Question: Problem 12-53 (Algo) Dual and Single Allocation Rates (LO 12-6) Burwell Manufacturing is organized into two divisions (Agriculture and Mining) and a corporate headquarters.

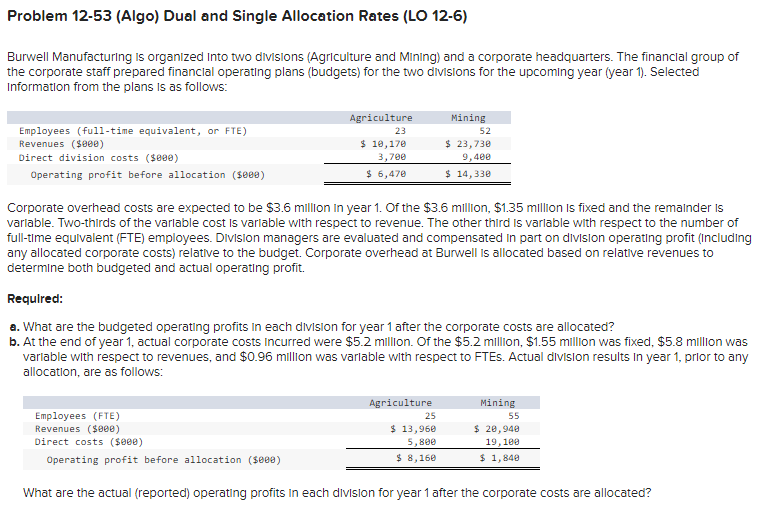

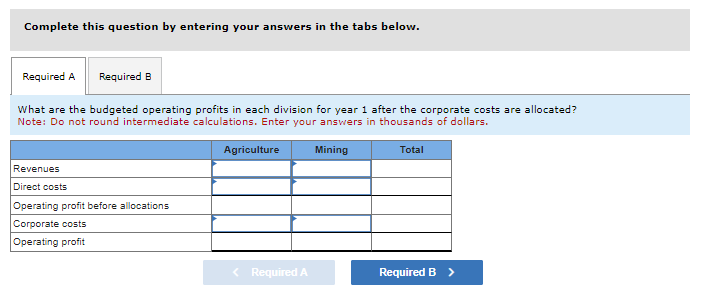

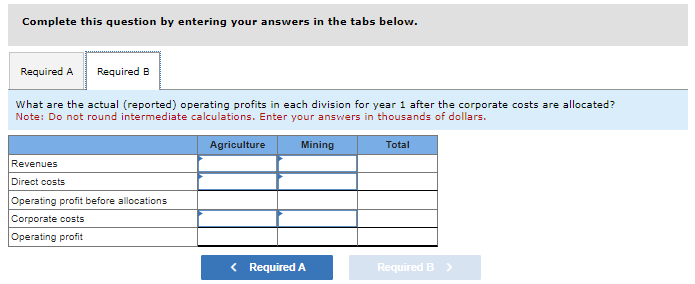

Problem 12-53 (Algo) Dual and Single Allocation Rates (LO 12-6) Burwell Manufacturing is organized into two divisions (Agriculture and Mining) and a corporate headquarters. The financial group of the corporate staff prepared financial operating plans (budgets) for the two divisions for the upcoming year (year 1). Selected Information from the plans is as follows: Employees (full-time equivalent, or FTE) Revenues ($800) Direct division costs ($800) Operating profit before allocation ($800) Agriculture 23 $ 10,170 3,700 $ 6,470 Mining 52 $ 23,730 9,400 $ 14,330 Corporate overhead costs are expected to be $3.6 million in year 1. Of the $3.6 million, $1.35 million is fixed and the remainder is variable. Two-thirds of the variable cost is variable with respect to revenue. The other third is variable with respect to the number of full-time equivalent (FTE) employees. Division managers are evaluated and compensated in part on division operating profit (Including any allocated corporate costs) relative to the budget. Corporate overhead at Burwell is allocated based on relative revenues to determine both budgeted and actual operating profit. Required: a. What are the budgeted operating profits in each division for year 1 after the corporate costs are allocated? b. At the end of year 1, actual corporate costs incurred were $5.2 million. Of the $5.2 million, $1.55 million was fixed, $5.8 million was variable with respect to revenues, and $0.96 million was variable with respect to FTEs. Actual division results in year 1, prior to any allocation, are as follows: Employees (FTE) Revenues ($800) Direct costs ($000) Operating profit before allocation ($000) Agriculture 25 $ 13,960 5,800 $ 8,160 Mining 55 $ 20,940 19,100 $ 1,840 What are the actual (reported) operating profits in each division for year 1 after the corporate costs are allocated? Complete this question by entering your answers in the tabs below. Required A Required B What are the budgeted operating profits in each division for year 1 after the corporate costs are allocated? Note: Do not round intermediate calculations. Enter your answers in thousands of dollars. Revenues Direct costs Operating profit before allocations Corporate costs Operating profit Agriculture Mining Total Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B What are the actual (reported) operating profits in each division for year 1 after the corporate costs are allocated? Note: Do not round intermediate calculations. Enter your answers in thousands of dollars. Revenues Direct costs Operating profit before allocations Corporate costs Operating profit Agriculture Mining Total < Required A Required B >

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to follow these steps Required A Budgeted Operating Profits 1 Budgeted Revenues and Direct Costs Agriculture Revenues 18... View full answer

Get step-by-step solutions from verified subject matter experts