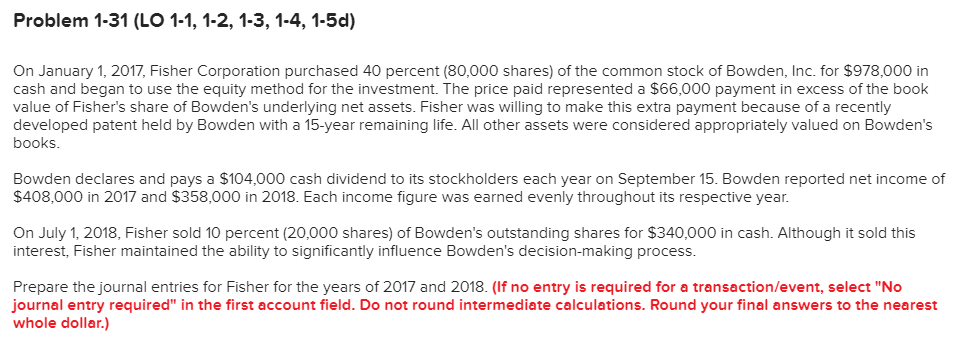

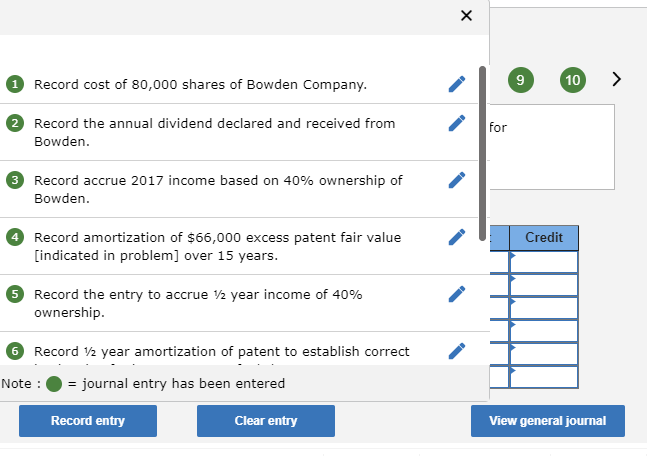

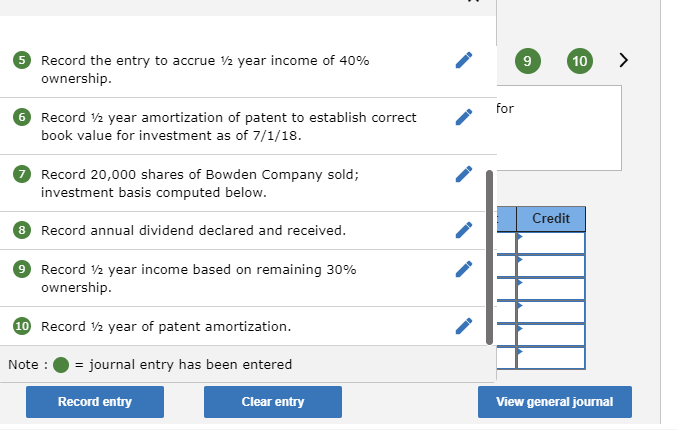

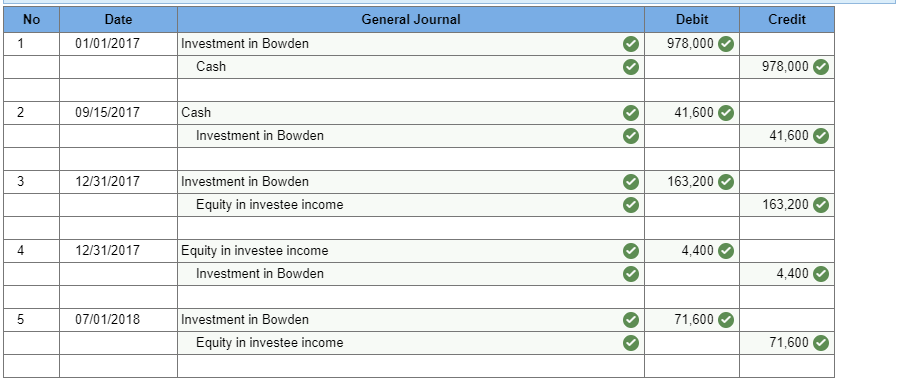

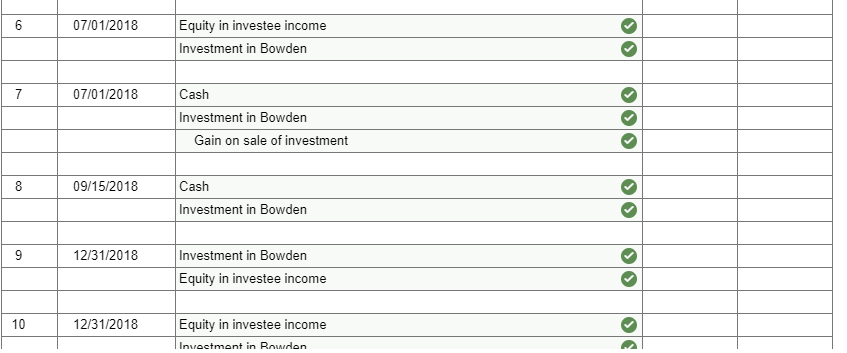

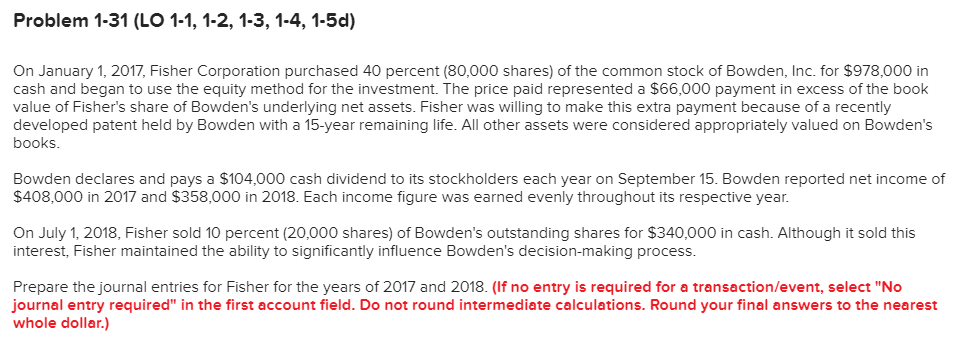

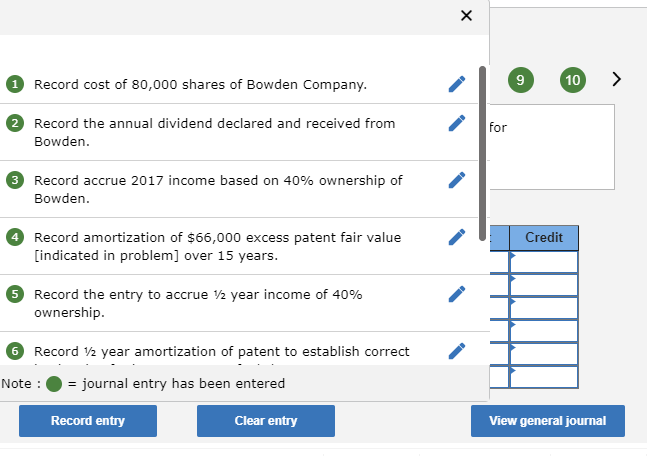

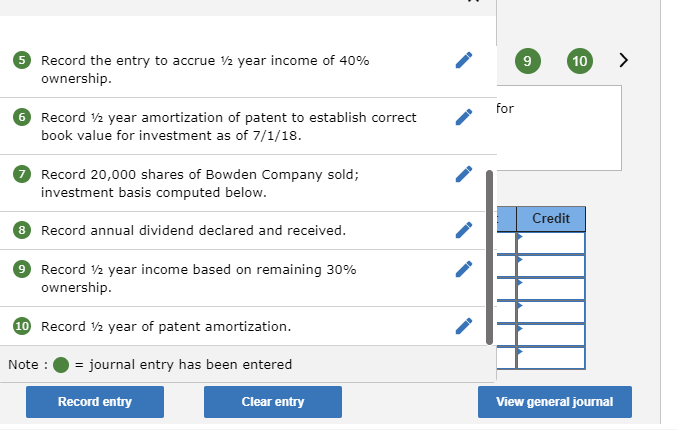

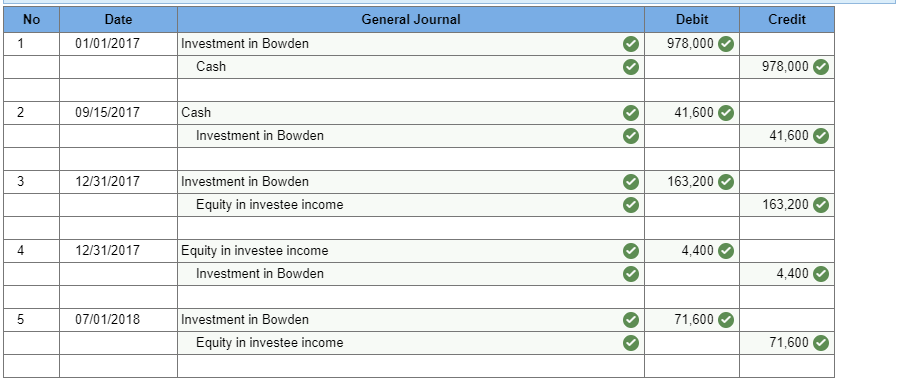

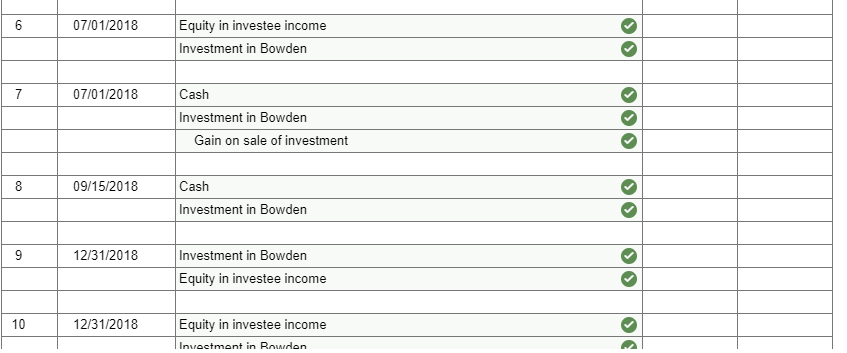

Problem 1-31 (LO 1-1, 1-2, 1-3, 1-4, 1-5d) On January 1, 2017, Fisher Corporation purchased 40 percent (80,000 shares) of the common stock of Bowden, Inc. for $978,000 in cash and began to use the equity method for the investment. The price paid represented a $66,000 payment in excess of the book value of Fisher's share of Bowden's underlying net assets. Fisher was willing to make this extra payment because of a recently developed patent held by Bowden with a 15-year remaining life. All other assets were considered appropriately valued on Bowden's books. Bowden declares and pays a $104,000 cash dividend to its stockholders each year on