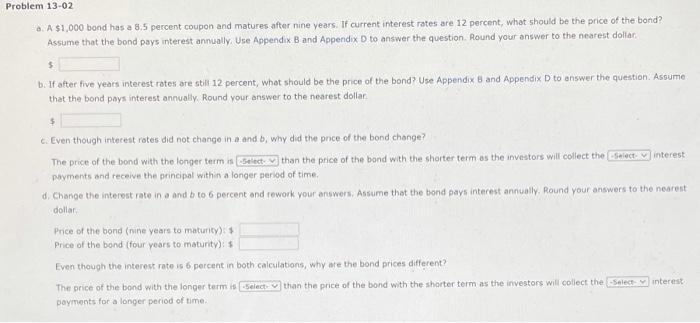

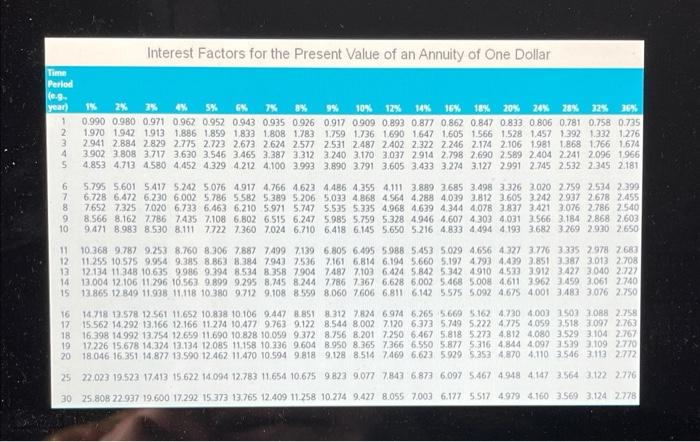

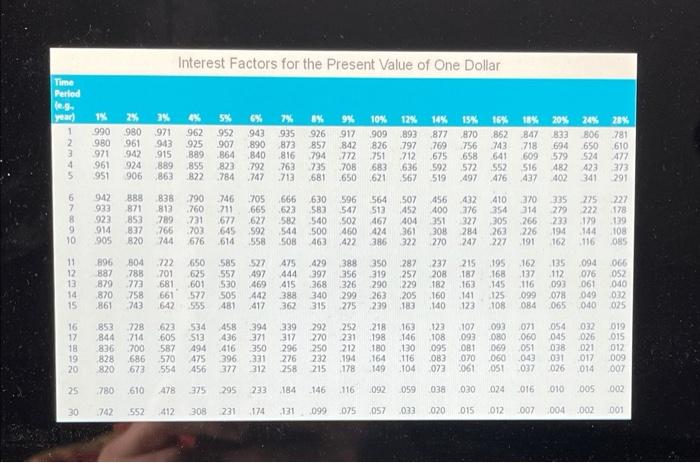

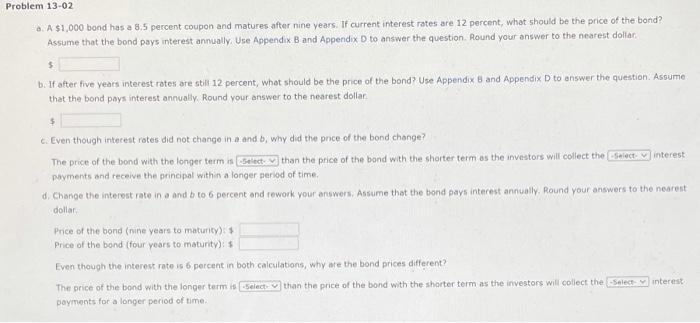

Problem 13-02 2. A $1,000 band has a 8.5 percent coupon and matures after nine years. If current interest rates are 12 percent, what should be the price of the bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar $ b. If after five years interest rates are still 12 percent, what should be the price of the bond? Use Appendix and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar $ c. Even though interest rates did not change in and b, why did the price of the bond change? The price of the bond with the longer term is Stect than the price of the bond with the shorter term as the investors will collect the select interest payments and receive the principal within a longer period of time d. Change the interest rate in and b to 6 percent and rework your answers, Assume that the bond pays interest annually. Round your answers to the nearest dollar Price of the bond (nine years to maturity) Price of the bond (four years to maturity): $ Even though the interest rate is 6 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is Select than the price of the bond with the shorter term as the investors will collect the select interest payments for a longer period of time Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. year 1% 2% 2% 4% 5% GN 10% 12% 14% 16% 18% 20% 20% 28% 22% 20% 1 0.990 0.90 0.971 0.967 0952 0943 0935 0.926 0917 0.909 0.893 0.877 0862 0.847 0.833 0.806 0.781 0.758 0.735 2 1970 1942 1913 1.886 1859 1833 1.808 1783 1.759 1736 1690 1647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 3 2.941 2884 2829 2775 2.723 2.673 2.624 2577 2531 2.487 2402 2322 2.246 2.174 2.106 1981 1.868 1.766 1674 4 3902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3240 3.170 3.037 2914 2.798 2.690 2589 2.404 2241 2096 1966 4.853 4.713 4580 4452 4.329 4212 4.100 3.993 3,890 3.791 3,605 3.433 3.274 3.127 2991 2.745 2532 2345 2.181 6 5.795 5.601 5.417 5.242 5.076 4917 4.766 4623 4486 4.355 4.111 3.889 3685 3.498 3.326 3.020 2759 2.534 2399 7 6.728 6.472 6.230 6.002 5.786 5582 5.389 5.206 5,033 4868 4.564 4.288 4.039 3.812 3.605 3.242 2937 2.678 2.455 8 7.652 7.325 7020 6.733 6.463 6.210 5.971 5.747 5.535 5335 4.968 4.639 4 344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7786 7435 7108 6.802 6.515 6.247 5.985 5.759 5.328 4946 4,607 4 303 4.031 3.566 2.184 2868 2603 10 9.471 8.983 8.530 8.111 7722 7360 7.024 6.710 6.418 6.145 5.650 5216 4833 4.494.4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 78877499 7139 6,805 6.495 5.988 5.453 5.029 4.656 4327 3.776 3335 2978 2683 12 11 255 10.575 9.954 9.385 8.353 8.384 7.943 7536 2.161 6,814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11348 106359.986 9.394 8.534 8.358 7904 7487 7.103 6.424 5842 5342 49104.533 2912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7786 7367 6.628 6.002 5.468 5.0084611 3962 3.459 2.061 2740 15 13.865 12.849 11.938 11.118 10:3809712 9.108 8.559 8.060 2606 6.811 6.142 5575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 17.578 12.561 11652 10.838 10.106 9.447 8.851 8:312 7824 6974 6.265 5.669 5162 4.730 4:00) 2502 2.088 2.758 12 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 800271206373 5749 5.222 4775 4059 3.518 3097 2.763 18 16 398 14992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 3.201 7.250 6.467 5.818 5.273 4.812 4080 3.529 3.104 2.767 19 17.226 15.678 14,324 13.134 12.08S 11.158 10.336 9.604 8.950 8.365 7366 6.550 5.877 5216 484440977539 3.109 2770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.5463.113 2772 25 22.023 19.522 17413 15.622 14.094 12,783 11654 10,675 9.8239.077 7,843 6873 6.097 5.467 4 948 4.147 3.564 3.122 2.776 30 25 808 22.937 19.600 17.292 15 373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5.517 4.9794.160 3.569 3.124 2.778 Interest Factors for the Present Value of One Dollar 20% 24% 28% 1 . 679 he mm 233 184 146 116 1092 059 : 174 131 099 07 057 033 2004