Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 13.19 Residual Income Valuation. The Coca-Cola Company is a global soft drink beverage company (ticker: KO) that is a primary and direct competitor with

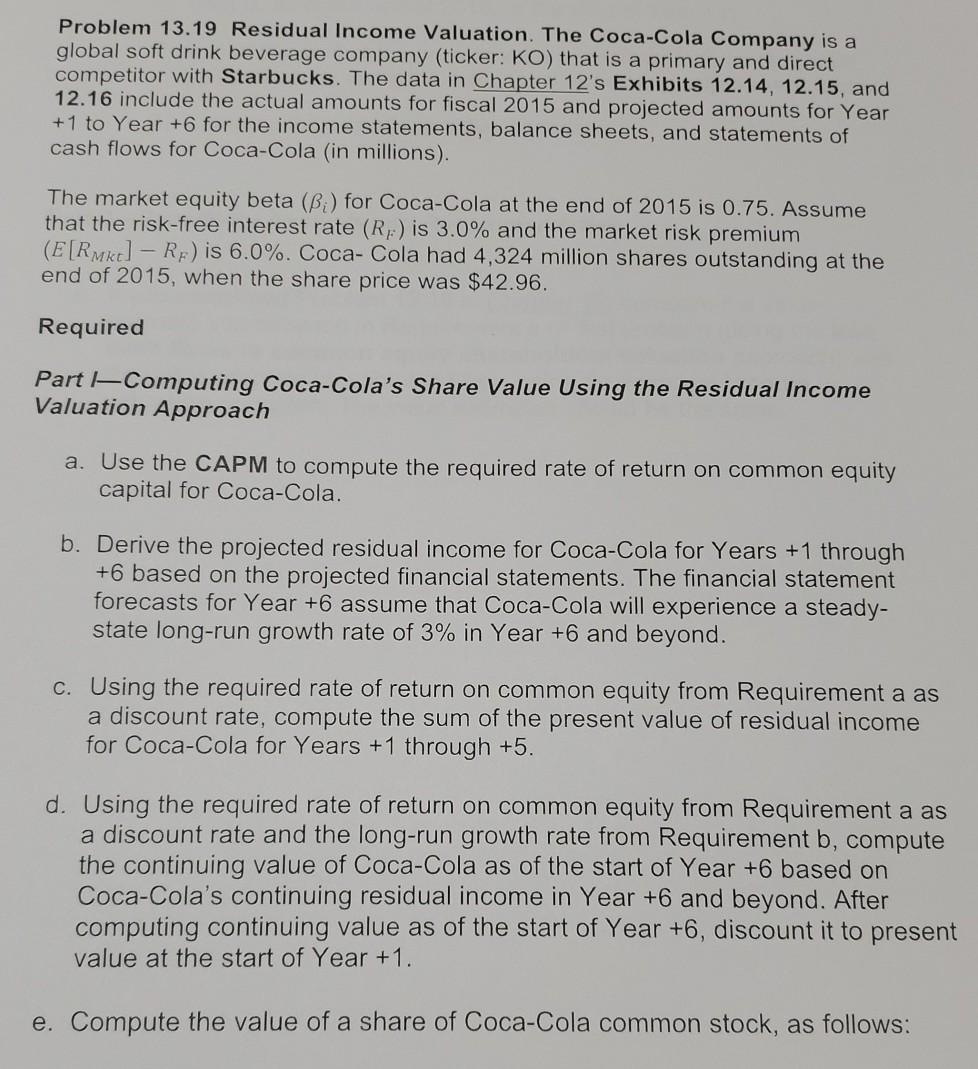

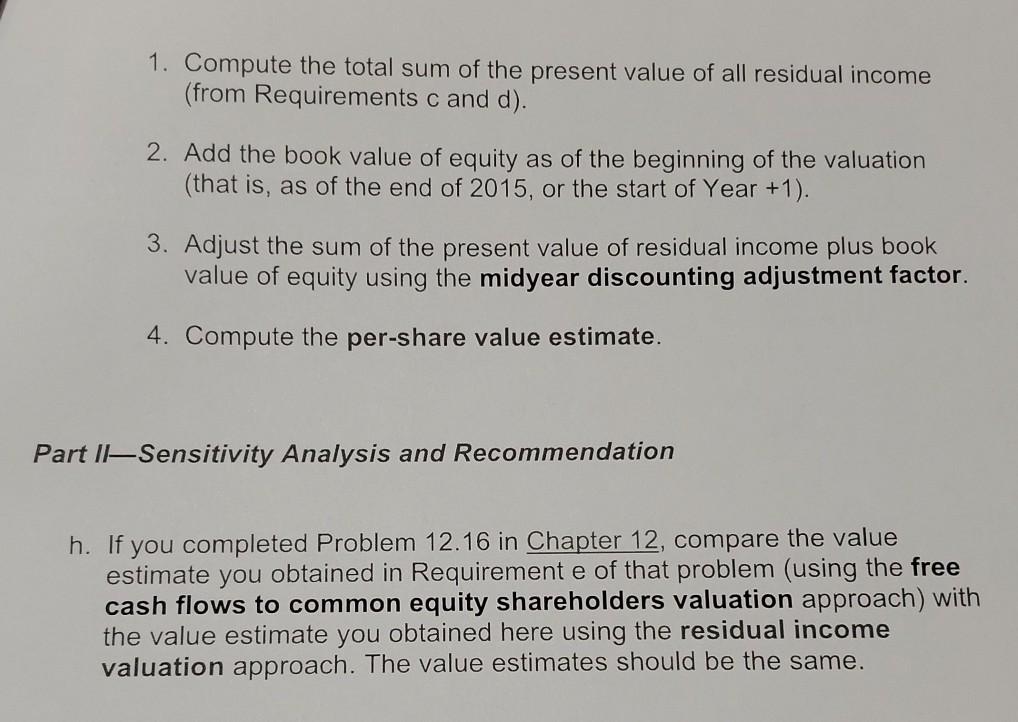

Problem 13.19 Residual Income Valuation. The Coca-Cola Company is a global soft drink beverage company (ticker: KO) that is a primary and direct competitor with Starbucks. The data in Chapter 12's Exhibits 12.14, 12.15, and 12.16 include the actual amounts for fiscal 2015 and projected amounts for Year +1 to Year +6 for the income statements, balance sheets, and statements of cash flows for Coca-Cola (in millions). The market equity beta (B:) for Coca-Cola at the end of 2015 is 0.75. Assume that the risk-free interest rate (Rp) is 3.0% and the market risk premium (E[RMke] - Rp) is 6.0%. Coca-Cola had 4,324 million shares outstanding at the end of 2015, when the share price was $42.96. Required Part Computing Coca-Cola's Share Value Using the Residual Income Valuation Approach a. Use the CAPM to compute the required rate of return on common equity capital for Coca-Cola. b. Derive the projected residual income for Coca-Cola for Years +1 through +6 based on the projected financial statements. The financial statement forecasts for Year +6 assume that Coca-Cola will experience a steady- state long-run growth rate of 3% in Year +6 and beyond. c. Using the required rate of return on common equity from Requirement a as a discount rate, compute the sum of the present value of residual income for Coca-Cola for Years +1 through +5. d. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement b, compute the continuing value of Coca-Cola as of the start of Year +6 based on Coca-Cola's continuing residual income in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value at the start of Year +1. e. Compute the value of a share of Coca-Cola common stock, as follows: 1. Compute the total sum of the present value of all residual income (from Requirements c and d). 2. Add the book value of equity as of the beginning of the valuation (that is, as of the end of 2015, or the start of Year +1). 3. Adjust the sum of the present value of residual income plus book value of equity using the midyear discounting adjustment factor. 