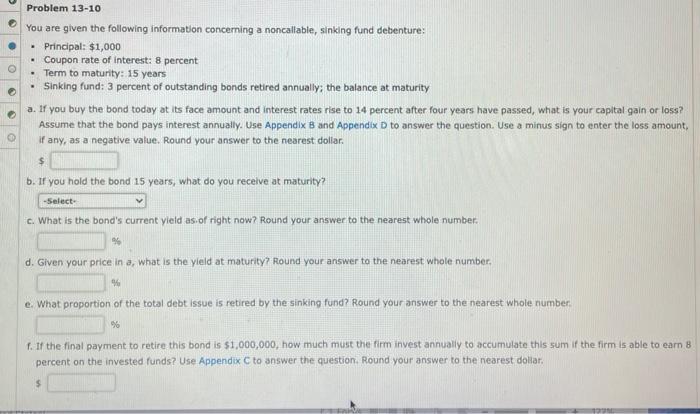

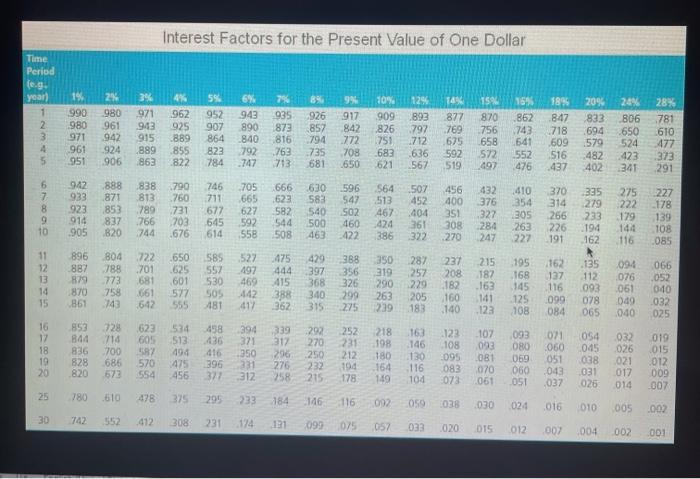

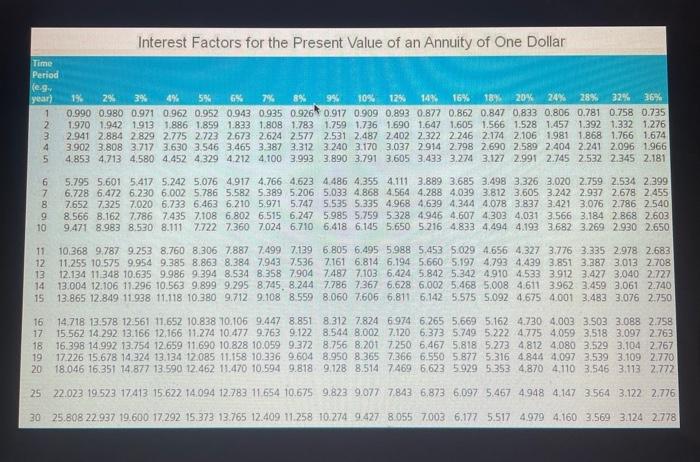

Problem 13-10 You are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 8 percent Term to maturity: 15 years Sinking fund: 3 percent of outstanding bonds retired annually; the balance at maturity a. If you buy the bond today at its face amount and interest rates rise to 14 percent after four years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. $ b. If you hold the bond 15 years, what do you receive at maturity? -Select- c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. d. Given your price in o, what is the yield at maturity? Round your answer to the nearest whole number, % e what proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number, f. If the final payment to retire this band is $1,000,000, how much must the firm invest annually to accumulate this sum If the firm is able to earn 8 percent on the invested funds? Use Appendix Cto answer the question. Round your answer to the nearest dollar. $ www e Interest Factors for the Present Value of One Dollar 1 2 Time Period | e.g year) 689 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e. year 19% 29. 3% 49 5% GS 7% 99. 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 1 0.990 0.980 0,971 0962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0,833 0.806 0.781 0.758 0.735 2. 1970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1736 1.690 1.647 1.605 1.566 1.528 1457 1.392 1.332 1.276 3 2.941 2.884 2829 2.775 2.723 2673 2624 2577 2.531 2.487 2402 2 322 2246 2.174 2.106 1981 1.868 1.766 1674 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3,037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1966 5 4.853 4.713 4.580 4.452 4329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.27 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5971 57475.535 5.335 4968 4639 4.344 4.078 3 837 3.421 3,076 2.786 2.540 8.566 8.162 7.786 7435 7.108 6.802 6.515 6.247 5985 5.759 5328 4946 4 607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.1117.722 7.360 7.024 6.710 6.418 6145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 NO 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7943 7.536 71616.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11348 10.635 9.986 9 394 8.534 8.358 7904 7.487 7103 6,424 5.842 5.342 4.910 1.533 3912 3.427 3,040 2727 13.004 12.106 11.296 10.563 9.899 9.295 8.745. 8.244 7.786 7.367 6.628 6.002 5.468 5,008 4.611 3962 3.459 3.061 2.740 13.865 12.849 11938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14 718 13.578 12.561 11652 10.838 10.106 9.447 8.851 8.312 7.824 6.9746.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15:562 14 292 13.166 12,166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4775 4,059 3,518 3.097 2.763 18 16.398 14992 13.754 12.659 11690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4812 4080 3,529 3.104 2.767 19 17.226 15,678 14,324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 20 18.046 16.351 14 877 13.590 12.462 18:470 10.594 9.818 9.128 8.514 7469 6623 5929 5353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17413 15.622 14 094 12.783 11 654 10.675 9.8239.077 7.843 6,873 6,097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22 937 19.600 17292 15373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5517 4979 4.160 3,569 3124 2778