September 15. Bowden reported net income of $408,000 in 2017 and $358,000 in 2018. Each income figure was earned evenly throughout its respective year. On July 1, 2018, Fisher sold 10 percent (20,000 shares) of Bowden's outstanding shares for $340,000 in cash. Although it sold this interest, Fisher maintained the ability to significantly influence Bowden's decision-making process. Prepare the journal entries for Fisher for the years of 2017 and 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) 0 Record cost of 80,000 shares of Bowden Company. 2 Record the annual dividend declared and received from Bowden. Record accrue 2017 income based on 40% ownership of Bowden. Credit Record amortization of $66,000 excess patent fair value [indicated in problem] over 15 years. Record the entry to accrue 12 year income of 40% ownership 6 Record 12 year amortization of patent to establish correct Note : = journal entry has been entered Record entry Clear entry View general journal 5 Record the entry to accrue 12 year income of 40% ownership. 6 for Record 12 year amortization of patent to establish correct book value for investment as of 7/1/18. Record 20,000 shares of Bowden Company sold; investment basis computed below. Credit 8 Record annual dividend declared and received. 9 Record 12 year income based on remaining 30% ownership. 10 Record 12 year of patent amortization. Note : = journal entry has been entered Record entry Clear entry View general journal No General Journal Credit Date 01/01/2017 Debit 978,000 Investment in Bowden Cash 978,000 2 09/15/2017 41,600 Cash Investment in Bowden 41,600 12/31/2017 0 163,200 Investment in Bowden Equity in investee income 163,200 12/31/2017 4.400 Equity in investee income Investment in Bowden 4,400 5 07/01/2018 71,600 Investment in Bowden Equity in investee income 71,600 07/01/2018 Equity in investee income Investment in Bowden 07/01/2018 Cash Investment in Bowden Gain on sale of investment 09/15/2018 Cash Investment in Bowden po 00 00 00 000 9 12/31/2018 Investment in Bowden Equity in investee income 10 12/31/2018 Equity in investee income Investment in Rowden