 of taxable of the Income is But not amount Over over The taxis Over $ 0 $ 19,900 10% 5 0 19,900 81,050 $ 1,990.00 + 12% 19,900 81050 172.750 9,328.00 +229 B1.050 172.750 329,850 29,502.00 +24% 172,750 329,850 418,850 67,206.00 + 32% 329,850 418.850 628,300 95,686,00 35% 418,856 628,3002 168.993.50 +37% 628,300 I taxable Income is: Over Burnor ove $9.950 of the amount OVE $ 0 0 9.950 40,525 86,375 The taxi 109 $ 995.00 12% 4,664,00 229 14,751.00 24% 33,603.00 +32% 47,843.003546 84.496.75 379 9,950 40,525 40,525 86,375 164,925 209425 314150 164,925 209,425 314,150 86,375 164,925 209,425 NG NLFr bald 314, 150 Phaseout Status Exemption Begins at Ends at Married, joint ingle or head of household Married, separate $114,600 73,600 57,300 $1,047,200 523,600 523,600 $1,505,600 818,000 752,800 Problem 12-48 (LO.2.3,4,5) tynn, age 45, is single and has no dependents. Her income and expenses for 2021 are reported as follows Income $233,000 Salary Taxable interest on corporate bonds 13,700 Business income 64,000 3,200 6.000 8,500 Expenses Home office expense deduction (associated with sole proprietorship) State income taxes Real property taxes Home mortgage (qualified housing interest Home equity loan interest Investment interest Cash contributions to various charities 9,200 2.500 15,500 2,900 The $64,000 business income is from Apex Office Supplies Company, a sole proprietorship that you and operates. Apex daimed MACRS depredation of $3.175 on personal property used in the business and placed in service in the current year Lynn received interest of $30,000 on City of Pensacola private activity bonds that were issued in 2015. Based on the finandal information presented above, compute Lynn's ANT for 2021. ignore the one-halt deduction for self-employment taves for this problem Click here to access the Tax Rate Schedes. Click here to contemption tables tt an amount is zero, entero Round your intermediate computations and final answers to nearest dollar. Gross income 312,500X Adjusted gross income 307,500 Les deductions from AG 35,800 wable income Regular tax calculation 271,700 Totalta 69,639.25 Computation of alternative minimum tas Taxable income 271,700 plus pouvents and tax references 40.000 Les negative at Numative minute income 1,500 309,900 LAT 76,076 X AMT 231824 65.471 X 2021 Tax Rate Schedules Single-Schedule X Htaxable Income is: But not Over ove $ 0 $ 9,950 of the amount over of the amount over The taxis 1096 $ 0 $ 0 Head of household-Schedule Z If taxable Income is: But not Over over The tax is: S 0 $ 14,200 ... 1096 14,200 54,200 $ 1,420.00 + 12% 54,200 86,350 6,220.00 +2296 B6,350 164,900 13,293.00 24% 164.900 209 400 32.145.00 +32% 209.400 523,600 46,385.00 35% $23600 156,355.00 +37% Married filing separately- Schedule Y-2 14,200 54,200 86,350 164,900 209.400 523,600 9,950 40,525 $ 995.00 + 12% 9,950 40,525 86,375 4,664.00 +22% 40,525 86,375 164,925 14,751.00 +24% 86,375 164,925 209425 33,603.00 +32% 164,925 209,425 523,600 47,843.00 +35% 209,425 523,600 157,804.25 + 37% 523,600 Married filing jointly or Qualifying widow(er)- Schedule Y-1 of taxable of the Income is But not amount Over over The taxis Over $ 0 $ 19,900 10% 5 0 19,900 81,050 $ 1,990.00 + 12% 19,900 81050 172.750 9,328.00 +229 B1.050 172.750 329,850 29,502.00 +24% 172,750 329,850 418,850 67,206.00 + 32% 329,850 418.850 628,300 95,686,00 35% 418,856 628,3002 168.993.50 +37% 628,300 I taxable Income is: Over Burnor ove $9.950 of the amount OVE $ 0 0 9.950 40,525 86,375 The taxi 109 $ 995.00 12% 4,664,00 229 14,751.00 24% 33,603.00 +32% 47,843.003546 84.496.75 379 9,950 40,525 40,525 86,375 164,925 209425 314150 164,925 209,425 314,150 86,375 164,925 209,425 NG NLFr bald 314, 150 Phaseout Status Exemption Begins at Ends at Married, joint ingle or head of household Married, separate $114,600 73,600 57,300 $1,047,200 523,600 523,600 $1,505,600 818,000 752,800