4. Compute the per-share value estimate. Part 11-Sensitivity Analysis and Recommendation h. If you completed Problem 12.16 in Chapter 12, compare the value estimate you obtained in Requirement e of that problem (using the free cash flows to common equity shareholders valuation approach) with the value estimate you obtained here using the residual income valuation approach. The value estimates should be the same. Problem 13.19 Residual Income Valuation. The Coca-Cola Company is a global soft drink beverage company (ticker: KO) that is a primary and direct competitor with Starbucks. The data in Chapter 12's Exhibits 12.14, 12.15, and 12.16 include the actual amounts for fiscal 2015 and projected amounts for Year +1 to Year +6 for the income statements, balance sheets, and statements of cash flows for Coca-Cola (in millions). The market equity beta (B:) for Coca-Cola at the end of 2015 is 0.75. Assume that the risk-free interest rate (Rp) is 3.0% and the market risk premium (E[RMke] - Rp) is 6.0%. Coca-Cola had 4,324 million shares outstanding at the end of 2015, when the share price was $42.96. Required Part Computing Coca-Cola's Share Value Using the Residual Income Valuation Approach a. Use the CAPM to compute the required rate of return on common equity capital for Coca-Cola. b. Derive the projected residual income for Coca-Cola for Years +1 through +6 based on the projected financial statements. The financial statement forecasts for Year +6 assume that Coca-Cola will experience a steady- state long-run growth rate of 3% in Year +6 and beyond. c. Using the required rate of return on common equity from Requirement a as a discount rate, compute the sum of the present value of residual income for Coca-Cola for Years +1 through +5. d. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement b, compute the continuing value of Coca-Cola as of the start of Year +6 based on Coca-Cola's continuing residual income in Year +6 and beyond. After computing continuing value as of the start of Year +6, discount it to present value at the start of Year +1. e. Compute the value of a share of Coca-Cola common stock, as follows: 1. Compute the total sum of the present value of all residual income (from Requirements c and d). 2. Add the book value of equity as of the beginning of the valuation (that is, as of the end of 2015, or the start of Year +1). 3. Adjust the sum of the present value of residual income plus book value of equity using the midyear discounting adjustment factor. 4. Compute the per-share value estimate. Part 11-Sensitivity Analysis and Recommendation h. If you completed Problem 12.16 in Chapter 12, compare the value estimate you obtained in Requirement e of that problem (using the free cash flows to common equity shareholders valuation approach) with the value estimate you obtained here using the residual income valuation approach. The value estimates should be the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started