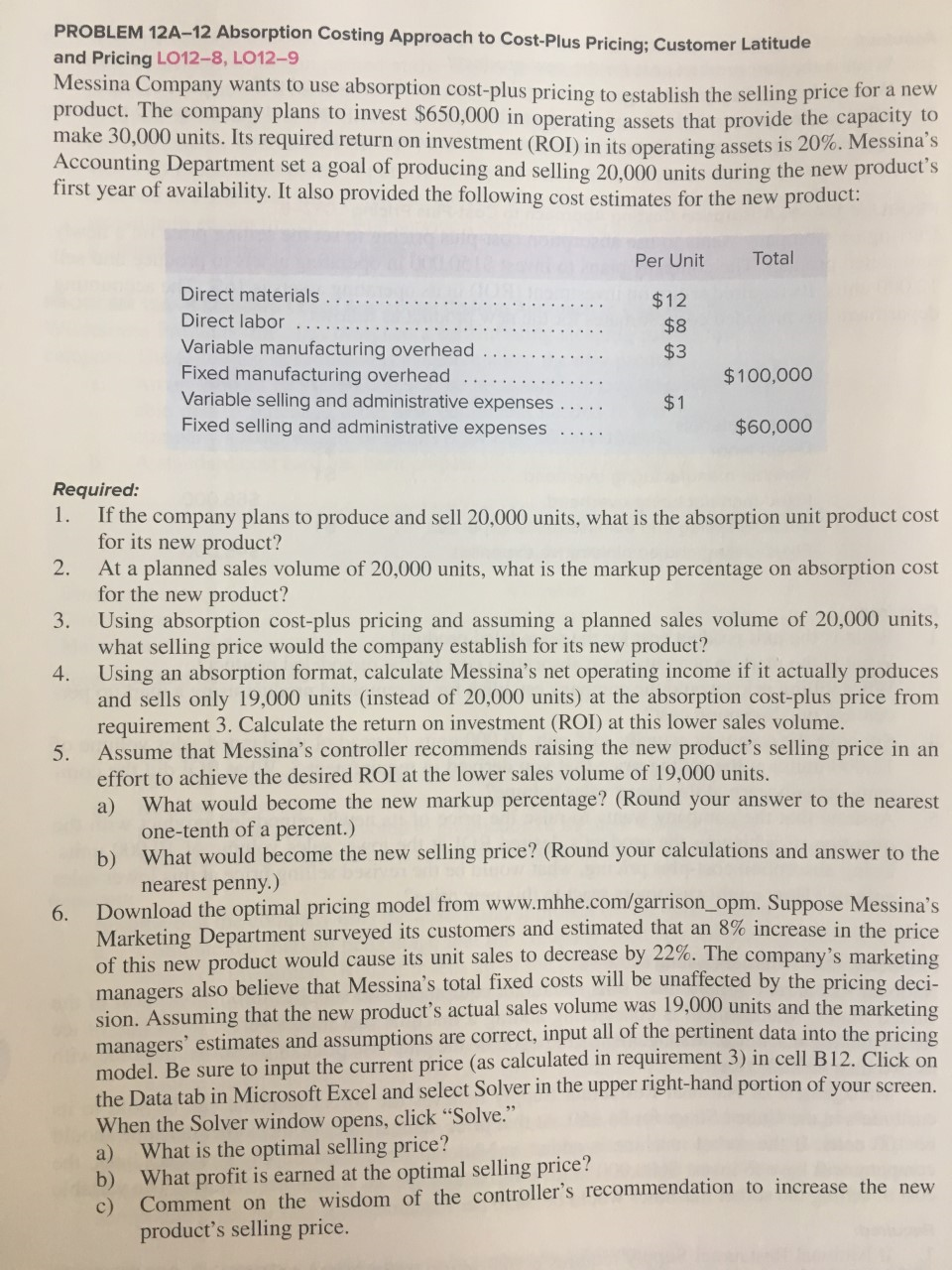

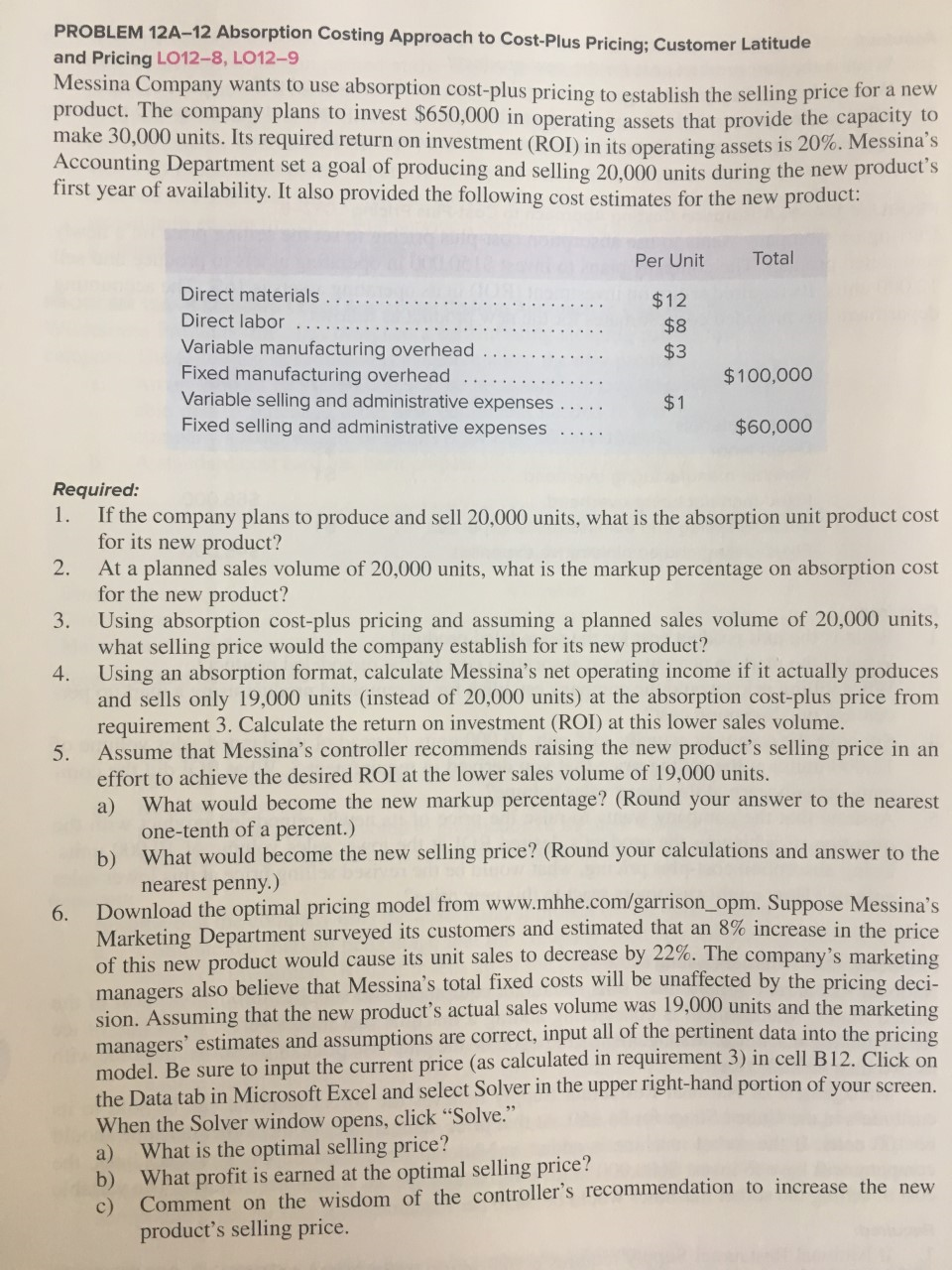

PROBLEM 12A-12 Absorption Costing Approach to Cost-Plus Pricing: Customer Latitude and Pricing L012-8, L012-9 Messina Company wants to use absorption cost-plus pricing to establish the selling price to product. The company plans to invest $650,000 in operating assets that provide the capas make 30,000 units. Its required return on investment (ROI) in its operating assets is 20%. Accounting Department set a goal of producing and selling 20,000 units during the new proc first year of availability. It also provided the following cost estimates for the new product: Per Unit Total CULTOU T . . . . . . . . . . . . . . . Direct materials ... Direct labor ...... Variable manufacturing overhead ....... Fixed manufacturing overhead .............. Variable selling and administrative expenses..... Fixed selling and administrative expenses ..... $12 $8 $3 $100,000 $1 $60,000 5. Required: 1. If the company plans to produce and sell 20,000 units, what is the absorption unit product cost for its new product? 2. At a planned sales volume of 20,000 units, what is the markup percentage on absorption cost for the new product? Using absorption cost-plus pricing and assuming a planned sales volume of 20,000 units, what selling price would the company establish for its new product? 