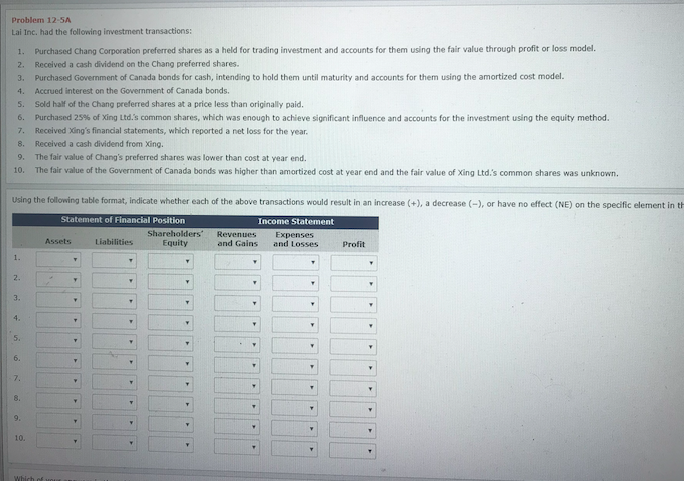

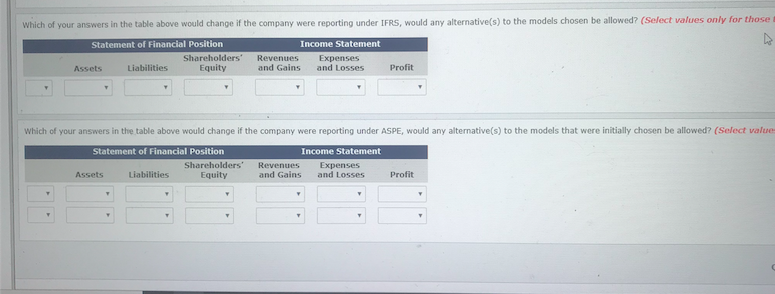

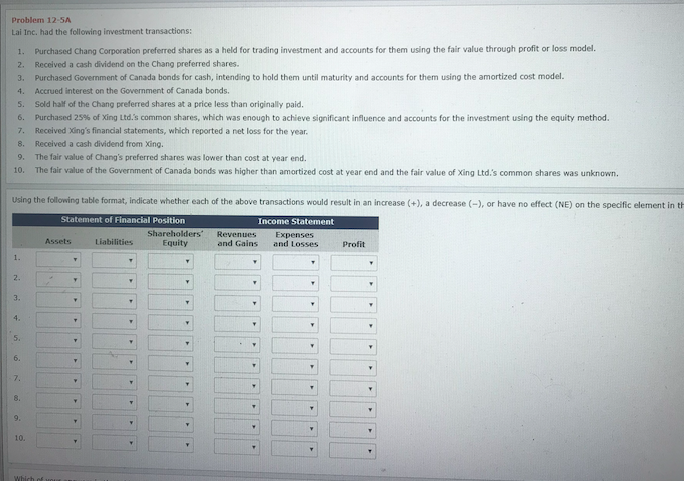

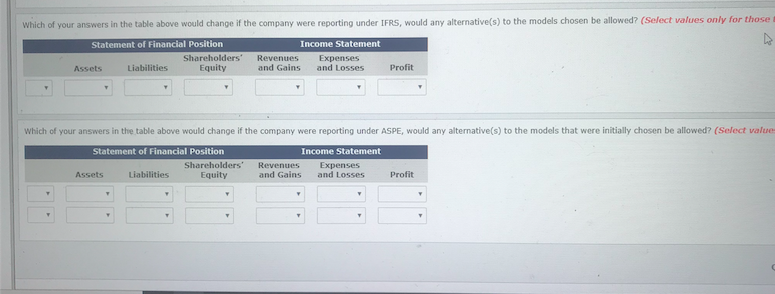

Problem 12-5A Lai Inc. had the following investment transactions: held for trading investment and accounts for them using the fair value through profit or loss model, Purchased Chang Corporation preferred shares as 1. Received a cash dividend on the Chang preferred shares. Purchased Government of Canada bonds for cash, intending to hold them until maturity and accounts for them using the amortized cost model. Accrued interest on the Government of Canada bonds. 2. 3. 4 Sold half of the Chang preferred shares at a price less than originally paid. Purchased 25% of Xing Ltd.'s common shares, which was enough to achieve significant influence and accounts for the investment using the equity method. Received Xing's financial statements, which reported a net loss for the year. 5. 6 7 Received a cash dividend from Xing. The fair value of Chang's preferred shares was lower than cost at year end. 8 9 The fair value of the Government of Canada bonds was higher than amortized cost at year end and the fair value of Xing Ltd.'s common shares was unknown. 10. Using the following table format, indicate whether each of the above transactions would result in an increase (+), a decrease (-), or have no effect (NE) on the specific element in th Statement of Financial Position Income Statement Shareholders" Equity Revenues Expenses and Losses Assets Liabilities and Gains Profit 1. 2. 3. 4. 5. 6. 7, 8. 9. 10. Which of a Which of your answers in the table above would change if the company were reporting under IFRS, would any alterrnative(s) to the models chosen be allowed? (Select values only for those i Statement of Financial Position Shareholders Equity Income Statement Expenses and Losses Revenues Liabilities and Gains Profit Assets Which of your answers in the table above would change if the company were reporting under ASPE, would any alternative(s) to the models that were initially chosen be allowed? (Select values Statement of Financial Position Income Statement Shareholders" Equity Revenues and Gains Expenses and Losses Liabilities Profit: Assets Problem 12-5A Lai Inc. had the following investment transactions: held for trading investment and accounts for them using the fair value through profit or loss model, Purchased Chang Corporation preferred shares as 1. Received a cash dividend on the Chang preferred shares. Purchased Government of Canada bonds for cash, intending to hold them until maturity and accounts for them using the amortized cost model. Accrued interest on the Government of Canada bonds. 2. 3. 4 Sold half of the Chang preferred shares at a price less than originally paid. Purchased 25% of Xing Ltd.'s common shares, which was enough to achieve significant influence and accounts for the investment using the equity method. Received Xing's financial statements, which reported a net loss for the year. 5. 6 7 Received a cash dividend from Xing. The fair value of Chang's preferred shares was lower than cost at year end. 8 9 The fair value of the Government of Canada bonds was higher than amortized cost at year end and the fair value of Xing Ltd.'s common shares was unknown. 10. Using the following table format, indicate whether each of the above transactions would result in an increase (+), a decrease (-), or have no effect (NE) on the specific element in th Statement of Financial Position Income Statement Shareholders" Equity Revenues Expenses and Losses Assets Liabilities and Gains Profit 1. 2. 3. 4. 5. 6. 7, 8. 9. 10. Which of a Which of your answers in the table above would change if the company were reporting under IFRS, would any alterrnative(s) to the models chosen be allowed? (Select values only for those i Statement of Financial Position Shareholders Equity Income Statement Expenses and Losses Revenues Liabilities and Gains Profit Assets Which of your answers in the table above would change if the company were reporting under ASPE, would any alternative(s) to the models that were initially chosen be allowed? (Select values Statement of Financial Position Income Statement Shareholders" Equity Revenues and Gains Expenses and Losses Liabilities Profit: Assets