4. Using an absorption format, calculate Messina's net operating income if it actually produces and sells only 19,000 units (instead of 20,000 units) at the absorption cost-plus price from requirement 3. Calculate the return on investment (ROI) at this lower sales volume. Assume that Messina's controller recommends raising the new product's selling price in an effort to achieve the desired ROI at the lower sales volume of 19,000 units. a) What would become the new markup percentage? (Round your answer to the nearest one-tenth of a percent.) b) What would become the new selling price? (Round your calculations and answer to the nearest penny.) 6. Download the optimal pricing model from www.mhhe.com/garrison_opm. Suppose Messina's Marketing Department surveyed its customers and estimated that an 8% increase in the nr of this new product would cause its unit sales to decrease by 22%. The company's marketing managers also believe that Messina's total fixed costs will be unaffected by the pricing deci- sion. Assuming that the new product's actual sales volume was 19,000 units and the managers' estimates and assumptions are correct, input all of the pertinent dat model. Be sure to input the current price (as calculated in requirement 3) in cell B12. Click the Data tab in Microsoft Excel and select Solver in the upper right-hand portion of your screen When the Solver window opens, click Solve." a) What is the optimal selling price? b) What profit is earned at the optimal selling price? Comment on the wisdom of the controller's recommendation to increase the new product's selling price